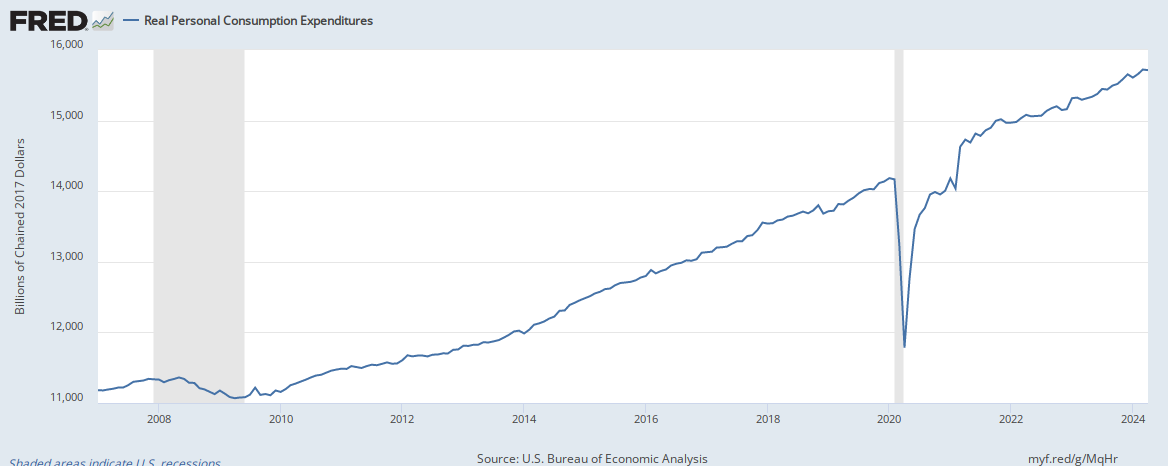

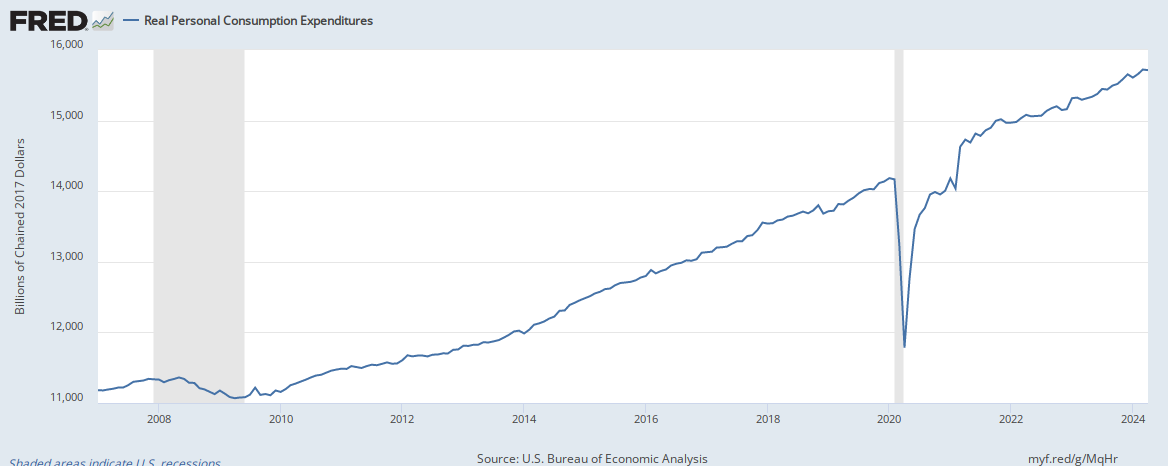

I couldn't find a chart of the SMI

Posted on 03/29/2022 7:25:25 PM PDT by SeekAndFind

Two years ago, slippers went stratospheric.

Normally, they sell in cycles. There is an “on” season for slippers through the fall and winter. Then, sales taper off during the warmer months.

But 2020 was different. Slipper sales that April almost doubled versus 2019.

The COVID-19 pandemic was in full swing. Folks were in no hurry to leave their homes. They were dressing for leisure, streaming entertainment, and saving their cash… And while we saw odd bursts in products like slippers, huge swaths of the economy suffered.

But today, a big thaw is coming to the global market. Travel plans are on the rise, spending is back – and a slumbering giant is about to return with new buying power…

It’s a demographic that has stayed quiet during the pandemic reopening. These folks preferred to play it safe while other consumers rejoined the in-person world.

That’s changing now. And the resulting economic growth could be massive.

After two years of isolation, older Americans are about to open their wallets…

Older Americans have been the most cautious since the start of the pandemic.

One way to see this is the Spending Momentum Index (“SMI”), a measure of consumer spending from Visa. The SMI measures the share of Visa cards that has increased or decreased spending compared to the same period a year earlier.

An SMI higher than 100 shows a stronger spending momentum from the year prior. An SMI below 100 shows weaker momentum.

From March 2020 to January 2022, the 25- to 44-year-old demographic had an average spending momentum of about 106.4. The 45- to 64-year-old demographic showed more restrained growth, for an average SMI of 101.1.

However, the spending momentum of Americans 65-and-up actually fell. Their average SMI was only 97.6 for the period, making older Americans the only demographic to spend less on average during the pandemic.

It makes sense. Older folks were the most at risk of severe illness. So they were doing less than anyone. And their spending dropped more as a result. That’s changing, though…

Visa’s newest data suggests the purse strings are loosening. This February, the older demographic leapfrogged 45- to 64-year-olds.

Older consumers are spending once again. And their pockets are deeper than ever…

We all know that stocks and real estate went on a tear in 2021. But what you may not know is that, between fall and winter, these assets pushed U.S. household net worth up by $5.3 trillion dollars. Total household net worth surged to a record $150 trillion…

Roughly 41% of this money is in the hands of Americans 65 and older.

This cash is burning a hole in these consumers’ pockets. And as they return to the economy, the impact will be huge.

Travel should be a big winner. According to AARP Research, 67% of adults 50-plus are planning at least one trip in 2022… with an average plan for four. And travelers plan to spend about a thousand dollars more than their pre-pandemic average.

But vacation spending is only the beginning…

Older folks will renovate homes. They’ll schedule medical procedures. And they’ll impulse-buy lots of stuff.

So get ready… We’re about to see what it looks like when two years of pent-up purchasing power floods into the economy. And it should be a powerful force behind stocks.

Good investing.

Yep, that would be us and we are elderly.

“Buy a wheel barrow soon. You will need it to go to grocery stores to carry enough cash.”

People don’t believe that this is possible-but an older kindly neighbor gave me a sheet of uncancelled Weimar Republic 200 million Deutchmark stamps when I was a kid to give me a start on my stamp collection. I figured that I could by a significant chunk of West Germany with that…

When everything costs twice as much.

An American mother gathers what’s left of the family’s life savings, piles the cash in a wheel barrow and starts off to the store to buy a week’s groceries. Half way there a robber confronts her. The thug knocks her down, dumps the cash and runs off with the wheel barrow.

My soon to be favorite non joke about inflation.

Just like the Fed did from May 1987 to Sep 1987 (before the October flash crash). Just like they did from June 1999 to May 2000 (dot-com bubble burst, S&P 500 dropped 49% to fall of 2002). Then they raised rates steadily from June 2003 to Sep 2007 (S&P 500 topped in Oct 2007 before it dropped 56% to March 2009). It was almost like they were trying to bring down the rapid Bush rebound from the dot-com burst.

Fed raising rates (and in this case also tapering bond purchases) combined with high Shiller PE means stay out of equities.

People are buying prep.

Then my ex put them in the Church parking lot sale,

This is valid economic analysis….16 months ago.

Everything is tempered now by the skyrocketing inflation. And those older folks that you say are ready to open their wallets? They are, but they vividly remember 1970’s-80’s inflation.

They will temper their spending.

It must be all that talk about regime change in Russia which would end human civilization or maybe Biden’s threat to use chemical weapons that’s making the economy stronger. We need to document everyone who voted for BiDeN and take away their voting rights . No way ignorant communists should be allowed to vote in this country. Anyone who was guilty of fraud should have their voting rights removed and then promptly executed for treason.

So we will be somewhere between massive global depression and/or mass starvation and record-setting growth in a booming economy.

Yes, I will invest accordingly.

Really?! This "older American" hasn't changed his spending patterns at all since his part of Alaska went back to normal ops in May 2020.

So slippers are a major market indicator. Good to know.

Getting killed by gas prices, but we have slippers.

I couldn't find a chart of the SMI

Lot more self control than the government.

So when prices go up, SMI goes up. So it's useless when we have high inflation. Sure, whatever.

Yep! Guns and ammo are my only discretionary spending for the last year.

Well Golly. I better get spending. I want that new Jeep 4 door pickup. AND the 4 door tundra. And I want that beach house in San Diego. And I better spend money on that nice mountain retreat in Telluride. And I have always wanted a luxury yacht like. Spending is good for Biden’s ratings .

The author must be a Common Core Math student

No wheelbarrow needed. Just a socially acceptable QR code. By posting here, you can’t buy the $40 head of lettuce anyway.

Yep....spending more for less. People

gotta eat, pay for gasoline, and need

abodes. Every single thing we buy has

got up in price. Making it look like

our economy is booming. But we’re barely

gettin’ by. Three more years of this

nightmare may finish us as a once great nation.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.