Posted on 12/18/2011 11:44:24 AM PST by blam

Global Economic Crisis: The U.S. An Insolvent And Ungovernable Country

Economics / Global Debt Crisis 2012

Dec 18, 2011 - 11:57 AM

By: LEAP

As announced in previous GEABs, in this issue our team presents its anticipations on the changes in the United States for the period 2012-2016. This country, the epicentre of the global systemic crisis and pillar of the international system since 1945, will go through a particularly tragic in its history during these five years.

Already insolvent it will become ungovernable bringing about, for Americans and those who depend on the United States violent and destructive economic, financial, monetary, geopolitical and social shocks. If the United States today is already very different from the "super-power" of 2006, the year the first GEAB was published, announcing the global systemic crisis and the end of the all-powerful US, the changes we anticipate for the 2012-2016 period are even more important, and will radically transform the country's institutional system, its social fabric and its economic and financial weight.

At the same time, every December, we evaluate our anticipations for the year just ended. This exercise, too rarely practiced by the think tanks, experts and media (1) is a tool enabling our subscribers (2) as well as our researchers to verify that our work retains a high added-value and and is in direct contact with reality. This year our score improved slightly and LEAP/E2020 attained an 82% success rate in its anticipations for 2011.

In addition we also detail our recommendations on foreign currencies, gold, stock exchanges and the consequences of the United Kingdom’s marginalization within the EU (3) on the Pound, Gilts and UK debt and we set out some advice on developments of the American institutional system (4).

In this public communiqué we have chosen to present an excerpt from our anticipation on the changes in the United States for the 2012-2016 period.

But before addressing the American case, we wish to review the situation in Europe (5).

From the non-dislocation of Euroland to the dislocation of the United Kingdom As anticipated by our team, the EU summit in Brussels on 7 and 8 December last has led to two key events:

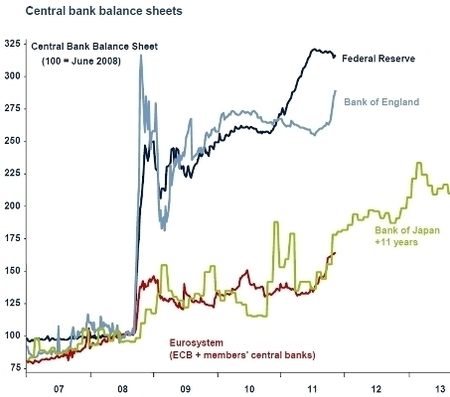

* The further integration of Euroland with an acceleration and strengthening of budgetary and financial integration and the initiation of a fiscal integration (6). The Eurozone governments, led by Germany, have confirmed their willingness to go right through to the end of this process, unlike all the Anglo-Saxon and Eurosceptic discussions which, for the last two years, predicted that Germany would abandon the Euro. At the same time, they have refused to follow the path of the Fed and the Bank of England by refraining from running the printing press (Quantitative Easing) as long as budgetary discipline is not achieved within Euroland (7). The clear failure of QE in the US as in the UK (8) confirms the relevance of this choice which will allow the issue of Eurobonds at the end of 2012 (9).

US, UK, Japanese and European central bank balance sheets (2007-2011, based 100 in June 2008) - Source: Société Générale, 11/2011 In contrast, the "assurance" that the Greek case (of a “voluntary tax” of a 50% “haircut” for the country’s private creditors) will remain an exception is a promise that binds only those who believe it. Incidentally it has been pushed by the French President, Nicolas Sarkozy, whose citizens are well aware, after five years of seeing him in action, that his commitments have no lasting value and are always tactical in nature (10).

* The lasting marginalization (at least 5 years) of the UK within the European Union vividly confirms that it really is now Euroland that henceforth leads European affairs. David Cameron’s inability to gather even only two or three of the United Kingdom’s “traditional allies” (11) illustrates the structural weakening of British diplomacy and the general lack of confidence in Europe on UK’s ability to overcome the crisis (12). It’s also a reliable indicator of the loss of US influence on the continent since the sending of Treasury Secretary Tim Geithner and Vice President Joe Biden to maraude on the mainland a few days before the summit served no purpose and didn’t prevent the British failure (13).

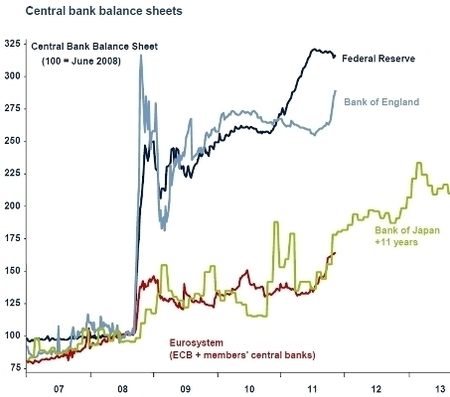

Comparison between interest rates on current debt and the market rate for 10 year borrowing - Source: Figaro, 11/2011

In fact this summit will have been historic, but not yet because it will have settled the European financial and budgetary problems. As we anticipated in December 2010, and as Angela Merkel has just said in the Bundestag, the Euroland path is a long journey, complex and chaotic, like the road traveled since the 1950s for European integration (14). But it’s a way that strengthens our continent and will place Euroland at the heart of the world after the crisis (15). If markets are not happy with this reality, it's their problem. They will continue to see their ghost-assets go up in smoke, their banks and hedge funds go bankrupt, trying in vain to push up interest rates on European debt (16) resulting in the ratings of the Anglo-Saxon credit rating agencies losing all credibility (17).

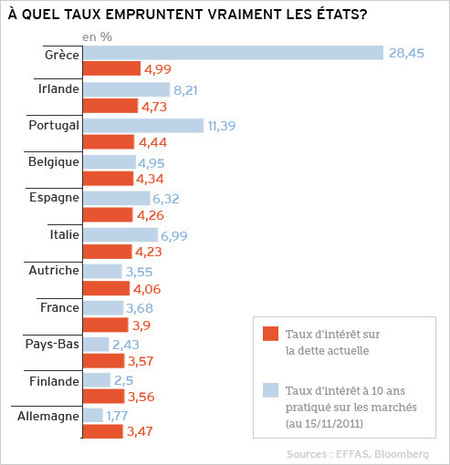

Large hedge funds’ donations to the British Conservative Party (2001-2011) - Source: Financial Times, 12/2011

This summit is historic because it confirms and boosts the return of the EU founding countries in charge of the European project and because it shows that far from witnessing a collapse of the Euro zone, the shock treatment attempted by David Cameron on the orders of City financiers (18), is resulting in an acceleration of the United Kingdom’s dislocation (19). In addition to the confrontation between Liberal Democrats and Conservatives which Cameron’s posture initiated, undermining even further a coalition already in really bad shape, this British marginalization raises fierce opposition in Scotland and Wales whose leaders proclaim their attachment to the EU and its volition, as regards Scotland (20), to join the Euro once the independence process starts around 2014 (21).

And, the icing on the cake, the collusion between the City and the British government is now a topic that extends beyond the UK’s borders and reinforces the continent’s determination to finally bring this “outlaw” under control. As we have described since December 2009 and the beginning of the attacks against Greece and Euroland, the City, alarmed by the consequences of the crisis as regards European regulations, launched itself in an attack against an evolving Euroland, putting the Conservative Party and Anglo-Saxon financial media in its service (22). The episode of the recent Brussels summit marks a major defeat for the City in this increasingly public war, exposing by the way the resentment of a majority of British who are not so much against Euroland than against the City (23) accused of exploiting the country (24).

With £1.8 trillion of public money invested in banks to prevent their collapse in 2008, the British taxpayers are in fact those who have paid the most for the rescue of financial institutions. And the British government may well continue to exclude this amount from its public debt calculations by claiming it’s an “investment”, de facto, fewer and fewer people consider that the banks in the City will recover from the crisis, especially since its worsening in the second half of 2011: the shares purchased by the Government in fact are already worthless. The “UK hedge fund” is on the brink of collapse (25) ... and thanks to David Cameron and the City, it’s isolated with no one to come to its aid, neither in Europe nor the United States.

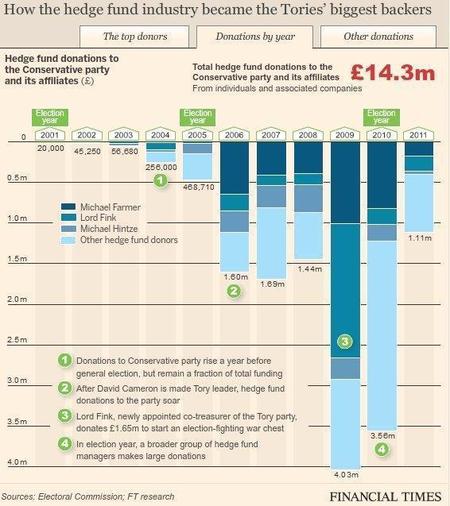

With the Chinese bubble (26) about to join the European recession and the US depression, the 2012 storm will determine whether David Cameron and his finance minister George Osborne are worthy descendants of the great British sailors.

Maritime freight costs China/Europe (in blue) and China/USA (in red) (September-November 2011) - Source: Phantonomics, 12/2011

But back now to the extract from our anticipation on the future of the United States for the 2012-2016 period.

The Future Of The USA - 2012-2016: An Insolvent And Ungovernable United States

In this issue, our team therefore gives its anticipations regarding the future of the United States for the 2012-2016 period. We recall that since 2006 and the first GEAB issues, LEAP/E2020 described the global systemic crisis as a phenomenon characterizing the end of the world as we know it since 1945, marking the collapse of the American pillar on which this world order has rested for nearly seven decades. Since 2006, we had identified the period 2011-2013 as that during which the “Dollar Wall” on which the power of the United States sits would fall apart.

Summer 2011, with the cut in the United States’ credit rating by S & P, marked an historic turning point and confirmed that the “impossible” (27) was indeed in the process of coming true. Therefore today, it seems essential to provide our subscribers with a clear anticipatory vision of what awaits the “pillar” of the world before the crisis at the point when the crisis moved into “top gear” in summer 2011 (28).

Thus, according to LEAP/E2020, the 2012 election year, which opens against the backdrop of economic and social depression, complete paralysis of the federal system (29), strong rejection of the traditional two-party system and a growing questioning of the relevance of the Constitution, inaugurates a crucial period in the history of the United States.

Over the next four years, the country will be subjected to political, economic, financial and social upheaval such as it has not known since the end of the Civil War which, by an accident of history, started exactly 150 years ago in 1861. During this period, the US will be simultaneously insolvent and ungovernable, turning that which was the “flagship” of the world in recent decades into a “drunken boat”.

To make the complexity of the current process understandable, our team has chosen to organize its anticipations around three key areas:

* US institutional deadlock and the break-up of the traditional two-party system

* The unstoppable spiral of recession/depression/inflation

* The breakdown of the US socio-political fabric

The unstoppable US economic spiral : recession/depression/inflation (extract)

In fact, the United States ends 2011 in a state of weakness unmatched since the Civil War. They practice no significant leadership at international level. The confrontation between geopolitical blocs is sharpening and they find themselves confronted by almost all the world’s major players: China, Russia, Brazil (and in general almost all of South America) and now Euroland (30).

Meanwhile, they cannot control unemployment where the true rate stagnates at around 20% against the backdrop of an unabated and unprecedented reduction in the labour force (which has now fallen to its 2001 level (31)).

Real estate, the foundation of US household wealth along with the stock market, continues to see prices drop year after year despite desperate attempts by the Fed (32) to facilitate lending to the economy through its zero interest rate policy.

The stock market has resumed its downward path artificially interrupted by two Quantitative Easings in 2009 and 2010. US banks, whose balance sheets are much more heavily loaded with financial derivative products than their European counterparts (33), are dangerously approaching a new series of bankruptcies of which MF Global is a but a precursor, indicating the absence of procedural controls or alarms three years after the collapse of Wall Street in 2008 (34).

Poverty is gradually increasing in the country every day, where one in six Americans now depend on food stamps (35) and one in five children has experienced periods of living on the streets (36). Public services (education, social, police, highways...) have been significantly reduced across the country to avoid city, county, or state bankruptcies. The success with which the revolt of the middle class and the young (TP and OWS) has met is explained by these objective developments. And the coming years will see these trends get worse.

The weakness of the 2011 US economy and society is, paradoxically, the result of the “rescue” attempts carried out in 2009/2010 (stimulus plans, QE ...) and the worsening of a pre-2008 “normal” situation. 2012 will mark the first year of deterioration from an already badly impaired situation (37).

SMEs, households, local authorities (38), public services,... have no more “padding” to soften the blow of the recession into which the country has fallen again (39). We anticipated that 2012 would see a 30% drop in the Dollar against major world currencies. In this economy, which imports the bulk of its consumer goods, this will result in a corresponding decrease in US household purchasing power against a backdrop of double-digit inflation.

The TP and OWS have, therefore, a bright future ahead of them since the wrath of 2011 will become the rage in 2012/2013.

Regardless, after reading, I (now) feel like buying more ammo.

Not to worry, it will soon be 2012, the end of the world. If not, life goes on.

Prepare for the worst, and be glad when it doesn’t happen. I predict we will elect a Republican president and conservative Congress, and slowly, but surely, turn things around. The left hasn’t won yet.

The author(s)may very well be correct, but as they are obviously biased in favor of “euroland” they are suspect. Further, our country and our countrymen have been underestimated before. If we can get the liberals and RINOs out, we will turn this ship around. If not, we will go down the path described in the article.

Ungovernable ... yeah, I can sign off on that one. We’ve always been a nation of mavericks thoroughly unwilling to be led around by the nose.

They “represent” us, they don’t “lead” us.

As for the rioting ... hmmm ... whaddaya think would trigger that? Stopping all the government checks, maybe?

I found this at Zero Hedge, The yield curve (with pictures) isn’t signaling recession or more Fed intervention. But look at the last chart (Fed Funds Rate). It shows that it it getting worse and worse and The Fed is running out of options, So a Euro kaboom will really hurt the US. It’s not showing up in bond markets ... yet.

QE3? The Message From The Yield Curve is No – “But these aren’t normal times, Cato”

If/when the economy collapses, the ‘Ungovernable Country’ will be in the inner cities along with locations with WEAK gun laws(blue states).

The law abiding areas that are heavily armed will take care of themselves.

There will be some sporadic rioting here in Texas but overall, law and order will prevail.

I am going to enjoy watching Hollywood mansions, bureaucrats homes in Fairfax county and parts of Manhattan implode.

sure, they'll throw some dollars to the union and govt workers, but you know who really benefits...the union bosses...they're all getting millions to be the stooges that they are...

most of us on FR have family...we have children..we have adult children with their own children.....we have beloved nieces and nephews and great neices and nephews...

we don't want finacial collapse...nothing good will come of it....

we might buy ammo galore and dig a moat around our houses but our most precious assets...our loved ones....are here and there and we can't protect them...

so ammo buying to me is moot....it won't protect my grandchildren 300 miles away....

we better sweep into office from dog catcher to president some decent people that love America....we need leadership at the top to survive...

God bless America and send us the grace to revive America....

Most of our problems stem from the fact that we are gradually becoming governable — a trend I hope to see reversed in the near future.

I wish I could be as optimistic as you but judging from the recent legislation getting passed in our US House of Representatives I would not count on much change. The republican majority just overwhelmingly voted for a bill which allows US citizens to be snatched off the street and detained indefinitley without a lawyer or a court hearing. Not too comforting.

bfl

This country, as conservatives knew it, ended when the Ten Commandments was removed from the town square and replaced with moral relativism.

Prepare accordingly.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.