China now dumping is evidence that they are getting ready for war with US.

Posted on 03/19/2023 5:51:34 AM PDT by Kaiser8408a

Its Gov’t Gone Wild! Insane spending budget by “Sloppy Joe” Biden, Yellen asking Warren Buffet for banking advice (seriously??), a war in Ukraine that America doesn’t seem to actually want to win, etc. But its the banking system where banks are getting crushed by rising inflation and interest rates (but failed to hedge). Sigh.

As I always told my investments and fixe-income students at University of Chicago, Ohio State University and George Mason University, a 10 basis point change in the 2-year and 10-year US Treasury yield is a big deal. This morning, the US Treasury 2-year yield fell -32 basis points while the 10-year Treasury yield fell -14.8 basis points.

At the same time, gold 3.8% and silver rose 4.7% on banking fears.

While it shouldn’t pass the House vote (but you never know in Mordor on The Potomac), Sloppy Joe’s budget proposal is a joke.

Debt would hit a new record by 2027, rising from 98 percent of GDP at the end of 2023 to 106 percent by 2027 and 110 percent by 2033. Nominal debt would grow by $19 trillion, from $24.6 trillion today to $43.6 trillion by 2033. Deficits would total $17.1 trillion (5.2 percent of GDP) between FY 2024 and 2033, rising to $2.0 trillion, or 5.1 percent of GDP, by 2033.

And then we have Sloppy Joe and Statist Janet Yellen meeting with mega donor Warren Buffet for advice on dealing with the banking crisis … made by Biden’s energy policy and insane Covid spending by the Administration. And, of course, The Fed’s “too low for too long” monetary policy. What is 92-year old Warren Buffet going to say?

Gold and silver are where its at!

This should be Joe Biden’s campaign slogan if he actually decides to run for reelection in 2024.

(Excerpt) Read more at confoundedinterest.net ...

Precisely.

How many banks would fold if the Treasury didn’t keep the inverted yield curve to stop the market price of long term Treasuries from crashing.

Watch as the Government Mortgae Associations like Ginnie May and Freddie Mac must refinance within 24 months the $12 trillion of notes they issued issued short term to lend out in fixed rate 3% to 4% mortgages for 30 years. The refinance rate will be double the rate they lent the money out.

None of this debt is included in the $32 trillion national debt. It’s off the books.

It’s a good thing that the Treasury Notes payable to China and Blackrock are variable rate interest so their market value doesn’t drop. / emphasis on sarcasm

We know that in the car market, the trade-in value of a car is considerably less that its retail (dealer sales price) value. For those who buy physical gold, does the same hold true. I.e., is the price you pay of physical gold considerably higher than the price you're offered when you try to sell it? Has anyone here sold their physical gold? Were the "net" dollars you received what you expected"

In my limited experience you get the melt value of gold which is usually 10% off the spot price.

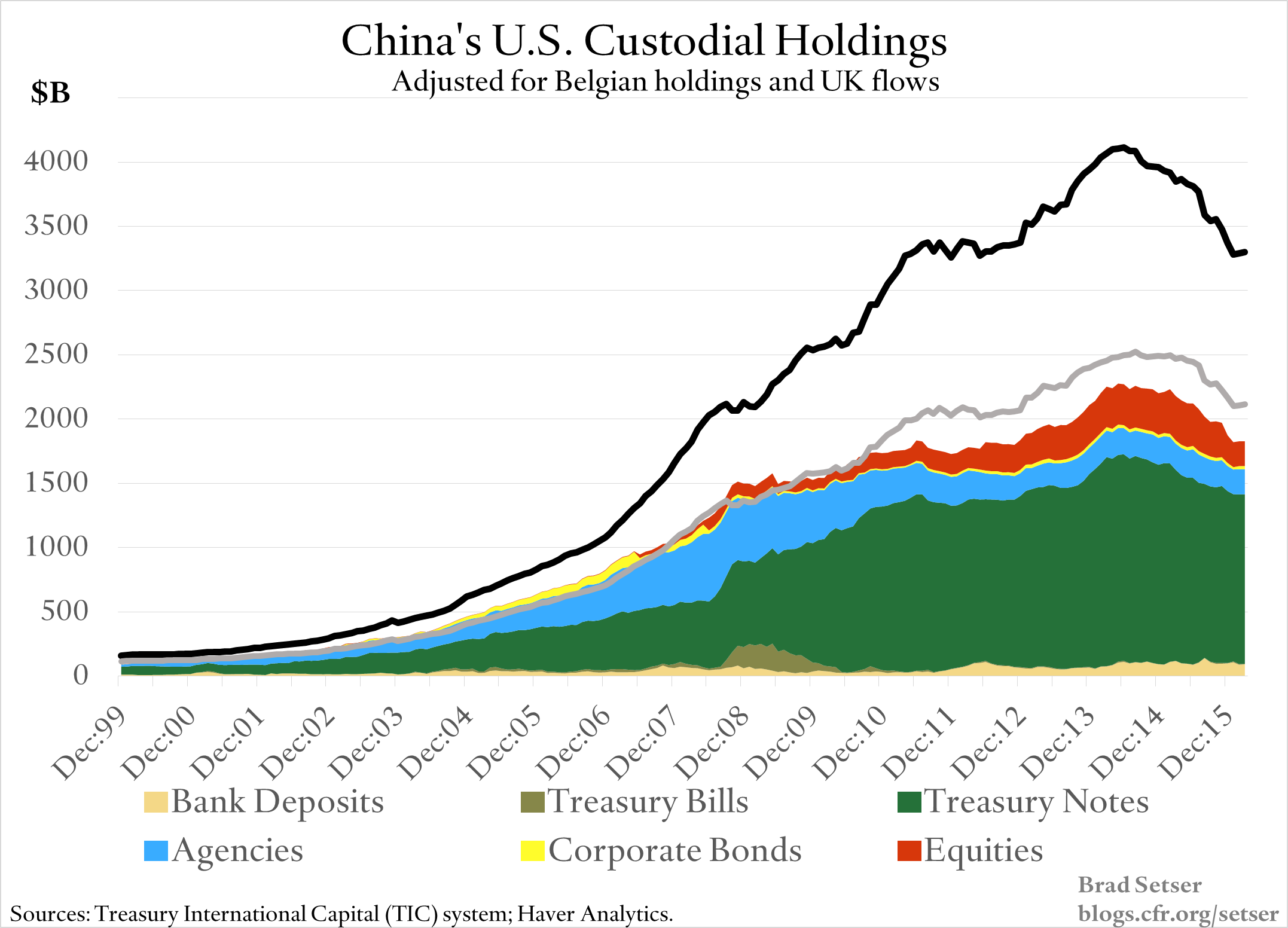

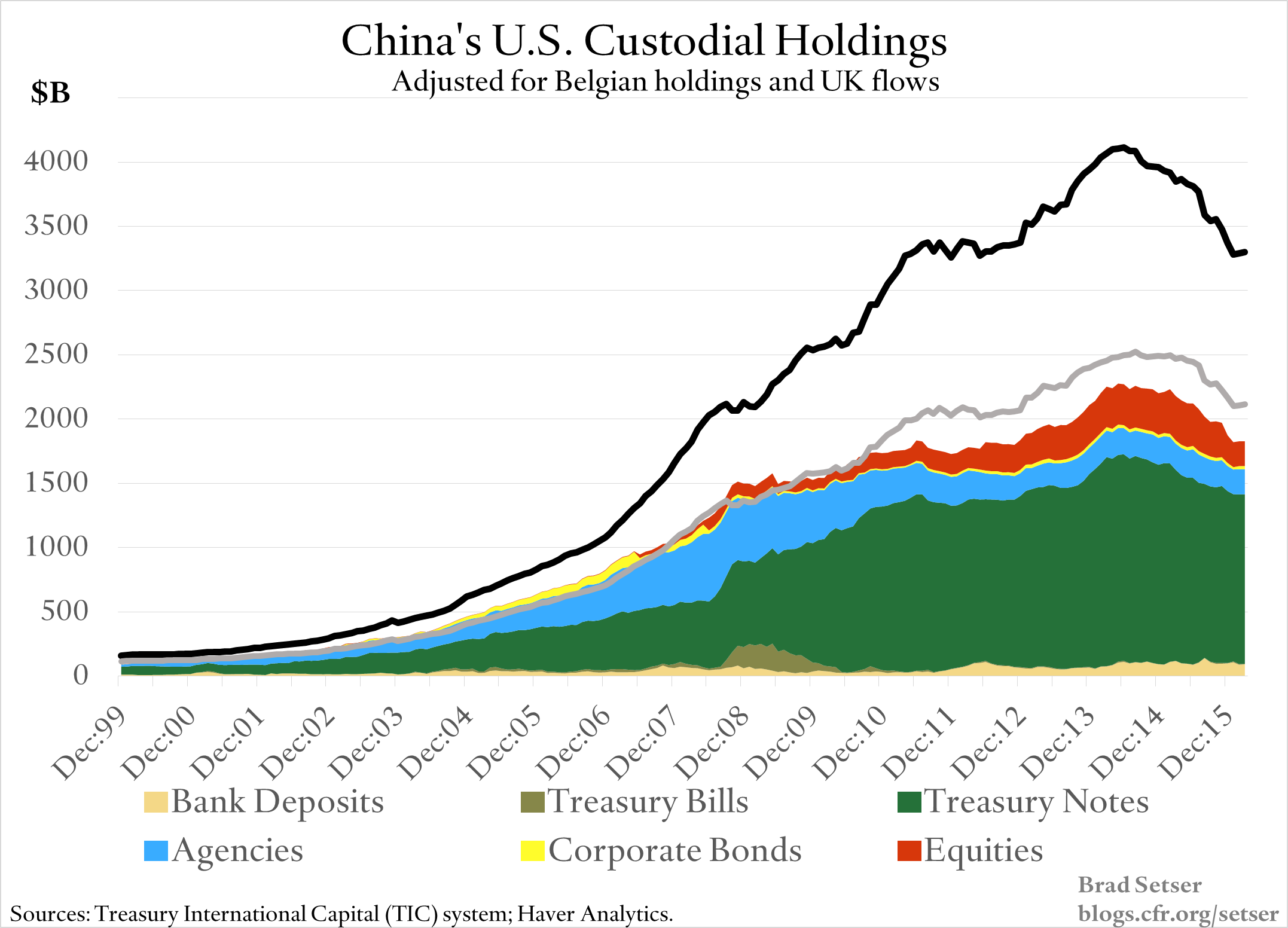

China now dumping is evidence that they are getting ready for war with US.

Interesting. So, would it be fair to say that a typical gold investment would need to gain 10% in value before it begins generating a positive return for the owner?

Physical silver has been getting 15% or more over spot pricing on ebay.

Sold some silver for cash to some local buyers in the last year. Cash in hand was about 10% over spot.

Probably a good rule of thumb.

Wow. Will check it out. I have a lot of silver. Maybe time to cash in some.

There are three main classes of pricing below large scale wholesale (and futures / derivitives etc) that individual small time investors will encounter / deal with in the physical market. Melt, spot, and retail. These three are somewhat general and variations of all three exist.

Melt is what what a refiner / smelter (or his agent) will pay for PM bearing materials ranging from jewelry shop scrap to worn out jewelry and damaged bullion coins, etc. It's generally around 90% of spot +/-.

“Spot” is the market basis price based on the large global markets, and generally what the scrap (“melt”) and retail markets bracket.

The physical retail market is where PMs are sold in bullion form by dealers at “spot” price plus a markup known as “premium”. In the retail market, PM bullion can be sold back to the dealers, generally for “spot”. The premium you pay to buy but lose when you sell is what dealers make their living from. Premiums vary dealer to dealer, and day to day. Prices are available online at the many dealer's websites. Kitco, JM, Apmex, Moneymetals, etc are all mainstream and trustworthy.

The variation you need to keep your eye out for is this; there is a population of savvy folks out there who accumulated bullion (called “stacking”) during their working life and are slowly selling their stash to fund their retirement. These folks will sell for spot plus a reduced premium (compared to a dealer). They are mostly selling bits at a time, and if you are buying bits at a time, they are the best source for your stack.

Good info. Thanks.

As long as the democrats have the ink paper and a printing press nothing else matters.

It’s their answer to everything nobody can cause a flash fire like a democrat

For 1/10 oz. American Eagle retail price v. buy back price:

https://www.providentmetals.com/2023-american-eagle-1-10-oz-gold-coin.html

( I have bought silver from here. I like “junk” silver)

You pay a huge % premium over spot when buying in smaller sizes. About 30% for the 1/10 ounce size. But a small fraction of that, around 5% premium, for a 1 ounce size.

If my calculation is right, the buy back price is 31% less than the retail price. Ouch !!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.