Posted on 09/07/2012 4:32:41 PM PDT by lbryce

ACTUAL TITLE:

Are Chinese Banks Hiding “The Mother of All Debt Bombs”?

China's massive bank financed stimulus was intended to keep the economy moving. It may instead lead to economic disaster.

Financial collapses may have different immediate triggers, but they all originate from the same cause: an explosion of credit. This iron law of financial calamity should make us very worried about the consequences of easy credit in China in recent years. From the beginning of 2009 to the end of June this year, Chinese banks have issued roughly 35 trillion yuan ($5.4 trillion) in new loans, equal to 73 percent of China's GDP in 2011. About two-thirds of these loans were made in 2009 and 2010, as part of Beijing's stimulus package. Unlike deficit-financed stimulus packages in the West, China's colossal stimulus package of 2009 was funded mainly by bank credit (at least 60 percent, to be exact), not government borrowing.

Flooding the economy with trillions of yuan in new loans did accomplish the principal objective of the Chinese government — maintaining high economic growth in the midst of a global recession. While Beijing earned plaudits around the world for its decisiveness and economic success, excessive loose credit was fueling a property bubble, funding the profligacy of state-owned enterprises, and underwriting ill-conceived infrastructure investments by local governments. The result was predictable: years of painstaking efforts to strengthen the Chinese banking system were undone by a spate of careless lending as new bad loans began to build up inside the financial sector.

When the Chinese Central Bank (the People's Bank of China) and banking regulators sounded the alarm in late 2010, it was already too late. By that time, local governments had taken advantage of loose credit to amass a mountain of debt, most of it squandered on prestige projects or economically wasteful investments. The National Audit Office of China acknowledged in June 2011 that local government debt totaled 10.7 trillion yuan (U.S. $1.7 trillion) at the end of 2010. However, Professor Victor Shih of Northwestern University has estimated that the real amount of local government debt was between 15.4 and 20.1 trillion yuan, or between 40 and 50% of China’s GDP. Of this amount, he further estimated, the local government financing vehicles (LGFVs), which are financial entities established by local governments to invest in infrastructure and other projects, owed between 9.7 and 14.4 trillion yuan at the end of 2010.

Anybody with some knowledge of the state of health of LGFVs would shudder at these numbers. If anything, Chinese LGFVs are known mainly for their unique ability to sink perfectly good money into bottomless holes in the ground. So taking on such a huge mountain of debt can mean only one thing — a future wave of default when the projects into which LGFVs have piled funds fail to yield viable returns to service the debt. If 10 percent of these loans turn bad, a very conservative estimate, we are talking about total bad loans in the range of 1 to 1.4 trillion yuan. If the share of dud loans should reach 20 percent, a far more likely scenario, Chinese banks would have to write down 2 to 2.8 trillion yuan, a move sure to destroy their balance sheets.

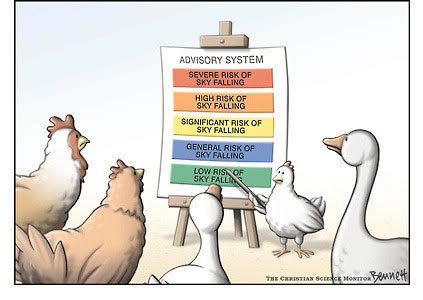

Anyway, the grand prize that I managed to win all by myself is that this article which hardly sounds legitimate has pushed me over the cliff, stories I will never believe again with one scaremongering story day after day

I WILL NEVER AGAIN GIVE A SH!T, NEVER AGAIN WILL I GIVE A RAT'S *SS, CARE IN THE SLIGHTEST ABOUT THE LATEST DYSTOPIAN CATASTROPHE ABOUT TO UNFOLD, ECONOMIC, METEOROLOGICAL, BACTERIOLOGICAL, STORIES WHEREBY A HUGE POOL OF THE ALIEN ACID BLOOD FEATURED IN THE MOVIE ALIEN, ACID SO POWERFUL IT LIQUIFIES DIAMOND IN NANO-SECONDS, IS ABOUT TO BLOW , THE PRESSURE IS BUILDING UP AND WILL EXPLODE AT ANY SECOND AND TURN THE EARTH INTO A HUGE FIERY CINDER. WHILE THE WHOLE WORLD MAKES PLANS TO STOE FOOD, MATERIEL TO SURVIVE, I'M GOING INTO MY BACKYARD SLEEEP IT ALL OFF IN THE HAMMOCK AND HAVE MYSELF REALLY GOOD LAUGH.

Might want to stay away from the “business insider” blog, the “zero-sense” blog, and oh, the “economic collapse” blog. And maybe the SHTF blog too.

Every year since 2000 has been the year of collapse, according to the FReepers who pimp them here.

The allcaps and the exclamation points alone on those blogs are enough to drive one to drink.

Thanks for your comments.

My post was made in full 3D sarcasm and parody. But I also wanted to make a very striking point about all apocalyptic BS we are allowing into our psyche to pointlessly, needlessly damaging effect. I’m quite aware of who is pushing the economic panic buttons that include the ones you mentioned but the story I linked to is from one of the most responsible, diligent resources on the Web, Instapundit at PJMedia. Still, the news break attitude in which he broke the story kind of pushed me over the edge, in a parodying, sarcastic frame of mind.

Buy gold.

I wish the US was in such good shape:

The World’s Biggest Debtor Nations

Old numbers, not including "unfunded mandates"

20. United States: 99.46%Speeches by Richard W. Fisher, president and CEO of the Federal Reserve Bank of Dallas

External debt (as % of GDP): 99.46%

Gross external debt: $14.959 trillion

2011 GDP (est.): $15.040 trillion

External debt per capita: $47,664

Storms on the Horizon

Remarks before the Commonwealth Club of California

May 28, 2008

"No combination of tax hikes and spending cuts, though, will change the total burden borne by current and future generations. For the existing unfunded liabilities to be covered in the end, someone must pay $99.2 trillion more or receive $99.2 trillion less than they have been currently promised. This is a cold, hard fact. The decision we must make is whether to shoulder a substantial portion of that burden today or compel future generations to bear its full weight."

A better comparison would be total local and state American governmental debt - they only total around 18% of US GDP.

Maybe Bernanke can give them some of our worthless dollars, since it appears they have loaned us some of their worthless yuans.

To prevent duplication, please do not alter the published title. Thanks.

Yes, sir. I was just trying to make a point but I certainly agree with you on the practical aspect.

It's hard to compare apples to apples with China and the USA, given China's

- lack of separation of state (central government) and private interests

- dubious accounting standards

- lack of transparency

- systemic cronyism

- and widespread corruption

On second thought, as Rosanna-Rosanna-Dana from SNL would say - never mind... :-)

But, unfunded state liabilities never get rolled into the annual state financial budget discloses. According to this site:

State Budget Solutions' third annual State Debt Report shows total state debt over $4 trillion -the state debt and unfunded liabilities is more like 27% of GDP.

Add that to the federal debt and unfunded liabilities ($4.2+ trillion in state and $16 trillion fed debt plus $110+ trillion liabilities), puts the US debt at 870% of GDP!

Also see:

State Budget Solutions State Debt Profiles 2012 (spreadsheet)

67% of state debt tied to pension liabilities, budget reform group says

"Market-valued unfunded public pension liabilities made up 67% of all state debt, according to a report Tuesday by State Budget Solutions, a non-profit organization advocating state budget reform.The group's third annual state debt report, which looked at combined debt and future spending obligations in all 50 states as of Dec. 31, found that $2.8 trillion of the $4.19 trillion total debt total goes toward pension liabilities.

Yes, China is in trouble.... FEDX CEO “ I’ve been somewhat amused watching some of the China observers, I think, completely underestimate the effects of the slower exports on the overall China economy.”

I read the article at some other source and recalled the comments I made at the post. Thanks for mentioning it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.