Skip to comments.

Lower Tax Rates Yield Higher Revenue

Posted on 11/09/2012 9:35:39 AM PST by Trapped Behind Enemy Lines

Since the implementation of the federal income tax in 1913 we have had only four administrations which significantly lowered income tax rates. In each and every single instance marginal tax rates were lowered revenues increased to the US Treasury.

The first time income tax rates were reduced came about in the 1920s during the Harding-Coolidge Administrations. Under the direction of Treasury Secretary Andrew Mellon, the top tax rate was reduced from 77% to 25%. After tax cuts were fully implemented, revenues increased to the Treasury by 61%. Calvin Coolidge especially understood the concept of maximizing revenues and the law of diminishing returns. In a speech delivered in New York City in 1924, Coolidge said:

"The first object of taxation is to secure revenue. When taxation of large incomes is approached with that view, the problem is to find a rate which produce the largets returns. Experience does not show that the higher rate produces the larger revenue. Experience is all in the other way. When the surtax on incomes of $300,000 and over is 10 percent, the revenue is about the same as when it was 65 percent. There is no escaping the fact that when the taxation of large incomes is excessive, they tend to disappear. In 1916 there were 206 incomes of $1,000,000 or more. Then the high rate wento into effect. The next year there only 141, and in 1918, but 67. In 1919, the number declined to 65. In 1920 it fell to 33 and in 1921 it was further reduced to 21. I am not making the argument with the man who believes 55 percent ought to be taken away from the man with $1,000,000 income, or 68 percent from a $5,000,000 income, but when it is considered that in the effort to get these amounts we are rapidly approaching the point of getting nothing at all, it is necessary to look for a more practical method. That can be done only by a reduction of the high surtaxes when viewed solely as a revenue proposition, to about 25 percent...The experience of the Treasury Department and the opinion of the best experts place the rate which will collect the most from people of great wealth, thus giving the largest relieft to people of moderate wealth, at not over 25 percent."

The second significant tax rate reductions came about in the 1960s during the Kennedy-Johnson Administrations when to the top marginal tax rate was lowered from 91% to 70%. Revenues increased to the US Treasury by 33% after the tax cuts were fully implemented. JKK was even more succinct when he said in 1963:

"Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased--not a reduced--flow of revenues to the federal government."

The third time federal income taxes were significantly reduced came about in the 1980s under the Reagan Administration when the top tax rate was lowered from 70% to 28%. Revenues increased to the Treasury by 100% after the tax cuts were implemented. Vice President Joe Biden, then a US Senator voted for the final installment on those tax cuts in 1986 as did most other senate Democrats.

The fourth time tax reductions came about was in 2000s under the George W. Bush when the top rate was lowered from 39.5% to 35%. Here is how Investor's Business Daily (09/07/2012) measured the impact of those tax cuts:

"...Bush's income and capital gains tax cuts--once fully in effect in 2003--accelerated economic growth and boosted job creation. In fact, the economy created 8.1 million new jobs in the four years after the tax cuts took effect."

Revenues to the Treasury then reached their all time record high in 2007, fully debunking the myth that tax-cuts blow holes in the deficit. To the contrary, cuts in marginal tax rates INCREASE revenues to the US Treasury each and every time they have ever been tried as indicated by the historical record. In addition to increased revenues to the Treasury, tax rate reductions were always immediately followed by significant increases in economic growth as measured by GDP, a lowering of unemployment, and an upswing in the DJIA---in all four instances WITHOUT exception.

President Calvin Coolidge gave the most in depth and detailed explanation of why lower tax rates yield higher revenues. When tax rates are excessive to the point of punishing, those with high incomes tend to shelter it and behave defensively. They invest in tax exempt municipal securities and bond funds. They invest in tax deferred retirement accounts and real estate tax shelters. The super rich can set up tax free foundations which they control and keep control of the money. They can do estate planning and set up trust funds for their designated heirs--Joseph Kennedy Sr did this in the 1930s and 40s making all nine of his children millionaires and thus escaping a huge tax obligation on himself. Of course Kennedy retained control over those trust funds until he became incapacitated. And of course we have heard of the Rockefeller, Ford, and Carnegie Foundations among many others which were primarily created to avoid excessive taxation. Further, in today's global economy, capital is very fluid and flows to where it it most welcome and can be put to the most efficient use and that more often than not means offshore.

The Occupy Wall Street crowd would be stunned and amazed to learn you often get more with less. People respond better to sugar and honey than they do with salt and vinegar. But then again what is the intent? To secure the maximum amount revenue or punish people? Barack Obama clearly wants to punish. During the 2008 presidential primary campaign, during a debate, Charles Gibson, discussing capital gains taxes pointed out to Obama when that tax is lowered, higher revenues followed. Obama said it didn't matter, that out of fairness, hedge fund managers should be paying higher capital gains taxes. Then, more recently, just days before the election, Obama exhorted his supporters to vote for revenge. Does not matter to people like Obama, that with their thirst for revenge and desire to punish, they will secure LESS revenue for the Treasury as the wealthy will shelter their income rather than risk it making productive investments in a high tax environment.

TOPICS: Politics

KEYWORDS:

To: Trapped Behind Enemy Lines

The goal of the left is not primarily to raise taxes.

Their primary goal is to deprive the citizenry of both their prosperity and their ability to become prosperous, which crushes their spirit.

Controlling the cash is the secondary objective, which allows them to buy votes by reducing entire blocs to wards-of-the-state.

And we have to take the language and the argument back.

They are NOT redistributing “wealth” at this point.

They are redistributing income from those who earn to those who WILL NOT.

To: Trapped Behind Enemy Lines

To: whitedog57

They are the New Bolsheviks. Its not about revenue its about redistribution.

4

posted on

11/09/2012 10:55:15 AM PST

by

culpeper

(I have sworn upon the altar of God eternal hostility against every form of tyranny... TJ)

To: Trapped Behind Enemy Lines

We have 16 trillion dollars of debt. Why would the Democrats care about taxes? We keep making the mistake that the Democrats care about this country. They don’t. They care about themselves and the Democrat party. I had several teachers at the university who belonged to The Communist Party of America. One guy used to stroke his beard and tell us about the dictatorship of the proletariat. One cold Winters day, I was trudging through the snow when I saw an expensive sports car coming down the road. There was Professor Proleteriat driving with the cute girl who sat next to me in his class. He was married, by the way. Grifters. 90% of them are just grifters. Defund the universities.

5

posted on

11/09/2012 11:03:09 AM PST

by

blueunicorn6

("A crack shot and a good dancer")

To: Trapped Behind Enemy Lines; Ghost of Philip Marlowe; whitedog57; culpeper; blueunicorn6

Trapped Behind Enemy Lines wrote:

The third time federal income taxes were significantly reduced came about in the 1980s under the Reagan Administration when the top tax rate was lowered from 70% to 28%. Revenues increased to the Treasury by 100% after the tax cuts were implemented.

Arguments like that caused me to analyze the Reagan tax cuts years ago. Following is the short analysis:

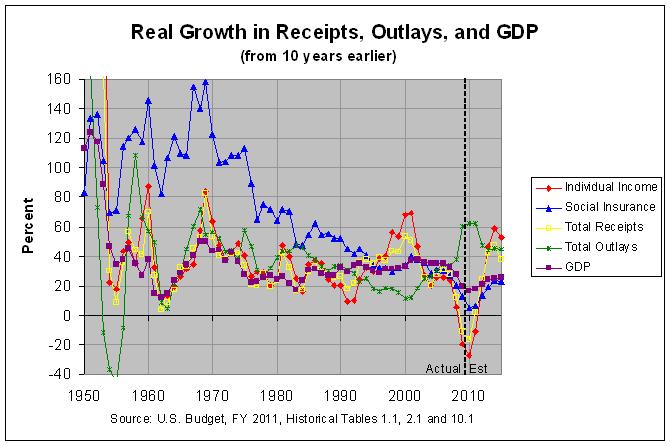

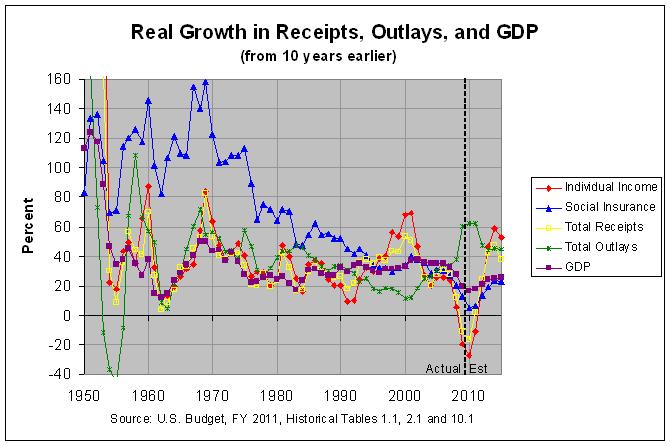

The argument that the near-doubling of revenues during Reagan's two terms proves the value of tax cuts is an old argument. It's also extremely flawed. At 99.6 percent, revenues did nearly double during the 80s. However, they had likewise doubled during EVERY SINGLE DECADE SINCE THE GREAT DEPRESSION! They went up 502.4% during the 40's, 134.5% during the 50's, 108.5% during the 60's, and 168.2% during the 70's. At 96.2 percent, they nearly doubled in the 90s as well. Hence, claiming that the Reagan tax cuts caused the doubling of revenues is like a rooster claiming credit for the dawn.

Furthermore, the receipts from individual income taxes (the only receipts directly affected by the tax cuts) went up a lower 91.3 percent during the 80's. Meanwhile, receipts from Social Insurance, which are directly affected by the FICA tax rate, went up 140.8 percent. This large increase was largely due to the fact that the FICA tax rate went up 25% from 6.13 to 7.65 percent of payroll. The reference to the doubling of revenues under Reagan commonly refers to TOTAL revenues. These include the above-mentioned Social Insurance revenues for which the tax rate went UP. It seems highly hypocritical to include these revenues (which were likely bolstered by the tax hike) as proof for the effectiveness of a tax cut.

Hence, what evidence there is suggests there to be a correlation between lower taxes and LOWER revenues, not HIGHER revenues as suggested by supply-siders. There may well be valid arguments in favor of tax cuts. But higher tax revenues does not appear to be one of them.

You can see this and a longer analysis at this link. As the first graph there shows (also shown below), GDP growth in the decade following the Reagan tax cuts was nothing special following the Reagan tax cuts and was actually subpar following the Bush tax cuts.

For years, I've asked supply-siders to tell me any specific numbers or conclusions in my analysis that they disagree with. Alternately, I've asked them to post a link to one serious economic study that purports to show evidence of any income tax cut that has ever paid for itself. None have.

6

posted on

11/10/2012 1:06:09 AM PST

by

remember

To: remember

So, in your world, a 90% increase in income tax receipts during the 80s is low? I’m not going to waste my time debating a true believer, but your own facts and arguments support the null hypothesis.

7

posted on

11/10/2012 8:32:04 AM PST

by

blueunicorn6

("A crack shot and a good dancer")

To: blueunicorn6

blueunicorn6 wrote:

So, in your world, a 90% increase in income tax receipts during the 80s is low? I’m not going to waste my time debating a true believer, but your own facts and arguments support the null hypothesis.

A "true believer" is someone who believes that tax cuts will raise revenue, despite the fact that there does not exist one serious economic study that purports to support that. If you think otherwise, accept my challenge. Tell me any specific numbers or conclusions in my analysis that you disagree with. Alternately, post a link to one serious economic study that purports to show evidence of any income tax cut that has ever paid for itself.

8

posted on

11/10/2012 1:52:26 PM PST

by

remember

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; ColdOne; Convert from ECUSA; ...

But how does The Party foster dependency and destroy all organizations and entities capable of raising dissent? Duh!

Thanks Trapped Behind Enemy Lines.

9

posted on

11/16/2012 9:19:56 PM PST

by

SunkenCiv

(https://secure.freerepublic.com/donate/)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson