Posted on 01/14/2011 8:33:09 AM PST by BenLurkin

Gold prices were tanking Friday as central banks in emerging markets took steps to tame inflation and Federal Reserve Chairman Ben Bernanke raised his U.S. growth forecast.

Gold for February delivery was falling $25.70 to $1,361.30 an ounce at the Comex division of the New York Mercantile Exchange. The gold price Friday has traded as high as $1,377.80 and as low as $1,360.30.

The U.S. dollar index was adding 0.04% to $79.23 while the euro was down 0.05% to $1.33 vs. the dollar. The spot gold price Friday was holding up better, down only $9.20, according to Kitco's gold index.

(Excerpt) Read more at finance.yahoo.com ...

Monday they’ll go back up.

Gold would have to drop at least 136 dollars/oz to hit a trendline. 25 bucks an oz is a correction inside sideways movement.

Time to buy on pullbacks.

I currently see gold prices being “slammed” by 1.8%.

Current US monetary policy and debt levels continue to clearly indicate nothing but strong BUY signals in precious metals.

But then, I’m not schooled in the obfuscation and parsing terminology of Ivy League economists.

Soem hot money is going into oil, nat gas and food commodities.

Buy gold now???

It's the fraud, stupid.

And it has never been worth zero!

I’ll wait till it reaches $1200 and then REALLY BUY !

Gold has treated me well. I’m not abandoning that ship yet.

Time to buy at the bottom.. of the dip in prices..

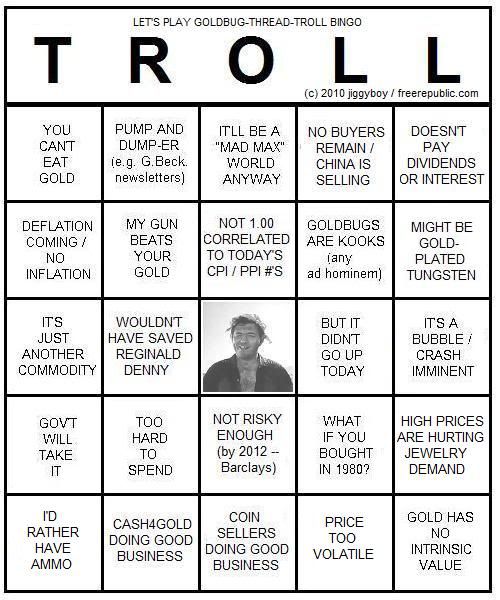

Someone post that pic where all of the common responses are put on the bingo card for the Gold threads.

Same here!

If I bought a single ounce of gold today, it would be worth $463.25 within weeks.

I am the only one holding the price of gold up right now, and everyone who own golds, owes me a deep debt of gratitude.

I don’t care about temporary day to day set backs in gold. Over 10 years it has gone uip over 300%. If you want to look long term investment in gold, then just look at the web site below with the U.S. Dollar.

The above site tells you the U.S. dollar will collapse. It’s impossible to go this way forever. And when it does collapse gold and silver will sky rocket in the United States.

Keep in mind this does not have to happen, but our politicians are either too stupid or intentionally doing this. I don’t think they are that stupid. Perhaps some of them. Even China and India are getting away from it. Once the U.S. dollar is no longer the world’s reserve money. Prepare to see money double or tripple over a 30 day period. I would say we are about 2 to 3 years away from this situation. I can see gas at about $15 to $20 a gallon in about 5 years. That will be because our currency will collapse.

I’m not trying to frighten you, but just getting you ready for what is coming down the road.

In fact, as this thread is about dropping prices, the responses so far are pretty much the opposite side of the usual stuff as well. No "haha I knew it was a bubble" stuff yet.

First thing you learn in markets and charting that nothing moves in a straight line. Also, the markets can stay irrational longer than you can stay solvent.

Recently, very nice run in gold since about Aug. ‘10. A retrace or pullback is typical after a run up. Never really was a panic during the run just steady buying.

Guessing here but this could go on for months before resuming to higher highs. Without a fix for debt, situation is hopeless and gold is the best indicator of that failure.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.