The 'rats sure aren't going to help.

Posted on 04/16/2008 4:38:39 AM PDT by TigerLikesRooster

Oil hits new high above $114, dollar supports

1 hour, 37 minutes ago

Oil struck a new record high above $114 a barrel on Wednesday, buoyed by the weak U.S. dollar, inflows of speculative money and long-term constraints on supply.

U.S. crude was 53 cents higher at $114.32 a barrel by 5:43 a.m. EDT, just below a fresh peak of $114.41. Today's price is more than three times the average price of 2002, when oil's rally began.

London Brent crude for the new front-month of June was up 54 cents at $112.12.

"The funds and technicians are in the driving seat," said Christopher Bellew, of Bache Commodities Ltd.

"There has been growth in the level of speculative money going into commodities markets."

The weak dollar -- together with strong demand -- has driven oil and other commodities such as corn, gold and rice to record highs in recent months, as investors and speculators have sought a hedge against inflation.

"The dominant factor continues to be the U.S. dollar and I expect this to continue for a while," said Gerard Rigby, an analyst at Sydney-based Fuel First Consulting.

"Whenever you get any kind of good economic news out of the (United States) at the moment, the dollar will rise and oil falls, and the other way round, you get a new oil record," he added.

The dollar headed towards a record low versus the euro on Wednesday, hurt by caution ahead of quarterly earnings announcements by major U.S. banks and worries about the turmoil in credit markets.

CHINA DEMAND

Lifting some concerns over a supply squeeze, Mexico, a major supplier to the U.S., reopened its three main Gulf of Mexico oil ports as bad weather cleared, the government said. Only a smaller Pacific port remained shut.

But in a sign that consuming countries were still concerned about a supply shortfall, Britain's prime minister Gordon Brown on Tuesday called on the Organization of the Petroleum Exporting Countries to boost production to counter rapidly rising prices.

OPEC, which pumps more than a third of the world's oil, insists it is supplying enough oil.

Demand in the world's top consumer may be losing steam. U.S. crude oil imports fell in February to the lowest level in a year.

They declined by 486,000 barrels per day (bpd), or 4.9 percent, from the month before to 9.514 million bpd, the federal Energy Information Administration said.

But China's diesel imports rebounded in March to 490,000 tonnes, up some 49 percent from a month earlier, and remained robust in April and May, as the government extended a tax break on imported fuels.

China's economy grew 10.6 percent in first quarter, the National Bureau of Statistics said, slower than the 11.2 percent in the fourth quarter, but stronger than forecast of 10.0 percent, underscoring the resilience of the world's fourth largest economy despite fierce winter weather and a global credit crunch.

U.S. crude oil inventories likely rebounded last week, with an increase in imports lifting supply, following a surprise drawdown the week before, a Reuters poll of 14 analysts showed. But gasoline stocks probably fell for the fifth week running.

(Additional reporting by Annika Breidthardt in Singapore; editing by James Jukwey)

Ping!

I foresee a calamitous crash at some point down the road when the last folks on this train realize they have been had by swallowing the theory oil prices can only go up and attempt to get out at any cost. The beginning will be seen as soon as consumer spending in America shows a confirmed slowing trend, I.E. more then a month or 2 drop. Once we stop consuming the likes of China will cut back production since there is no one to pick up the slack with Europe also slowing.

I say oil will be trading at about $58-65bbl within 1 year.

Whose $$$ is behind our first Afro-American candidate anyway, hmmm?

My place of employment is just 1/4 mile from my apartment. I will be getting alot of walking in this spring & summer!

SAO PAULO, Brazil — A deep-water exploration area could contain as much as 33 billion barrels of oil, an amount that would nearly triple Brazil’s reserves and make the offshore bloc the world’s third-largest known oil reserve, a top energy official said Monday.

National Petroleum Agency President Haroldo Lima cautioned that his information on the field off the coast of Rio de Janeiro is unofficial and needs to be confirmed - but his comments sent shares of state-run oil company Petrobras soaring in New York and Sao Paulo.

Petrobras said in a statement that more studies are needed to determine the potential of what could be the planet’s largest oil find in decades. Analysts said the magnitude of the find, if confirmed, could have far-reaching global energy ramifications. Exploration is what we need.

The section about “large percentage used for generating electricity” just isn’t so. The rest of that looks pretty good.

Our blood, our fortune, their freedom and we get the shaft.

i thought pelosi was going to bring down gas prices.

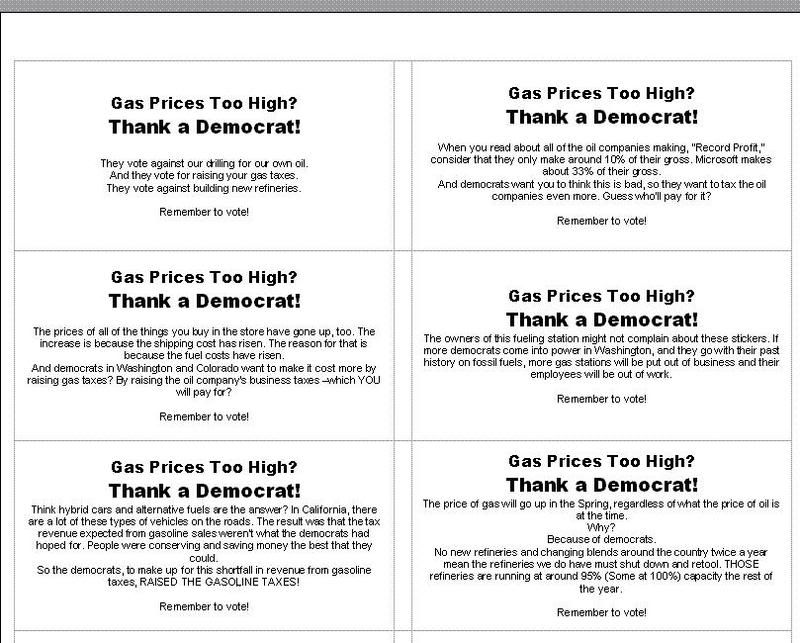

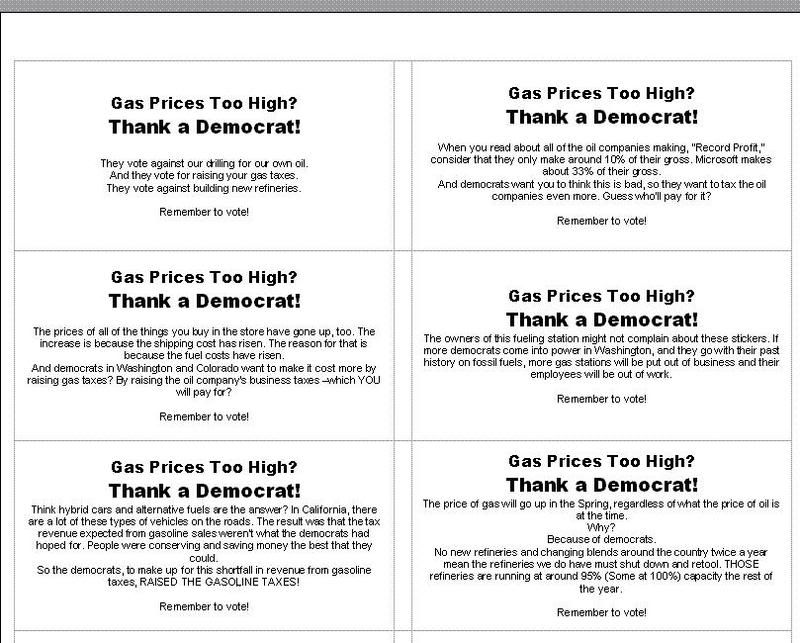

Where did you find that?

The conspired run up will peak around Memorial Day with a barrel selling for around $125. Then the real numbers will come out, then bust!!

Globally, people are making the choice to feed & house themselves and their families first. The rest of their money will be put back.

True, there are several out their that make real good incomes and will go on vacation this summer, however, several are not in that boat and they will stay home.

When one looks at the recent housing bust, auto sales and retail sector reports coupled with the , yup, we're heading into a significant retraction in the economy especially when couple with the inflation in food and fuel.

The odd thing about the inflation in food prices is that our own federal tax dollars are being paid to farmers to let 38 million acres of land sit idle and not be planted. Yeah...like the gov and working on its plan.

Now.

Just what is going to drive the American 'service sector' economy?

It will not be manufacturing because people have over burdened themselves with credit and the money isn't there to borrow neither.

As the sub-prime over building / over-priced housing market banking sucked a big wad from the economy with a lot of it going south of the border for all the illegal Hispanic labor and fat bonuses to execs that have bankrupted their companies.

It's just a well orchestrated Ponzi scheme to force shamnesty down our throats by the whores on The Hill.

I just made it in MS Word and took a screenshot of the template.

We are staying home. Dad’s got a truck and a hybrid camper for vacations. They are staying put.

I joined Sam’s Club and we can walk there. Dad works 5 miles from home and loves to cycle.

Our cars will be sitting this summer.

Look at the price of fertilizer ($245/ton in 2007 vs $873/ton in 2008 on average) now compared to last year. Yes, it is oil related, but the demand / supply for oil hasn't increased 200% in one year.

It's all tied together as a conspired forcible economic rape of the American citizen.

Why isn't the government cutting spending at this very moment? The economy is already in a serious bout of stagflation heading for a serious recession.

Cut taxes and that will inject money into the economy....works every time.

Good luck....family is what is most important anyway. It's just gonna be an uphill battle the next 3-4 years as wages will eventually catch up.

Thanks!

Hey, maybe we’ll get a pool! A pool, the grill, a nice deck chair for mom. It can be a vacation right in our back yard!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.