Why the financial meltdown will continue and worsen.

Posted on 09/16/2009 7:30:46 AM PDT by SeekAndFind

A year ago this week, Lehman Brothers blew up, dramatically advancing one of the worst financial disasters in history. The reckless behavior of greedy Wall Street bankers had come home to roost, making life a lot tougher for the rest of us.

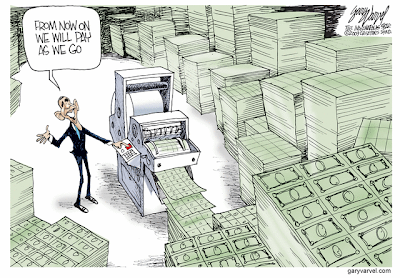

Since then, what have President Barack Obama and Congress done to prevent them from doing it again?

Pretty much what Obama did when he spoke to Wall Street earlier this week. Talk.

"They really haven't done anything that could prevent another meltdown," says Joseph Mason, financial-sector expert who used to work for one of the main national banking regulators, the Office of the Comptroller of the Currency, or OCC.

A year after the demise of Lehman, there are no new rules in place to:

* Control the vast "shadow banking industry" of mortgage originators, insurers and investment banks that caused the crisis. * Limit excessive risk taking by big Wall Street banks. * Rein in the short-term incentives in lavish pay and bonus packages that tempted executives to take excessive risks. * Beef up regulatory agencies like the Securities and Exchange Commission so they can do a better job policing Wall Street.

The key takeaway: There's nothing in place to stop another financial meltdown.

Yes, the president has sent reform proposals to Congress, but they've stalled.

"Quite frankly, they've made hardly any progress," agrees Edward Grebeck, a debt market strategist with Tempus Advisors in Stamford, Conn. "I don't think anything positive has been done."

And while politicians bicker over health care and with the markets up so much that the urgency for financial reform has receded, Wall Street banks are back to work.

Citigroup , Morgan Stanley (MS, news, msgs) and other banks are churning out financial instruments similar to the ones that helped cause the crisis.

(Excerpt) Read more at articles.moneycentral.msn.com ...

Are you saying that we are not having a Financial Meltdown right now ????

Tax revenues are down how many percent?

40%?

That’s not a meltdown???????????????

I believe the melt is still in effect and that it’s going to get a whole lot worse than it is now.

BOHICA!

These banks and financial house got to pay another year of record bonuses - I call that progress.

Starting assumption of this article - that greed and wall street caused this meltdown is incorrect. The cause of this melt down was the implementation of socialist policies in an attempt to make mortgages affordable for those that should not get then and could not afford them.

The rosy scenarios coming out of Washington are pure fantasy. Rampant inflation is looming and will probably strike sometime within the next year. The current level of massive government spending is unsustainable and will bankrupt the country if it hasn’t already. Wall Street does not reflect these predicaments and yet they are extremely important to the financial and economic health of our country. IMHO that is why the stock market rallies are artificial and do not reflect realism.

The rosy scenarios coming out of Washington are pure fantasy. Rampant inflation is looming and will probably strike sometime within the next year. The current level of massive government spending is unsustainable and will bankrupt the country if it hasn’t already. Wall Street does not reflect these predicaments and yet they are extremely important to the financial and economic health of our country. IMHO that is why the stock market rallies are artificial and do not reflect realism.

The rosy scenarios coming out of Washington are pure fantasy. Rampant inflation is looming and will probably strike sometime within the next year. The current level of massive government spending is unsustainable and will bankrupt the country if it hasn’t already. Wall Street does not reflect these predicaments and yet they are extremely important to the financial and economic health of our country. IMHO that is why the stock market rallies are artificial and do not reflect realism.

Already seeing major inflation at the grocery store.

It is happening as we speak.

I have the sneaky feeling that the corporations are doing quite well thank you, with half their employees laid off.

The gummint isn’t the only one with lots of waste fraud and abuse.

Businesses are now having to operate more efficiently with much less staff.

This is not to say that everyone laid off was redundant or a useless employee.

A good friend of mine in the commercial real estate market said that when the commercial market crashes, it’s gonna get much worse than it is right now.

Why the financial meltdown will continue and worsen.

You forgot our insane energy policy. High energy prices are what started the whole ball rolling.

RE: You forgot our insane energy policy. High energy prices are what started the whole ball rolling.

Does anybody out there have any memory of the reason given for the establishment of the DEPARTMENT OF ENERGY ..... During the Carter Administration?

Anybody?

Anything?

No?

Didn’t think so!

Bottom line .... We’ve spent several hundred billion dollars in support of an agency ...the reason for which only a few who reads this can remember.

Ready???????

It was very simple ..

And at the time everybody thought it very appropriate...

The ‘Department of Energy’ was instituted on 8-04-1977

TO LESSEN OUR DEPENDENCE ON FOREIGN OIL.

Hey, pretty efficient, huh?????

AND NOW IT’S 2009, 32 YEARS LATER ...

AND THE BUDGET FOR THIS “NECESSARY” DEPARTMENT IS AT

$24.2 BILLION A YEAR.

IT HAS 16,000 FEDERAL EMPLOYEES AND APPROXIMATELY

100,000 CONTRACT EMPLOYEES AND LOOK AT THE JOB IT HAS DONE!

THIS IS WHERE YOU SLAP YOUR FOREHEAD AND SAY “WHAT WAS I THINKING??”

Ah, yes, good old bureaucracy...

And NOW _ we are going to turn the Banking System, Health Care & the Auto Industry over to government?

May G o d Help Us !!!

“Already seeing major inflation at the grocery store.”

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Grocery prices overall are awful but in my area we are seeing MEAT prices drop like a stone. We have bought ribeye steak for $3.99 a pound and boston butts are available at $.89 a pound, this actually SCARES ME! When meat prices drop rapidly I expect that farmers are liquidating herds which means shortages and sky high prices later on. I am VERY, VERY concerned about the state of our agricultural system right now with the water shutoff in California and plots afoot in Washington to pass some kind of incomprehensibly insane bill to wreck food production.

There is no way for me to believe anything but that Obama was put in office for the purpose of destroying this country. Someone told me last week that he disagrees with almost everything Obama stands for but he still thinks the man loves America and asked me if I thought so. I told him I can see absolutely no reason whatsoever to think that Barack Insane Obama loves America.

Our whole government is rotten from top to bottom. Something bad is coming. I can feel it. You really spelled it out. Government wrecks everything.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.