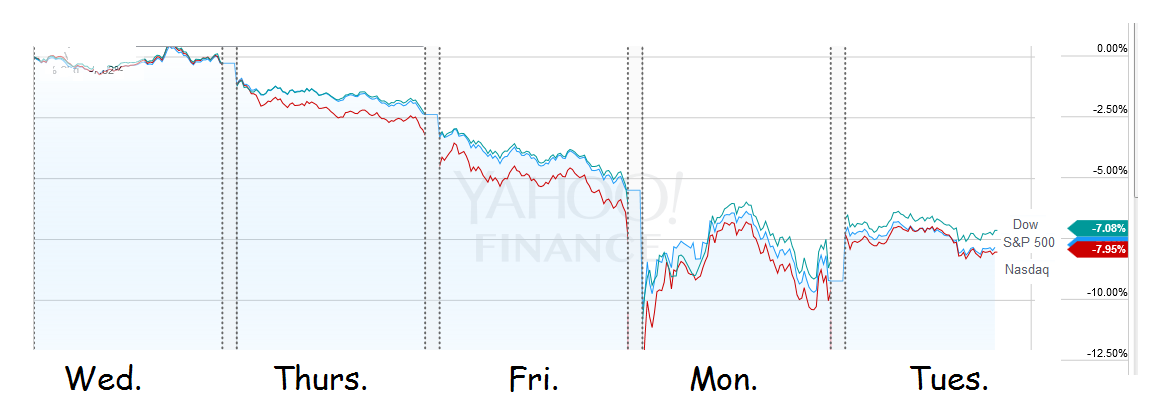

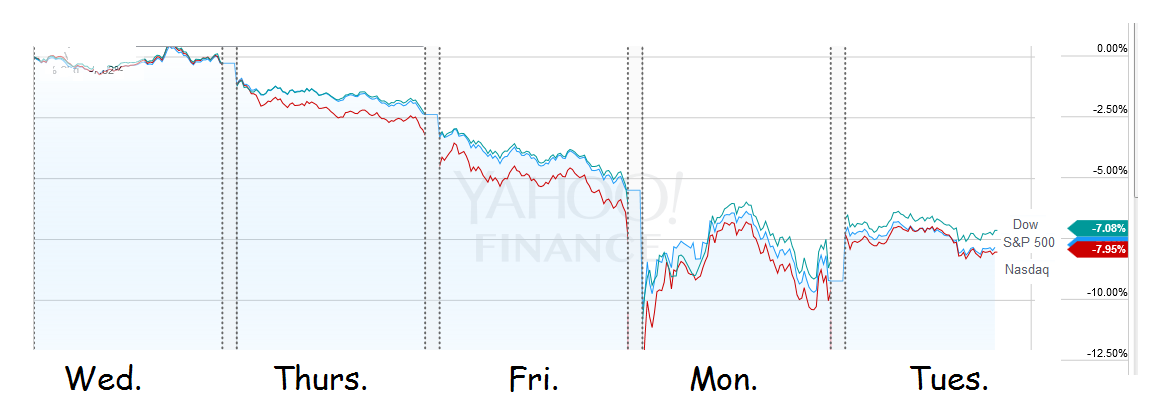

Nobody knows the future for sure, but we can know that today's rebound still hasn't even made it up to as far as yesterday's highs (from here):

Posted on 08/25/2015 6:15:14 AM PDT by expat_panama

U.S. stock index futures pointed to a sharply higher open on Tuesday, recovering from the plunge seen in global stocks on Monday as mayhem in Chinese markets and interest rate fears dominated markets.

Dow futures were up around 450 points in premarket trading, implying a 320 point bounce at the open and shrugging off deeper selling in China. Equity markets in China fell further in the final hour of trading on Tuesday, with the Shanghai Composite (Shanghai Stock Exchange: .SSEC) settling below the key 3,000 mark, to end the day down 7.6 percent.

Read More More selling may be ahead, but bull market called not dead yet

Japan's Nikkei 225 (Nihon Kenzai Shinbun: .N225) index was the second-biggest laggard in the region, closing down 4 percent, after turning negative in the afternoon trading session Tuesday.

European equities bucked the weakness seen in Asia , and were trading firmly in the green in early deals. The pan-European Stoxx 600 rallied 2.8 percent, with French (Euronext Paris: .FCHI), German (XETRA: .GDAXI) and U.K. (FTSE International: .FTSE) stocks all up around 1.5 percent. Basic resources stocks were the key outperformer, gaining in excess of 3 percent.

On the data front, there are a flurry of housing market indicators due Tuesday, with the FHFA and Case-Shiller home price indices for June both due at 9.00 a.m. ET and new home sales figures for July at 10.00 a.m. Other releases include the Conference Board's consumer confidence indicator for August at 10.00 a.m. as well as the flash Markit services and composite PMIs for the same month.

"After yesterday's data vacuum, we get U.S. new home sales and Conference Board consumer confidence this afternoon. Neither of these is going to change anyone's expectation about the outlook for Fed policy...

(Excerpt) Read more at finance.yahoo.com ...

Of course they do. They know exactly what they are doing. They are creating an entire generation to be dependant upon gov't.

I had to think a sec, there really are folks that have decided to prevent price plunges by government fiat --not just what we've been seeing in China but like all the new U.S. regs passed after the '87, '00, and '09 crashes.

According to the Fed website any rate hike announcement will have to wait until next month.

“According to the Fed website any rate hike announcement will have to wait until next month.”

Leaves a lot of potential for some wild knee jerks in between.

hey, pundits make big bux second guessing the fed.

Can't find it now but I thot I saw something this AM about China's clampdown on bad econ news. They wouldn't need to if they had their own ABCNBCBBSCBSUSATodayCNN

ABCNNBCBS...

Let's see how it ends up today - the initial 600+ futures and the 300+ open seem to be tapering (250 now). Anyone who trusts that the market is running under valid "indicators" and not being skewed by the really big money folks is________________ (fill in your own blank).

Because they are banking (haha, no pun intended) on the “resiliency” of the American economy. Rates have not increased in nearly a decade and the liberal/progressives have a tendency to over believe their own propaganda.

Always keep in mind our truth is not their truth, even when it comes to the economy. They don’t want capitalism, their goal is something much less desirable and they’ve been slowing eeking their way to it for quite some time. We always ponder how they could be so stupid/dumb, but it is ourselves who are being suckered into their progressive world.

Top current lie: The unemployment rate

What the Fed thinks? Federal Reserve officials might raise interest rates soon because they have a theory: Falling unemployment pushes up prices and wages, requiring tighter credit to keep inflation in check.

We all realize the current rate is bogus, ...right? 92 million not working, not counting people who have given up looking for a job, this is a huge illusion and sadly they actually believe the current unemployment numbers.

Second lie: Inflation

What the Fed thinks? We’re entering an inflationary cycle because ...uh? prices and wages are going up. Wait, that is based on the first lie?

Truth: The velocity of money has been dropping for quite some time now. When the velocity of money drops, that is a signal for deflation, not inflation.

Velocity of M1 Money Stock in the US is at a current level of 5.956, up from 5.939 last quarter and down from 6.191 one year ago. This is a change of 0.29% from last quarter and -3.80% from one year ago. http://ycharts.com/indicators/velocity_of_m1_money_stock

Yeah, we can keep looking at all the data, but it isn’t any good. Much of it is flawed to a frightening level to keep people stuck in their normalcy bias.

The problem in all this mess is THEY believe their own lies? It humble low life’s like me can tease out the truth, why can’t they? Because their endgame goal isn’t the same as mine. They’ve been itching to pull this trigger for nearly a decade. Watch all the good news come out over the next few days about the American economy...

I even found an article from yesterday claiming a rate in increase is actually a decrease! http://finance.yahoo.com/news/fed-hike-could-lower-interest-153918126.html;_ylt=AwrC1DH3f9xVZHIA7VvQtDMD;_ylu=X3oDMTBybGY3bmpvBGNvbG8DYmYxBHBvcwMyBHZ0aWQDBHNlYwNzcg—#

Oh please. Futures run round the clock and always have. They shut down for a few hours here and there but the market is essentially open 24 hrs. I used to daytrade futures for my living. I didn’t trade much overnight because the volume is too low.

That's not what it said. It said a hike in the overnight rate may cause longer term rates to fall.

I predict at 4pm it will be down 250

September 23.

This is August. That was just the warning shot

Have you shorted the market?

I’m sure he’s bought lots of puts.

China’s version of the Federal Reserve made some good choices... it’ll hold things off for a while..,

Nobody knows the future for sure, but we can know that today's rebound still hasn't even made it up to as far as yesterday's highs (from here):

That's what we're hearing from everyone but China’s version of the Federal Reserve, but those guys don't have a convenient website where they say what they mean. China's econ leaders are so opaque it's laughable.

It’s hard to imagine what the marriage of a command economy with capitalism under commie thugs is like... well, other than what we see - - which - - as you pointed out - isn’t much....

What do you see for tomorrow? ;^)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.