Skip to comments.

U.S. household net worth posts biggest gain in a year

Reuters ^

| 3-12-2015

Posted on 03/12/2015 11:47:17 AM PDT by Citizen Zed

Rising stock prices and home values pushed the net worth of U.S. households higher in the fourth quarter, a reassuring sign for the outlook for consumer spending.

The increase added $1.52 trillion to the total wealth of American families, putting it at $82.91 trillion, a report by the Federal Reserve showed on Thursday. The increase in net wealth was the largest since the fourth quarter of 2013.

While U.S. consumers have appeared somewhat shy in their spending habits in recent months, Thursday's data suggests their strengthening financial footing could help convince them to open their wallets more.

(Excerpt) Read more at reuters.com ...

TOPICS: Chit/Chat

KEYWORDS: and; damnedlies; lies; statistics

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

To: Citizen Zed

The propaganda machine is running full tilt this week.

21

posted on

03/12/2015 3:54:01 PM PDT

by

VTenigma

(The Democratic party is the party of the mathematically challenged)

To: tacticalogic

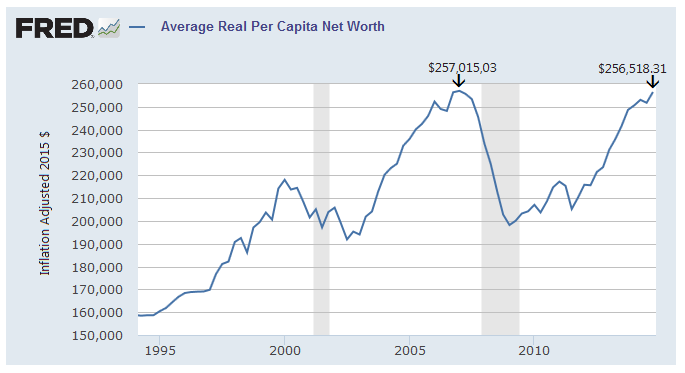

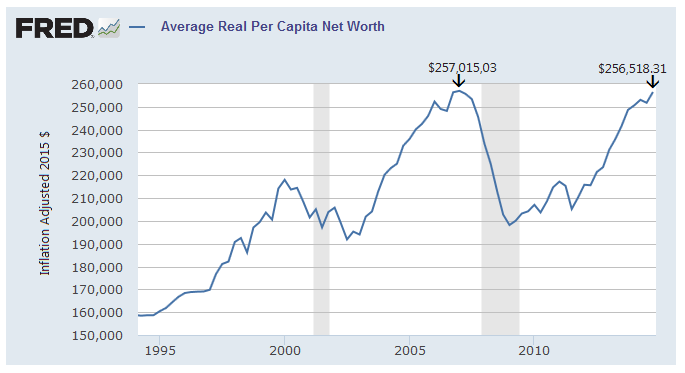

Inflation.That's part, and the other part of why the "total wealth of American families" is at an all time high is because the number of U.S. families is at an all time high. Divide the total net worth by the number of Americans, adjust for inflation and you find that --

--for the past 8 years Americans are worse off. They worked all those years, they not only have nothing to show for those years of work but they're worse off.

To: expat_panama

Is any of that “net worth” in home values the result of mortgage bailouts? IOW, how much of this increase in the average household “net worth” is just the result of nationalizing a lot of bad mortgage debt? What do the numbers look like if you subtract the average households share of the national debt from that?

To: tacticalogic

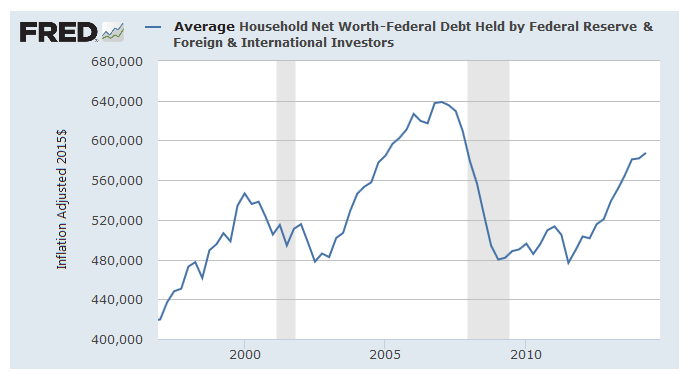

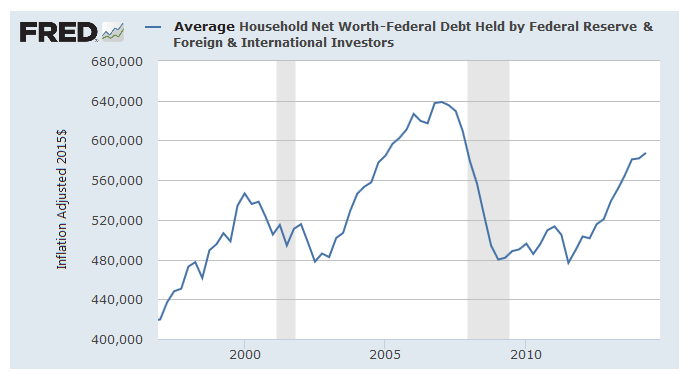

that “net worth”... ...result of mortgage bailouts?... ...the average households share of the national debt from that? The mortgage thing is not that big, say less than $2T out of the total $83T, but the national debt's interesting. OK, so most of it's owed to private Americans so we can't count that, but take away the nat. debt held by foreigners and the fed reserve it lowers private net worth to $73T.

To: expat_panama

By my calculation, that puts the average household net worth at about 225K.

To: tacticalogic

—that’s the average for the individual per capita, the household might be two or three times as much. On the outside chance that your personal bank balance is less that $225,000 then you’re like most of us. Wealth has a habit of being created by the few really clever ones and most of us make do w/ say half that...

To: expat_panama

You’re right. But either way the “net worth” calculations are failing to account for the share of the national debt that still has to be paid back, and that’s doubled under Obama.

To: Citizen Zed

Why home prices are appreciating:

28

posted on

03/13/2015 12:09:00 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

Wow. Brilliant analysis, but it makes you sick.

29

posted on

03/13/2015 12:10:01 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

That’s definitely a big factor. Low interest rates mean people can afford more house, and that in turn makes demand and prices go higher.

To: expat_panama

Which is the really important thing, no? A few clever ones make life much, much better for the rest of us.

Imagine an island on which a genius inventor creates a pill that, if taken once a day, sustains all life and maintains one’s youth (say mid twenties). He charges 100% of the productive output of all the people on the island. Are they, in a free market, better off or not?

You’ve got absolute income inequality. He earns 100% of the islands income. We should expect income inequality in a competitive market. It’s a sign of robustness.

31

posted on

03/13/2015 12:13:21 PM PDT

by

1010RD

(First, Do No Harm)

To: Cementjungle

The only reason 90/100 buyers care about the price is its the maximum their banker told them they can afford the payment on. RE is unnaturally buoyed by absurdly low interest rates. It’s a mess.

Think about the people who are now trapped like tax serfs in a certain jurisdiction because, once again, they cannot sell their house. The transaction costs on a home sale are 5-10% of the purchase price minimum. If you’re at break-even you’re as good as underwater.

32

posted on

03/13/2015 12:19:38 PM PDT

by

1010RD

(First, Do No Harm)

To: tacticalogic; expat_panama

Kotlikoff estimates that at $220T IIRC, but I’ve heard some people slam his analysis. Any thoughts?

33

posted on

03/13/2015 12:21:13 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

The only reason 90/100 buyers care about the price is its the maximum their banker told them they can afford the payment on. RE is unnaturally buoyed by absurdly low interest rates. It’s a mess. I always ignored that stuff when home buying. I was always super paranoid abut what would happen if I lost my job somehow.

To: tacticalogic

“net worth” calculations are failing to account for the share of the national debt that still has to be paid back, and that’s doubled under Obama.Remembering that the topic's 'American net-worth' we can forget the national debt held by Americans --it gets paid back later when Americans are taxed to pay themselves and total American wealth stays the same. We do need to count the national debt held by foreigners because eventually Americans will be taxed to pay foreigners and total American wealth will drop. Same with debt held by the Federal Reserve because they'll have to be paid back when they need to dump their debt to fight inflation.

Here's the actual American wealth taking into account debt Americans owe as taxpayers--

--and what we got is that the average American household is over $50 thousand poorer than it was before '07 when Pelosi took over. The good news is that households are on average $100k richer than they were when Pelosi got demoted..

To: 1010RD

Wow. Brilliant analysis, but it makes you sick.lol!!! I remember always getting in trouble as a kid for constantly coming up with new ways to make people around me sick. One of these days I need to grow up...

To: Citizen Zed

PLUSGOOD, DOUBLEPLUSGOOD!

To: expat_panama

Remembering that the topic's 'American net-worth' we can forget the national debt held by Americans --it gets paid back later when Americans are taxed to pay themselves and total American wealth stays the same. Okay. But assuming that "debt held by Americans" is in bonds, are they counting the value of those in "net worth" calculation, like stocks? If so then that's like borrowing money from yourself and counting it as an asset but ignoring the liability of having to pay it back.

To: tacticalogic

"debt held by Americans" is in bonds, are they counting the value of those in "net worth"... ...counting it as an asset but ignoring the liability of having to pay it back. Right now Americans have $97T in assets (which includes $7T in federal debt) along with $14T in liabilities --that's what gives us the the $83T in net worth we're talking about. If Americans are taxed $7T to pay the debt, then American private bank accounts drop by $7T and the money buys back the bonds and goes into U.S. private bank accounts. Bank accounts don't change but the bond holdings change by dropping $7T. So if we pay off the national debt then Americans get poorer, but the government gets richer because it no longer has the $7T liability.

So for Americans to get richer we need a bigger national debt. I think I'm missing something here...

To: expat_panama

So for Americans to get richer we need a bigger national debt. I think I'm missing something here... That seems to be how it works out if you count the individual's federal bond holdings as a asset, but don't count the taxes that will have to be levied to pay them back as a liability. You get an artificially inflated picture of private net worth.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson