Posted on 01/15/2011 8:49:35 AM PST by blam

We Could Be In Great Depression II – But We’re Not! (Everything Is Okay Now)

Economics / US Economy

Jan 14, 2011 - 03:00 PM

By: Sy Harding

Global financial authorities proved to be quite adept at reacting quickly, step-by-panicked step, to the financial crisis as it unfolded, making hasty dramatic moves dreamed up on the fly in panicked weekend meetings.

That the efforts worked is obvious. We are not in Great Depression II.

Heck, we're already back to buying new cars, packing the airports and vacation destinations, and piling money into the stock market. Bankers are not jumping out of office windows as in the 1930's. Those eased out of their former positions are enjoying impressive golden parachute retirements. Those still in their positions are already celebrating humongous performance bonuses again. The U.S. government has even made sizable profits from many of the temporary bailout loans and investments.

And the good news doesn’t stop there.

Global central banks, the International Monetary Fund, the U.S. Congress, and financial regulators, have thoroughly investigated the causes of the crisis and promised changes that will prevent such near disasters from ever happening again.

That is such a relief.

- If only global financial authorities could provide something more concrete than verbal assurances, anything at all to indicate they are able to see, and are willing to address, potential problematic conditions before they develop into the next crisis.

So far they have not only left the previous problematic conditions in place, but have amplified their potential for damage.

For instance, too big to fail financial institutions have become larger than ever, made so by the very actions chosen to solve the crisis. The largest dozen banks were quickly handed hundreds of $billions, with few restrictions on how the money was to be used, and encouraged, in some cases even forced, to acquire their weaker competitors. JP Morgan Chase took over Bear Stearns. Bank of America took over Merrill Lynch. Wells Fargo took over Wachovia. JP Morgan Chase took over Washington Mutual to name a few.

Meanwhile, the more than 7,000 small and medium-size banks were left hanging in the breeze, and two years after the crisis ended are still going under at a faster pace than during the crisis. And more than a million home-owners lost their homes just in 2010, with a million more destined for the same treatment this year.

Then there is the so-called moral hazard, the behavior that can be expected from people who are insulated from punishment for their actions.

Congress and the regulators have shown the major financial firms more clearly even than before that greed and high risk activities carry no risk for them, that if they lead to disaster the calamity will fall on others, while the financial firms will be rescued and probably even rewarded, coming out the other side bigger and more profitable than ever.

What could Congress and the regulators be doing?

After the Great Depression, and later after the 1987 crash, real reform measures were introduced. They included the Glass-Steagall Act, passed in 1933, which separated and restricted the activities of financial institutions, the ‘Uptick Rule’ in 1938, which disallowed the unrestricted short-selling that had been responsible for exacerbating stock market declines and crashes. After the 1987 crash, trading restrictions known as ‘curbs’ were placed on program-trading firms, preventing them from exacerbating another market decline with waves of massive computerized sell-programs.

Those reforms worked quite well for a very long time.

However, financial industry lobbyists were successful in having Glass-Steagall repealed in 1999, which resulted in banks becoming heavily involved in brokerage, mutual fund, and proprietary trading activities, as well as the packaging and promotion of questionable investment products like sub-prime mortgages.

Wall Street was then successful in having the uptick rule repealed in 2007, and the New York Stock Exchange confirmed in November, 2007 that it had scrapped the curbs on program-trading firms. Both repeals were allowed just before the severe 2007-2009 bear market began.

Congress and the regulators acknowledged the connection, but in spite of the promises of re-regulation of the financial industry, none of those previous successful regulations have been re-introduced. And the financial reform bill finally signed into law last July was so watered down by the time of its passage as to be a joke.

Meanwhile, the debt crisis that has been sweeping across Europe is being papered over country crisis by country crisis with still higher levels of debt, while Euro-zone officials and G-20 nations repeatedly meet but are unable to agree on much of anything related to more permanent solutions.

Bubbles used to be rare events. But since the repeal of Glass-Steagall, which allowed the major banks to become involved in all areas of the financial industry, we’ve experienced a stock market bubble in 2000, a housing bubble in 2006, and a debt bubble in 2008.

It may be that governments were adept at getting us out of a serious crisis once it hit.

But where are the signs they are even trying to prevent the next one?

The Fed is correct in saying that unemployment at 9.4% is too high, but that without the bailout efforts it would be at 25%, as in the Great Depression.

But what would it be, and where would the U.S. economy be, if Congress, the Fed, and regulators had done their jobs, left previous regulations in place and enforced, and there had not been a housing or debt bubble?

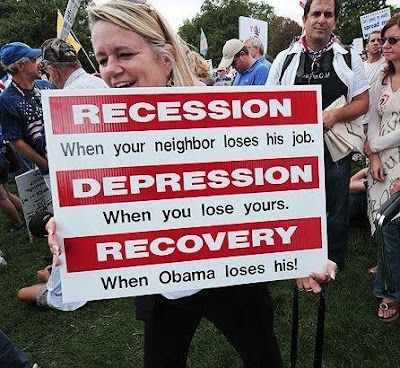

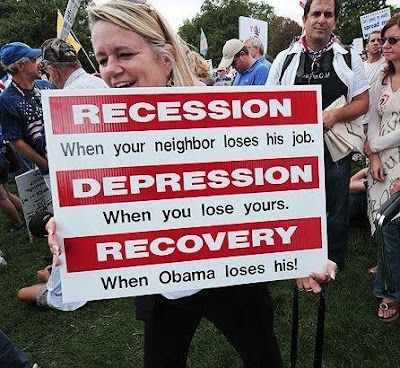

We are and have been in a depression and nothing anyone says will change the truth.

LLS

Alan Greenspan is the father of the modern bubble, beginning with the stock market crash if 1987.

This government is downright dishonest and the truth is swept under the MSM bus headed for Hell!

Yes, the economy is doing so well that Evergreen Solar in Massachusetts just announced that it is closing its Devens plant with a loss of 800 jobs. And on Thursday, my corporate division announced another voluntary separation program to eliminate 130 positions. The jobs picture is bad and getting worse.

Yep, Democrats were told, but keep pressing that next uptic as utopia...

Transcript of Pelosi, House Democratic Leaders, and Economists’ Press Conference Following Economic Forum 10/21/2009

http://www.speaker.gov/newsroom/pressreleases?id=1414

Former Federal Reserve Vice Chairman Alan Blinder

“So for that reason, despite the fact that we’re looking at an absolutely horrendous long-term fiscal outlook...”

It's not just the million+ foreclosures, the ADDITIONAL NEW CLAIMS each week are more added to the roles to be processed next year. Foreclosures are rising, and jobs ain't coming. Gas is going higher and so are corn flakes. We are in deep doo!

We need a clean sweep. The Beaurocraps need to get into the job market and compete with those with real skills. The tax system needs to be junked and rewritten for liberty. Then, maybe we can see some equity!

Pray. It is the "effectual, fervent prayer" that moves mountains! Christians need to understand that this is an ETERNAL battle with temporal consequences. Take each day and make it new! God is still with us...

Your link didn’t work for me.

Things would have been different in the years 1929 - 1942 if the government had borrowed $5 or $6 trillion dollars from Japan and Germany and handed it out to their cronies, Wall Street, favorite ethnic “communities”, strong democrat voting blocs, etc.

In fact, the “First Great Depression” would then look a lot like our present “Second Great Depression”.

Our benefits just went up so our take home pay is less and tuna was up 30% this morning at the grocery store. If these are happy days, I’d hate to see the depression ones.

And cable, internet and garbage collection sent out notices last month that bills would increase on the 1st.

Precisely. There hasn’t been a “recession” since Bush left office. This is, by any worthwhile definition, a real depression, and anyone still making money should be praying each night that it stays that way.

OUTSTANDING!!

It breaks my heart to know Jimmy is a flaming libtard.

The country is essentially broke. How we dig out of this hole will be a huge challenge I don’t believe the pols are willing to tackle and solve and it.

The U.S. debt is now over 14 trillion and the U.S. government is very close to losing its AAA credit rating.

When that happens, it will be the beginning of the end and eventual chaos and turbulence...

http://news.yahoo.com/s/ap/20110115/ap_on_re_us/us_debt_wars/print

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.