Posted on 04/30/2020 4:04:22 AM PDT by SES1066

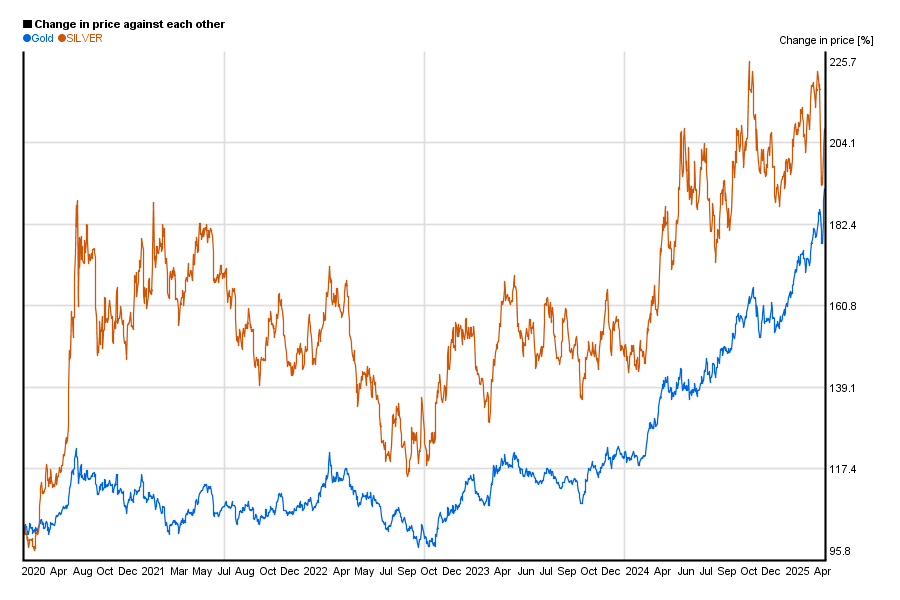

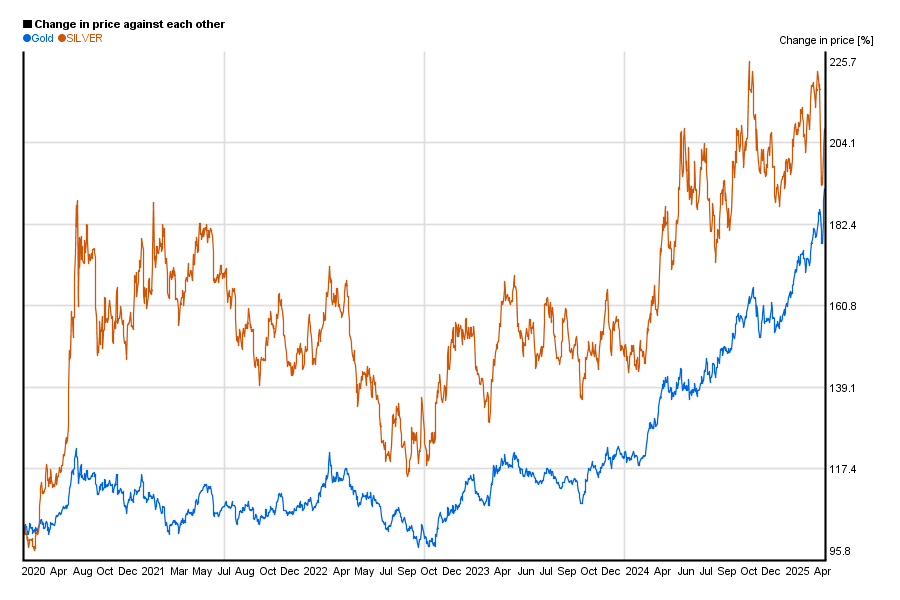

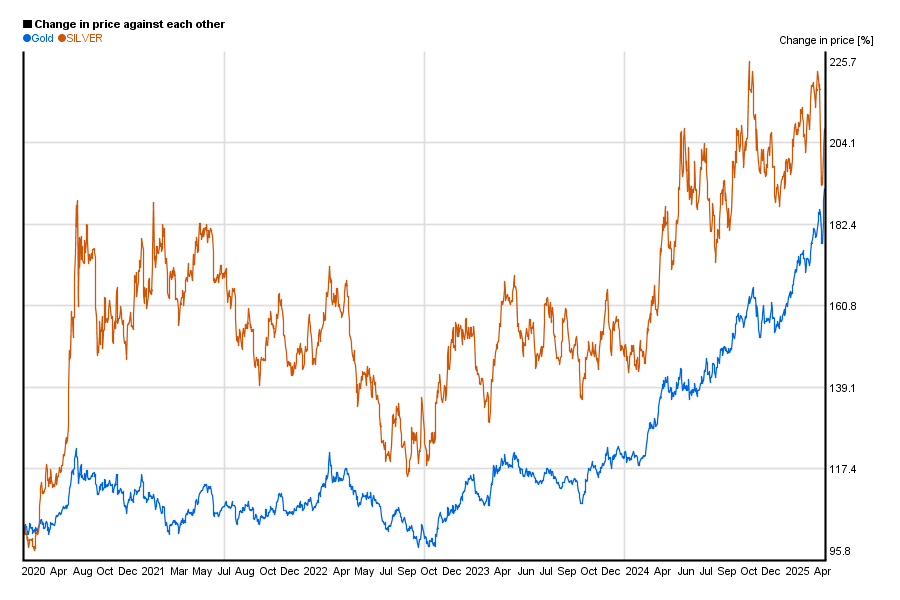

This chart compares gold prices and silver prices back to 1915. Each series shown is a nominal value to demonstrate the comparison in actual investment returns between each over various periods of time.

As this is a live, interactive chart, I can't freeze and post the image, you have to go there to see it yourself. I was thinking that I'd use this panic to sell some silver, now(?), not so much!

The price of silver is driven primarily by industrial demand, and then inflation. When industial use returns, inflation will start affecting the price.

I was always told that Silver is an industrial metal as well as a bullion value, so with this pandemic slowdown I can see that component dropping some value BUT the drop STARTED before January! Is China that big of a buyer of Silver?

I am truly perplexed here!

I’ve seen some “experts” claim gold will go to between $8,000 & 12,000/ounce. I think one even claimed $20,000/ounce.

How possible and

likely is that?

Some think SFEG will go from about $0.08/share to between $3.00 & $15.00/share.

I’m too much of a novice & layman to make much sense out of such claims.

You have any insights or comments?

Right now it is the flight-to-safety people and long-term contracts that are keeping the price from cratering like oil. I could see another drop, before heading north.

$20,000 gold is fantasy, barring manipulation, but usually the manipulation is to drive the price down. People will usually start selling at 40-50% profit, locking in some gains, rather than letting it all ride.

I’ve bought silver eagles and silver bars. I give the eagles as gifts to kids and grandkids as lessons in economics. They’re beautiful. I gave my son a couple of golden eagles when he got back from combat in 2004. I got them for around $400. I should have cashed in everything and bought more gold then. But I did ok with land and real estate. No one has a crystal ball. Dang.

Smile, looks like we both found the same chart BUT mine is BIGGER!

Thanks for the assist!

SILVER $15.62 listed price

1 oz Silver American Eagle BU (Random Year)

$25.42

1 oz Silver Art Round - Random Design

$23.59

Quite a premium.

How many of those "experts" then immediately offer to sell you some of their gold?

I know there are people who trade based on the gold/silver price ratio based on the historical relationship between the two. I am not a fan of that strategy because the ratio until currencies were delinked with precious metals was due to government coinage with those metals. For example, I collect Victorian era British coins. One had the sovereign minted in gold but all the lower denomination coins until the pence were based on silver. So the government forced a ratio between gold and silver price. If the market ratio got out of whack it would pay for people to melt coinage as an arbitrage. That process no longer exists.

Would it be possible to chart just the ratio of the prices? I.e., a single line representing the price of gold divided by the price of silver? Such a chart would depict much more elegantly and clearly the disparity in prices which the author is decrying.

Thanks!

Regards,

But that delinkage occurred so long ago! Why would you look askance at any trading strategy based on the gold/silver price ratio today?

As you point out, such a strategy wouldn't have worked in Victorian times.

So how about using that strategy anytime in the last half century? Any objections?

Regards,

Silver coin purchases are outstripping coin production. Coin and bar production can’t keep up with demand, creating a gap in price. In other words, silver and silver coins are two different products.

Silver casting grains can be gotten for $18.21 an ounce for a 10oz minimum purchase, but that is hard to resell.

Obviously. Thanks.

The best I can do here is this chart of "How many ounces of silver it takes to buy ONE ounce of gold (troy ounces). Below is the 1 year and 10 year charts and as you can see from the 10 year, there is a gradual rise to 80:1 but it spiked here in March to 124 and has dropped into the low 110s but is climbing this AM!"

The price of silver is being manipulated.

If you go to the usmint.gov website, you will have to pay $55.95 for one Silver proof Eagle coin.

That is the true price of silver. They will charge you 3 times more to buy than to sell because physical silver (at $14.00) is not easy to get.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.