Skip to comments.

Are Stock Market Bears About to Get Clobbered Yet Again?

The Fiscal Times ^

| April 13, 2016

| Anthony Mirhaydari

Posted on 04/14/2016 4:27:49 AM PDT by expat_panama

On the surface, Wall Street is in the midst of an uneasy standoff. After a historic nine-week rebound rally, the Dow Jones Industrial Average now trades near levels first reached in late 2014, just below massive resistance around 18,000. The trading range between 17,800 and 17,500 has contained trading since the middle of March.

Yet a new long-term bear market seems to have started last May, based on the pattern of lower highs and lower lows on the NYSE Composite and the Russell 2000 Small-Cap Index, both of which are trading at levels first reached in late 2013. U.S. investors are holding a $1 trillion bet against stocks.

Are the bears right? Or are they about to get smashed, once again, as the seven-year Fed-fueled bull market rages on?

To be sure, the fundamentals are challenging, with both earnings and U.S. GDP growth hurting as of late. The Atlanta Fed cut its GDPNow estimate of first-quarter growth to just 0.1 percent. First-quarter earnings for the S&P 500 are expected to decline about 10 percent from last year, the fourth consecutive quarter of falling profitability and the worst showing since 2009.

Reporting kicked off with a disappointment from aluminum maker Alcoa (AA) Monday evening: Sales of $4.95 billion missed the $5.27 billion analysts were expecting. On a GAAP basis, which removes much of the accounting shenanigans, earnings per share were just $16 million, or less than a penny per share.

The reporting season trudges on with a spate of big bank results later this week. JPMorgan (JPM) beat expectations before the bell Wednesday, though its profit dropped to $5.52 billion from $5.91 billion in the first quarter last year.

Bank of America (BAC) and Wells Fargo (WFC) will report Thursday morning, and Citigroup (C) will report on Friday. Results are likely to be pressured by a drop in long-term Treasury yields earlier this year (which pressures net interest margins) while a collapse in first-quarter mergers and acquisitions to levels not seen since the first three months of 2014 are going to weigh on investment bank revenues.

Stocks have been kept out of the abyss by the Federal Reserve’s modified rate hike plans for 2016 and by ongoing hopes of a persistent recovery in energy prices. The Energy Select SPDR (XLE) climbed above its 200-day moving average for the first time since September 2014 on Tuesday thanks to renewed chatter about a Saudi-Russia production freeze agreement. Tehran had been demanding that any production freeze be set at its pre-sanctions output level of around 4 million barrels per day vs. around 3.4 million now.

Yet these reports stand in contrast to recent comments by Saudi deputy crown prince Mohammed bin Salman, who suggested the kingdom would only participate in an agreement if Iran played ball. No less than Goldman Sachs warned clients that market expectations seem to be getting extended vis-à-vis the prospects and viability of any deal, adding that they see greater odds of a bearish dynamic following the meeting.

After all, Riyadh and Tehran are locked in a religion-based proxy war throughout the Middle East. Not exactly the type of good faith needed to lock down a deal. And with crude oil rallying 21 percent over the last six days, Russia and OPEC better deliver an agreement that goes against their individual self-interest — especially since it risks ceding market share to U.S. shale producers that have yet to suffer a round of widespread defaults and bankruptcies.

A pause on Fed rate hikes and a rebound in energy prices, on the surface, seem like positives. And over the near-term, they are. But both only sow the seeds of destruction — for a bull market dependent upon the flow of cheap credit to corporate balance sheets to fund share buybacks and dividends — by potentially pushing inflation rapidly higher.

It's ironic that the catalyst for the epic market rip out of the Feb. 11 low will also, based on current trajectories, be responsible for its undoing.

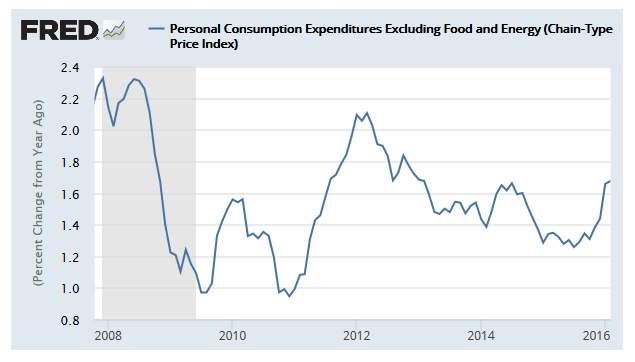

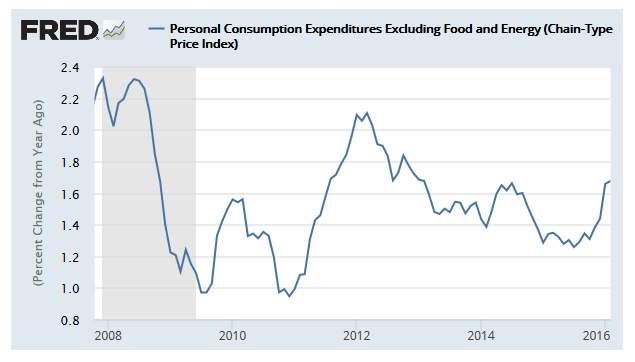

A rate hike delay and higher energy prices will only encourage further acceleration in inflation pressure — which, by the Fed's preferred measure shown above, is rapidly bounding toward their 2 percent target. A tightening job market, higher shelter costs and higher medical costs are all contributing to the increase.

A rate hike delay and higher energy prices will only encourage further acceleration in inflation pressure — which, by the Fed's preferred measure shown above, is rapidly bounding toward their 2 percent target. A tightening job market, higher shelter costs and higher medical costs are all contributing to the increase.

Should inflation start chugging toward 3 percent, the Fed won't be able to respond to every little market selloff as it has over the last few years: with the promise of a pause in policy tightening or well-placed hints of negative interest rates or more bond-buying. The resulting rise in long-term bond yields will pinch off the major source of new money into stocks. Without the buying demand, stocks will fall.

Last year, according to Yardeni Research, buybacks and dividends hit a record of $954 billion vs. a prior high of $835 billion in 2007. From 1Q09 to through 4Q15, buybacks and dividends totaled $4.8 trillion. In comparison, according to the Fed's flow of funds database, equity ETF inflows totaled $223 billion, foreign inflows totaled $111 billion, equity mutual fund inflows totaled $97 billion.

On balance over this period, institutional investors pulled around $211 billion out of the market while households pulled $169 billion.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; markets

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-44 next last

We can be kind and say the writer wanted to make inflation simple, but imho his inflation chart was misleading. We got deflation, and

the total index (

including food and energy) dropped last month. Yellen knows this.

To: expat_panama

the P/Es for sp and Nasdaq are, I think, 27 and 23.

they were as high as SEVENTY ONE in 2008. That worked out well.

While they are too high for my liking, I see a correction and not a collapse unless of course the world economy collapses, then all bets are off.

2

posted on

04/14/2016 4:31:54 AM PDT

by

dp0622

(The only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; aposiopetic; ..

To: expat_panama

What is the story about the meetings going on with the Fed this week? The first news I heard Monday morning was the Fed was going into an unscheduled emergency secret meeting Monday, then was going to have a meeting with Obama and Biden that afternoon and then Obama was going to have a public announcement Tuesday at 3 PM.

Then I heard the Fed was going to have meetings Monday, Tuesday, and Wednesday mornings....

To: expat_panama

Meanwhile, the hot political issue for today is men dressed as women being able to use the women’s restrooms.

Our $20 trillion in debt nation is close to economic disaster and our citizens are being led to focus on LGBTQBS.

5

posted on

04/14/2016 4:39:15 AM PDT

by

boycott

(--s)

To: dp0622

...the P/Es... ...too high for my liking, I see a correction... Yeah, I've been selling some, but I'm still keeping most. I'm in "the trend is our friend" mode.

To: dp0622

It's interesting that the market had a correction and GDO slowed the very next quarter after the Fed raised rates.

All in all I agree with your prediction. As you said the big caveat is the rest of the world.

7

posted on

04/14/2016 4:43:28 AM PDT

by

Sir_Humphrey

(Strong minds discuss ideas., average minds discuss events, weak minds discuss people -Socrates)

To: Sir_Humphrey

8

posted on

04/14/2016 4:44:22 AM PDT

by

Sir_Humphrey

(Strong minds discuss ideas., average minds discuss events, weak minds discuss people -Socrates)

To: Gadsden1st

What is the story about the meetings...Yeah, Yellen's good at that. My private take is that last Dec. she caved to the "obamanomics is great" crowd and raise rates last Dec., and has regretted it ever since. Sure, we got a lot of positive signs, but we also got one heck of a lot of negs too.

To: expat_panama

Agreed.

I almost ######ed up big time about a few months ago, when the dow was in the 16000s. Told wife she might have to move asset but just wait a little longer.

That was CLOSE!!

10

posted on

04/14/2016 4:45:08 AM PDT

by

dp0622

(The only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: expat_panama

I pulled out of the market completely in Aug. 15, put 15% back in in ETF’s, etc. that go up with deflation/poor economy and select residential real estate .......

We are up 26% or more for the year...........

But finger on the trigger ready to react if the bull comes back......highly unlikely as I see it.........

11

posted on

04/14/2016 4:45:50 AM PDT

by

Arlis

To: Sir_Humphrey

and that’s a big caveat with China, Japan and others running 200 plus percent of GDP debt!!

I’ve been eying the currencies and EUR and AUD are holding on to their gains from the past six weeks.

AUD/USD was at .68 not long ago. Now closing on .77.

Eur/Usd bounced off 1.08 and has held 1.13 for a while.

Once the dollar clobbering all trend reverses, there’s gonna be a lot of money to be made there.

But be careful with 5000 percent margin!!!!!!

Some companies offer 50,000!!! percent margin!!!

12

posted on

04/14/2016 4:48:40 AM PDT

by

dp0622

(The only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: boycott

“It doesn’t matter! We owe it to ourselves!”

/sarcasm

13

posted on

04/14/2016 4:49:38 AM PDT

by

Travis McGee

(www.EnemiesForeignAndDomestic.com)

To: boycott

...the hot political issue for today is men dressed as women... ...Our $20 trillion in debt nation is close to economic disaster...True, although when you pick up a newspaper with a pic of some guy in drag in the Ladies --along side a table of budget numbers, we all know what catches the eye first.

To: expat_panama

A nation foolishly de industrializing, like the USA, will suffer bouts of deflation for decades to come.

Thanks gloBULLism, thanks Free Trade.

15

posted on

04/14/2016 4:53:20 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Arlis

finger on the trigger ready to react if the bull comes back..It's a matter of time frame. True, indexes are down a % or two year-to-date, but they're also up say 15% from Feb.'s dip.

To: expat_panama

True, although when you pick up a newspaper with a pic of some guy in drag in the Ladies —along side a table of budget numbers, we all know what catches the eye first.

In a long ago time, they called it “bread and circuses”

17

posted on

04/14/2016 4:58:01 AM PDT

by

LMAO

(I know Hillary and I think she'd make a great president or Vice President. Don Trump 2008)

To: sauropod

18

posted on

04/14/2016 4:58:06 AM PDT

by

sauropod

(Beware the fury of a patient man.)

To: expat_panama

It’s a feint.......won’t last......IMHO........

19

posted on

04/14/2016 5:00:36 AM PDT

by

Arlis

To: LMAO

“bread and circuses”As gov't policy it's outdated. In today's info age it no longer matters what 'catches the eye' because the voter can click elsewhere real fast. We all can see what's happening, and if we chose not to we have to understand that the consequences are not because everything's 'rigged'; we chose not to look.

This victimhood 'rigged' song'n'dance is for crybabies. mho

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-44 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

A rate hike delay and higher energy prices will only encourage further acceleration in inflation pressure — which, by the Fed's preferred measure shown above, is rapidly bounding toward their 2 percent target. A tightening job market, higher shelter costs and higher medical costs are all contributing to the increase.

A rate hike delay and higher energy prices will only encourage further acceleration in inflation pressure — which, by the Fed's preferred measure shown above, is rapidly bounding toward their 2 percent target. A tightening job market, higher shelter costs and higher medical costs are all contributing to the increase.