Posted on 04/21/2013 8:57:21 PM PDT by blam

United States Decaying From Within! Stocks, Gold and Dollar Outlook

Stock-Markets / Financial Markets 2013

April 21, 2013 - 06:58 PM GMT

By: Robert M Williams

No one seemed to notice or care that on June 28, 2012 the City of Stockton, California filed a petition for chapter 9 bankruptcy protection with the United States Bankruptcy Court, Eastern District of California, Sacramento, Case No. 2012-32118. On Monday, April 1, 2013, a federal judge ruled that Stockton was eligible for bankruptcy protection, over the objection of creditors who argued the city could come up with more money. U.S. Bankruptcy Judge Christopher Klein said Stockton can move forward with a plan to reorganize debt. He twice stated that the creditors had acted in bad faith and had refused to pay their share of the costs for negotiations.

As a result Stockton became the nation's largest city to fail financially. At that time, all eyes were on the port city of 300,000 as experts warned the action could set off a string of similar filings among cash-strapped municipalities. Since then half dozen cities have filed for Chapter 9 protection under the U.S. Bankruptcy Code, including the city of San Bernardino. Of course the media never mentions this. During the 90-day mediation period, Stockton's creditors refused to negotiate unless the city cut payments to the state pension plan known as CaLPERS. By law the negotiations were confidential, but that detail emerged during the three-day trial that concluded last week. Judge Klein said the creditors could not legally walk away from the table, but he left the door open for CaLPERS obligations to be part of negotiations in the coming phases of the bankruptcy. At issue will be whether U.S. bankruptcy law trumps California law, which says the pension plan must be funded.

The $900 million Stockton owes to the California Public Employees Retirement System (CaLPERS) to cover pensions is its biggest debt -– as is the case with many cities in California. Stockton slashed its police and fire departments, halted bond payments, cut employee benefits and adopted an emergency-spending plan that cut many city services. But the city continues to pay into the state pension. Stockton's bankruptcy is expected to be closely watched for precedent, and could be appealed as high as the US Supreme Court.

Two of America’s larger cities and relics from the industrial age, Detroit and Philadelphia, are also in serious financial trouble. With respect to Detroit the Governor, Rick Snyder, declared a state of financial emergency two months ago. The Governor pointed to more than $14 billion in long-term liabilities, including underfunded pensions. The city is also poised to end the fiscal year more than $100 million in the red without an infusion of cash, this in a report published last week. The Governor then named Kevyn Orr as the city's emergency manger giving him many of the same powers as a bankruptcy judge. He can throw out contracts with public employee unions and vendors that the city can't afford, and he can make further cutbacks in already depleted city services if he decides the city can't afford them.

Philadelphia isn’t much better off as it attempted to convince bond buyers to take on more of its debt in an effort to avoid bankruptcy. As it turned out Philadelphia's closed-door two-day schmooze fest with 100 bond underwriters and other would-be lenders only served to generate unwelcome publicity for the nation's most broke big (million plus residents) city.

Philadelphia was hoping to attract investors for the city, which is rated three steps above junk by Standard & Poor’s. The city and its authorities have $8.75 billion in outstanding debt as of September, according to bond documents, and these same documents also show Philadelphia has less than 50 cents set aside for every $1 it expects to pay current and future retirees.

The conference also includes tours of city assets for sale set for day two, including the Philadelphia Gas Works, the largest municipally owned natural-gas utility in the U.S. The city plans to hire a broker to steer the sale of the system, which may fetch as much as $496 million, according to Lazard Ltd., this according to Bloomberg.

So there you have it, two of the nations larger cities watching to see how Stockton’s bankruptcy plays out in Federal court. Debt among municipalities and cities is close to US $1.8 trillion and then you have another US $1.2 trillion on the state level, and a good chunk of this is under stress at this time. High unemployment and shrinking revenues have reduced income from taxes and attempts to raise taxes have simply led to even less revenue in a self-stoking vicious cycle that doesn’t seem to have any end.

Meanwhile the Federal Reserve seems to be waking up to the fact that deflation, and not inflation, is the real problem out there. On Thursday Richmond Fed President Jeffrey Lacker and Minneapolis Fed President Narayana Kocherlakota said they will be watching price data closely for further signs of falling prices, and that the Fed must be on its guard against falling prices. "If inflation looked like it was going to sag further on a persistent basis, I would certainly consider stimulus for the purpose of bringing inflation up to target," Lacker told reporters, according to Bloomberg.

In a separate speech, Kocherlakota said that cooling price pressures were "definitely a cause for concern." The comments echoed remarks made on Wednesday by the St. Louis Fed President, James Bullard, who said he was concerned that the Fed's preferred measure of inflation, the personal consumption expenditures price index, increased at a 1.3% rate in February, well below the Fed's 2% target. This implies the Fed will maintain its $85 billion-per-month asset-purchase program for longer than expected and perhaps augment it with other easing steps. Who would have guessed?

Deflation should have been on the Fed’s radar screen a long time ago. Just take a look at what’s happened to the price of copper :

Use of the word ugly to describe this chart would be an act of kindness. Copper suffered a major break down in price this week, falling below a trend line (red dashed line) that stretches all the way back to the 2010 low! This is precisely what you would expect to happen in a deflationary environment.

I have been talking about deflation for months because I’ve been watching the CRB Index decline for two years:

The prices of oil, sugar, cotton and cocoa have been declining for quite some time and recently the grains have joined in, but it doesn’t stop there. Take a look at this:

What you see here are charts in order of size of the three largest economies in Europe: German, France and England. All three topped out and began to decline while the Dow continued higher, and both Germany and France posted new lows for the year this week.

It’s important to understand that we’re not talking about southern Europe here. We are so used to hearing about the problems in Spain, Italy, Portugal and Greece that we forget to look at the meat on the bone. Northern Europe is entering into recession and the German solution of austerity will only serve to make matters worse. The US Federal Reserve made a terrible mistake in late 2006 when the credit crisis began to unfold; it fiddled while the US economy began to burn. By waiting until March 2009 to implement QE1, it allowed the seeds of deflation to be sown.

The fact that QE1 wasn’t enough simply aggravated the situation. Now the ECB will do the same thing, if not worse.

If you look east you’ll see that things in China, the world’s new economic engine, are even worse:

China’s been on the decline for close to three years and all of the pronouncements that they’ve had a soft landing and are on the rebound are wrong. The worst is yet to come, the only difference being that China possesses reserves.

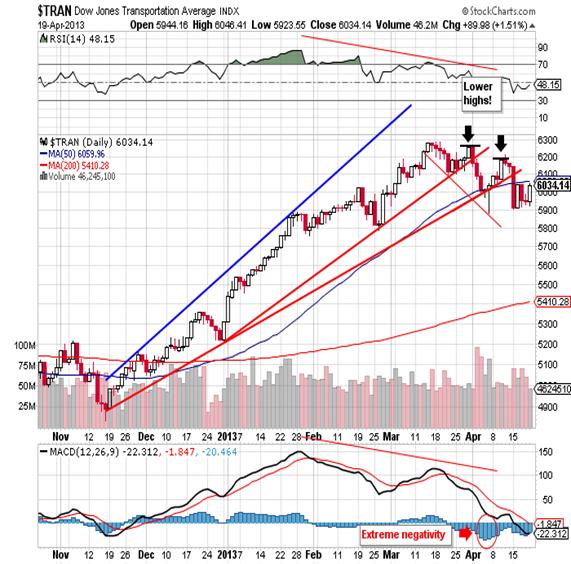

In the United States we are beginning to see cracks in the dam, and the Fed is concerned. If you look at the decay in the Transportation Index, you’ll see plenty of reason for concern:

The decline in the Transports is particularly worrisome because it means fewer goods are being shipped, and that means consumption is on the decline. You might recall that consumption is 70% of the US economy, so it’s a real problem.

The Dow has chosen to ignore the decline in the Transports and continues to make new all-time closing highs as you can see here:

The last all-time closing high came on April 11th at 14,865.14, and it was unconfirmed by the Transports. This week the Dow turned down and closed out the week at 14,547.51 and that’s below what was decent support at 14,580. A significant number of big companies, across a wide spectrum, have missed their earnings projections and the list includes Bank of America, J P Morgan, United Health, IBM, Textron, Apple and Caterpillar. It seems to me that profits over the last two years were a result of cost cutting, and now there’s nothing left to cut! The world economy is in decline so that means profits will decline even further, and sooner or later the Dow will have to follow whether the Fed likes it or not.

In 2009 the Fed embarked on a policy designed to do two things:

* Save the too big to fail financial institutions that were in truth bankrupt, and

* Prop up the stock market.

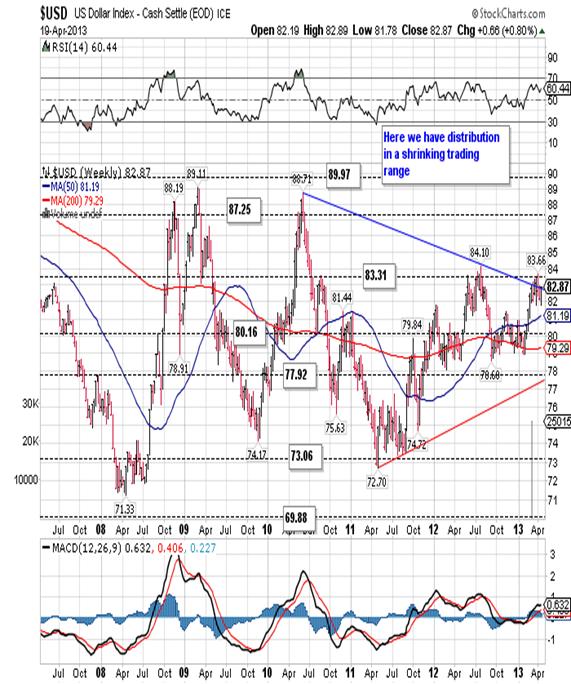

This idea of a duel mandate to create growth and jobs is just a cover story. As long as the banks stay afloat and you can read about rising stock prices in the Sunday paper, the rest is secondary. In order to make this happen the Fed knew it would need to print trillions of US dollars for an indeterminate period of time. This raised the question of how to go about it without crashing the US dollar? As you can see in the following weekly chart of the US Dollar Index, the greenback is a bit higher than where it was in January 2009 when the Fed hatched its scheme:

How is it that the Fed has created trillions of dollars out of thin air and yet the dollar has gained in value relative to other currencies? It’s because they hatched a plan that would require two things:

* First and foremost other nations would have to print so it was decided that Europe, China and Canada would all print. Japan finally joined in the fiat fest last month, and

* It became obvious later on that they would need to suppress the price of gold. You can’t have real money rising against all the major currencies while you’re singing a chorus of “things are just fine.”

They waited for gold to correct and then began coordinated attacks designed to drive the price lower, as low as possible, and they would quietly accumulate gold along the way.

The Fed and others know that gold will be a necessary requirement to maintaining power once the wheels come off. So they go into the paper (futures) gold market, using a series of shell and offshore companies, crossing trades with friendly brokers like Goldman and J P Morgan, and sell paper gold short. These attacks often begin by first selling gold stocks and silver short, then jumping on gold once it begins to wobble, and they would usually occur at night or early morning when volume was thin. Lately they’ve decided to be more blatant so they wait until New York opens to strut their stuff. Here is a close-up look at the Fed’s handiwork in a daily chart of gold:

I just read that the decline gold experienced from roughly 1,580 down to 1,321 is six standard deviations from the norm. That is an event that occurs once every five thousand years, so you have to ask yourself why the Fed, or any one else for that matter, would go to such extremes to pressure gold lower. After giving it much thought, I came up with one answer: desperation! I was wondering why the Japanese would come out with such an outlandish QE and at the same time the Cyprus plan evolved where they took depositors money. This in turn was immediately followed by the hit on gold. Putting two and two together, desperation is the answer that fits.

Let’s shift back to gold because there’s been an awful lot of publicity surrounding the subject, and most of it is wrong. Take a look at gold’s weekly chart:

Here we have a clear picture of the last two legs up and you can see that the current correction is still considerably less than its predecessor. Yet every morning Bloomberg goes to great lengths to remind us the bull market is over. The current correction down to 1,322 is marginally above the support from the 50% retracement at 1,502.30 and pictured below:

I know the human memory is a fragile thing but if you would just think back to the previous leg up (563 to 1,033) and the correction that followed, you’ll see that it retraced 75% of that rally! You might also recall that when gold fell back to 681, Bloomberg dedicated a lot of time to telling us why gold was going back down to 250. I seem to recall that gold proceeded to rally from 681.00 to 1,923! Now it’s the same bullshit all over again.

I told my readers for months that 1,522 must hold and when it broke I immediately told them to go short. I covered my short position at 1,345 and bought physical gold at 1,367 and again at 1,385, while hedging by selling paper gold every time it poked its nose above 1,400. Well on Friday I stopped hedging and I bought the June gold futures contract at 1,398.00 as I now believe the bottom is in. My belief is based on three things:

* RSI fell to an historical low of 15.00 indicating the most extreme overbought condition in many decades,

* China bought physical gold on every dip below 1,350, and

* You simply can’t find physical gold and silver in the market place.

The Fed cannot push against the string anymore without collapsing the paper market, and that would cause a crisis in confidence. Therefore I conclude that they’ve gone as far as they can go.

The spot gold closed out the week at 1,405.70 after bottoming at 1,321.50 on Tuesday:

Here you can see that gold distributed within a range from 1,619 to 1.540 in preparation for the break of support at 1,522 (not shown). The break occurred and the closing low of 1,351.50 occurred on Monday while the intraday low occurred on Tuesday and was tested on Thursday. From Thursday’s intraday low of 1,335.60 gold climbed 70.10 to close on Friday at 1,405.70, and because of the demand for physical gold it resisted each attempt to push the price lower by selling paper. On Friday there were numerous attempts to push the price lower by first selling gold stocks and then paper silver, but each and every time gold dipped to 1,390 buyers came in looking for physical gold.

Personally I have no ax to grind and I don’t care which way gold goes, but I do care about being on the right side of the trade. When I “knew” gold was going lower on the break of 1,522, I didn’t hesitate and I went short not caring who liked it. Likewise I bought physical gold at 1,367 and 1,386, and paper gold at 1,398 because I’m convinced the bottom is in after seeing blood in the streets. Even with the rally RSI sits at 29 and that is extremely oversold. There’s no doubt gold will run into resistance and there will by attempts to manipulate the rally, but the physical market is now in control for the first time in almost two years

. Bearishness is at an all-time high, even after the bounce, and no one wants to even talk about buying gold. In other words this is the perfect time to buy and I can’t recommend gold and silver enough here.

CONCLUSION

I have been following the markets for more decades than I care to remember and I began to get a whiff of corruption back in the Reagan era. Now the markets have what I can only describe as the stench of death. Anyone who’s ever spent time on a battlefield, or around a natural disaster with a lot of fatalities, knows what I’m referring to. You never forget it! The sources of this stench are the rotting corpses of many failed policies and broken promises. Free markets are now being replaced by a welfare system that is attempting to do the impossible. The government wants to legislate the poor into prosperity and yet it forgets that it cannot give something to someone with out first taking something from someone else!

John Hussman wrote that our financial markets actually have a natural equilibrium state that is far removed from where they are today. But interfering monetary policy (e.g. QE) and delusional fiscal policy have pulled the system away from its authentic state, to the point now where the forces to correct are placing growing strain on the status quo. As the system seeks to return to where it should naturally be, yields that the Fed is so desperately trying to engineer are going to become less in size and number.Investors need to realize that much of the "growth" the Fed is trying to return to was manufactured and unnatural. We are returning to a lower-growth environment, whether we want to or not.

Back before we began to meddle with the markets and redistribute wealth, the US rose to be the richest creditor nation in the world. It did so with a comparatively small government, no income tax, no central bank and using gold and silver as money! Then came the 1907 crash that devastated Wall Street and Mr. Morgan got together with Mr. Rothschild and decided to make sure that wouldn’t happen again. Out of this was born the US Federal Reserve and the IRS, and both began to operate in 1913. Since then America’s wealth, your wealth, has declined to the point where the US is now the largest debtor nation on the planet. All of your wealth has affectively been transferred to a very select few, and you are left to pay off the debts.

Along the way there have been changes designed to circumvent the US Constitution, and without a doubt these changes limit your freedom. Americans can now be held indefinitely and even executed without due process. Now we’ll use the bombings in Boston as an excuse to do away with whatever obstacles might still be in the way. What happened most recently in Cyprus is a coming attraction to what will happen to your IRA’s and deposits in American banks once people realize what a house of cards they are. Meanwhile these select few are out there buying all the gold, silver, available farm land and any other tangible, useful asset they can get their hands on because they know what’s coming.

Finally, I am not a fan of Robert Prechter and the Elliot Wave Theorist, mainly because they have never gotten gold right, but I want to leave you with a quote from the February edition of the Theorist: "When this piper gets paid, it's going to be an awesome sight." If you only knew how true that was, you wouldn’t sleep at night, and you wouldn’t have the slightest bit of trouble buying gold! The economic devastation will lead to armed conflict and the results will be tragic. It will take generations before we recover, and there’s always the chance that we won’t ever be the same, so prepare your self.

We are so close and that’s the message behind this latest decline in gold, an event that occurs only once every six thousand years!

(WAD!)

Goldbug ping.

We noticed. California is bankrupt and is near collapse. But that doesn’t stop the liberal idiots in charge from continuing their idiotic big spending ways. Doesn’t even slow them down. The inevitable collapse is going to be a big surprise to them. And to their legions of highly paid government union worker goons (useful idiots) who are going to see their plush pension funds go *poof*.

And the USA is not far behind.

Nominated for most charts ever in a posting. Good work.

When it goes poof!

They will be angry and feel entitled to your 'stuff'...they'll come looking for you too.

Prepare now!

Deflation will be disastrous in a heavily leveraged society such as ours. Debt will become nigh on unpayable. Debt will still be denominated in dollars, dollars that will be increasingly dear as they're worth more. But like cockroaches after a nuke, there that debt still is, it survived, now payable in dollars equivalent to those of thirty years ago. Who can pay a $350,000 mortgage note on a 1983 average salary? Practically no one.

Retire your debts with cheap dollars so you can keep your expensive ones is the strategy for deflation, imho.

Well, for once in my life I’m glad I don’t have anything. And as soon as it goes belly up, they can foreclose on me and I can bail the hell out of California.

I still think the best bet is baked beans!!

That doesn’t work for those of us in states subject to judgement for any balance owed above and beyond the price fetched at auction. We’ll be hounded until it’s paid.

Well, when the state, county and city governments here all go belly up and the trash and garbage is no longer picked up, the water flows only sporadically, the sewers are all backed up and flowing into the streets, electrical and phone service failing, and gangs of looters are running free, the place will be pretty much uninhabitable. Think the ruins of Detroit writ large. Property values will fall to zero.

What happened most recently in Cyprus is a coming attraction to what will happen to your IRA’s and deposits in American banks once people realize what a house of cards they are.

Meanwhile these select few are out there buying all the gold, silver, available farm land and any other tangible, useful asset they can get their hands on because they know what’s coming.

...and firearms with an appropriate stock of ammo.

Wow, thanks for posting. I love charts.

Moderately prepared...

No one in their right mind would ever purchase a government Bond again and the present owners of municipality and city Bonds (which is close to US $1.8 trillion and then you have another US $1.2 trillion on the state level), will start dumping Bonds, to recover whatever they can get.

I own a small finger of a plateau - just over 12 acres. The

finger next to mine includes my adjoining hillside as well as the hillside of the adjoining land on the other side. There are two streams, one in each valley (about 70’ below the plateau) and a natural spring. It’s about 20 acres, mostly wooded with a 3 acre patch on top connecting to level woods at the tip of the finger.

I’m bidding on it at auction this Saturday. As much as I want to put the bucks into PM’s, I think this may actually be the better “deal” in the long run. RE taxes are only around $200 a year.

PM’s come next, beyond what I already have.

This thing has been obvious since around 2006, though I confess I didn’t really think it could get all that bad. It is so easy, even for those of us who don’t have TV, to be in denial about just how bad this can get. We have to forget the past and look at how current events will effect the future. And we must understand that we become numbed to just how bad it has already gotten.

We are already in WDII.(World Depression II), regardless of all the fake stats that keep being published. And yet it is obvious that we are still on the cusp of something much more serious. It’s looking more and more like it is late August, 1939. I don’t know when it will pop, but pop it will. For the US it may be the full implementation of Obamacare that is the final straw. But the word “straw” does not really apply.

We noticed. California is bankrupt and is near collapse. But that doesn’t stop the liberal idiots in charge from continuing their idiotic big spending ways.

I think that those politicians in a position to actually make decisions on this stuff are like a pilot of an airplane flying over rugged mountains and the “fuel low” light is about done flashing and we’re running on fumes. The pilot can either lawn dart into the mountains and just end it or he can do all he can to keep the plane on a glide path while he searches in vain, looking for a magic landing strip in the middle of the mountains, all the while telling the passengers everything’s fine. If he told them what is really happening, panic may cause the crash to come sooner and he wants to “kick the can” as long as possible - just in case that landing strip does show up.

But more and more of us notice that the rocky peaks are getting closer and closer. Eventually it will come to its climax.

Government spending is a good example. It is so huge that it is now a major part of the economy. If the government stops spending to the point that it actually makes a dent in the deficit, it will cripple the economy and put it in a deflationary death spiral. It’s the “lawn darting” I mentioned earlier. Imagine the jobs that would vanish in government and private sector government contract suppliers. And then the support industries - cars, real estate, food, motorcycles, computers.

There is no way to slowly deflate this balloon. It would require certain industries to become sacrificial lambs. Nobody is going to do that voluntarily. The “solution” will not be voluntary any more than the final contact the above airplane makes with the earh will be voluntary. And when it does make final contact it will be very ugly indeed.

Well, for once in my life I’m glad I don’t have anything. And as soon as it goes belly up, they can foreclose on me and I can bail the hell out of California.

You may be able to stay longer than you think, even if you do stop paying. Just sayin’...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.