Source: Federal Reserve.

Posted on 07/04/2011 7:39:32 AM PDT by SeekAndFind

The housing market is a mess. Prices might look cheap, but probably aren't finished falling. They've basically fallen back to historic averages. The washing out process that happens after bubbles burst usually takes assets far below average. Euphoria doesn't just end. It turns to hatred. Fool me once ... you know.

Still, housing is going to recover. It might be years from now, but it's going to happen. You can guarantee it. Those are strong words, but the force that will drive recovery is even stronger.

A driver behind the housing bubble was that we built too many homes. For most of the last decade, new home construction grew far faster than population growth or household formation. This wasn't surprising. It didn't even matter that there weren't enough new households to fill all the new homes. Investors would happily purchase a new home -- or 10 -- and let it sit empty. The sole point was to let it appreciate and sell it at a profit.

But today we're in the exact opposite position. New home construction is comatose. It doesn't make any sense for contractors to keep building. "The construction industry is dead right now," Yale economist Robert Shiller said last month. "They don't see any profit in building homes at these prices." That's the strongest force you could ask for to keep new home construction glued to the floor, and it means homebuilding in relation to the size of the economy is nowhere near normal levels.

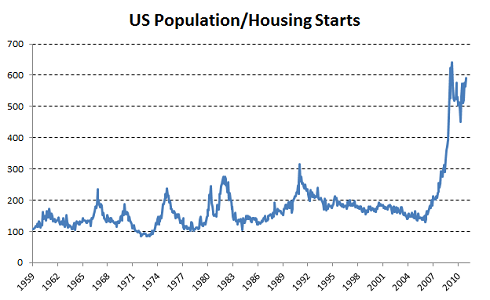

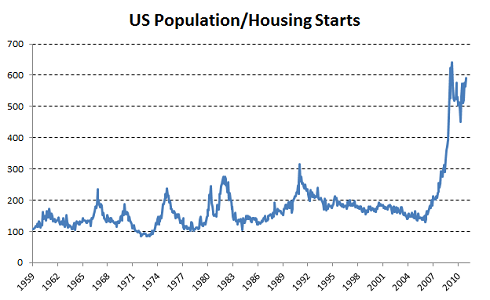

Here's a good way to visualize this:

Source: Federal Reserve.

The higher the line on this chart, the higher the odds are that we'll need to build more homes in the future. Obviously, we're in uncharted waters right now.

Some more figures to throw at you: In 2005, about 1 million new households were formed while more than 2 million new homes were built. That created an inventory glut. Today, about 1 million new households are still being formed, yet housing starts (new home construction) are running at about 560,000 per year. That's eating up excess inventory -- quickly.

That trend should stand, too, thanks to the U.S.' strong demographic and immigration trends. Household formation over the next decade should average nearly 1.5 million per year, according to the Joint Center for Housing Studies at Harvard University.

Simply put, the number of homes being built today cannot, and will not, support population growth. Excess from the housing bubble is being removed, and will likely be mostly cleared out in another year or two. After that, one of two things (or a combination of both) has to happen.

The first is home prices will rise. It's simple. At the rate we're going today, demand will not only catch up with, but surpass, supply in the future. And that's a fairly safe forecast to make. Unlike demand for stocks, gold, or bonds, a minimum level of demand for housing can be projected rather safely based off household formation -- itself a relatively safe forecast being based on demographics.

Once prices start rising after new households clear out excess inventory, homebuilders will regain the incentive to build. They'll have the demand to do it. I think that's the most important point to consider when looking at companies like Pulte (NYSE: PHM ) , NVR (NYSE: NVR ) , and KB Homes (NYSE: KBH ) . If these companies can stick it out another two years or so, business is practically guaranteed to improve. Quite substantially, too. A lot of these companies are being priced based solely off of today's derelict housing market without respect for the inevitable construction rebound. Could be an interesting sector if you've got the patience. Most investors don't, and that's why these companies trade where they do.

More importantly, no modern U.S. recession has ever fully recovered without the help of housing. Even in non-bubble times, housing is one of biggest economy drivers for the simple reason that it's the largest investment most people ever make. Its downfall is a major reason our economy is still in a funk. And we'll probably stay there for a while. But if there's light at the end of the tunnel, it's from the chart above. The inevitable rebound in construction is one of the most positive future indicators we have today -- even if that future is a full two years away.

Again, the housing market is a mess and will probably get worse. Count on it. But everything is in place for a recovery. All markets are cyclical, and when you look at the numbers it's hard not to think we're near the bottom of this cycle.

“They’ve basically fallen back to historic averages”

2001 levels is “historic”?

Wages have not moved much past 1994 levels. Housing is still priced higher than people really can afford. Housing prices have plenty of room to fall even further.

Except that Obummer is POTUS.

A truly inept analysis. There is an enormous overhang of homes banks are keeping off the market. And, just what does this genius think is going to happen when rates rise, as they surely will? What about the social unrest that will inevitably accompany the growing divide over what the government can borrow and steal for redistribution?

The author assumes that we can keep kicking the can down the road. I think the next ten years will be chaotic and that the usual market analyses will be useless.

Doesn’t take a rocket scientist to figure that out. There’s more people needing housing and they’re not making more land. Of course it will turn around. And prices will rise. Heck, prices never so much as hiccupped here and they’ve been zooming higher and higher.

This would make sense if the American economy was picking back up and middle class people were working, but the economy has been shedding good jobs in favor of layoffs and jobless recovery (doing better but not hiring back anyone) and outsourcing to other countries.

People are going to need good paying jobs to pay for these houses, or if there are no good paying jobs to be had, the houses will continue to sit empty until the prices drop to where people can afford to make the payments for them.

The. Last number I heard about 3.4 million homes were empty with another 2 or 3 million in default and subject to foreclosure, and this stupid writer thinks we are eating into the inventory. ROFLOL, and the great die off of the baby boomers is around the corner. Writer lives in the twilight zone.

He’s using a lot of words and numbers to say, “I assume that, if we stop building more, someone will eventually want to buy the existing inventory.” However, there are a lot of reasons (the chief being Barack Hussein Zerobama) that this could prove to be an erroneous assumption.

I’m filing this under, “You can ‘prove’ anything with statistics that were made up anyway.”

Our aging and educated baby boom population is being replaced by illiterate manual laborers from South/Central America. Yeah landscapers and housekeepers will be snapping up 3000 sq ft surplus McMansions. Right.

“That trend should stand, too, thanks to the U.S.’ strong demographic and immigration trends.”

Not too sure what demographics are being discussed, but the immigration thing is hardly a cause for celebration.

“All markets are cyclical...”

In “unfettered” pure capitalism, that statement is true. “Twould be difficult to define today’s capitalism as such.

Well, what happens if the USA goes bankrupt - which seems a possibility if Obama somehow gets 4 more years.

On Mark Levin on Friday I heard him reading from a paper saying the CBO analysis is wayy off because a rise of treasury notes interest to just the average rate will bury us. He said this would eat up the entire savings of the Ryan plan and that’s even if it was passed.

I just don’t see how anything can be predicted now - well, except for disaster if zero gets four more.

Multiple flaws in this piece, but the real 600 pound gorilla that is left out: The local, state and federal spending/debt crisis.

It is a fool indeed that makes predictions now based on previous downturns. Never have the US AND the rest of the world had a debt situation like we have now. And we have never tried to recover with an America hating fascist at the helm.

IMO, very few parallels can be drawn between now and previous recessions. Since this piece is basing its entire premise on that reasoning, the author is a fool.

I remember the depression of FDR’s days, and that’s what we are heading for.

Our government is out of control in trying to solve things by printing money and throwing it down “stimulus” rat-holes.

Prepare for it ... a crash is coming.

..xacree. Where is the optimism? What are the expectations? Currently, the average man is worse off than three years ago. What is the prognosis for the future? Higher unemployment, Increased energy costs, Greater taxes to pay for the Obama debt, Lower disposable family income.

Whats needed is a business person in the WH , not a fantasy text book marxist.

Nice try....

“Still, housing is going to recover. It might be years from now, but it’s going to happen. You can guarantee it. Those are strong words, but the force that will drive recovery is even stronger.”

Those are NOT strong words. It’s also only been ‘years’ since the Roman Empire peaked in strength.

There are millions of unneeded houses in this country, there are probably 10s of millions of houses just waiting to enter the market (as owners want to move, but are waiting for things to get better).

We also have the largest square footage of living space per person in world history (in fact, 50% bigger than just 20 years ago). This is going to bite us BIG-TIME as energy costs go through the roof (particularly electricity, since we don’t build power plants anymore). What does that mean? People will be FORCED to double and triple up...and the glut will get that much bigger.

No, we’re just seeing the preliminaries...the real housing crash is still a few years away.

For housing to recover, we need one or both of the following to happen: A 50% increase in population (hello Illegals), and/or a 33% reduction in housing stock (as in burn them to the ground). Then housing will balance our ability to afford it. If we don’t get the increase in population, we will gradually get the reduction in housing stock, as houses will simply remain unoccupied and rot away (hello Detroit).

I suspect that this guy is sitting on a house he can’t afford and is trying to game the market so he can sell it. No reasonable analyst could conclude things will get better.

“but the force that will drive recovery is even stronger”

The same forces that would produce a $20 loaf of bread, reckless monetary expansion.

I agree with you to a point. We’ve got piles of overpriced houses that nobody wants. On the other hand, the low end market is hot (includes trashed foreclosures). The banks are making tons of money churning mortgages courtesy of the Fed and Freddie (who allows everyone to refi with zero equity). The Fed will keep devaluing the dollar and people will keep unloading their dollars partly into real estate.

In a normal economy, yes, housing and land ALWAYS recover. But what has happened is that we have an aging demographic which can’t move “back” to smaller homes because they can’t sell their existing homes to younger people coming up in the world. Indeed, the number of younger people able to afford homes is shrinking. Obama has seen to that. So I’m not sure I’d entirely agree with this guy. If Japan had a normal economy in housing, we could look there for what happens to an aging economy’s home prices-—but it doesn’t.

mark

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.