Skip to comments.

Financial System Disappearing into Black Hole – Egon von Greyerz

USAWatchdog.com ^

| September 25, 2019

| By Greg Hunter’

Posted on 09/25/2019 10:08:25 PM PDT by amorphous

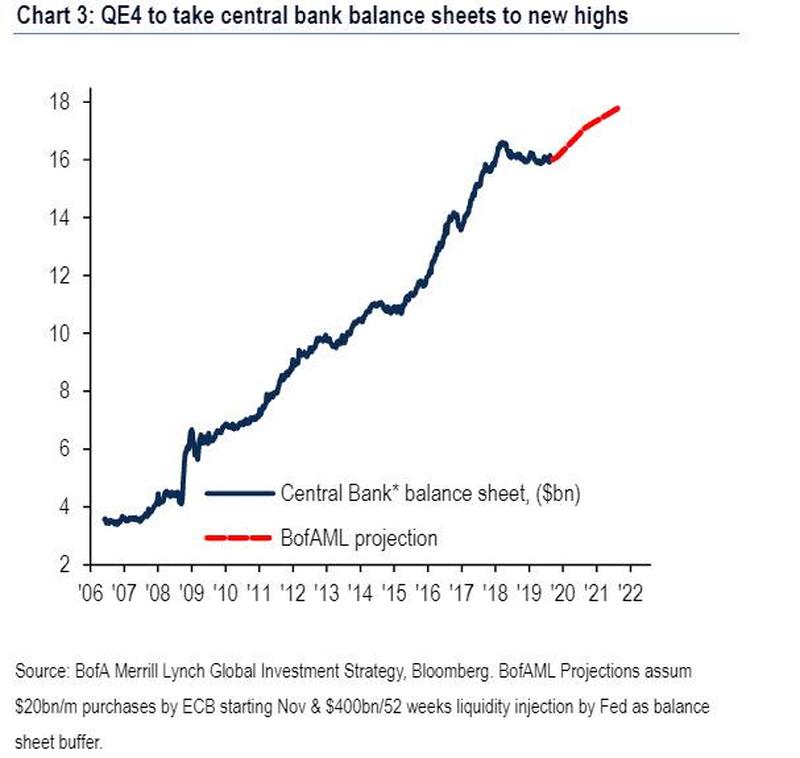

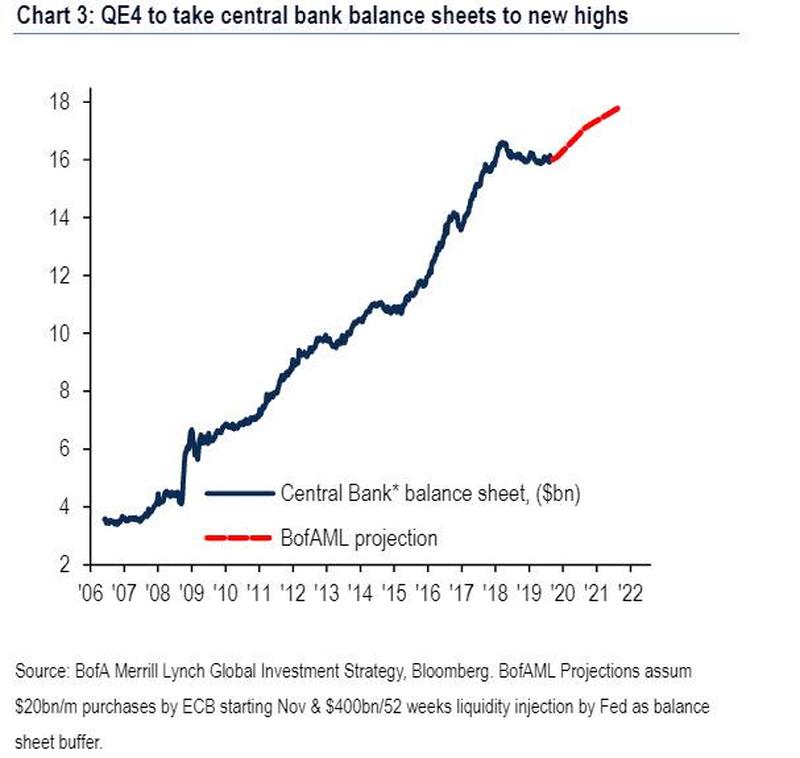

Financial and precious metals expert Egon von Greyerz (EvG) says the signs abound that we are nearing the end of this global fiat money experiment while central bankers are befuddled. EvG explains, “The central banks are panicking. They don’t know what to do anymore. They are just starting to print money and with the euro on a daily basis. . . . Europe is starting QE again with $20 billion a month, but that’s nothing compared to what is coming. . . . The panic that started with central banks in the summer in late July and August was, to me, the first step towards total chaos in the world that we will be seeing in the months and years to come. They (central bankers) see it clearly. They know the banking system is absolutely on the verge of collapse. They know Deutsche Bank (DB) and CommerzBank, too, are down 95%. If you show this chart to a child and ask where is that likely to go, it is likely to go to zero. DB, with their $50 trillion in derivatives, there is no chance they will survive. Of course, Germany and the ECB is panicking because that will affect the whole banking system worldwide. This is why they have started to print money now because there is a massive liquidity problem, and that’s Germany, which is the best country in the EU from the point of economics. Then you take Italy, Spain, France and Greece and they are in a real mess. This is why the whole system is on the verge of disappearing into a black hole. . . . With the U.S., there is massive liquidity pressure there too.”

The massive amount of money printing to keep the fiat system afloat is just starting. EvG contends, “This is just a practice round. This is just more money at this point. The balance sheet . . . of the Fed is going to go from around $4 trillion to $40 trillion. It is going to go to $100 trillion before this is over. So, right now, they are just practicing a bit because they are going to put the pedal down to the bottom very soon. . . . There is no other way to save this system, it has gone too far. I am not a pessimist. I don’t want to see the end of the world, but you can see their actions. You can see that now there is absolutely no way out. The only thing they know is to print money. They have already reduced rates to zero or negative, which is a disaster in and of itself.”

EvG predicts, “All of these bubble assets that are based on just credit and credit expansion are going to implode measured in real terms, measured in gold. I expect the stock market and the property market to lose at least 95% or more in real terms. . . . The next up cycle for gold (and silver) has started. The next phase of this market has started, and it is going to go on for a long, long time. It is going to go to levels that will be hard to believe today. . . .The world cannot have solid growth until this debt has imploded . . . the transition will be terrible, but I don’t see any other solution to this. . . .The debt can only be wiped out by also wiping out all the asset values. You can’t just make the debt disappear and have the assets stand there at the values that they are today. . . . When this debt is written off or implodes, or whatever they want to call it, that means all these assets are going to go down. That’s why I am saying it is going to go down 95% against gold. There is absolutely no other way, in my view.”

TOPICS: Business/Economy; Reference; Society

KEYWORDS: financial; gold; greghunter; greyerz

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-52 next last

1

posted on

09/25/2019 10:08:25 PM PDT

by

amorphous

To: amorphous

CENTRAL BANK MANTRA:

* The sky is falling.

* Must raise interest rates.

* Trump must be stopped.

2

posted on

09/25/2019 10:15:23 PM PDT

by

Hostage

(Article V)

To: amorphous

3

posted on

09/25/2019 10:20:37 PM PDT

by

laplata

(The Left/Progressives have diseased minds.)

To: Hostage

Thus far in 2019, we’ve seen the following:

• COMEX gold began the year at $1281 and recently hit $1530 for a gain of 19.4%

• COMEX silver began the year at $15.54 and recently hit $18.60 for a gain of 19.7%

4

posted on

09/25/2019 10:20:48 PM PDT

by

amorphous

To: laplata

Financials are getting sketchy...I think it's both chickens coming home to roost and TPTB setting Trump up for failure by 2020 elections.

Very good info rich interview. One of Greg's best podcasts at link above.

Also, heads-up concerning the repo market.

Repo Market Guru: "Whatever Changed Last Week Is Clearly Still A Problem"

https://www.zerohedge.com/markets/repo-market-guru-whatever-changed-last-week-clearly-still-problem

"The problem, as Hartnett also identified, is that this will take the central banks' balance sheet to new all time highs, resulting in the biggest asset bubble in history getting even bigger... and setting up the world for an even greater crash when the fed's pushing on a string fails. And while nobody knows when that will happen, the fact that the financial system nearly collapsed last week even with $1.4 trillion in "excess" liquidity for reasons still unknown, means that like a great white shark, the market now needs constant liquidity injections, or else it will collapse."

5

posted on

09/25/2019 10:28:58 PM PDT

by

amorphous

To: amorphous

Coincidental with a criminal RICO investigation of JP Morgan and others regarding market manipulation of the same.

Naked shorting has kept gold and silver down to artificially boost the dollar so that trade imbalances could continue and American industry would decay and be ripped off the continent.

It’s not rocket science.

I will not chase gold because it’s a timing trap. Gold miners are a better play. Equipment, services and technology for the miners is even better (more stable).

We will end up with Fed going bust and gold-backed federal cyber with federal controls and search warrant access options. But Fed will squeal and use whatever scare tactics possible to avert its demise.

POTUS said last year he has enough gold to take down the Fed.

I welcome the end of the Fed. They have caused way too much trouble, much more than they are worth.

Laying financial siege on rogue regimes like Iran will still be possible with a takeover of Rothschild banks by gold-backed cyber.

It’s a financial war and its outcome has been in planning for decades.

6

posted on

09/25/2019 10:34:27 PM PDT

by

Hostage

(Article V)

To: amorphous

This is contrived, it’s their (JPM led cabal) fightback to scare the markets.

Collapsing their system is what Trump wants but he has a plan for controlled collapse. The system custodians want to bring financial calamity in hopes that it will harm Trump in 2020.

They lost on the interest rate - pending recession gambit, now they are contriving a coming financial collapse.

Eff ‘em. We know their game now.

7

posted on

09/25/2019 10:40:54 PM PDT

by

Hostage

(Article V)

To: amorphous

8

posted on

09/25/2019 10:47:13 PM PDT

by

Bobalu

(Buy and hold physical silver! Consider this a warning my FRiend.)

To: Hostage

I will not chase gold because it’s a timing trap. Me either. Currently it's too important to have a little physical gold/silver on hand as an insurance policy.

POTUS said last year he has enough gold to take down the Fed.

I doubt their is enough gold and silver in the entire world to cover government debt, PM loans, bonds, retirement accounts, social programs, and especially collateralized debt obligations.

Well maybe there is, at a thousand times their current value.

Laying financial siege on rogue regimes like Iran will still be possible with a takeover of Rothschild banks by gold-backed cyber.

Maybe just crypto.

It’s a financial war and its outcome has been in planning for decades.

Agree. Soon to be a shooting war, IMO.

9

posted on

09/25/2019 10:48:07 PM PDT

by

amorphous

To: Hostage

It must get real interesting when you try explaining how the Fed was able to operate with the gold standard all those years, seeing as you think the two somehow conflict.

10

posted on

09/25/2019 10:49:20 PM PDT

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

To: Bobalu

See my tagline Great advice, IMHO, along with preparations for surviving during difficult times.

We've been talking about some kind of collapse for a long time. I hope it never arrives, but now is not the time to lower our guard as preppers. The longer this goes on, the worse it may be when/if things start going bad.

For example, even a decade or two ago, who would have ever dreamed we would have negative interest rates today?!

In '08, I cashed in all of my Money-market CD's, as did millions of others because of low returns. Such actions probably contributed to the banking crisis along with all the other issues at the time.

To: Pelham

The "conflict" is with the bankers and government bureaucrats having control over "our" money - they immediately spend or gamble it away with no remorse. And when it's gone, the bureaucrats borrow and obligate the people to borrow more from the bankers.

And the bankers arrange for these stooges in government to pass bills refunding their loses - gambling or otherwise, as now they're "too-big-to-fail". All of this happens with no regard for middle Americans or the country's well being. The "beast", "the creature from Jekyll island" has torn loose from it's restraints.

Luckily we now have a self-proclaimed "king of debt" as president - what could go wrong?! Hopefully nothing. But just in-case there are unforeseen problems, keep a little gold/silver buried in the backyard.

To: amorphous

I suspect that it will depend much on who is elected in 2020. If Warren is elected, we may see an economic collapse.

13

posted on

09/26/2019 1:42:11 AM PDT

by

familyop

("Welcome to Costco. I love you." - -Costco greeter in the movie, "Idiocracy")

To: amorphous

They know the banking system is absolutely on the verge of collapse. They know Deutsche Bank (DB) and CommerzBank, too, are down 95%. If you show this chart to a child and ask where is that likely to go, it is likely to go to zero. DB, with their $50 trillion in derivatives, there is no chance they will survive. Of course, Germany and the ECB is panicking because that will affect the whole banking system worldwide. This is why they have started to print money now because there is a massive liquidity problem, and that’s Germany, which is the best country in the EU from the point of economics.

...

The problem with Europe is they refuse to cut taxes and regulations in order to stimulate the economy.

14

posted on

09/26/2019 3:05:41 AM PDT

by

Moonman62

(Charity comes from wealth.)

To: Pelham; All

A little history talk for those interested.

The Fed was a long time in evolution. Groups of financiers bequeathed membership into exclusive clubs focused their energies and plans on dominating finance long before their group settled on how to make a central bank which was always a goal, and how to share control of that bank. The history of the families involved in it is an interesting but long one.

Originally these elite financiers designed that the Fed be installed as a concessionaire set up for replacing worn paper money. The paper was gold backed but the Fed’s role starting in 1913 was only printing and keeping the books. They needed a low profile because of the sensitive history of paper currency and its exchange for gold or silver. The owners of silver bullion were all nearly bankrupted by Coinage act of 1873 which rendered silver certificates nearly worthless. The fight that ensued was tense and not forgotten.

The designers of the Fed had in mind their goals and removing the gold standard was not factored in until there was a system that could control the value of the paper. That system was the petro-dollar which came much later.

Agents of JP Morgan and privileged others were already envisioning how banking would be designed and controlled before the 1913 Fed Reserve Act was ever passed (which was their creation). They were not talking just yet about the gold standard but rather how to extract maximum fees for maintenance that their Fed was tasked to perform and how they would expand and replace all other US Bank Notes that were in usage. They were mindful not to wipe out fortunes of others that might start a political war.

There were two general categories describing the storing of physical gold. One was government gold and the other was private gold. The US Govt did not engage in ‘fractional reserve banking’ that Morgan et al engaged in. Morgan (meaning the bankers club) could inflate their debt holdings with a smaller control reserve. The 1913 Fed reserve Act was designed to let them do this. But gold got in the way.

Keep in mind these bankers looked at their assets as debt imposed on others. Debt was their product. Deb was their way of taking control over resources and labor. The US Govt had no such view of assets as debt. Until the 1930s, the US Govt had no control of private gold. Morgan knew they could expand debt production by fractional reserve banking and they needed only a fraction of gold to store to ‘kite’ their scheme.

Banking regulations at the time did not prohibit Morgan from kiting their system. Banking was a business independent of government yet intertwined with it when Congress needed to authorize government loans. Government needed banking, banking did not need government unless debt was involved. But gold got in the way as the value of gold was controlled by the US Govt.

There are several fascinating histories of the back and forth between banking and government but the bottom line is that the US Govt became more dependent on bankers than the other way around. Bankers had the bargaining leverage. With this leverage the Morganites insisted that the loans be collateralized by gold which allowed further kiting on the private side

The value of gold placed a limit on the amount of product = debt that bankers could produce. Gold was in the way.

How long did it take the Morgan club to rid itself of gold? The elementary answer is 1971 - 1913 = 58 years. But that ignores all the fights and conflicts along the way.

Go back a bit to the 1920s, 1929, and the years of the Hoover Admin. The installation of the Federal Reserve started in 1913 and kept a low profile. It was slow going and quiet. The Income Tax Code which was designed to extract from Americans the revenues needed to make interest payments on government loans taken from Morgan was only 14 pages long. Most Americans (>98%) never filed (rate was only 1%), reporting was on the honor system. As the US Govt took out loans, it focused on the rich (rate 7%) to get what it needed for interest payments. Over time the lawyers for the rich shifted the tax burden to the middle class by crafting clever definitions of the word ‘income’. That’s a whole other story.

But in the 1920s, stock exchanges were fueled by Americans bringing money from a new source which was Morgan’s kiting system aka fractional reserve banking. Morgan kiting was creating a lot of debt and Americans expanded companies, construction, transportation, everything, all fueled by dollars that were only partially backed by physical gold. Morgan could print Reserve Notes and plot to overtake US Bank Notes but it couldn’t print its notes AT WILL because of pesky gold valued outside its realm, valued by the US Govt. Gold jammed the Morgan kiting system.

But what Morgan could do is sell securities based on debt, especially mortgage debt. The Morganites were a clever bunch, What they couldn’t get by using their federal notes, they got by inventing a new form of funny paper, mortgage-backed securities to sell to Wall St. investors looking for a return on investment.

Apart from buy-sell market values, stock brokerages were mandated to value stocks on accounting reports that were measured in balance sheets, income statements, cash flow, all of which were measured in dollars, gold-backed dollars. Stocks were stuck on gold-backed dollar valuations. And Americans had a lot more of these quasi gold backed notes from Morgan kiting than there was gold to cover them.

As these quasi notes found pathways into the stock exchanges, stock prices were lifted, companies received more investment which further boosted stock prices and what did Americans do? They went to their banks to withdraw more dollars to purchase stocks. The Morgan kiting disease infected the stock exchanges. The bank reserves fell and the debt machines (banks) were stuttering.

As the stocks continued to climb, more dollars left banks and were taken to stock brokerages (or direct company buys). Banks looked for ways to put their kiting genie back in the bottle. Eventually kiting dollar streams slowed to a trickle and the stock market sputtered, bounced, dove and eventually crashed. As stocks were wiped out, Americans relied on what they had left in banks to survive but banks called a holiday.

Voila, John Dillinger.

The human behavior is easy to understand but the bank propaganda is so thick that getting true information to people is jammed; signals were and are still jammed.

The banks then began confiscating American homes in foreclosures to cover their mortgage security debt, their own debt, because Americans were cast to the curb (the power of debt). Breadlines, 25% unemployment, vagrants begging for food on a scale never seen before. And lots of homeless people never having experienced homelessness before. My own grandmother, a devout Christian woman, told stories of all the people walking the roads and streets that were kicked out of their homes.

And Hoover. Hoover’s people were actually doing some good although he was blamed for everything. But the Morgan disease had long taken root before he was sworn in so as soon as was in he had to react with no time to plan and prepare. But still his people drafted worked with Carter Glass and Henry Steagall to draft some fairly good legislation that Hoover signed in 1932 as the Glass-Steagall Act of 1932 and then it expanded in FDR’s first year in office as the Glass -Steagall Act of 1933. Despite its origins in the Hoover Admin, FDR signed it because he knew Americans were angry at banks and especially Wall St. investment banks which Glass-Steagall was shutting out of home mortgage markets.

This is the human misery element that historians usually ignore or gloss over and which bankers could care less about. By bankers is not meant bank employees who are just workers. Bankers are persons with a predisposition toward lording over debtors leading society to believe debtors are fools and if they get in trouble, it’s their fault. But I look at bankers as pushers of addictive substance. People are flawed, they always will be and they should not be allowed to get in over their heads with debt. But bankers could care less unless a strong hand is threatening their backside.

The good news is the strong hand that menaces them gets their attention and respect except their alpha banker cohort will gather secretly to plot a removal of that strong hand. Yes, they plot behind the scenes. Because to them the Golden Rule of Christians “do unto others what you would have them do unto you” means “He who has the Gold, Rules”. They will pay whatever it takes to preserve their rule.

There’s a lot of history here but here’s the thing that addresses what was raised, the coexistence of banks and the gold standard. That coexistence was never settled and agreed to. Gold was always in the way. It just took a long time to get rid of it so that production of debt could get into high gear. Debt enables master rule.

How did gold get played in banking in the history of the Federal Reserve of 1913 through to abandonment of the gold standard in 1971? It’s a long history but one needs to understand there are two tiers (actually more) of banks, there’s the alpha banks or so-called leading banks and there are the little nobody community banks.

The little banks depend on rich uncle banks many of which are Wall St. Banks, the little banks depend on them like children depend on their parents or caretakers. When little junior gets in trouble, he goes to rich uncle and asks for help. And mean old hook nose Captain Morgan will say give me GOLD and I will give you my paper called dollars heh-heh-heh.

All that changed under Glass-Steagall where Captain Morgan banks were ‘enticed’ to expand what was defined as ‘eligible paper’. The Morgan bankers were encouraged to buy Junior’s government bonds and such, including some classes of short-term paper. Morganites didn’t want to do that so they demanded gold as collateral on their loans to government to which the FDR Admin said nope, not only nope but all your gold belongs to us.

There was no peaceful coexistence between bankers and gold, that is gold not in their hands.

When Glass-Steagall was repealed in 1999 (and its repeal was in planning for a long time before 1999), how long did it take for the Morganites to crash the mortgage market? Less than 10 years. And boy did they make a killing, Trillions. Much taken offshore. Ill gotten gains. Oh, but it’s the maid’s fault! She didn’t deserve to be in that penthouse apartment!

How was the janitor able to qualify for a loan that landed him in the 5-bedroom house in an upscale neighborhood?

Very simple.

Wall St. aholes got hold of a spreadsheet. On the spreadsheet they filled in 5,000 fictitious names and addresses of fake homes having fake mortgages averaging about 300k each. That’s about 1.5 billion total for the math challenged. They took this spreadsheet and attached it to a security wrapper and made a Mortgaged-Backed Security. They ‘traded’ it (fake buy and sell on the inside) a few times with banker friends to ‘season’ it. Then they put it on the market to institutional investors sans mortgage listing. When investors committed funds to investment trusts, a small fraction of the funds would pay to dispatch mortgage brokers (many were criminals left over from the S&L crisis) across the country to find applicants for mortgage loans. Brokers ended up signing anything that moved. And the Wall St. aholes would do dozens of these fake securities every couple weeks or so.

When the music stopped, Wall St. aholes had already channeled their ill-gotten gains through Delaware Trusts (Biden, Biden, & Biden) and then on to offshore trusts.

And they were never held accountable.

Because Joe the Plumber was to blame! He was such a fool to get in over his head. My goodness.

It’s like a new car maker designing and selling a car that won’t go slower than 100 mph when stepping on the gas. When Joe gets in the driver’s seat and steps on the gas, accelerating to 100 mph without an ability to slow down, he crashes! Wreckless Driver! Fool! Joe’s fault!

There should be laws against that happening and in fact there are, but not for bankers.

Today we are approaching a point where technology renders bankers obsolete. Actually we are there but not yet up operationally. Bankers are not needed. They are troublemakers. Not the bank employees! Rather the ‘bankers’.

But will bankers fight the technology that kicks their butts? Absolutely yes.

In fact they have Google’s minions putting out ‘stories’ that a quatum leap in quantum computing is going to smack some quantum on blockchain! Bwahahahahaha! Such comedians!

They are scared.

They hate me.

They hate people like me that are on to them. And we are not a few,

But hey, the repo market! Flashback to 2008! Market collapse coming!

WE’RE ALL GOING TO DIE!

My name is Captain Morgan and if Mr. Not-My-President doesn’t do what I say, then John Q. Public gets it understand?

Everything is going to crash! The Sky is Falling! It’s the plumber’s fault!

15

posted on

09/26/2019 3:08:16 AM PDT

by

Hostage

(Article V)

To: Hostage

Well he’s mostly right. After the 2020 election I expect Trump to make his move on the Fed. I would not want to have money in the big four banks. Especially Bank of America and Wells Fargo. I’m moving my mom’s accounts out of Wells Fargo right now.

He’s right about gold but wrong about property. The interest rates are going to be zero or near zero so peple will invest in gold, silver and real estate.

16

posted on

09/26/2019 4:15:03 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: amorphous

Silver is up $8.00 an ounce since I bought some.

My kids said, “Why so much dad”?

They asked because I bought 9 pounds.

Looks like the old man done good!

17

posted on

09/26/2019 4:20:50 AM PDT

by

airborne

(I don't always scream at the TV but when I do it's hockey season!)

To: Hostage; Mariner; lightman; Roman_War_Criminal; CodeToad

Naked shorting has kept gold and silver down to artificially boost the dollar so that trade imbalances could continue and American industry would decay and be ripped off the continent. It’s not rocket science....We will end up with Fed going bust and gold-backed federal cyber with federal controls and search warrant access options....But Fed will squeal and use whatever scare tactics possible to avert its demise. ….It’s a financial war and its outcome has been in planning for decades.

This!

18

posted on

09/26/2019 4:23:01 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Bobalu

19

posted on

09/26/2019 4:23:40 AM PDT

by

airborne

(I don't always scream at the TV but when I do it's hockey season!)

To: amorphous

Those central bankers and elitists would be in the same bread line as the rest of us.

20

posted on

09/26/2019 5:14:46 AM PDT

by

bk1000

(I stand with Trump)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-52 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson