Skip to comments.

Corporate Tax Avoidance: Where’s the Harm?

Townhall ^

| 05/27/2013

| Chris Edwards

Posted on 05/27/2013 7:54:05 AM PDT by SeekAndFind

Politicians are having fun slapping around big corporations for supposedly not paying enough taxes. In this country, Apple is the current target, while in Europe it’s Google, Amazon, and Starbucks, according to the Washington Post today.

But there is an elephant in the room that the many reporters and politicians blustering over the issue have been too ideologically blind to see: There is no obvious harm being done by today’s corporate tax avoidance.

The first thing to note is that when investment flows through tax havens, it’s not clear that it causes any economic distortions. The Washington Post story makes a big thing out of foreign direct investment (FDI) flowing through low-tax Bermuda and the Netherlands, but then ending up funding actual factories built elsewhere. Economists worry when taxes distort real investment flows, but that does not seem to be happening here. Indeed, FDI is likely being allocated efficiently across final destination countries in these situations, and the interim trip through low-tax jurisdictions simply shaves off an extra layer of unproductive and distortionary taxes.

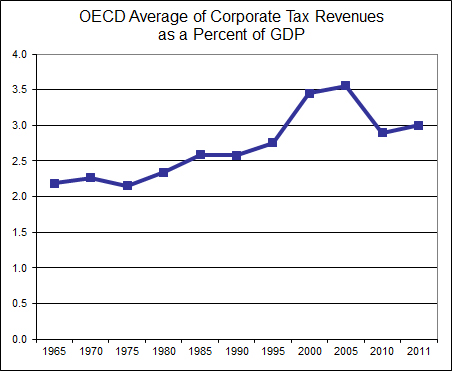

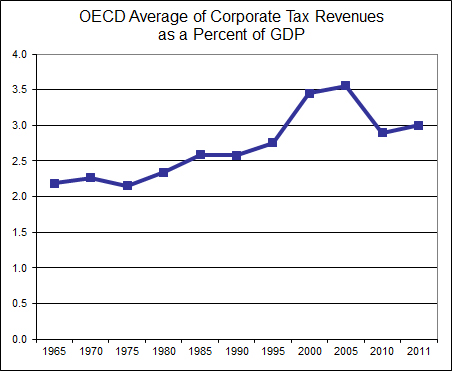

An even more obvious reason to question whether corporate tax avoidance is causing any harm–even from a pro-government perspective–is that corporate tax revenues have been trending upwards across the developed world. The chart below shows that corporate tax revenues as a share of GDP have been rising over the decades, despite the dramatic reductions in statutory tax rates in most countries. Revenues dipped in recent years because of the recession, but they are now trending upwards again even though growth is still very sluggish. (OECD data here).

So even if one believes the liberal view that higher government revenues are a good thing, there is no evident harm being done to government budgets from today’s supposed rampant tax avoidance. For more, see Dan Mitchell’s piece here, and Global Tax Revolution here.

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: apple; corporatetax; taxavoidance

To: SeekAndFind

Taxing corporations is double-taxation.

But in Commie-world, the more you can tax the better.

2

posted on

05/27/2013 8:03:39 AM PDT

by

E. Pluribus Unum

(It is the deviants who are the bullies.)

To: E. Pluribus Unum

More than double really. Look at the way taxes are imposed at all levels of the manufacturing process as those corporations attempt to make products. (I personally think eliminating that type of taxation is the best direct way to create jobs)

3

posted on

05/27/2013 8:15:38 AM PDT

by

cripplecreek

(REMEMBER THE RIVER RAISIN!)

To: SeekAndFind

"There is no obvious harm being done by today’s corporate tax avoidance."In a political environment where control of the language equates with control of the issues, I have a problem with the phrase 'tax avoidance' as used in this context.

Let's play their game and call it 'corporate tax COMPLIANCE'. After all, they are voluntarily complying with the tax code.

As Dingy Harry likes to say, 'We have a voluntary income tax system'...

4

posted on

05/27/2013 8:37:55 AM PDT

by

DJ Frisat

((optional, printed after my name on post))

To: SeekAndFind

A simple flat tax and a tax code of less than fifty pages would end the pain and excesses of our taxes and IRS. Congress and lobbyists have created a nightmare tax system which adds costs to individuals and businesses just navigating the tax code dangers.

5

posted on

05/27/2013 8:38:16 AM PDT

by

RicocheT

(Eat the rich only if you're certain it's your last meal)

To: SeekAndFind; All

Would someone besides me infirm the fool who wrote the headline that corporations don’t pay taxes, but instead just collect them from their customers before forwarding them off as “corporate taxes”. Just another cost of doing business.

6

posted on

05/27/2013 8:46:22 AM PDT

by

mazda77

To: SeekAndFind

Us “little people” are so confused we’re actually arguing FOR elite banking / new world order to not pay the taxes they managed to have imposed on US.

See, the little people who work and pay taxes can’t escape the taxes.

Here’s a recent article:

http://www.northjersey.com/news/opinions/209030881_IRS_intimidation_is_nothing_new.html

Little privately-held business pays THROUGH THE NOSE.

They get “double taxed” like crazy.

But is taxing corporations a good thing ?

The thought behind taxing corporations as well as individuals is simple: if corporations are not taxed at all, the wealthy will simply keep all their income inside corporations.

What do you think tax-exempt foundations are ? A) avoiding tax, while at the same time B) still controlling what all the capital inside them is used for.

For example, the Ford Foundation’s assets are now over $10 billion.

FF spends about $500 million every year.

On what ?

Things that help the biggest power / financial interests in the world retain their tight grip of control over government, education, etc.

It’s a gift from prior generations of elites to today’s generation. Better use of the capital, from the aging elite’s point of view, than turning it over to government - since the elites aimed their government tax plans at the little people, NOT themselves.

If the super rich manipulated (with their boy Senator Aldrich) the IRS into existence to extract money out of the little people then have most of it spent on government contractors and interest payments to banks they control, why would they want to pay the IRS themselves ? The IRS is there to collect money for new world order’s use, not for new world order to pay taxes.

I’m not going to be an idiot and scream about General Electric, Apple and other publicly-held corporations needing to be able to avoid paying income tax. And all the while I’m NOT able to avoid paying income tax - corporation or not.

Either way, I pay. All the little people pay either way. The corporations that control news media, your Congress, the public schools, foreign policy... they’re able to skip out.

7

posted on

05/27/2013 9:49:24 AM PDT

by

PieterCasparzen

(We have to fix things ourselves)

To: SeekAndFind

Render unto Caesar...

Whose image is on the bits in their coin?

8

posted on

05/27/2013 9:53:30 AM PDT

by

TArcher

("TO SECURE THESE RIGHTS, governments are instituted among men" -- Does that still work?)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson