Posted on 03/13/2023 9:54:23 AM PDT by SeekAndFind

In the wake of two bank failures, the Federal Reserve and the US Treasury announced a bank bailout program that could be dubbed “QE Extra Lite.”

Last week, Silicon Valley Bank was shuttered by federal authorities after the bank suffered significant losses selling bonds in order to raise capital. When that news hit, depositors rushed to pull funds from the bank, making it functionally insolvent. Then over the weekend, federal authorities shut down Signature Bank.

On Sunday, the FDIC created “bridge banks” to handle both insured and uninsured customer deposits. Banking regulators assured depositors that they would have full access to all of their funds.

Meanwhile, the Federal Reserve announced a loan program that will allow other banks to easily access capital “to help assure banks have the ability to meet the needs of all their depositors.”

The Bank Term Funding Program (BTFP) will offer loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Banks will be able to borrow against their assets “at par” (face value).

According to a Federal Reserve statement, “the BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

The US Treasury will provide $25 billion in credit protection to the Fed from the Exchange Stabilization Fund.

This will ostensibly help banks avoid the situation that brought down Silicon Valley Bank.

Last week, SVB sold a large portion of its bond portfolio at a $1.8 billion loss. SVB CEO Greg Becke said the bank made the sale “because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients.”

The bank bought the bonds when interest rates were low. As a result, the $21 billion available for sale (AVS) bond portfolio was not yielding above cash burn. Meanwhile, rising interest rates caused the value of the portfolio to fall significantly. The plan was to sell the longer-term, lower-interest-rate bonds and reinvest the money into shorter-duration bonds with a higher yield. Instead, the sale dented the bank’s balance sheet and caused worried depositors to pull funds out of the bank.

Many other US banks are likely in the same situation. As the Fed jacked up interest rates to fight price inflation, it decimated the bond market. (Bond prices and interest rates are inversely correlated. As interest rates rise, bond prices fall.) With interest rates rising so quickly, banks have not been able to adjust their bond holdings. As a result, many banks have become undercapitalized on paper. The banking sector was buried under some $250 billion in net unrealized losses on bond portfolios as of Dec. 31.

The BTFP gives banks a way out, or at least the opportunity to kick the can down the road for a year. Instead of selling bonds that have dropped in value at a big loss, banks can go to the Fed and borrow money at the bonds’ face value.

You could categorize this plan as quantitative easing extra lite.

Understand, this is not exactly QE. The Fed is not buying Treasuries. It will only hold them as collateral for the loans. Once the loans are paid back, the Treasuries will go back on the bank’s books.

But it is like QE in the sense that the Fed will create money out of thin air to make these loans. That is inflationary, just like quantitative easing, although the inflation is ostensibly temporary. When the bank pays back the loan, that money will drain out of the system. Of course, that assumes the loans get paid back.

Also like QE, the Fed is putting its thumb on the bond market by incentivizing banks and other institutions to hold Treasuries instead of selling them into the market. In effect, it creates an artificial limit on the supply of Treasuries, which will artificially keep prices higher than they otherwise would be.

In effect, this Federal Reserve loan program will have some of the same systemic impacts as QE, but on a much more limited basis – thus the term “QE Extra Lite.”

The powers that be insist this is not a bailout. But it is absolutely a bailout.

The plan creates a mechanism for banks to acquire capital they couldn’t otherwise access under normal market conditions. Meanwhile, uninsured depositors will get their money back.

The government can plausibly claim it is not bailing out SVB or Signature Bank. Both institutions appear to be doomed. But the government is bailing out uninsured depositors and it is setting the stage to bail out other banks that would have suffered the same fate without the loan program.

In effect, the loan program and deposit guarantee signal to other banks that they have nothing to worry about. It also calms the public and lowers the likelihood of bank runs.

Will Taxpayers Foot the Bill?

The powers that be also insist this won’t cost taxpayers. Agins, in one sense, this is true. The US government isn’t going to raise taxes. And the only way the taxpayer would be directly implicated is if any of the banks taking loans defaults and Fed taps into the $25 billion in credit protection extended by the US Treasury. But as Peter Schiff pointed out in a tweet, the taxpayer will be on the hook for the inflation tax.

According to @POTUS the government bank #bailout won't cost taxpayers any money. That's a lie. While it's true that no one's taxes will be raised to pay for it, the #Fed will print lots of money to cover the cost. That's #inflation and everyone will pay higher prices as a result. — Peter Schiff (@PeterSchiff) March 13, 2023

Even if it’s only temporary, the loans will inflate the money supply. That is the definition of inflation.

And looking at the bigger picture, this bailout likely means the end of the Fed’s inflation fight.

And this is how the various small banks are doing today.

The take home here is that, unfortunately, Joe Biden's 9am pep talk did little to boost confidence in small US banks.

Or, It would be the Savings and Loan 2.0 Crisis but we regret to inform you there are no savings." Meanwhile, all hail JPMorgan, pardon, JPMega, which is about to have some $18 trillion in deposits.

That word does not mean what you think it means!

That word does not mean what you think it means!

For people who don’t keep up with banking regulatory terminology, BTFP stands for Bureaucrats Taking From People.

Of course my family’s money is in two of the riskier banks, and I am not in control of it...

RE: That word does not mean what you think it means!

By all means, please tell us what it REALLY means.

RE: Of course my family’s money is in two of the riskier banks, and I am not in control of it...

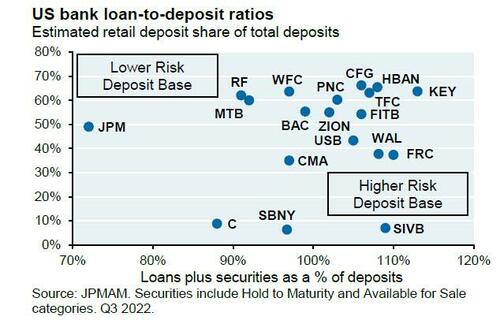

Don’t panic. Not every bank on that chart is that risky.

Edit to add.... let’s say you withdrew all your deposits from these banks, where are you going to put the money? Under your mattress?

Just be sure that you don’t have more than $250,000 in those banks or own their stocks if they are publicly traded.

These money-creating measures will hasten the demise of the petro-reserve dollar and further the move toward the CBDC.

I agree with Schiff. This marks the end of the line for the Fed’s tightening policy. They tried and failed to get inflation under control, and the remedy was killing small-to-medium-sized banks as depositors exited in favor of U.S. treasuries yielding 5%, state-income-tax-free. But now what? Hyperinflation, I’m afraid. Your cash pile is in deep trouble, kids.

Translation - gold and precious metals to increase in value

PAPER DEBT MONEY, PART 1

https://www.bitchute.com/video/J25K2rZWPuSr/

PAPER DEBT MONEY, PART 2

https://www.bitchute.com/video/t955nfnXsHUN/

I found this very interesting on Thomas Massie’s Twitter last night. Other than Musk at Twitter, it seems like business as usual in DC.

“Just got off of a zoom meeting with Fed, Treasury, FDIC, House, and Senate.

A Democrat Senator essentially asked whether there was a program in place to censor information on social media that could lead to a run on the banks.”

I was referring to the Fed's pronouncement, not you.

Yup, we are now locked into 6+% inflation for the foreseeable future. I expected the Fed to bring inflation down to 4% by summer of 2024, albeit with plenty of pain. So much for my expectations.

I am of the opinion that state-chartered banks need to be backed by a state level FDIC. Furthermore, the state level FDIC should be backed by the actual FDIC, i.e a two-tier system.

RE: These money-creating measures will hasten the demise of the petro-reserve dollar and further the move toward the CBDC.

The irony is, the demise of SVB *IS THE RESULT OF MONEY PRINTING DUE TO GOVERNMENT OVERSPENDING and ANTI-ENERGY DRILLING POLICIES*.

SVB was a victim of too much money being invested in them to fund start-ups and small businesses. Where are they going to put all those cash while evaluating these businesses? Of course on the safest financial instruments in the country -— GOVERNMENT BONDS!

Their mistake was to tie up their money in LONGER TERM BONDS which mature in 5 to 10 years.

Right now, because of inflation ( again caused by government OVERSPENDING and MONEY PRINTING ), the Fed has to fight it by INCREASING interest rates. Short term rates are HIGHER than long term rates ( an inverted yield curve ).

Ordinarily, this would not be too much of a problem. The problem came when investors in SVB realized that they could get higher yields in short term bonds and a massive number of them started to withdraw their deposits or take back their investments SIMULTANEOUSLY. SVB had no choice but to sell their bond holdings ( at a loss of course ) to service these withdrawals resulting in what we have now — A LIQUIDITY CRISIS.

ALL CAN BE TRACED BACK TO THE ORIGINAL SOURCE OF THE PROBLEM — GOVERNMENT INFLATIONARY SPENDING !!

We knew what it meant when Yellen said no bailout because her lips were moving. So the woke a-holes will be rescued -BOHICA.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.