Posted on 01/27/2012 1:17:11 PM PST by Razzz42

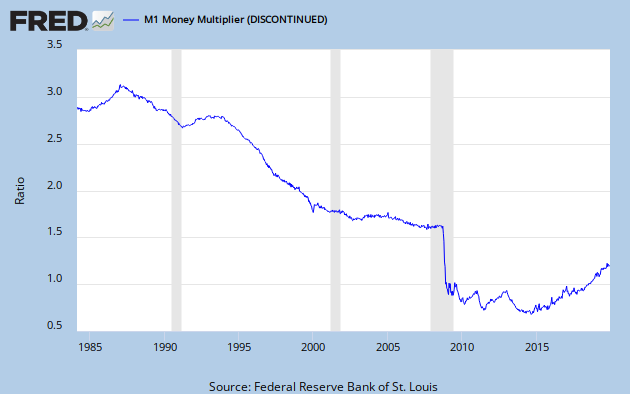

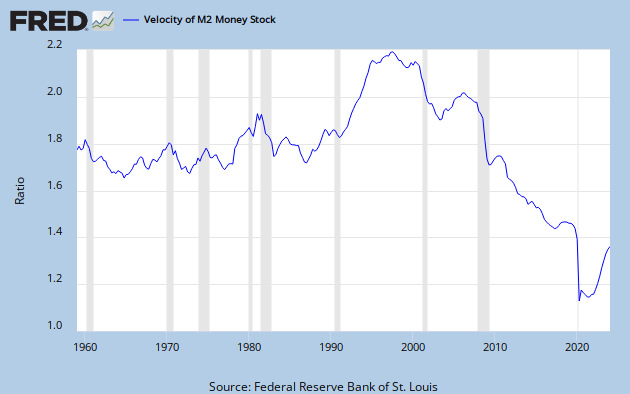

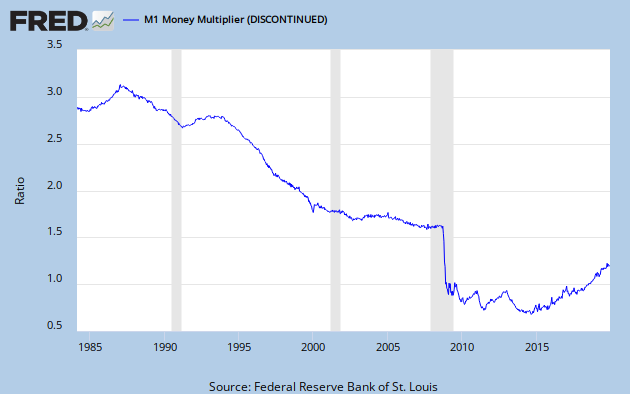

Keeping interest rates low may have the APPEARANCE of stimulation, but that effect is NOT being passed on by the banks. Interest Rates on loans, even credit cards, have not declined in proportion to the drop in interest rates at the Fed. Therefore, the deflation aspect is shifting profits to banks further bailing them out to make up for their losses in the speculation of mortgages. NOTHING is being done to help the people or the economy whatsoever! They are NOT lowering borrowing costs of consumers or business so the Fed can pretend it is helping the economy, but it is ONLY helping the banks. If the banks passed on the low rates to borrowers, then there might be some stimulus effect.

It is NOT lower interest rates that will create inflation – but HIGHER! There are two primary factors to understand. (1) Keeping rates low (really negative) insofar as what banks are paying people for their cash, makes things like holding physical gold less onerous because you are not losing interest income. (2) Eventually the low rates will NOT stimulate borrowing, but a migration of capital from cash to private assets including stock where there is a real rate of return in dividends not attainable in a bank and this sets the stage for rising rates as there becomes LESS cash on deposit at the banks - COMPETITION. (3) When rates rise, this will send the government deficits into hype-active status causing the Sovereign Debt Crisis to accelerate.

Therefore, the whole point of reviewing historical events is critical for the plot remains the same – it is just the actors playing character role that change. The Panic of 1796-1797caused the end of Debtors Prison ONLY because so many FAMOUS POLITICAL people went to prison. The US was the emerging market and thus it was the same effect we saw in Russia and China after 1989. There are still booms within a declining trend but each rally fails to make new highs. Hence the trend remains intact. Those who cannot see the pattern in history are condemned to repeat the same mistakes. It was nice to hear Newt Gingrich say he isn't running for president to "represent Goldman Sachs." But talk is cheap.

Pelosi owned a piece as well, and then there's that crowd in the Dakotas doing the same thing.

The industry was overdue for a shakeout, but Congressional action to shift costs from hard pressed merchants to credit card users saved them.

Now that Obama says things are getting better I expect him to submit a bill to bring down allowable rates for credit card companies any moment./s

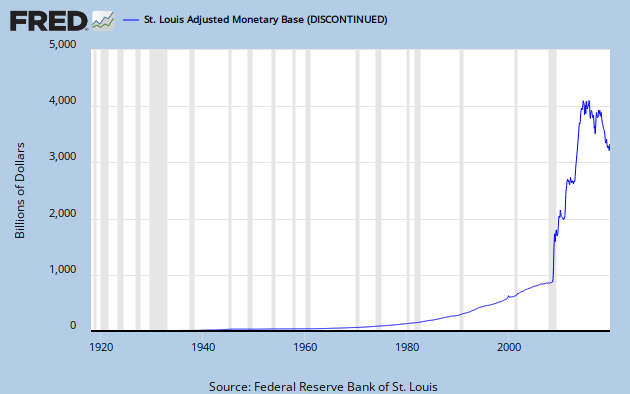

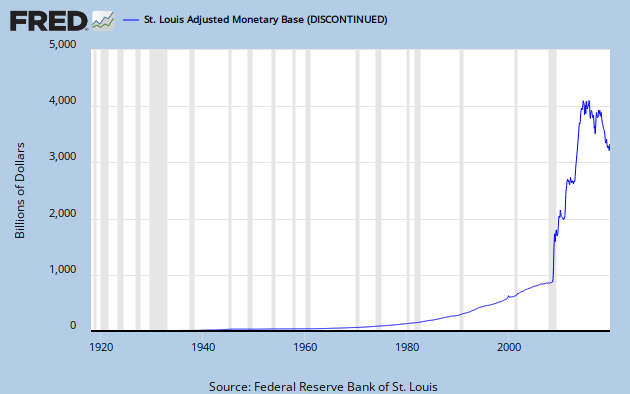

Look at that huge monetary growth. We already have real inflation of 8% or so (shadow statistics).

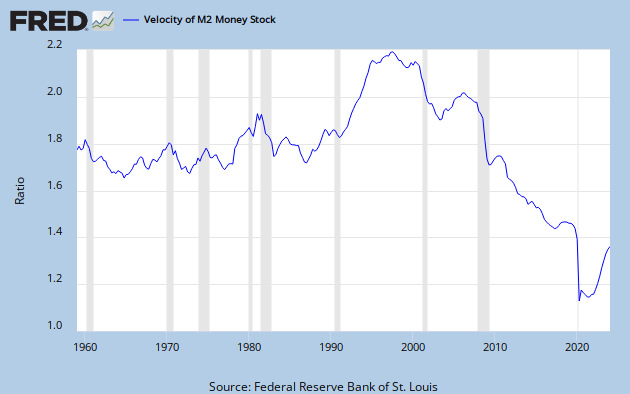

Thank you. That's the cause of price inflation -- interest rates are only an inducement to get it into circulation faster.

Indeed. Why is it so many Americans, even conservatives, don’t understand this. Instead they are conned by Washington to fear deflation more than inflation.

It's another Keynesian shibboleth.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.