Posted on 01/09/2015 8:07:02 AM PST by SeekAndFind

It's getting serious now: On Wednesday, West Texas Intermediate futures tested a low of $46.83 a barrel before rebounding.

That's down nearly 57 percent from the summertime high of $107.68 and pushing toward the depths last seen during the 2008 financial crisis and recession that followed. Wholesale gasoline futures tested a low of $1.31 a barrel.

The wipeout in energy prices has been covered on all angles in recent months — including my recent piece on the negative repercussions for the U.S. economy, corporate earnings, and energy independence. Now, the focus is increasingly turning to how bad the damage could get.

New estimates from Bank of America Merrill Lynch put the short-term floor somewhere below $35 a barrel — a drop that would represent a decline of nearly 30 percent from here as the market is oversupplied by about a million barrels of oil per day.

SNIP

Oil demand is unlikely to soak up the excess supply anytime soon, with Europe stalled, Japan picking up the pieces from its recent sales tax hike and China still trying to control its runaway housing and fixed-asset investment bubbles without pricking its bad debt problem.

The demand situation also has an element of negative self-reinforcement: Bank of America Merrill Lynch analysts note that 50 percent of the global oil demand growth of the last decade has come from oil producing countries. That's a problem, with Russia heading into recession and sovereigns in the Middle East drawing down currency reserves. And besides, they estimate that any response on the demand side would occur with a six month lag anyway.

(Excerpt) Read more at thefiscaltimes.com ...

“35 bucks a barrel and still above 2 bucks a gallon for gas.

Feds and states want to raise taxes to keep prices up there.

I’m guessing at the >$2 buck price as I am still paying almost $7 a gallon here in the Alaska bush...it’ll never go down.”

Here in the lower 48 you never hear about what’s going on up nort and the high costs of living up dare due to transport.Why do you say that ? And does it have anything to do with fed refining policies ?

I think it's very significant. I Fill up 2x a week. The price drop is an extra $50 a week in disposible income. When everybody in America suddenly gets an extra 10% in disposible income, that's a lot of money that gets spent into the economy.

They ship our gas in by barge twice a year.

We may see a break this spring. It would be awesome but I won’t hold my breath.

I don’t entirely agree. AFAIK, there has never been a period (until recently) when drills were standing idle because they didn’t have a good location in which to drill.

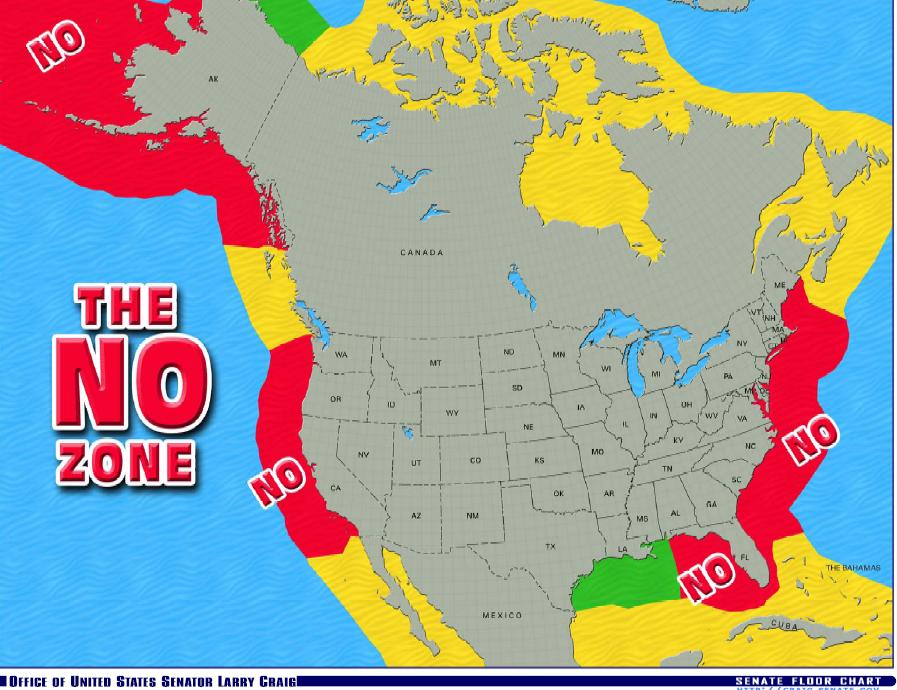

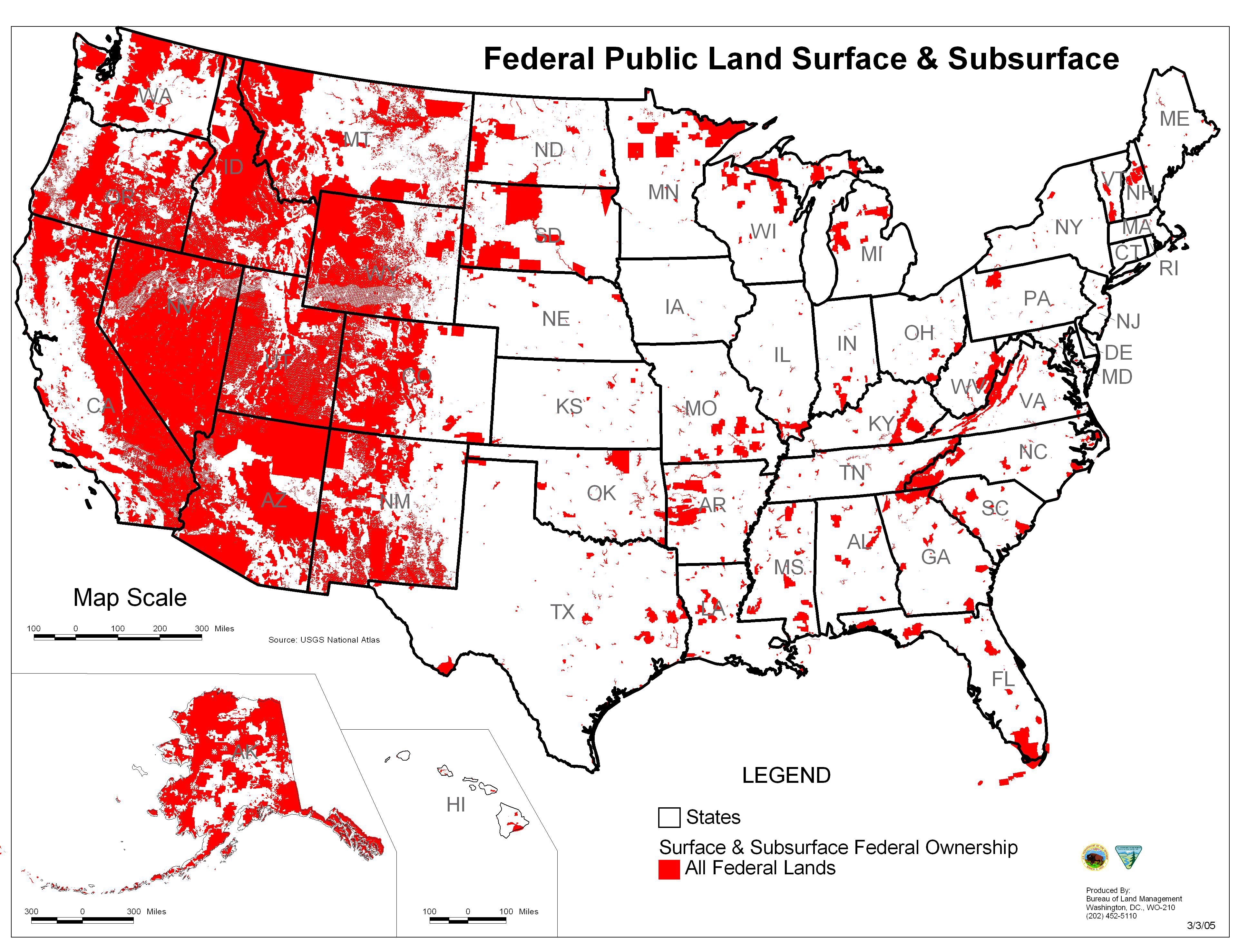

Now, it’s probable that some federal lands out west were better sites than some drilled on private land east of the Mississippi.

But to my mind a drilling company would have to be idiotic to pursue drilling on federal lands, with regulations and enforcement subject to change with each election, in preference to drilling on private land subject primarily to state regulations.

IOW, the reason more wells haven’t been drilled is due to limiting factors. I believe those have been primarily trained personnel and to a lesser extent number of rigs. I don’t think lack of drilling sites has generally been one.

God bless the frackers, even if Caliph Baraq is getting credit for it.

People are already losing jobs. It won’t affect me in electrical, but surveyors and other oil specific trades are all feeling it. The economic hit from that is far greater than a few bucks saved.

I'm an electrical engineering working oil/gas/petrochem. It is already having an effect in new project work. When we don't design new work, construction trades hire less of everyone.

I know Substation contractors that were going full-speed for Texas oil field locations are slowing down already.

Thanks. My comments were with regard to the (I assume) specialty rigs used for horizontal drilling and fracking. Not total rigs.

And I still haven’t seen any evidence rigs stood idle because the feds refused to open land for them.

There’s an interesting chart.

In 1800 or 1930 you could buy a top end men’s suit for an ounce of gold. And you still can.

First understand hydraulic fracturing is done after the drilling rig moves off.

Oil driller says its high-tech rigs can’t compete with cheap crude

http://www.freerepublic.com/focus/f-news/3244433/posts

Even the most technologically advanced drilling rigs are finding less work as oil prices crash.

Oklahoma oil driller Helmerich & Payne expects 40 to 50 of its souped-up drilling machines to come off the market over the next few weeks, after 11 of those models went idle in the past month, it said in an investor presentation Tuesday.

The firm added it has seen spot prices for its so-called FlexRig units fall 10 percent, and some oil companies are dropping out of contracts early.

It wasn't the only reason. But more land available for production is more competition for mineral production, which is lower prices for mineral acquisition, which is lower prices to the producers, which is more rigs into exploration/production.

Of course drilling rigs are coming out of production now that prices have fallen off the edge.

But it’s not because there is no place for them to drill.

More locations is more competition and lower prices for locations.

Do you really believe it would have no effect if all this was opened up for exploration and production?

Your map is out of date.

Eastern seaboard was recently opened up for exploration.

http://www.nola.com/environment/index.ssf/2014/07/obama_opens_eastern_seaboard_t.html

Still doesn’t answer the question on refineries in Alaska for local use to lower gas prices there.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.