Posted on 04/12/2016 7:48:45 AM PDT by C19fan

Every few months, another think tank or financial institution releases a new report sounding the alarm about the fiscal crisis facing state and local pension funds, and the findings are reliably dismissed by public sector unions and their political backers. But the latest research, from researchers at Stanford’s business school, is hard to ignore. The Financial Times reports:

(Excerpt) Read more at the-american-interest.com ...

Have no fear.

They will manage to patch it together and limp along until a republican is president.

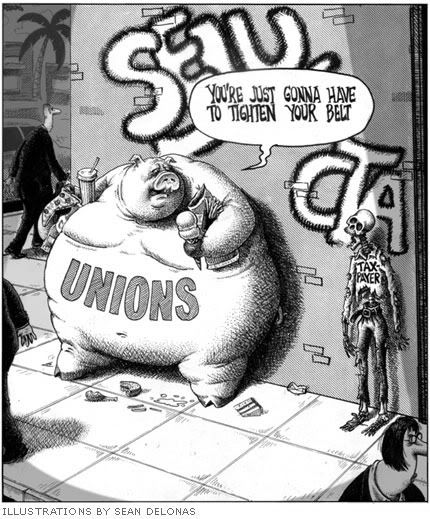

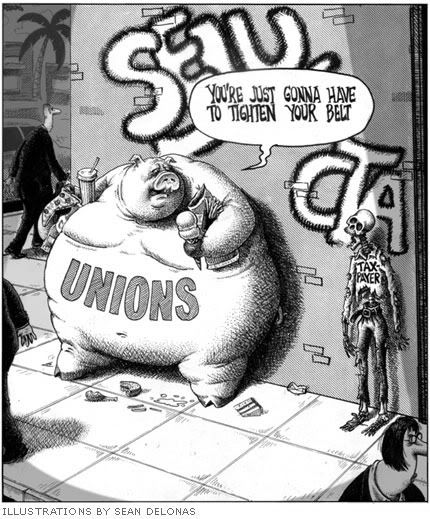

Public pensions and unions should be illegal

Since they get to vote for their opposition and the tax payers get to flip the bill

Same nonsense goin on in New Jersey

I say liquidate the pension fund and give back to the workers in a 401K

Public sector Union pension shortfall. Most public and private companies went over to 401K’s over 15 years ago or longer.

Now Taxes are so high they want to loot private retirement accounts so they can keep up with the Government Employees pensions.

And for the few that still remain, the Government regulates them twice as strict as their own pension systems.

With the current regime in charge it wouldn't suprise me one bit if people woke up one morning to to find their 401Ks and savings stripped Cyprus style for the "greater good". Not one bit.

Oh they’re already talking about it. I bet the legislation is already written and is just waiting on the right moment to introduce.

Bill CLinton had the idea first when he was President, it comes up EVERY YEAR Since. IT WILL HAPPEN!!

The problem is just as much the making of the Republicans. Don't fool yourself.

Just like the economy. The economy seems to be hanging on by threads with 1% or 2% growth. Should a Republican be elected n November I wonder if the dam will break and a number of things will then start moving into crisis mode.

They just have to make sure their Safe Rooms are built first. Because they will need them.

Maybe I missed your point.

Let's say your local city council met, plopped down and approved a budget that outlined every expenditure for the next 20 years, increasing spending with each year based upon projected growth. Would you believe the next city council would be bound by that budget?

If the answer is no, then why would that same city council be bound to some budgeted retirements and benefits some council put in decades ago (or even last year?)

Let's state how deep the pit is, for example, in California. When the dot com bust happened in the stock market, CALPERs, the public employee pension fund, lost quite a bit of money (the state and many cities were deeply involved in investing retirement money in ‘California companies’, many of which were overinflated.) The way CALPERs works is that it is assumed that a certain percentage of return will come each year (in the case back then, the expected return was 8%.) Each city is obligated to make up whatever percentage of the expected return doesn't occur - so in that particular era, when CALPERs had a return of -28%, that meant that every city was obligated to pay half again what they had already contributed to the pension funds.

But this is brilliant... Knowing that cities didn't have funds to repay that shortfall (and mismanagement of public funds), CALPERs said that cities only had to pay back the expected interest on that lost money. Oh, heck, call it all lost money - just pay the interest, and everything will be just fine.

You literally have cities issuing bonds in California to pay the interest on CALPERs debt from 16 years ago. And even more fascinating, you have electorates approving those bonds.

So when your local city council says ‘we don't have money to pay to keep the library open’, what they really mean is ‘We're still paying off debts from nearly two decades ago which we had no say in, plus making new debts as again CALPERs fell short of the projected rate of return, and thus we're spending all your cash on paying for former employees.’

A nice start would be RICO charges against CALPERs and enablers for embezzlement of public funds. Either way, it is a pyramid scheme which they are leveraging against the value of your property. Guess how this is going to play out.

And if that happens, that Republican president will be blamed for everything.

Just as Herbert Hoover was blamed for the great depression, a Republican will be blamed for any economic problems we face in the future.

I say liquidate the pension fund and give back to the workers in a 401K

This is a good idea. Take whatever is in the pension funds, and divide it up among the beneficiaries. And tell them, this is what you are going to get. Politically would be difficult, but, since we see the projected shortfalls of promised pension payments are so huge, something’s gotta give.

The way I look at it, it is their money. And the less the government has control of it, the better. But politicians and unions promised these lofty pensions. A gym teacher in New Jersey, making 112K a year will retire with a promised pension of 61K a year plus full medical benefits for life.

That teacher put in less then 100K into the pension but will get his money back in the first year. The taxpayers are on the hook for the rest of his life.

That is not a pension, it is a Ponzi scam. Madoff went to jail for a scheme like that, but our political officials get re-elected.

To a degree.

But Obama has shown democrats and republicans both that the barriers and restrictions they thought were in place to prevent them from going whole-hog, bat-crap crazy on over-spending and financial irresponsibility were only imaginary.

He demonstrated that if they are willing to ignore the constitution, ignore their oath of office and take a dump on citizens and the country, that together they can get away with just about anything.

I imagine thare are a lot of Washington democrats and republicans eagerly waiting in the wings for a chance to try out all the tricks Obama has shown them in the last 7 years.

Would you believe the next city council would be bound by that budget?

This happens in every board room of every company in the world. Regardless of what took place in the past you need to set a budget for the future. If bad decisions were made in the past cap it. Pay off what you owe but don’t let any new people on board. If you can’t handle tough decisions then you are not fit for the job. Stop giving the city council a break and letting them blame the past council.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.