A college education is a great thing to have, at the right price. A BS in electrical engineering at a cost of $20K is usually a good investment. A BA in modern dance at a cost of $200K generally isn't.

Posted on 01/17/2017 8:37:01 PM PST by SeekAndFind

My brother-law has given his kids the same ultimatum; in-state tuition and they pay if they want to live in an apartment or on campus.

I sent my kid to college when I should have bought him a McDonalds.

Breach of Contract

University Professors failed to fulfill their obligation to deliver marketable skills.

Student debt is a fake contract.

Meanwhile, the ‘Older Americans’ (tm) are receiving 5 to 6x what they paid into Social Security.

No, this will not end well. Generation Snowflake thinks they are entitled to a certain lifestyle and I do expect intergenerational envy to rear its ugly head - with horrific consequences.

everything the gov’t touches becomes expensive and poor quality

everything

student loans is one example

Co-signed or PLUS loans

To quote Nancy Reagan, “Just say no”—plenty of ways for young people to get an education without them or their families taking on debt they can’t afford.

Excellent point! Parents ought to be willing to pay to keep their kids away from the advanced indoctrination centers.

Sounds like those skipped meds and doctors appointments are really the result of Obamacare.

A college education is a great thing to have, at the right price. A BS in electrical engineering at a cost of $20K is usually a good investment. A BA in modern dance at a cost of $200K generally isn't.

I go to colleges to use their libraries, costs nothing.

In homeschool I learned how to invest, manage and make money. I have no debt, and could now afford to attend college, but it wouldn’t be the most productive use of my time.

I’ve mentioned it many times, but our son did undergrad and grad school with not a cent of tuition paid. Living at home keeps expenses down. I’ve heard friend’s kids say they needed to go to a school out of town and live on campus because they wanted to “college experience”...to which I say the “college experience” has caused many to kids slack off in school.

My kid was no genius, and he had several friends who accomplished the same thing, college and grad school, tuition free.

Dual credit during high school took care of AA with no tuition (15 minute commute to local community college.)

B.A. at state school (35 mile commute to state school campus) state merit scholarship handled tuition if your ACT/SAT scores were good and had a good grade point.

Grad school at a private University. Teaching Assistant position paid for full tuition, plus small stipend. (22 mile commute to University.)

Completely done with education, undergrad and graduate, at 21 (AA in high school speeds things up) and no student debt.

You have to live in a state/county that offers H.S. Dual Credit program, and also some sort of merit scholarship to state schools.

True. And, after 3 years, you can discharge income tax debt in bankruptcy.

Appropriate for working less than 9 months out of the year and having every 7th year off is 45K

I recently learned this the hard way. I co-signed for my wife on a Visa card 22 years ago. We were divorced five years ago and the terms of our divorce required her to close out the card. Last fall the bank called me to say that she had run up $7000 on the card and hadn't made a payment in three months.

I called a lawyer and he said that my only legal option is to pay the $7000 and then sue her to try to recoup my losses. Her only income is from a disability and I can't touch it under Florida law. The Lawyer said that it would be futile to try to sue her and it just be throwing good money after bad.

I had planned on retiring next summer, but now it looks like I'll have to work at least another year to pay off her debt.

Want a college education join the Military, or get a job. I’m not paying for it as your parent or grandparent. Mine didn’t. Live at home and follow the rules.

When I set my trust funds up, my grandson has an education fund, for which only books and tuition is available, want more work for it. He can choose tech or college, 1 ER draw for health need and that is limited to $500. Any thing left over stays until he turns 35. And his father does not have control over it. His aunt/uncle does and they knows what I want to a T. It’s spelled out very well.

Suck it up buttercups the free ride is over.

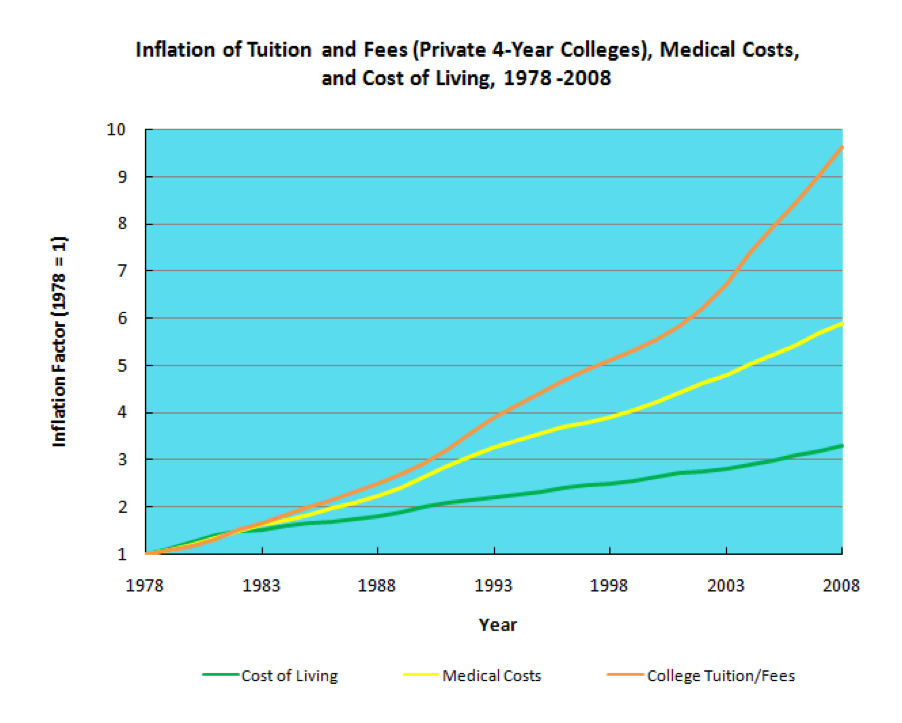

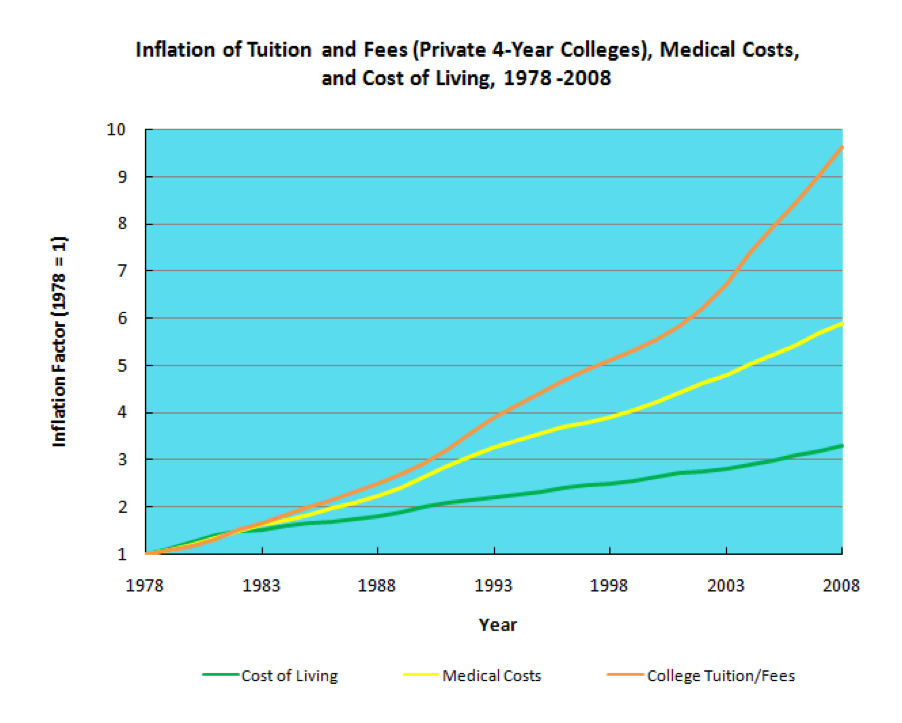

Government made money easy to get to go to college so college got a lot more expensive. The same thing happened with houses in around 2005. People later walked away from their houses but they can’t as easily walk away from their college debt.

It is pretty simple, if more money isn’t hard to get you can essentially “afford more”. More demand, higher price. This squarely lands at the feet of government and good intentions without regard to consequences.

If government announces there’s a program lending $8000 per year to every college student, then college tuition price rises by $8000.

That’s what happened. The student who worked and parents who saved so the student wouldn’t have to take out loans is forced to take out loans or drop out of school.

At 6-8% interest.

The Consumer Financial Protection Bureau should not be trusted.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.