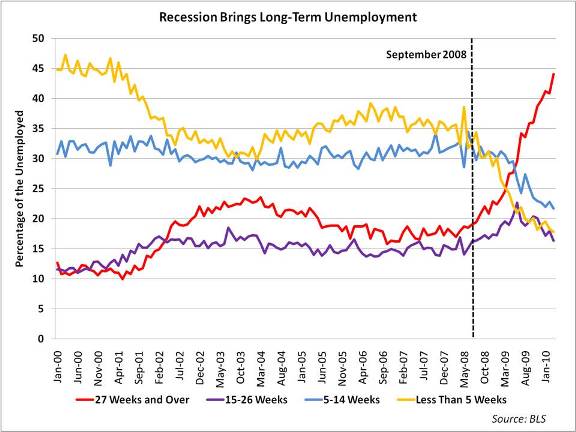

This chart is based on seasonally adjusted data from the Bureau of Labor Statistics. As you can see, last month, over 44.1 percent of unemployed workers (6.5 million workers) had been unemployed for 27 weeks or more; at the start of 2008, 18.3 percent of unemployed workers fell into this category. Importantly, these measures of unemployment exclude workers who want employment but were, for various reasons, not included in BLS’s unemployment calculations — an estimated 5.8 million workers.

Using data from the Department of Treasury’s Financial Statement of the United States, this chart shows the United States debt held by the public from 2000 to 2009. These holdings have been divided into debt held by domestic investors and foreign investors. In 2000, foreign investors held roughly half as much debt as domestic investors; by the end of 2009, foreign debt holdings were slightly greater than domestic holdings of the public debt. While the ownership of our debt may be theoretically neutral, there is a case to be made that this debt reliance gives significant bargaining power to individual foreign governments.

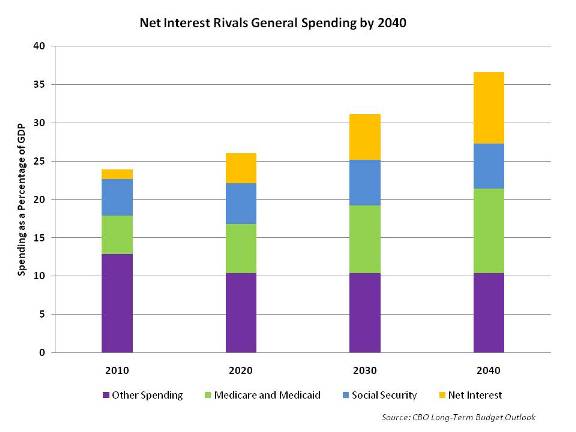

New Research by Mercatus Center Senior Research Fellow Veronique de Rugy examines the cost of the debt in another way. Using the Congressional Budget Office’s long-term budget projections, this chart compares the relative contributions of general, Medicare and Medicaid and Social Security and net interest spending. While general spending and Social Security spending are projected to remain relatively constant through 2040, spending on Medicare and Medicaid is projected to grow to 11% of GDP from its current 5%. Most shockingly, interest costs, or spending to maintain our debt, are projected to increase by more than 7 times by 2040 to 9.3% of GDP – this is a far larger share of our GDP than is currently dedicated to any single department, war or program.

-- Veronique de Rugy is a senior research fellow at the Mercatus Center. She was previously a resident fellow at the American Enterprise Institute, a policy analyst at the Cato Institute, and a research fellow at the Atlas Economic Research Foundation. Her research interests include the federal budget, homeland security, taxation, tax competition, and financial privacy issues