And yet Obama and the Dems don't think the "rich" are taxed enough. This is going to hurt the job situation -- as someone said, nobody got a job from a poor person...

Posted on 03/03/2013 12:35:21 PM PST by tobyhill

Although Washington is gridlocked again over whether to raise taxes on the rich, wealthy families are already are paying some of their biggest federal tax bills in decades, while the rest of the population continues to pay at historically low rates.

A new analysis shows that average tax bills for high-income families rarely have been higher since the Congressional Budget Office began tracking the data in 1979.

(Excerpt) Read more at kwtx.com ...

Even if we taxed the rich at 100% we wouldn’t cover the current deficits. Houston we have a (spending) problem.

And yet Obama and the Dems don't think the "rich" are taxed enough. This is going to hurt the job situation -- as someone said, nobody got a job from a poor person...

Someone needs to define “wealthy”. The poverty line used to be, and might still be around $34,000. But what is middle class, and wealthy?

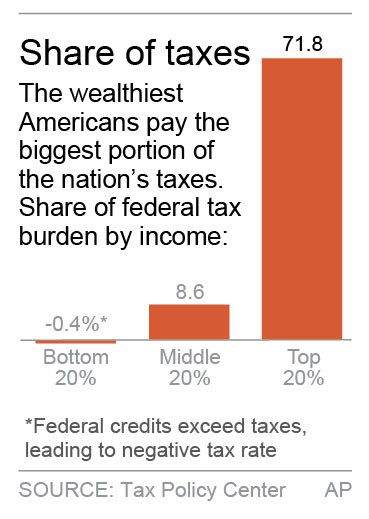

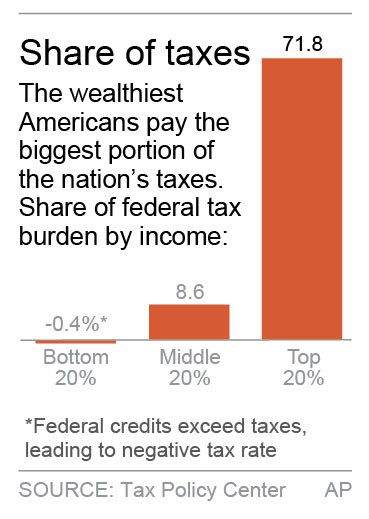

For 2013, families with incomes in the top 20 percent of the nation will pay an average of 27.2 percent of their income in federal taxes, according to projections by the Tax Policy Center, a research organization based in Washington. The top 1 percent of households, those with incomes averaging $1.4 million, will pay an average of 35.5 percent. ..... < snip > ..... On average, households making more than $1 million this year will pay 37.2 percent of their income in federal taxes ..... < snip > ..... The middle 20 percent of U.S. households — those making an average of $46,600 — will pay an average of 13.8 percent of their income in federal taxes ..... Over the past three decades, the average federal tax rate for this group has been about 16 percent. ..... < snip > ..... it is clear that for 2013, average tax bills for the wealthy will be among the highest since 1979. It also is clear that federal taxes for middle- and low-income households will stay well below their averages for the same period. ..... < snip > ..... Average after-tax incomes for the top 1 percent of households more than doubled from 1979 to 2009, increasing by 155 percent, according to the CBO. Average incomes for those in the middle increased by just 32 percent during the same period while those at the bottom saw their incomes go up by 45 percent. ..... < snip > < snip > ..... President Barack Obama and Democratic leaders in Congress say the wealthy must pay their fair share ..... < snip >

On average, the families in the bottom 20 percent of households don't pay any federal taxes. Instead, many will actually get tax credits payments from the federal government, which will result in a >negative tax rate. Because usually "the rich get richer" their total income is taxed at much higher "progressive" rate. How is that "fair"?

Since there has never been a "fair tax" and there can never be defined goal posts or a practical consensus definition of "fair share" of taxes, it's easy to keep demagoguing the term to those who think they will not be negatively affected by the taxes on or redistribution of "Other People's Money". So the "progressives" describe it in terms of income "inequity" or "inequality" - which is simply a play on some people's base envy and resentment - straight out of Marxist playbook.

This (hopefully temporary) mental confusion afflicts people not only in the U.S., but in other places where people should know better - like the U.K., Spain, France, Italy and now otherwise more sane Switzerland where people have just voted to limit executive pay by more than 2 to 1 Swiss Pay Curbs Leave Government to Struggle With Details - because it seems like a chance to "get even" without understanding the consequences or stopping for a moment to think why "poor are getting poorer" and life for "middle class" is getting harder despite all the "fair share" taxes and other measures that were instituted by government / liberal do-gooders before the latest rounds of "fair share" taxes/fines/fees/mandates or increases in minimum wages or tax credits are demanded...

But here what the eventual consequences will be for the middle class and the poor down the road - they're the ones who will be "Greece'd"!

From Next Stop, Greece - B, by Gene Epstein, 2013 February 18

< snip > ..... Federal debt is a record $12.2 trillion, or 76% of the nation's annual output of goods and services. While that's still well below Greece's 153%, we're headed steadily in the wrong direction. According to estimates by the Congressional Budget Office, adjusted by Barron's to account for recent tax increases and other factors, if the U.S. doesn't raise taxes further and cut spending dramatically, the national debt could easily reach 153% of economic output by 2035. These are not just numbers. If the U.S. national debt continues ballooning, we can be sure of a deep, long-lasting recession — very likely a depression — sometime in the next two to three decades. The unemployment rate could easily surge to 20%. ..... < snip > ..... This problem can't be solved by asking the rich to pay a little more, despite what the president says. In fact, Barron's calculates that immediately increasing the marginal tax rate to 50% on the top 1% of the country's earners would bring in $500 billion over the next 10 years. This would barely dent the country's debt load, which would then be $20 trillion, and do little to forestall a financial crisis. ..... < snip > ** ..... To appreciate the magnitudes involved, the national debt by 2023 would be in the range of $20 trillion, give or take. It shouldn't be surprising that even aggressive tax hikes on the top 1% won't save the day. While the rich do earn a lot, they aren't that numerous. ..... < snip > ..... One lesson in this exercise: Unless President Obama proposes drastic spending cuts, his vision for America requires imposing crippling taxes on the very people whose continued prosperity he so strongly champions — the lower 99%. Even a 25% tax hike on this broad group wouldn't be enough to solve the budget problem unless it was combined with sharp cuts in spending. ..... < snip > Special Report--Debt Crisis: If we fail to rein in spending and increase taxes — starting now — the U.S. in 22 years could be in worse shape than Greece is today.

** A link to the chart of national debt-to-GDP ratio projections including hypothetical adjustments, such as new Obama taxes "on the rich" and the rollback to pre-Bush tax rates: When Will the Fiscal Crisis Strike?

And in the follow-up article, things are called what they really are - a Ponzi scheme.

From One of the Costliest Ponzi Schemes Ever - B, by Gene Epstein, 2013 February 23

Samuelson's error has been effectively exposed by another Nobel Prize winner, economist James M. Buchanan, who died last month. According to Buchanan's public-choice theory, which he also called "politics without romance," politicians reap short-term gains from spending money that can be paid back long after they leave office. They therefore have a strong incentive to preach and practice continued fiscal irresponsibility, to the point that future tax bases become heavily mortgaged. The revenues that could be realized don't even come close to covering the sums that are being committed. ..... < snip > Buchanan didn't use the term Ponzi, as far as I know. But he warned prophetically that chronic deficits were becoming an institutionalized part of the way government operates. ..... < snip > ..... SPEAKING OF THE SYSTEM, deficit dove Paul Krugman was on to something when he recently observed that "George W. Bush squandered the Clinton surplus on tax cuts and war, and that window has closed." ..... Why the "window has closed" implies a defeatism that defies logic. Not even Buchanan thought change was impossible. Also, the "Clinton surplus" had a great deal to do with the defeat of "Hillarycare" and the influence of Newt Gingrich on the Clinton budget. ..... < snip > In a 1967 Newsweek column, the late Nobel laureate economist Paul Samuelson called Social Security "a Ponzi scheme that works." While Ponzi schemes in the private sector always go bust, the government's version worked, according to Samuelson, because it was financed by an ever-expanding tax base, which in turn was fueled by an ever-growing economy.

The author, Gene Epstein, nails Krugman on yet another hypocrisy: in NYT article in February 2005 Krugman chastised President Bush for deficit of 2.6% of GDP as being "indeed a major problem"; in February of 2013 with the deficit optimistically projected to run at 5.3% of GDP "the deficit problem was mostly solved" by Obama.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.