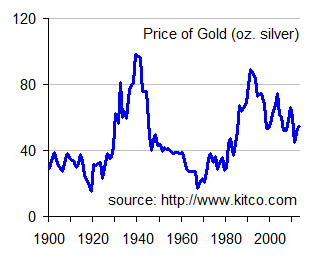

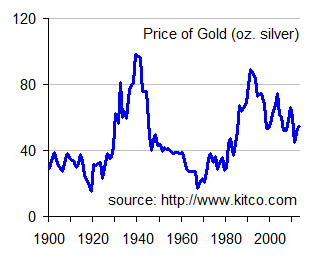

A few times on the open market traders have been willing to swap an oz of gold for just 20 oz silver, and at other times they've demanded over 90 oz. of silver. So the dollar can't be equal to 'gold and silver', it has to be 'gold or silver'.

Posted on 08/19/2013 8:59:25 AM PDT by DeaconBenjamin

The answer to all of this, f course is to get the government the hell out of the economy, all of it. Resources will be properly and efficiently allocated. If water is in short supply then the price for it will go ưp wand new sources (massive salt water conversion, for instance) will be found.. Prices will determìne prety much everything far more efficiently and rapidly than any government planning board could do. And, in truth, no government planning can do.

First let's agree that we want the government to coin money and regulate its value. Then we can argue about how we want that done; I'd expect the arguments will center on how the dollar's value affects the economy.

First let's agree that we want the government to coin money and regulate its value. Then we can argue about how we want that done; I'd expect the arguments will center on how the dollar's value affects the economy.

If, by that statement, you mean that Congress should set the weight of the dollar in gold, then I agree with you. Otherwise, the government has no idea at all what the value of the dollar should be and we'd be much better off if it just stayed out of it.

So what would happen if the Fed stopped printing money?

Deflation like the 1870s and 1880s, when the US economy grew like China’s does today? Demand for savings for investment rather than free money from the Fed (enabling savers to actually earn interest on their accounts)? Less pouring of billions of dollars into uneconomical investments in hopes of a quick profit?

Gold and silver should be the legal money with no government regulation of the ratio or value.

OK, so we agree that arthurus is wrong and that the government has a lot to do with the economy. As for the dollar's value, my agreement or disagreement doesn't matter. What we're working with is this--

U.S. Constitution Online Article 1 - The Legislative Branch Section 8 - Powers of Congress The Congress shall have Power... ...To coin Money, regulate the Value thereof...

So Congress decided that this morning the dollar would be worth 1/1375.25 oz gold, and in the afternoon they changed it to 1/1365.00 oz. If this is still not what you want, then you might want to be more specific about values and time frames.

A few times on the open market traders have been willing to swap an oz of gold for just 20 oz silver, and at other times they've demanded over 90 oz. of silver. So the dollar can't be equal to 'gold and silver', it has to be 'gold or silver'.

Gold and silver would and should operate separately. Silver is necessary in the mix for “small change” to preclude the resort to paper.

Like how the federal government once made a one-oz gold coin worth 20 one-oz silver dollars? It was madness. Sure, mindless bureaucrats can declare by fiat that the ratio has to be one to 20, but the open free market can (and has) put it at one to a hundred. Metals are raw commodities with wildly fluctuating market values and what we need is money that keeps prices stable.

The government can have a legitimate function in a gold money system and that is to buy and sell gold at a given price that never changes and to run its own operations such that the government doesn’t get behind the 8-ball with gold i.e. doesn’t run a debt.

—and forget silver; that can be done. Of course, the price of silver will be even more erratic so we’d have to forget about using silver in coins. The big problem though is that the price of copper, oil, food, everything else would also swing wildly. That was the problem with the gold peg, crazy prices.

That goes hand in hand with the liberal belief that America has grown rich by impoverishing the rest of the world and that America's impoverishment is necessary to make things right with the world. They are accomplishing that goal perversely by increasing inflation but that new money accrues to the government and steals value from the citizenry by increasing the number of dollars into which the measure of the total value of the economy is divided and keeping the new dollars for itself. That money is to be used and is used to "equalize" and compensate the poor of the world who have been ripped off by previous inflation in America. Actually there are a couple of contradictory fantasies here but liberals and intellectuals are quite capable of believing two or more utterly contradictory things simultaneously and acting on their beliefs.

Value is all well and good but in the market place where we work for a living we deal with prices. Right now an oz of gold sells for 55 oz of silver. In the early '90's it was over a hundred oz silver and a couple decades before that it was less than 20 oz silver.

Like it or not those were the prices. That's why --politics aside-- virtually nobody wants to use gold as money to buy food and shelter.

You trash silver then say that’s why we can’t use gold! Some people just prefer fiat money, even people who think they are conservative. Well fiat money is what got us where we are. Fiat money in history has always done that. Some folks think that well the right people weren’t in charge of the money. Well communists think that about all the failed examples of socialism, too.

The same argument could be made against any currency, you know. You seem to view the dollar as somehow having fixed value. It does not. There was a time when stability was sought and encouraged, and lip service is still given to the notion of so doing. But, being an expat, I’m quite sure you’re aware of the several wild swings the dollar has experienced, just over the past six years. Colombian Pesos have taken a nosedive versus the dollar of late, that after spiking fairly wildly upward over the preceding several years. Those crazy Colombians I guess, see-sawing tgeir currency like that around the fixed dollar. Of all the nerve, lol.

Look, I had nothing to do with it, I'm just telling you what happened so there's no point in blaming the messenger because y'all are just going to get the same reality elsewhere.

Cheers!

I have no idea what you’re on about. You seem to believe that the dollar has a fixed value relative to commodities or other currencies, with the dollar constant and “other” floating. That just isn’t so, I merely pointed that out to you. Very surprising lack of understanding there, coming from an expat such as yourself.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.