Skip to comments.

Global markets slide on Greek crisis fears

CNBC ^

| Jun 29, 2015

| Kalyeena Makortoff

Posted on 06/29/2015 4:26:42 AM PDT by expat_panama

The deepening Greek crisis hit global markets on Monday, as the country imposed capital controls ahead of a national referendum on creditors' bailout conditions.

Uncertainty surrounding the country's economic future dragging equity markets lower. European markets were trading sharply lower, with the pan-European Stoxx 600 (^STOXX) falling around 2.4 percent in morning trade. Both Germany's DAX (^GDAXI) and France's CAC (Euronext Paris: .FCHI) fell nearly 3.5 percent.

U.S. futures also indicated a lower open, with the Nasdaq (^NDX), S&P (^GSPC) and Dow Jones Industrial Average (Dow Jones Global Indexes: .DJI) all seen opening down over 1 percent.

Greece's main stock exchange is expected to remain closed all week - along with the country's banks - but banking stocks elsewhere in Europe were hard hit on Monday. Portugal's Banco Comercial Portugues (Euronext Lisbon: BCP-PT) was down nearly 9 percent, while Italy's Banca Monte Dei Paschi Di Siena (BMPS (Milan Stock Exchange: BMPS-IT)) lost 7.1 percent.

Growing fears of a Greek default were reflected in the sovereign debt markets, with yields on Greek government debt spiking. The 10-year yield hit 14.5 percent, up 367 basis points - its highest level since December 2012.

Peripheral bond yields also rose, with Portugal, Italy and Spain's 10-year yields all up on the day.

The yield on Germany's benchmark 10-year Bund, meanwhile, fell 13 basis points to around 0.78 percent. And U.S. Treasury yields also slipped amid a flight to safe-haven assets.

The euro (Exchange:EUR=) was also down against the dollar, falling 0.5 percent to trade around 1.1106.

Deutsche Bank's Francis Yared warned of a "pronounced" risk-off move in markets.

[SNIP]

It comes ahead of a referendum on Sunday, July 5, which will see citizens vote on bailout terms set out by the European Commission, International Monetary Fund (IMF) and European Central Bank.

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: Business/Economy; Foreign Affairs; Germany; News/Current Events; United Kingdom

KEYWORDS: alexistsipras; business; economy; europeanunion; france; germany; globalcrisis; greece; greekcrisis; investing; nato; syriza; unitedkingdom

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Deja vu replay time, here's where we are at a couple hours before opening bell (from here):

Barchart Futures Market Heat Map

Financials

+0.96% |

Softs

+0.44% |

Meats

+0.03% |

Currencies

-0.02% |

All Markets

-0.14% |

Grains

-0.30% |

Metals

-0.48% |

Energies

-0.86% |

Indices

-1.12% |

To: expat_panama

It times of fear, what do the big boys buy?

3

posted on

06/29/2015 4:45:34 AM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: MeneMeneTekelUpharsin

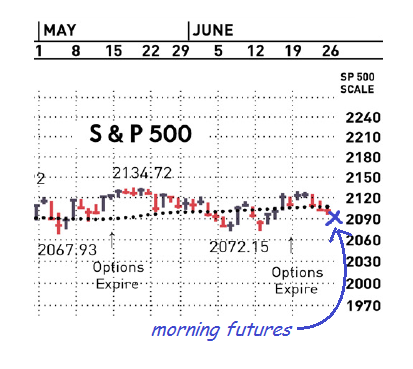

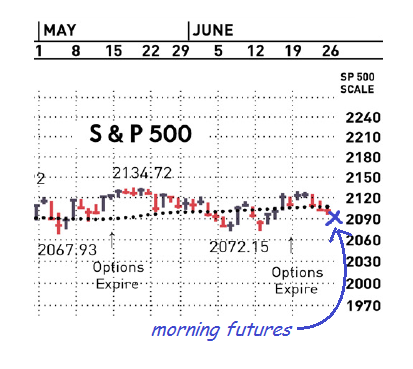

You're probably already heard the anecdote but we feel like the office boy during a crash asking J.P.Morgan what're stocks doing next, only hear him growl "they will fluctuate, they will fluctuate...". This morning's S&P500 futures may look scary but they're really just business as usual:

To: expat_panama

How can metals be going down when there's a currency crisis? Is it rigged so the big guys can buy metals?

If any other explanation makes sense, I'd like to know.

5

posted on

06/29/2015 5:23:32 AM PDT

by

grania

To: grania

The markets discounted for Greece a long time ago.

6

posted on

06/29/2015 5:44:54 AM PDT

by

Raycpa

To: expat_panama

Someone get the Austrian translator in here!

7

posted on

06/29/2015 5:51:25 AM PDT

by

batterycommander

(- a little more rubble, a lot less trouble.)

To: grania

...rigged so the big guys can buy metals? If any other explanation makes sense...Our 'not making sense' list ought to have "rigged" right up there at the top. Let's think together. In a market the only way to lower prices is to offer to sell at a lower price. If our "big guys" sell at a lower price then they've lowered the market transaction price. That also means they can't buy.

To: expat_panama

Why can’t they buy? If metals are sold at an artificially low price, they can buy metals and dump stocks before everyone else does if there’s a crisis. I read somewhere that the per-ounce cost of silver is less than it costs to mine and mint it. Does that make any sense?

9

posted on

06/29/2015 6:05:37 AM PDT

by

grania

To: batterycommander

Yeah, we need someone who speaks Austrian to help us with talking to the Australians...

To: expat_panama

11

posted on

06/29/2015 6:09:14 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: grania

...If metals are sold at an artificially low price, they can buy metals... Who? Are you talking about the "big guys"? Are we saying the big guys sell to artificially lower the price and they also buy at the same time? The way transactions work is someone has to buy at a price that some other seller wants and can't get elsewhere.

btw, while our friends in the futures markets are making contracts assuming a lower metals price, right now gold is trading $5/oz higher than it closed last Friday.

So much for futures traders....

To: Lurkina.n.Learnin

Rate Cut Fails to End Rout

--and rate cuts always boost the stock market!!!

To: expat_panama

“with yields on Greek government debt spiking. The 10-year yield hit 14.5 percent, up 367 basis points - its highest level since December 2012. “

I can’t figure out why yields aren’t at least 8000%.

14

posted on

06/29/2015 6:50:11 AM PDT

by

catnipman

(Cat Nipman: Vote Republican in 2012 and only be called racist one more time!)

To: catnipman

Yeah, that rate level suggests that bond traders see say, only a one out of ten chance of default per year. Traders can’t be idiots. At least not for long that is...

To: expat_panama

Gold is down. NUGT is at a 5 year low. Why isn’t gold a safe haven? The only thing on my radar looking good is TZA.

To: BipolarBob

Gold is down. NUGT is at a 5 year low. Why isn’t gold a safe haven?Because it is priced in dollars and the dollar is going UP on Euro troubles.

Your gold would be doing great if you had bought it in Euros and were converting it as such.

17

posted on

06/29/2015 12:03:12 PM PDT

by

NeoCaveman

(DC, it's Versailles on the Potomac but without the food and culture)

To: BipolarBob

For the day gold seems to be a ted up:

As for stocks in general my bet is that IBD may switch the outlook from "under pressure" to "correction", which in recent memory means the beginning of an uptrend.

To: NeoCaveman

10 yr note was up big today.

19

posted on

06/29/2015 1:20:18 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Added to my portfolio of RDS/B today.

20

posted on

06/29/2015 1:21:00 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

As for stocks in general my bet is that IBD may switch the outlook from "under pressure" to "correction", which in recent memory means the beginning of an uptrend.

As for stocks in general my bet is that IBD may switch the outlook from "under pressure" to "correction", which in recent memory means the beginning of an uptrend.