Posted on 02/09/2024 9:43:04 AM PST by SeekAndFind

The cost of housing remains a hot-button topic with both Millennials and Gen-Z. Plenty of articles and commentaries address the concern of supply and affordability, with the younger generations getting hit the hardest. Such was the subject of this recent CNET article:

“The housing affordability crisis means it’s taking longer for people to become homeowners — and that’s especially impacting millennials and Gen Zers, economically disadvantaged families, and minority groups. There’s not one single driver of the crisis, but several colliding elements that put homeownership out of reach: rising home prices, high mortgage interest rates and limited housing supply. That’s on top of myriad financial challenges, including sluggish wage growth and increasing student loan and credit card debt among middle-income and low-income Americans.”

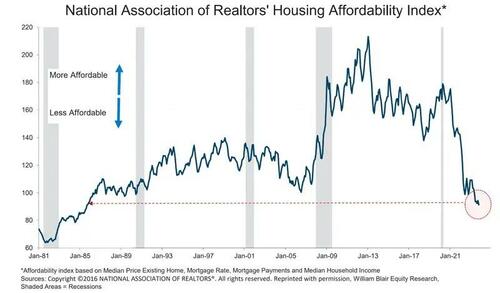

The chart below of the housing affordability index certainly supports those claims.

As noted by CNET, there are many apparent reasons causing housing to be unaffordable, from a lack of supply to increased mortgage rates and rising prices. Over the last couple of years, as the Fed aggressively hiked interest rates, the supply of homes on the market has grown. Such is because higher interest rates lead to higher mortgage rates and higher monthly payments for homes. It is also worth noting that previously, when the supply of homes exceeded eight months, the economy was in a recession.

At the same time, higher interest rates and increased supply should equate to lower home prices and, therefore, create more “affordability.” As shown, such was the case in prior periods, but post-pandemic housing prices skyrocketed as “stimulus checks” fueled a rash of buyers.

As is always the case with everything in economics, price is ALWAYS a function of supply versus demand.

The following economic illustration is taught in every “Econ 101” class. Unsurprisingly, inflation is the consequence if supply is restricted and demand increases.

While such was the case following the economic shutdown in 2020, the current housing affordability problem is a function of bad decisions made at the turn of the century. Before 2000, the average home buyer needed good credit and a 20% down payment. Those constraints kept demand and supply in balance to some degree. While housing increased with inflation, median household incomes could keep pace.

However, in the late 90s, banks and realtors lobbied Congress heavily to change the laws to allow more people to buy homes. Alan Greenspan, then Fed Chairman, pushed adjustable-rate mortgages, mortgage companies began using split mortgages to bypass the need for mortgage insurance, and credit requirements were eased for borrowers. By 2007, mortgages were being given to subprime borrowers with no credit and no verifiable sources of income. These actions inevitably led to increased demand that outpaced available supply, pushing home prices well above what incomes could afford.

This episode in the housing market resulted from zero-interest policies by the Federal Reserve. That policy and massive liquidity injections into the financial markets brought hoards of speculators, from individuals to institutions. Institutional players like Blackstone, Blackrock, and many others purchased 44% of all single-family homes in 2023 to turn them into rentals. As prices rose, advances like AirBnB brought more demand from individuals for rentals, further reducing the available housing pool. Those influences lead to even higher prices for available inventory.

Notably, it isn’t a lack of housing construction. The Total Housing Activity Index is not far from its all-time highs following the 2020 pandemic “housing rush.” The issue is the removal of too many homes by “non-home buyers” from the available inventory.

Furthermore, existing home sales are absent. Current homeowners are unwilling to sell homes with a 4% mortgage rate to buy a home with a 7% mortgage. As shown, existing home sales remain remarkably absent.

All of these actions have exacerbated the problem. At the root of it all is the Federal Reserve, keeping interest rates too low for too long. Oversupplying liquidity and creating repeated surges in home prices. It is not a far stretch to realize the bulk of the housing problem directly results from Governmental forces.

So, what does this have to do with the Democrats?

Sen. Elizabeth Warren, D-Mass., and three other Democratic lawmakers are pushing Jerome Powell to lower interest rates at the upcoming Fed meeting to make housing more affordable.

“As the Fed weighs its next steps in the new year, we urge you to consider the effects of your interest rate decisions on the housing market. The direct effect of these astronomical rates has been a significant increase in the overall home purchasing cost to the average consumer.” – Letter To Jerome Powell

As discussed above, lowering interest rates is not the solution to lowering housing prices. Lower interest rates would bring more buyers into a market already short inventory, thereby increasing home prices. We can already see the impact of lower mortgage rates on home prices just since October. Prices rose as yields fell on hopes the Federal Reserve would cut rates in 2024. If mortgage rates revert to 4%, where they were during most of the last decade, home prices will significantly increase.

There is only one solution to return home prices to affordability for most of the population. That is to reduce the existing demand. If Elizabeth Warren is serious about doing that, passing laws today would go a long way to solving that problem.

Restrict corporate and institutional interests from buying individual homes.

Increase the lending standards to require a minimum 15% down payment and a good credit score. (such would also increase the stability of banks against another housing crisis.)

Increase the debt-to-income ratios for home buyers.

Return the mortgage market to straight fixed-rate mortgages. (No adjustable rate, split, etc.)

Require all banks that extend mortgages to hold 25% of the mortgage on their books.

Yes, those are very tough standards to meet and initially would exclude many from home ownership. But, home ownership should be a demanding standard to meet, as the cost of home ownership is high. For the individual, such standards would ensure that home ownership is feasible and that such ownership, along with the subsequent fees, taxes, maintenance costs, etc., would still allow for financial stability. For the lenders, it would reduce the liability of another financial crisis to almost zero, as the housing market’s stability would be inevitable.

But most importantly, such strict standards would immediately cause an evaporation of housing demand. With a complete lack of demand, housing prices would fall and reverse the vast appreciation caused by a decade of fiscal and monetary largesse. Yes, it would be a very tough market until those excesses reverse, but such is the consequence of allowing banks and institutions to run amok in the housing market.

Naturally, none of this will ever happen or considered, as there is too much money in the housing market for corporations, institutions, and banks to feed on. But one thing is for sure: if the Democrats get their wish and the Fed cuts rates again, housing prices will become even more unaffordable.

Too bad there aren't any "participation houses" we can give them to shut them up.

I know this because my children have received such grooming from their college educations, alumni mailings, and social groups.

The left wants to evict you and take your home you have worked 40 years to pay off because you are "selfish".

Gen Z is the HUA generation.

They have a point.

And it doesn’t affect only GenZ and millennials. It affects EVERYONE.

When we were selling one of our homes many years ago, we were about a month from closing with a nice family with a couple small kids.

Some guy, not American by looks and accent, with honking big rings on his fingers and driving a VERY nice car, which was very out of place in that welfare town, stopped by and wanted to give us a cash offer, sight unseen. And didn’t seem fazed by the fact that we were under contract. He seemed to think we could break it and that would be fine.

I got really bad vibes from that one. We, of course, turned him down. I would not have sold to him for any amount of money.

Might the cost of housing have just a little bit to do with the tens of millions invading our country? Every one of them is going to need a place to live.

They have a housing plan for everybody. So many square feet per person in a large building. You WILL say you like it.

Don’t leave home without a 24 hour house sitter. Squatters.

Lower interest rates too early and we the people will get massive inflation - but it'll hit AFTER the election so democrats can help Biden get reelected. And the housing for 'the young'? With the massive inflation they'll lose their new homes, but democrats don't care 'cause their only goal is to put their goons and thugs in office.

“home ownership should be a demanding standard to meet”

Wrong

If you can buy it, that’s the standard-

Piles of nearly free “Other People’s Money” and lagging wage growth are the principle causes of the affordability issue.

Free money rocketed the prices - that’s not “home ownership” but rather simple rent-seeking behavior.

Lagging wages makes for uncertain futures - and difficulty putting together down payments.

A House price going from $50K to $500K in ten years is insanity.

“ whole “old people” just sit inside homes they don’t need or deserve”

Yes there are articles written on this.

Creating a divisive narrative by making up a issue.

You really can’t speak honestly about the housing problem without addressing immigration. Over the last several years more illegals have crossed than live in the state of Ohio. There may be upwards of fifty million illegals in the nation depending on who you listen to. When doesn’t the arrival of millions of people spark a housing crisis.

Your situation was definitely shadier than mine...

After my mother passed, I was the only one living in her town, so I was in charge of getting the house ready for sale. Not an expensive home, not a great neighborhood...actually “turning” Hispanic. The house wasn’t even on the market yet and a teenager from down the street brought a non-English speaking couple over to look at the house (while I was working there). They wanted to buy it for cash right then. I pictured them bringing paper sacks of cash to closing. I asked that they find a licensed broker to handle their side of the transaction....and actually found one for them. I needed someone that could translate...and someone to act as a barrier between my mother and their Mexican cash. It turned out to be an amicable transaction and they loved the house. But I wasn’t willing to take a chance.

(I actually grew up in that house. Interesting times.)

Glad it worked out well for you.

My sister looks at zillow and other real estate sites and noted the rapid rise in home prices that started several years ago.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.