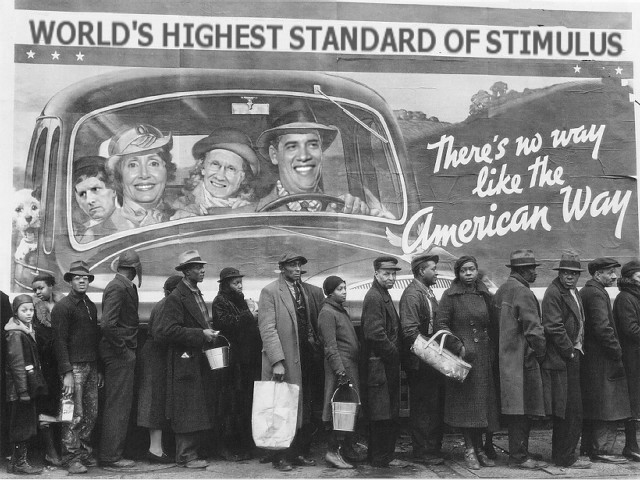

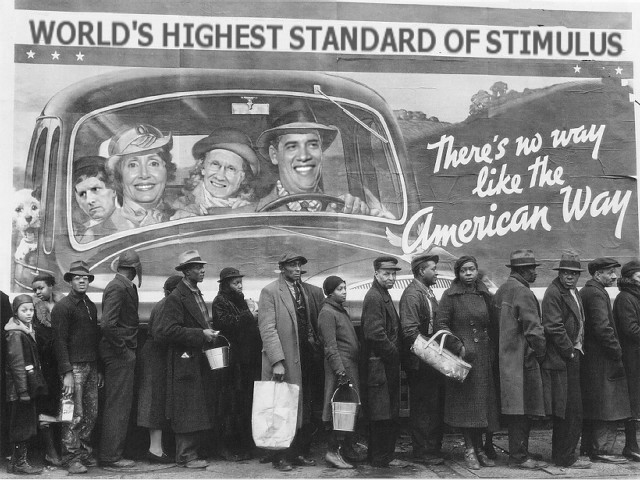

This isn't your Granddaddy's depression, NO SIR! This one all belongs to OBAMA!

Posted on 09/07/2010 4:28:16 PM PDT by Kartographer

David Rosenberg has outlined, in his latest letter, the 13 reasons with this so-called recovery is actually a depression.

Rosenberg sums it up like this:

This is what a depression is all about — an economy that 33 months after a recession begins, with zero policy rates, a stuffed central bank sheet, and a 10% deficit-to-GDP ratio, is still in need of government help for its sustenance.

Each one of these 13 reasons is more damning and highlights the true state of the economy: caught in a liquidity trap with little way out.

(Excerpt) Read more at businessinsider.com ...

We’re actually in a ...?

Time to make some hard decisions if we want to be America..

Seal the borders, out with illegals, clear the debt by cutting government, drill for our oil,etc.. last chance Nov 2010 to clear the field..

Time to make some hard decisions if we want to be America..

Seal the borders, out with illegals, clear the debt by cutting government, drill for our oil,etc.. last chance Nov 2010 to clear the field..

Amen to that.

Can you say ‘liquidity trap’? I thought you could.

These geniuses hardly consider the common sense exhibited by business folks.

It’s called interest on reserves (or IOR). None of the money that expanded the Fed’s balancesheet was ever intended to make it out the broader economy, but only to provide liquidity to the banking system. It is similar to the policy used in the Great Depression and has not been repeated since, until now. It was regarded as one of the largest contributing factors in delaying a recovery, which is a primary reason IOR was outlawed in the Banking Act of 1935.

Interest rates are backward looking, and somewhat counter-intuitive. When they are low it means money has been too tight, and tight money leads to disinflation/deflation.

The Fed needs to reduce or eliminate IOR and let some of that money seep out into the economy.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.