Has it occurred to ANYONE that our fate is to be swallowed whole by Zombies...in various and sundry forms?

Lord, Help us!

Posted on 10/23/2011 6:01:54 PM PDT by MontaniSemperLiberi

The US Treasury and Wall Street dealers are set to discuss whether to introduce a new debt security to help finance the country’s mounting budget deficit in the coming years.

Topping the agenda of a meeting on Friday between Treasury officials and dealers, who underwrite US government debt sales, is the possible introduction of floating-rate notes.

In contrast to normal fixed-rate Treasuries, which pay the same coupon throughout their lifespan, the payment to investors from floating-rate notes would go up or down as the Federal Reserve changed short-term interest rates. That could make them attractive to investors who think that Treasury yields have hit a floor and are set to rise in the coming years.

“We think the case for diversifying the Treasury’s funding sources by introducing [floating rate notes] is very strong in light of the prospect of persistently large budget deficits in the years ahead,” said Lou Crandall, economist at Wrightson Icap. “They would give the Treasury an additional tool for meeting unexpected increases in borrowing needs that would neither place upward pressure on long-term rates nor add to the government’s near-term rollover needs.”

(Excerpt) Read more at ft.com ...

It doesn't work of course because the pool of those not willing to buy a short term bond at a higher interest rate but buy a "floating rate note" is so limited.

If I were an investment bank though, I'd love these bonds because I could write a derivative on them and cash in.

This has D-I-S-A-S-T-E-R written all over it.

The looting of America continues apace.

Rather than trying to shuffle the deck chairs around to try to block the view of the iceberg, how about we stop outsourcing American factories and jobs, stop sending our technology to people who hate us, stop spending our national treasure on countries which don’t do anything for us - and create American wealth again.

We cannot spend money, we do not have.

We need to create wealth again. That means manufacturing.

AMERICAN MANUFACTURING.

That will require a real, pro-American trade policy.

All this financial sleight of hand is just three card monty.

We need jobs, and manufacturing.

Not tricks.

Has it occurred to ANYONE that our fate is to be swallowed whole by Zombies...in various and sundry forms?

Lord, Help us!

Investing in East European penny stocks would be safer than gambling with a floating interest U.S. Treasury note.

PLEASE CONSIDER DONATING TO FREE REPUBLIC TODAY OR BECOMING A MONTHLY DONOR

CLICK ON THE IMAGE ABOVE TO DONATE

Maybe we should consult with Zimbabwe finance folks first..

Good Lord. Like anyone needs these idiots to dream up something new.

This reeks of desperation...

Technically a derivative.

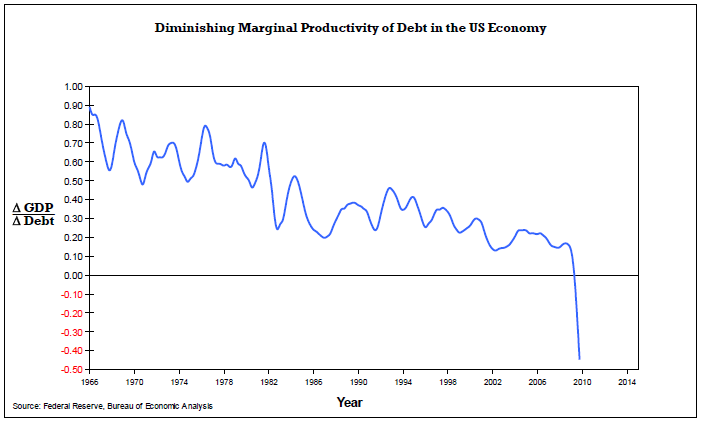

As some have predicted, the FED will never raise rates again. This is more proof of that position.

Also, it gives the US Gov't even more incentive to fudge CPI figures.

"Well doctor, if you can't bleed the patient at his arm anymore, try bleeding him at his leg. Bleeding is the only cure!"

Well, in the long run - you're right. Nothing good will come of this... But in the short run the economy will improve - they'll gin it up so it's humming by election time. After that, it'll crash. Bad ideas have a way of catching up with disaster. If Republicans win, we'll be blamed - even if the economy crashes a month later. If Obama's reelected, he'll have 4 years to milk the disaster to create a command economy under a socialist state.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.