Posted on 04/24/2013 7:18:36 AM PDT by blam

The Economic Depression Is Deepening

Economics / Great Depression II

April 23, 2013 - 05:47 PM GMT

By: Bill Bonner

Gold seemed to be stabilizing at the end of last week. Commodities remained weak. Steel has fallen 31% this year. Brent crude is off 17% since early February. And copper is down 15%.

Copper is the metal you need to make almost anything – houses, cars, electronics. When it goes down, it generally means the world economy is getting soft.

At the start of last week, the conventional analysis of the gold sell-off was that the central banks' efforts to revive global growth were working. The feds had the situation under control. So who needed gold?

By the end of the week, it appeared that gold – and commodities – had sold off for the opposite reason: because central banks' money printing wasn't working and the world was slipping further into a period of slow growth and barely contained depression. From Business Insider:

Recent U.S. economic data has been disappointing, especially in the realm of housing, which is what the US bull case is all about.

In Germany, dubbed the strong arm of Europe, economic sentiment just fell.

Where's the Growth?

And growth has begun to slow in China – still considered a global growth engine – as it continues to crack down on corruption, a property bubble and a bloated shadow banking business. China's plan to shift its economic model away from exports to domestic demand-led growth has also contributed to the lower growth rate.

In the US, building permits are down... and foreclosures are up. There is no renaissance happening in manufacturing. Only half of the new jobs expected showed up in March. Retail sales are down, and consumer confidence is off.

And in Britain, the unemployment rate is rising. Retail sales are falling. And figures coming out this week will probably tell us that the country is in a triple-dip recession.

Here's Ambrose Evans-Pritchard in The Telegraph:

It is becoming ever clearer that the roaring boom in global equities since last summer has priced in an economic recovery that does not in fact exist. The International Monetary Fund has had to nurse down its global growth forecasts yet again. We are still stuck in an old-fashioned trade depression, with pervasive overcapacity in manufacturing plant and a record global savings rate of 25% of GDP...

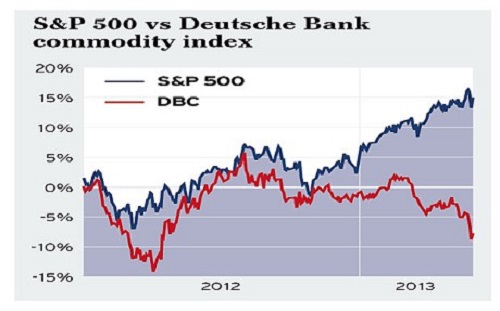

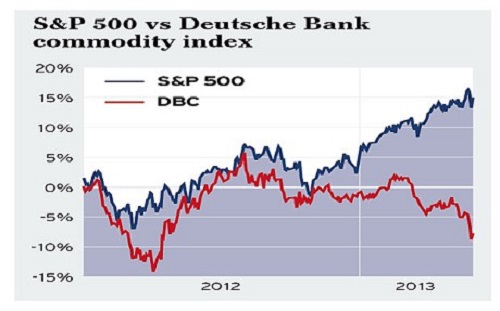

As you can see from the chart below, the divergence between stock markets and the Deutsche Bank index of raw materials is astonishing to behold, so like the pattern in early 1929...

The US economy is growing below the Fed's own "stall speed" indicator. Half a million people fell out of the workforce in March. Retail sales fell in March. So did manufacturing...

"There is a threat of deflation almost everywhere. A lot of central banks will have to follow the Bank of Japan, whatever they say now," said Lars Christensen from Danske Bank.

The era of money printing is young yet. Gold will have its day again.

If the economy were really doing well, employment would be going up, not the value of economically meaningless chips on the Wall Street craps table.

There are less jobs now in America than existed in 1979 thanks to Obama. Not only that, but they are much worse jobs... Walmart jobs, McDonalds burger flipper jobs...

Don't believe those phony unemployment numbers that the government and lapdog media are trying to sell you. Look at the truth - the "Labor Force Participation Rate" - this counts up all working age adults and then counts how many of them are working. Simple and straightforward without the lies and manipulation.

OBAMA: Destroyer of 4.5million jobs

You can look this up on the Bureau of Labor Statistics' home page.

That is how politicians solve problems, by hiding them.

When you count up unemployment, it is a "TWO STATE" condition - a person may be either:

1.) Employed

2.) Unemployed

So when the stop counting someone as unemployed, by default the liars count that person as employed after six months.

If they wanted to tell the truth, they would count them as employed when they actually found a job.

That's why you can only trust the Labor Force Participation Rate.

No problem. The economy just grew 3% through the magic of adding “intangibles”...

Who is John Galt ?

Thanks!

And to think, I was having a relatively GOOD Day!

Back to the bomb shelter.

For proof of this, just look at how much the price of oil has changed in the last 15 years. Oil was around $15/barrel in the late 1990s and has been as high as $140 in recent years. Does anyone out there really believe that the demand for oil has increased ten-fold in the last 15 years, or that the supply today is around one-tenth of what it was 15 years ago? LOL.

The shape of the supply curve for oil is not linear. In fact, it is particularly curved and nearly vertical (highly inelastic in the short run) as you approach full production.

Similarly, the shape of the demand curve may be highly inelastic in the short run; people gotta drive to work.

So, it is entirely possible for the Chinese to create an additional 10% demand, and the price therefore rise 100%. Or a 50% increase in demand to cause a 500% increase in the price.

We've got curves here, not lines.

Nonetheless, one of your points is well taken: monetary profligacy masks all sorts of economics. Oil prices could be considered a speculative bubble, for example.

One of the interesting things about oil is that it is also subject to local price pressure even though it is bought and sold on a global spot market. I'll bet most folks don't know that there's actually a glut of oil here in North America. Quite simply, we are extracting crude oil from the ground faster than we can transport and refine it. That's why the price for West Texas Intermediate has been markedly lower than Brent Crude for several years -- even though WTI has historically been more expensive.

Plus the price of natural gas has dropped 80% in past few years because of shale. Steel and plastics are much cheaper to produce and will get cheaper.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.