--pretty much shows what (imho) we've been seeing while we've had to put up w/ morons screaming about "soaring QE driven stock markets".

Posted on 07/31/2015 5:30:56 AM PDT by expat_panama

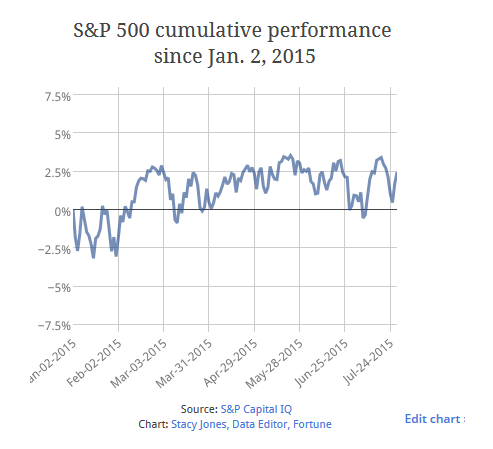

Flat markets, like the one we are in right now, do not suggest any particular outcome when the S&P 500 finally breaks out of its slumber.

You might have looked at your last brokerage statement and wondered why you’re no longer seeing the asset balance increasing like it had been. You may have taken a glance at your 401(k) the other day and wondered why it’s barely budged since Thanksgiving, excluding the contributions you’ve been making every two weeks.

You’re not crazy. The U.S. stock market has essentially gone nowhere...

[snip]

Market watchers have noted that the trading range (difference between the market’s highs and lows) so far in 2015 is among the narrowest ever recorded. The fact that this sort of mass indecision is transpiring just a few percentage points away from record highs is a fascinating development and possibly presages a major turning point in the predominant trend.

Put simply, we’re running out of both breadth and breath.

The important thing to remember, however, is that flat markets are not necessarily predictive of what will happen in the immediate future. I took a look at the historical record to get a sense of what happens when the S&P 500 finishes the first seven months of the year flat.

[snip]

Flat markets do not necessarily suggest any particular outcome when the S&P 500 finally breaks out of its slumber. It’s been down three times, flat once, and markedly higher in the other eight instances. All those narratives on what’s about to happen based on the current trading range should be discounted or ignored with extreme prejudice. The most common resolution has been a gain with much less volatility than usual, but the outcomes have been all over the map.

Keep this grain of salt handy...

(Excerpt) Read more at fortune.com ...

--pretty much shows what (imho) we've been seeing while we've had to put up w/ morons screaming about "soaring QE driven stock markets".

Deja vu reruns --looking at a repeat of yesterday: futures stocks -0.21% and metals -1.11% all after yesterdays no-where'sville. Reports this AM Employment Cost Index, Chicago PMI, and Michigan Sentiment - Final.

With no sheep to fleece the hft bots are biding their time.

Or maybe it means that even with QE the markets won’t soar.

Looks like we’ll written code to me, no memory leaks!

Even with bank accounts and CDs offering less than one percent, the stock market is the last place I’d invest right now.

“...The median return for all 12 flat-market years has been 6%...”

Could you put me on your finance ping list please?

Me too - thanks.

There is no there, there.

Gold took a big leap, today. Works for me! And, you’re right - my 401K and IRA have not moved much (still UP, but not by much) since last Fall.

Got a LOT more principle paid on the farm mortgage, though, and you know where my priorities lie, anyway. :)

Better buy a few more ribbons on eBay for my old Olivetti. I’ve got a Manifesto to type, LOL!

--and imho that beats the heck outa "down-not-by-much"...

Done!

Lots of folks on these threads talk about QE --maybe to sound like they've been thinking about these things-- but more often than not nobody seems to have any idea just what QE is. If you get a chance, please tell us what QE you're talking about that's "with" us these days?

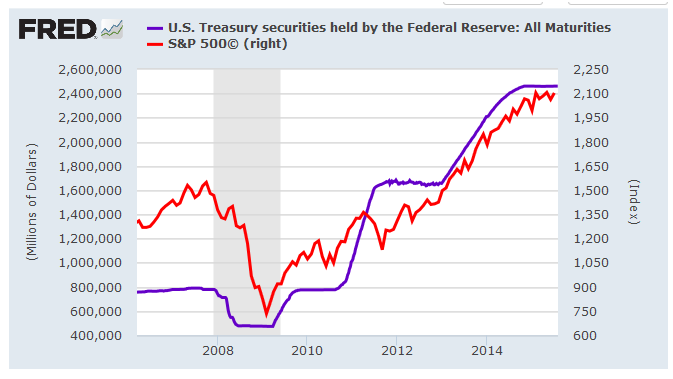

QE in the modern era ... the Federal Reserve buying hundreds of billions of treasury bonds.

Or have they quit that?

If they’ve quit, who’s buying all the bonds?

Good point. The most destructive policy is the Federal Reserve’s zero interest rate policy (ZIRP) which has been in place for so long that there hasn’t been a rate increase in more than nine years.

a fortune and therefore discredited chartist rants over his analysis of the entrails

The big buying sprees were '09, '11, and '13. The S&P had already begun its bounce before all three and the big '12-'15 run happened after QE1 and QE2. Fed buying stopped back in Sept. '14 and the S&P continued to climb for half a year. There's more going on w/ stocks than just QE.

If they’ve quit, who’s buying all the bonds?

From '08 to '15 the total Federal debt doubled by selling $9T and of that the Fed bought "only" $2T. There are plenty of other buyers.

Zero interest didn't "destroy" anything. The left just likes to say that so we won't blame taxes, regulations, and the loss of the rule of law.

Pete, we agree on a lot of things, but ZIRP bailed out bad banks and punished the prudent savers. I wholly blame terrible fiscal policy by Democrats from the local level to the federal level for screwing up the economy. Yet the FEDs response was the bail out banks with ZIRP which punishes the responsible people. Moral hazard is real. This low interest rate environment is unrealistic and net harmful.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.