Skip to comments.

Senate panel passes bill lifting crude oil export ban

Fox News ^

| July 30, 2015

| Associated Press

Posted on 08/03/2015 4:47:59 AM PDT by thackney

A Senate panel has approved energy legislation that would lift the 40-year-old ban on crude oil exports and open some areas of the Outer Continental Shelf to oil and gas exploration.

Republican Lisa Murkowski of Alaska, chairman of the panel, championed the plan to lift the restrictions. It passed by a party-line vote of 12-10.

Murkowski said lifting the ban would turn the U.S. into an energy superpower.

(Excerpt) Read more at foxnews.com ...

TOPICS: News/Current Events; US: Alaska

KEYWORDS: alaska; energy; export; globalwarminghoax; lisamurkowski; methane; oil; opec; petroleum; popefrancis; romancatholicism

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-55 next last

To: central_va

Dude you are lying. Back up your accusation. What statement have I made that is a lie?!?!?!

We only have enough domestic oil to meet a little over 50% of our own demand.

How many times have I explained to you in multiple posts in multiple threads that not all oil is the same. Refineries optimized for heavy sour do not economically refine light sweet.

21

posted on

08/03/2015 5:30:37 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: central_va

You don’t need NEW refineries just increase current capacities. And you think that magically happens at the exact same rate increases in crude production?

It takes years and billions of dollars to expand those units IF they can get the permits required.

And in a political climate that continues to ban the crude exports will never ban the refined products exports? Do you invest your dollars that way?

22

posted on

08/03/2015 5:33:25 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: jpsb

False. The supply curve is just as important as the demand curve in economics.

23

posted on

08/03/2015 5:34:23 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: All

IMPLICATIONS OF LIGHT TIGHT OIL GROWTH FOR

REFINERS IN NORTH AMERICA AND WORLDWIDE

file:///C:/Users/GT%20Engineering/Downloads/797317%20Implications%20of%20Light%20Tight%20Oil%20Growth.pdf

January 2014

Tim Fitzgibbon, Matt Rogers

The production of light tight oil (LTO) – or unconventional oil – in North America has grown dramatically, rising from almost nothing in 2010 to over 2 million barrels per day (bpd) in 2013. This growth shows no sign of slowing, with production currently increasing by about 75,000 bpd each month.

The application of production techniques that were first applied to shale gas – horizontal drilling in combination with hydraulic fracturing—has been driving this trend. These techniques have allowed producers to tap a vast resource that, while well known for many decades, has until now been uneconomic to produce. Most of this growth has come from two basins, the Bakken in North Dakota and the Eagle Ford in South Texas. However, the techniques are increasingly being applied in a number of other areas. While these newer plays are typically smaller -in acreage and resource size than the Bakken and Eagle Ford, several of these developing plays are reporting similar well sizes, and showing attractive economic returns and growth.

The volume, quality, and location of LTO supply growth pose both challenges and opportunities for the refining industry in North America, and the resulting changes could have important consequences for refiners worldwide.

LTO QUALITY AND ITS RAMIFICATIONS

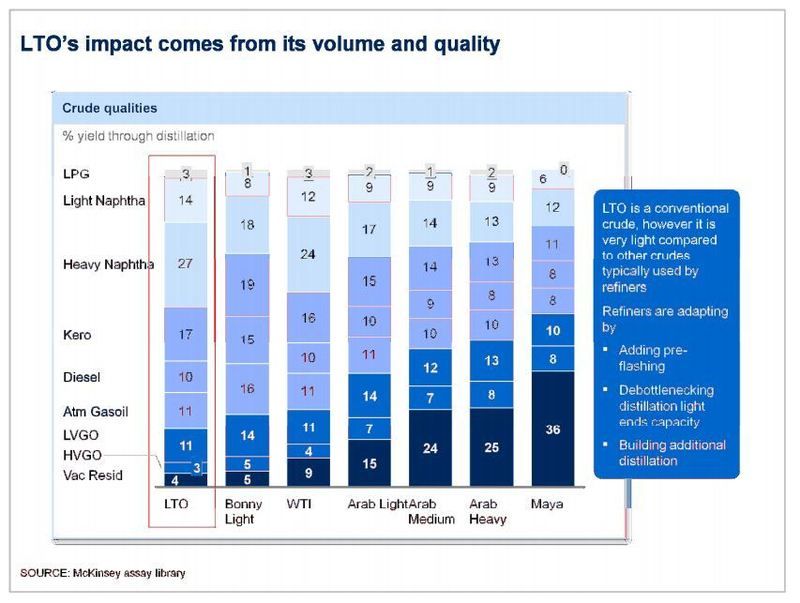

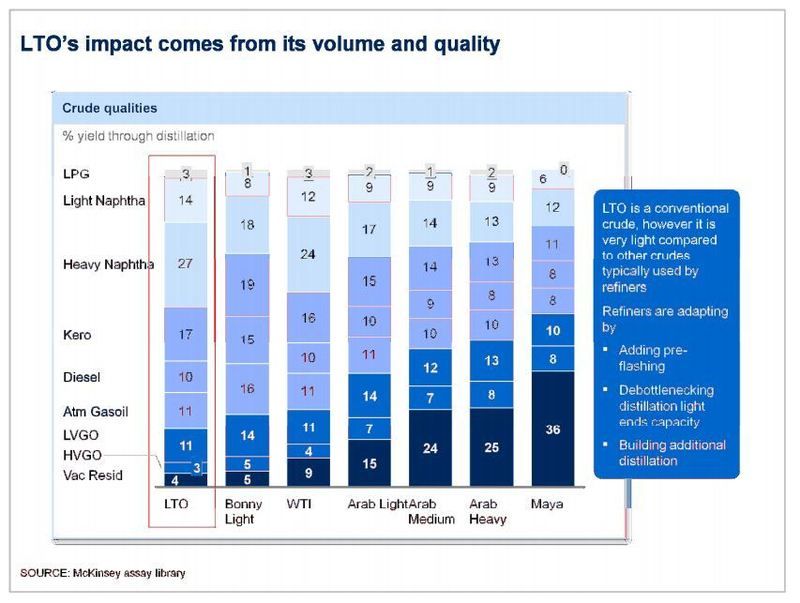

LTO from all resource areas is consistently lighter and sweeter than typical crude oils processed by North American refiners. LTO has almost twice as much naphtha and half as much bottoms material as Arab Light (Exhibit 1). Even relative to other light-sweet grades, such as West African Bonny -Light or West Texas Intermediate (WTI), LTO is noticeably lighter.

US refiners have invested heavily over the last two decades to process medium- to heavy-crude slates, especially on the US Gulf Coast. To process greater quantities of LTO, most refiners will have to either debottleneck the light-ends part of their distillation, or add new distillation that is specifically suited to LTO. Longer term, as LTO displaces medium and heavy crudes, refiners will struggle to keep their highvalue conversion units (FCC, hydrocracking, and coking) full. They will either need to reduce utilization of these units or find ways to backfill, perhaps through importing feedstock.

24

posted on

08/03/2015 5:52:57 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: All

25

posted on

08/03/2015 5:55:18 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

Oil is a vital finite natural resource, why pump US oil for the Chinese when we already import 50% of the oil we use? This is just more crony capitalism. US consumers will get screwed. It appears short term profits over rule long term strategic thinking, again.

26

posted on

08/03/2015 5:56:12 AM PDT

by

jpsb

(Believe nothing until it has been officially denied)

To: jpsb

Would you read post 24?

Do you honestly believe our oil producers work at below market rates already, and would continue to invest more dollars in a market that pays below market returns?

27

posted on

08/03/2015 5:58:50 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

When you say market you mean global prices right? The USA is also a market and I am sure oil producers are profitable in the US Market. They'd like to be able to sell in the global market where prices are higher. I get that. However oil is not a renewable resource and every barrel we sell overseas is one less barrel we have. It is crazy to export something vital, that can not be renewed, that we import huge amounts of.

The ban was put in place during the oil embargo back in the 70's. It's purpose was to preserve American oil for Americans. That purpose is just as valid today as it was back in the 70's.

28

posted on

08/03/2015 6:10:07 AM PDT

by

jpsb

(Believe nothing until it has been officially denied)

To: jpsb

No, you don’t get it.

All oil is not the same. All refineries are not designed to process the all oils.

This is about exporting our surplus expensive light sweet while we import the cheaper heavy sour our refineries are designed to use.

29

posted on

08/03/2015 6:13:05 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: outofsalt

True.

But most ethanol is used domestically to meet blending mandates, correct?

To: jpsb

Oil Export Momentum

http://www.wsj.com/articles/oil-export-momentum-1438125631

July 29, 2015

Support is growing to repeal a Nixon-era ban that Iran and Russia love.

The Washington news isn’t all bad these days: Republicans and some Democrats are working hard to gather enough votes to repeal the 40-year ban on exporting crude oil. With gasoline prices hitting new lows, now is the right political moment to do something right for the economy and national security.

The ban is a relic from the Nixon era when oil prices spiked and OPEC began. America’s unconventional oil boom has changed everything. U.S. crude production bottomed in 2008 at about seven million barrels per day and is now more than 11 million. The Energy Information Administration estimates that U.S. output could hit 18 million barrels a day by 2040. Crude inventories are at an 80-year high, and imports declined nearly 30% between 2005 and 2013.

The export ban is, paradoxically, one of the biggest threats to this U.S. production boom. The decline in oil prices over the past year has forced U.S. producers to slash investment and cancel projects. The U.S. rig count has dropped 50% since last autumn, and the industry has cut more than 125,000 jobs. Lifting the ban would offer new markets for U.S. oil and mean fewer layoffs.

This harm is compounded by the U.S. refinery mismatch. Most U.S. refineries are built to process heavy crude that the U.S. has long imported from the likes of Venezuela and Mexico. But most U.S. drillers are producing light, sweet crude. Refiners are slowly retooling to handle more U.S. crude, but record amounts of oil are still piling up in storage. So U.S. producers are getting $5 to $10 a barrel less than what oil sells for in the global market, which leads to further declines in domestic drilling.

excerpted for WSJ

31

posted on

08/03/2015 6:19:53 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: jpsb

Oil is a vital finite natural resource”

I think part of the issue here is that there is no such thing as “oil” as in one single commodity, that is exactly the same in all times and places. There is a big difference in grades/classifications of crude, and therefore big differences in how they are treated at the next stage.

The best markets currently for crude that needs less refining are export markets. Accordingly, they need to be opened up....so production can continue, and yes, eventually domestic refining will pick up to handle this new type of crude. But in the meantime, we don’t want production to stop...and part of that is for the reason you noted, national security.

That’s sort of how I see it....

To: ConservativeDude

33

posted on

08/03/2015 6:22:27 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

Take the comparison farther. If we banned the export of wheat, what would happen to our wheat production? Farmers could not afford to produce more than could be used domestically. They would drastically cut production. In just a few years, we would be importing wheat as the farmers would need to make sure each year their production stayed under domestic demand. Maybe. But what would likely happen is livestock feed would switch from corn to wheat, because wheat would then cost less than corn. Wheat and corn have almost the same carbohydrate content, but wheat has a larger protein content, so cattle would get bigger, fatter and leaner, as well as pork and chicken, so prices would fall. Since wheat is used in beer, that price would fall as well, so we would have BBQs and beer fests all over the US!...................

34

posted on

08/03/2015 6:27:27 AM PDT

by

Red Badger

(Man builds a ship in a bottle. God builds a universe in the palm of His hand.............)

To: bert

If there were long term export contracts to supply at a fixed price and the domestic supply diminished, the domestic price would rise while the export quantity and price was the seme”

True. And that exporter would be losing ground, and scrambling to find more product at a cheaper price so they don’t go bankrupt.

With the rising domestic prices, production would increase, the exporter might be able to take some of that, and might then actually survive their long term contracts....and if production increases enough, and supply is enough, and if that exporter is good at finding that cheaper production....then that exporter might end up actually making money.

Meanwhile, the overseas buyer gets a steady supply, at a fixed price, and reduced one of its variables....

Right?

Still trying to understand all of this....

To: ConservativeDude; jpsb

Since refined products are already allowed to be exported, Gasoline, Diesel, etc sells domestically for the price it can be exported. The final consumer doesn’t benefit from a couple refineries buying oil at below market rates.

Currently, the “raw” crude oil can be sent through a simple splitter, separating lights and heavies without either being a finished product, and those split feeds can be (and are) exported already.

The crude oil ban benefits the refinery sector over the oil producing sector. The government has no business picking and choosing winners and losers in private industry.

36

posted on

08/03/2015 6:30:33 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: central_va

just curious and I don’t know the answer.

But is most crop insurance a government program? Or a private one?

I think it’s mostly government, right?

To: Red Badger

Maybe. Really? You believe farmers would continue to produce more wheat than could be sold?

But what would likely happen is livestock feed would switch from corn to wheat, because wheat would then cost less than corn.

And if the ban was like the current crude oil ban? All grades of "raw" feedstock banned?

38

posted on

08/03/2015 6:32:35 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

Currently, the “raw” crude oil can be sent through a simple splitter, separating lights and heavies without either being a finished product, and those split feeds can be (and are) exported already.”

Yes. That’s my understanding as well.

And your point that the export ban is a boon for refineries with better lobbyists is well taken. Lifting the ban is not about crony capitalism; putting it in place is actually the crony capitalism.

To: Red Badger

Energy independence? Being a energy superpower? This is all kabuki theater on behalf of those wacky conservatives. The republican party needs to come up with real solutions instead of these gimmicks that help no one. /sarc

40

posted on

08/03/2015 6:34:08 AM PDT

by

EQAndyBuzz

(Democrats are parasites. It really is that simple.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-55 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson