Weeeeeeeee!

Posted on 10/09/2008 11:11:10 PM PDT by Crimson Elephant

Do cycles exist in the financial markets?

Take a look at the black line in the graph below. The U.S. stock market had a gigantic bubble back in 2000. When it burst, stocks came crashing down. Over the next several years, policy makers did all they could to get things going again, focusing mostly on monetary policy and increasing homeownership. This had the unintended consequence of creating too much inflation, which caused central bankers to tighten aggressively. Thus began what will almost certainly be declared a recession.

This mimics the US stock market bubble back in 1929...

(Excerpt) Read more at seekingalpha.com ...

Yes, snotty 27 year olds driving Masaratis.

Hey you watched Jim Rogers late tonight too! ;)

Yes, snotty 27 year olds driving Masaratis.

***And shoe shine guys giving stock tips.

At least the snotty 27 year olds are incredibly intelligent and have a future in many places.

I did, but I dont see hyperinflation in the future....I see deflation...

The problem in 1929 they actually tightened credit and regulations that caused the problem to be worse. Japan in the 1980’s increased their interest rate that made it worse also.

What’s the joke...”what’s the difference between a pigeon and a laid-off stockbroker?....the pigeon is still able to make a deposit on a Maserati.”

What’s the difference between an engineer and a pizza?

The pizza can feed a family of four.

did you hear the hedge fund manager on CNBC Europe just now Midnight Pacific saying Goldman, Sacks and Morgan Stanley will be taken over by the U.S. this weekend?

Europe falling 8% at opening again.

Listening to the real fear in his voice was chilling. Very chilling.

Weeeeeeeee!

Look out below. Some European stocks down 30%.

All the European indexes down about 10%.

You watching this?

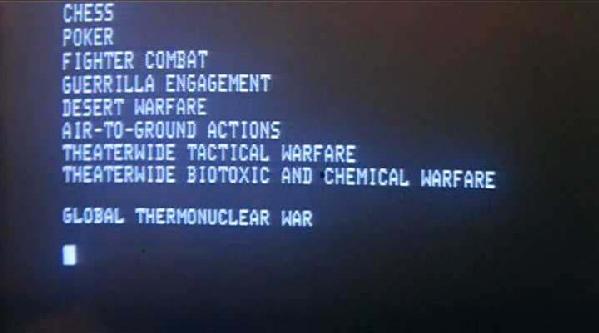

“It is like WarGames! Like a computer has declared global thermonuclear war against the markets!”

HONG KONG (MarketWatch) — Japanese insurer Yamato Life Insurance Co. filed for bankruptcy protection from creditors Friday, reportedly becoming the first in the industry to do so in seven years. The insurer said recent declines in the value of its securities holdings had impaired its balance sheet, with liabilities exceeding assets by 11.49 billion yen ($116.02 million), according to wire reports citing comments by a company spokesman at a press briefing Friday. Yamato had assets totaling 283.1 billion yen ($2.86 billion) and policies worth 1.075 trillion yen at the end of the fiscal year through March 2008, according to a report by the Nikkei newspaper. Yamato’s bankruptcy filing ranks as the fifth-largest corporate failure in Japan this year

“It is like WarGames! Like a computer has declared global thermonuclear war against the markets!”

"Shall we play a game?"

I think this is all margin calls and forced selling. Anyone would be out of their minds to sell at this big a discount.

Imagine when the bottom is reached, and things are stable for like 5 business days... Then imagine all the people with money buying back in. I don’t know if I can take all of this excitement! :)

This Brit explained Mark to Market clearer than anyone on the US Financial Channels.

The good thing about McMansions is that they can house 2 or more families.

“

Japanese insurer Yamato Life Insurance Co. filed for bankruptcy

protection from creditors Friday...

“

Gotta’ respect the Japanese.

First they grab our formerly world-class methods of manufacturing cars.

Now they carry on the good, old-fashioned (and nearly defunct in America)

way of dealing with a business failure.

The company goes belly-up, through some bankruptcy process, then

either emerges from bankruptcy or just goes out of bidness, liquidates,

and a more competent competitor expands to take over their market share.

Or a new company comes into the sector.

The business concept of “creative destruction” has left the USA and

found a new home in Japan.

The thing that never ceases to amaze me is our ability to communicate these things across the planet within seconds. Our fathers and our father’s fathers didn’t have this ability. steam ships... and before that sails... and before that just a dream. :)

God bless you and yours Karl! Keep Safe!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.