Skip to comments.

Donald Trump Likes Low Interest Rates But Says He'd Replace Yellen

Fortune ^

| April 19, 2016

| Stephen Gandel

Posted on 04/20/2016 4:35:09 AM PDT by expat_panama

The GOP frontrunner says low interest rates are good for America, even if the Fed Chair isn’t.

Donald Trump likes Janet Yellen’s low interest rates, but not the Federal Reserve Chairwoman herself.

“I think she’s done a serviceable job,” Trump tells Fortune. “I don’t want to comment on reappointment, but I would be more inclined to put other people in.”

As he’s said in the past, Trump tells Fortune that he would “absolutely” support proposals that would take power away from the Fed, and allow Congress to audit the U.S. central bank’s decision making.

That said, Trump seems to like what the Fed is doing with monetary policy.

“The best thing we have going for us is that interest rates are so low,” says Trump, comparing the U.S. to a homeowner refinancing their mortgage. “There are lots of good things that could be done that aren’t being done, amazingly.”

In fact, if the Fed were to raise interest rates now it could be disastrous, Trump says, because the country would be forced to pay higher interest rates on our debt, and that would be very “scary” for the economy.

“People think the Fed should be raising interest rates,” says Trump. “If rates are 3% or 4% or whatever, you start adding that kind of number to an already reasonably crippled economy in terms of what we produce, that number is a very scary number.”

It’s not certain that raising the fed funds rate would result in higher borrowing costs for the U.S. government—Treasury yields might fall if higher rates cause the economy to tip into recession—but other Republican candidates, like Ted Cruz, have said that low interest rates are hiding the cost of the nation’s debt. And if you were to raise interest rates that would force the government to stop spending, and cut the deficit.

But Trump doesn’t seem to be focused on that. Instead, Trump says he would like to take advantage of lower interest rates in order to refinance the debt and spend more money to rebuild the military and the country’s infrastructure. Trump did acknowledge that he thought we need to reduce our debt, but it was one of a number of things he thinks we need to do.

“The problem with low interest rates is that it’s unfair that people who’ve saved every penny, paid off mortgages, and everything they were supposed to do and they were going to retire with their beautiful nest egg and now they’re getting one-eighth of 1%,” says Trump. “I think that’s unfair to those people.”

And while Trump boasts about making America great again, he no longer has a plan, or a desire, to make the country debt free. In an interview with The Washington Post earlier this month, the GOP frontrunner said he’d be able to get rid America’s more than $19 trillion national debt “over a period of eight years.”

But Trump softened that stance in an interview Tuesday afternoon at his offices at Trump Tower.

“You could pay off a percentage of it, depending on how aggressive you want to be,” he says. “I’d rather not be all that aggressive. I’d rather not have debt but we’re stuck with it. If I had a choice of taking over debt free or having $19 trillion – which by the way is going up to $21 trillion very soon because of the omnibus budget, which is a disaster. If I had my choice I’ll take no debt every time.”

Trump made the comments about Yellen, the Fed, and the national debt to Fortune in a wide-ranging interview on his business career and how that would translate to his potential presidency. Fortune will publish a transcript of the interview later this week, accompanying a cover story in the magazine on how Trump runs his business, and what it says about how he would lead the country.

TOPICS: Business/Economy; News/Current Events; Politics/Elections

KEYWORDS: economy; investing; trump

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 next last

To: dp0622

I don't know how much they can diverge.

Here is a chart of the Fed funds and the discount rates going back to 1971 but there's no list of long rates for comparison.

41

posted on

04/20/2016 8:32:27 AM PDT

by

Pelham

(Trump/Tsoukalos 2016 - vote the great hair ticket)

To: Pelham

42

posted on

04/20/2016 8:55:08 AM PDT

by

dp0622

(The only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: Pelham

Those degrees are for Business Finance. It is all called Economics because it is a subset of Economics. Business school grads have typically had a survey course in economics which presents John Maynard Keynes as the foundation of Economics while touching on such outmoded ideas as are described in Wealth of Nations. Businessmen who are experts in Finance- the getting of money and moving it effectively typically have no concept of theory and the laws of Economics.

43

posted on

04/20/2016 9:04:34 AM PDT

by

arthurus

(Het is waar. Tutti i liberali sono feccia.)

To: expat_panama

I don't disagree that we have plenty of problems. We do have a lot of formerly middle/upper-middle income elderly people who saved plenty of money for retirement,expecting to live off the earnings based on average interest plus SS. Do you know what the difference is between 4% on $100,000 and .85%? $4,000 vs $850. That's the property taxes...

44

posted on

04/20/2016 9:07:42 AM PDT

by

Kay Ludlow

(Government actions ALWAYS have unintended consequences...)

To: dp0622

Here is a useful chart of the Fed funds rate.

You can add the 30 year bond with the Add Data Series button

45

posted on

04/20/2016 9:37:03 AM PDT

by

Pelham

(Trump/Tsoukalos 2016 - vote the great hair ticket)

To: expat_panama

I don’t see that he gave a reason as to why Yellen should be removed. Par for that Trump course.

To: dp0622

The market set the rates as they should be doing now.

That begs the question, what is the real cost of money without the Fed setting the rates????

To: arthurus

The reality is that you haven’t the faintest idea of what the course curriculum was or what he’s read since.

For all you know Marshall, Robbins, Robinson, Schumpeter and Friedman and Schwartz were taught. You can get all that at any college much less U Penn and Wharton. But thanks for sharing your Let’s Pretend ideas on what his education is.

48

posted on

04/20/2016 10:13:33 AM PDT

by

Pelham

(Trump/Tsoukalos 2016 - vote the great hair ticket)

To: Kay Ludlow

...live off the earnings based on average interest... --and I could decide to live off earnings from my reciting my poetry but it's a bad idea, just like deciding to live off of CD returns

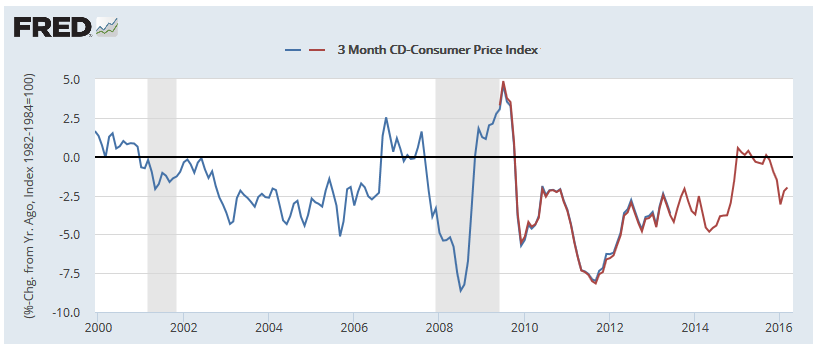

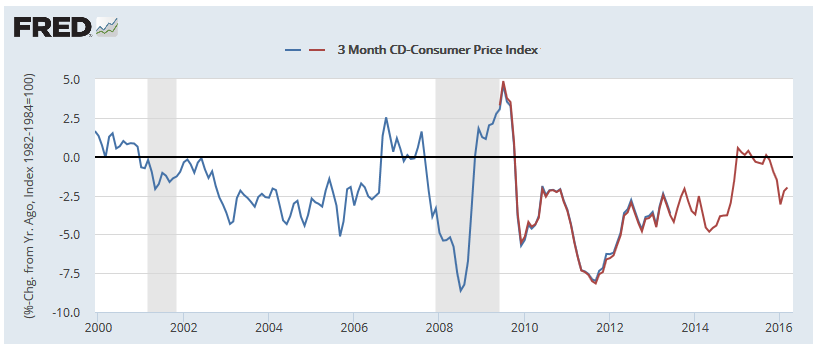

So the thing is that we just can't base our monetary policy on people's bad ideas. Yeah, we got folks crying because 3-month CD's are paying only 0.8% and after inflation the buying power has actually fallen -1.9%. Reality is that the average real CD return (interest - cpi) for decades now has been far worse:

Blaming other people and other things for our bad choices is always easier, but we need to at least blame something/someone that's believable.

To: Captain Peter Blood; Pelham

Thanks guys. Seems like we should let the market do what it will and fight through the pain until tax cuts kickstart the economy.

50

posted on

04/20/2016 10:37:11 AM PDT

by

dp0622

(The only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: dp0622

I have thought about this a long time and I wondered what the real cost of money is. If I had to hazard a guess I think it should be at least 8%.

Without the Fed back stopping the Bond market I bet the real rates would be at least 8% or more. But we have a artificial low rate and are borrowing money at a blended rate of around 3 to 3.5%. When it finally starts moving then trying to pay just the Interest on the Debt will start eating the entire US budget unless health care costs get us first.

To: Captain Peter Blood

I know. No matter who my friends voted for, many don’t see a happy ending, or at least most are smart enough to know it would take a lot of pain for at least a few years to get things on track.

With this country’s makeup now, I don’t see that happening.

52

posted on

04/20/2016 10:55:33 AM PDT

by

dp0622

(The only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: Pelham

Watch the results. I have seen this before and so have you if you think about it. I have known a lot of business school grads, some of whom have gone on to be very successful businessmen and none of whom understood what is in Wealth of Nations or Free to Choose or Human Action.

53

posted on

04/20/2016 11:13:17 AM PDT

by

arthurus

(Het is waar. Tutti i liberali sono feccia.)

To: Wyatt's Torch; 1010RD

don’t see that he gave a reason as to why Yellen should be removed. Par for that Trump course.Yeah, and not giving a reason's never hurt him nearly as much as giving one, as far as politics goes. Policy however's a different matter and imho a good reason to sack her might be that silly rate hike last Dec., --though she'd have only been following recommendations from Trump's interview on Bloomberg TV just a couple months before.

btw, it's super good to hear from you agin Wyatt, you've not only been missed but also worried about ;)

To: expat_panama

Thanks for the kind words. Suffice it to say it has been one hell of a last year.... I hope to be able to contribute more going forward. Glad to see the list is still going strong thanks to your good work :-)

To: dp0622; Captain Peter Blood

Reagan’s 1982 bill had investment tax credits which helped businesses purchase new equipment. I thought it was a good idea. IIRC the those credits were eliminated by the 1986 bill that Trump was trashing.

56

posted on

04/20/2016 11:55:26 AM PDT

by

Pelham

(Trump/Tsoukalos 2016 - vote the great hair ticket)

To: expat_panama

So you think people past their productive years should invest in risky (ie. stock or bond markets), when their opportunity to recover from any losses is 0? I realize there are no guarantees in life, but there used to be safe places to invest and earn income. Since the FED wants ALL money spent on something (since modern Keynesians believe saving is bad), they have ensured there aren't any. Municipal Bonds used to be safe, but they haven't looked good (in terms of budgets/balance sheets) in a long time.

Anyone who lived through the Great Depression (as my Mother did) knew how quickly one good loose everything in the stock and bond markets. When the banks collapsed, the government agents stole anything of value from customer safe deposit boxes. After that, the FDIC was formed to ensure the safety of banks, so people would feel they could trust someone with their money. Those people who lived through it when young, as they aged felt the banks were best for their money as they could earn money on their money (and did for the better part of 75 years, except the last 5).

Since I read your ‘about’ page, I'll add - Have you seen that there are a record number of companies defaulting on debt this year? Even with non-GAAP earnings reports, they are running out of ways to report profits. Earnings per share are primarily maintained for listed companies by borrowing at 0% to buy back their own stock, reducing the number of shares to divide earnings by. Stock prices this year have reason because of high-frequency program trading, where machines scan the news and frontrun the market with phantom buy/sell’s that are canceled milliseconds later (read Michael Lewis).

I'm an optimist in life, but in the realm of money there is just so much lying by the government, the corporations, the trading machines and the media, I just don't trust anyone anymore.

57

posted on

04/20/2016 1:19:46 PM PDT

by

Kay Ludlow

(Government actions ALWAYS have unintended consequences...)

To: norwaypinesavage

Especially when you essentially get a negative real interest rate earning after high inflation.

58

posted on

04/20/2016 2:13:44 PM PDT

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

To: norwaypinesavage

Exactly. At best you can rely on the differential. For instance selling one’s family home for a smaller home or condo, and pocketing the difference. Another extreme plan would be to sell and buy in a much cheaper market somewhere else in the country. But then you have the hardship of leaving one’s grown children behind.

59

posted on

04/20/2016 2:16:24 PM PDT

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

To: Kay Ludlow

Here’s a great idea. Let the market, not political movers, decide on rates. The idea of low rates, and no one will say this, is to punish savers and reward spenders. We have fallen for the cult of consumerism.

60

posted on

04/20/2016 2:18:14 PM PDT

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson