Laffer was a low level WH adviser during Reagan.

Administration and CabinetThe Reagan Cabinet Office Name Term

President Ronald Reagan 1981–1989 Vice President George H.W. Bush 1981–1989

Secretary of State Alexander Haig 1981–1982 George P. Shultz 1982–1989

Secretary of Treasury Donald Regan 1981–1985 James A. Baker III 1985–1988 Nicholas F. Brady 1988–1989

Secretary of Defense Caspar Weinberger 1981–1987 Frank C. Carlucci 1987–1989

Attorney General William F. Smith 1981–1985 Edwin A. Meese III 1985–1988 Richard Thornburgh 1988–1989

Secretary of the Interior James G. Watt 1981–1983 William P. Clark, Jr. 1983–1985 Donald P. Hodel 1985–1989

Secretary of Agriculture John Rusling Block 1981–1986 Richard E. Lyng 1986–1989

Secretary of Commerce Howard M. Baldrige, Jr. 1981–1987 C. William Verity, Jr. 1987–1989

Secretary of Labor Raymond J. Donovan 1981–1985 William E. Brock 1985–1987 Ann Dore McLaughlin 1987–1989

Secretary of Health and Human Services Richard S. Schweiker 1981–1983 Margaret Heckler 1983–1985 Otis R. Bowen 1985–1989

Secretary of Education Terrel Bell 1981–1984 William J. Bennett 1985–1988 Lauro Cavazos 1988–1989

Secretary of Housing and Urban Development Samuel R. Pierce, Jr. 1981–1989

Secretary of Transportation Drew Lewis 1981–1983 Elizabeth Hanford Dole 1983–1987 James H. Burnley IV 1987–1989

Secretary of Energy James B. Edwards 1981–1982 Donald Paul Hodel 1982–1985 John S. Herrington 1985–1989

Chief of Staff James Baker 1981–1985 Donald Regan 1985–1987 Howard Baker 1987–1988 Kenneth Duberstein 1988–1989

Administrator of the Environmental Protection Agency Anne M. Burford 1981–1983 William D. Ruckelshaus 1983–1985 Lee M. Thomas 1985–1989

Director of the Office of Management and Budget David A. Stockman 1981–1985 James C. Miller III 1985–1988 Joseph R. Wright, Jr. 1988–1989

United States Trade Representative William E. Brock III 1981–1985 Clayton K. Yeutter 1985–1989

Reagan, first act was to lift the oil embargo. And began cut in taxes and cuts in unnecessary spending.

The Laffer worship is well Laffable.

Yeah he voted for Clinton TWICE. Uh HUH.

Sorry but you aren’t allow to simply make facts up to fit your hysteric ignorance.

Thank you for showing me who Laffer is. He sounds good on TV!

Man are you really this ignorant of all historic fact?

I read that the ideal rate is between 16.5% and 17.8%, maximum revenue is achieved to the government. More or less than that range and total revenue to the government falls off.

PerryBot ?

I don’t understand this attack on Art Laffer at all. The Laffer Curve is an important part of constructive tax debate in this country. Does he give too much credit to Clinton? Hell yes he does - he should acknowledge that everything Clinton did he likes was sent to him by Newt’s congress.

But that’s about my only problem with him. I figure he does that so he has entry to networks like CNBC and so on. But the Laffer curve is a great description of how human nature reacts to tax policy. This is a mindless post IMO.

Yeah he thought tax cuts for the “middle Class” was a big mistake.

So here we have 999.

Cut the corp, top 10% of earners to 9%

Then stick the “middle class” with a SECOND tax. Get rid of ALL deductions.

So Laffer intends to stick it to the middle class. Where Reagan wanted to help the middle class.

Ronald Reagan probably voted for FDR 4 times

What a total lie!!! Clinton was running huge $100-$250 billion dollar yearly budget deficits even after RAISING federal income taxes. It wasn't until the Republicans took over Congress in 1995 that the budget deficit was brought under control and a surplus from 1998-2001. And under a Republican Congress, Clinton LOWERED the capital gains tax and the economy took off.

Get your facts straight or do not post!

Did u think u were at HuffPo?

Well:

1. I thought few credited Laffer with originating the “Laffer” curve, but more with popularizing it.

2. One big mistake one can make in economics is to confuse Keynes with the Keynesians. Keynes did not live long enough to see the simplistic models other attached to his name.

Who wrote this crap, Harry Reid. In both cases, the tax cuts increased revenue- Laffer was exactly right about that. The problem is that spending in both cases far exceeded that revenue.

Good grief, are we now going to trash every one we may have once respected because they know more about economics than a bunch of keyboard commandos.

Let me guess, Godfather's pizza sucks too?

Did you even check the source of the articles you posted? It is on a real estate agent website.

ctrust.com

Good grief, I didn’t know they were experts on economics.

Get back to me if this source tells me about how to hang curtains and I’ll listen to them.

Sourcing Time is like sourcing a DNC Talking Point.

Are You a DNC rabble rouser?

Also, there are different long term and short term Laffer curves. On the short term, the rate for maximum tax revenue is higher than the long term. People aren't going to quit their jobs today because their tax rates are too high this year. However, they will invest less in future production, work less hard for that promotion (would you work 50% more to get a mere 10% raise after taxes? I know I wouldn't.) and generally plan less for the future. Many leftists argue that the lack of immediate response from a high tax rate means that the rate for a maximum tax revenue is much higher than our current tax rate.

Oh, Reagan did lift the price caps on oil, after which the availability of oil went way up, followed by a price collapse a three or four years later. maybe you confused the price caps with the embargo.

“Interesting how all of the Keynesian Econ Haters are embracing a man whose guiding light is John Keynes.”

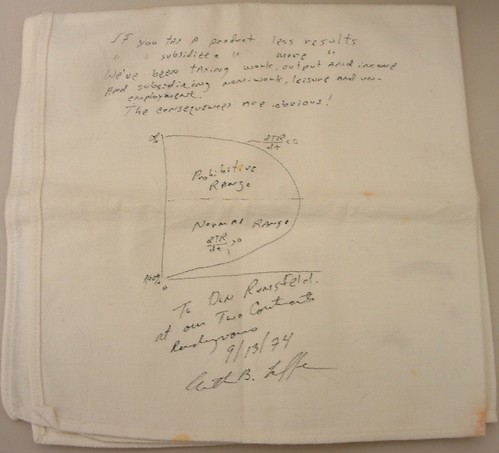

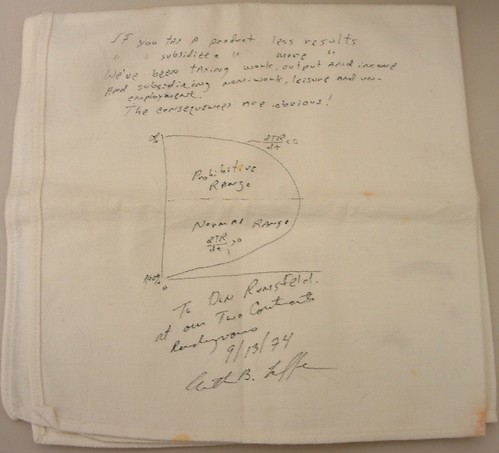

It sounds like we embrace something he once scribbled on a napkin, not the man himself. I have used it in discussions many times without even knowing it was called the Laffer Curve. It’s a simple way to explain something that should be obvious.

We can then debate whether maximizing revenue is an ideal goal - I would prefer tax rates well below the maximized level. I think very few outside of DC would like rates above that level, so helping them to understand the level exists and convincing them that we are above that level for the so-called rich would be a useful starting point.

x = tax rates

f(x) = GDP

g(x,f(x)) = government tax revenues

Since g(x,f(x)) is essentially a function of x, the curve of this function is continuous from x=0% to x=100%. At the endpoints, g(x) will equal zero since x=0 at zero and f(x) = 0 at 100.

For any continuous curve, the slope equation for that curve can be determined by taking the derivative of the equation for that curve. On any continuous curve,there exists a point which represents a maximum value. The slope at that point will be zero. The slope of the curve immediately at the left of that point will be positive while the slope immediately to the right will be negative.

If you are at a point to the right of the maximum value, then g(xp) will be lower than g(xmax). Thus decreasing x from this point will result in increased value for g.

This isn't Laffer. It isn't Keynes. It is simply Newton.