Skip to comments.

The American Investor's Stock Holding's at All-time High --Investor Thread May 12, 2015

Weekly Investor's Thread ^

| April 12, 2015

| freeper investors

Posted on 04/12/2015 10:27:18 AM PDT by expat_panama

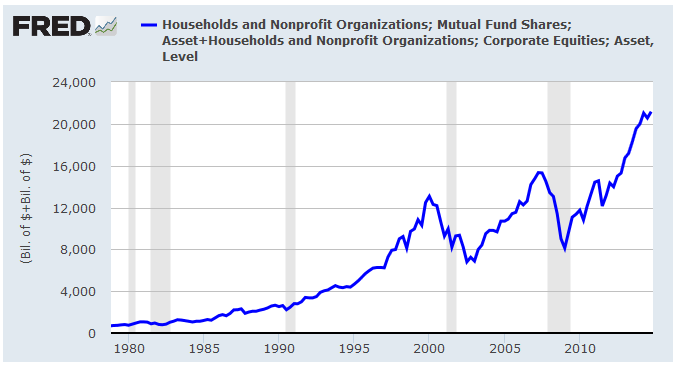

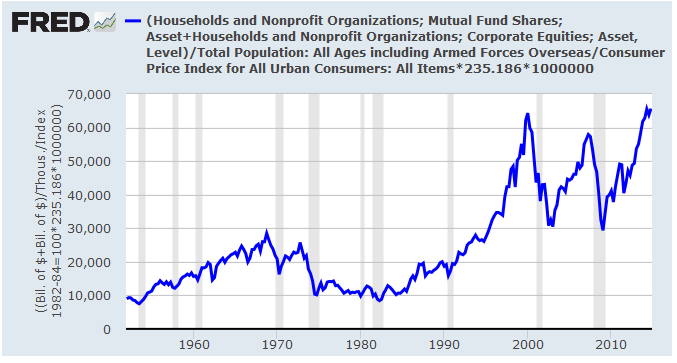

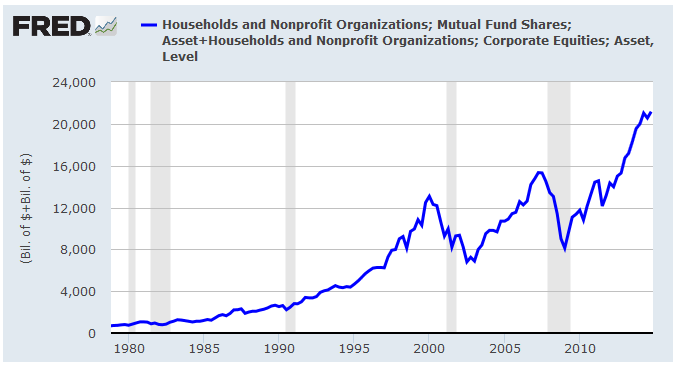

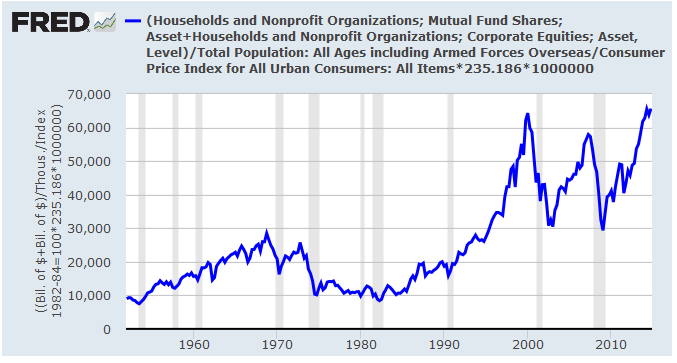

The total privately owned stocks and mutual fund shares adds up to a soaring record total $21,169,400,000 --according to the latest Federal Reserves Flow of Funds Report. Yeah I see all the hands waving --and the big question that follows has to do with population and inflation. We went through this back on an earlier thread when the press was tootin' about how America's private wealth was supposedly at an all time high but only as a total of inflated dollars. The average American's total holdings in real dollars is still less than it was eight years ago.  However, that's mainly because holdings in everything but stocks have been doing poorly, and looking at just the per capita real stock/mutual fund holdings we're seeing that the latest average has once again punched though to a new record high. [insert collective "huh" here] |

| Somehow this doesn't agree with what we've been hearing. I mean we just had this FR thread started by Red in Blue PA titled Over half of Americans have $0 in stocks and the thread's article was based on a poll commissioned by Bankrate posted April 9, 2015:  Did you miss the stock market rally? You're not alone (--and here's an excerpt from the original Bankrate study:)

It's often said that a rising tide lifts all boats, but a rising tide isn't much help if you don't have a boat. In the midst of a six-year market rally, more than half of Americans don't own any stock investments at all, potentially missing out on a big investing opportunity to build retirement savings and overall wealth, according to a new Bankrate Money Pulse survey.

Sitting on the sidelines Despite the proliferation of investment-based retirement accounts such as 401(k)s, 52 percent of Americans report not owning any stocks or stock-based investments such as mutual funds, according to Bankrate's Money Pulse survey.

That doesn't surprise Robert Stammers, CFA, director of investor education for the CFA Institute.

He says many Americans "see themselves as savers and they worry about capital preservation." Because of that, "they don't take the risk necessary to achieve the returns that they need to fulfill their long-term investment goals."

Opting out of stocks, which have historically been one of the highest-returning types of securities available to individual investors, is likely to have some harsh consequences for Americans over the long term.

"The average person has less than $25,000 saved for retirement," Stammers says. "So people certainly aren't prepared, and that's just making them less prepared."

[snip]

Methodology: Bankrate's poll was conducted by Princeton Survey Research Associates International, which obtained the data via telephone interviews with a nationally representative sample of 1,001 adults living in the continental U.S. Telephone interviews were conducted by landline (500) and cellphone (501, including 316 without a landline phone) in English and Spanish from March 19 to 22, 2015. Statistical results are weighted to correct known demographic discrepancies. The margin of error for the questions ranged from plus or minus 3.7 percentage points to plus or minus 5.3 percentage points.

[snip] * * * * * * * * * *

|

|

So what happens is the major news services just ran with it:

Over Half Of Americans Aren't Investing In The Stock Market (Forbes)

Over half of Americans pass on the stock market (usatoday)

Stock Market Is America's Great Wealth Equalizer (investors.com/ibd)

More Than Half of Americans Are Not Investing in the Stock Market (prnewswire)

Survey: 52% of Americans not in stock market (nbcnews)

Over Half of Americans Avoiding Stocks (abcnews)

Report: 52% of Americans Don't Invest in Stock Market ... (Fortune)

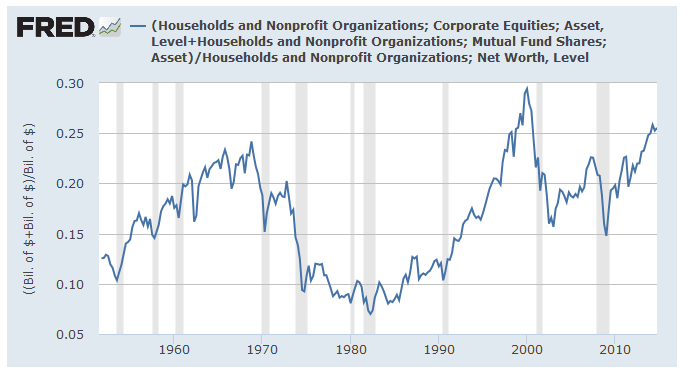

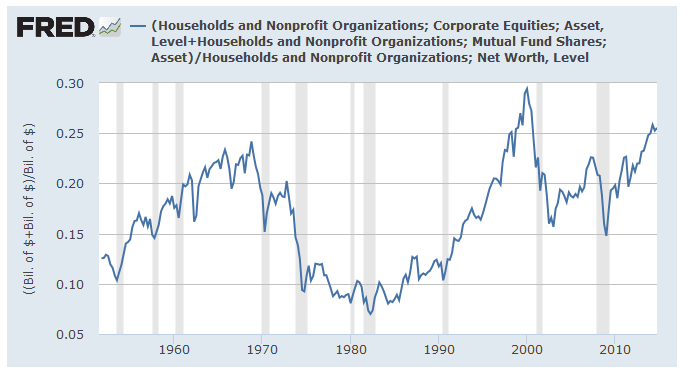

Let's face it doom'n'gloom pessimism sells. The left loves is because it's the basis for all the do-gooder gov't programs they want to fund, and the right loves it in hopes that it will somehow 'prove' what miserable failures all those do-gooder gov't programs have been. Back here in the real world the rest of us have been busy making our own lives better, we create wealth, and this talk about the fruits of our labor leads into two new areas of thought now. One is obviously the wealth-equality debate, and just what this average all time high for stock holdings means in terms of the majority of us who live on Main Street and not on Wall Street. We know that while it's for sure the average holdings are up our Bankrate friends are insisting that the masses are broke and that the lion's share of the population still views the stock market as a 'risky scheme'. Maybe, maybe not. IMHO we still need proof and the burden of said proof is on the bankrate people. Frankly I'm not impressed so far and I'll be even less impressed when some left-winger follows up with the old globalwarming saw "aw geez, he have to raise taxes 'cuz it might be true!!!" The other major area of thought we need to go through is consideration of just how significant these stock investments really are. Or aren't. The point being that savings isn't what we're living on now and that while stocks may be a fourth of our total wealth today it wasn't that long ago that it was a twelfth. America's personal net worth is more than just stocks, there's real estate, our land and homes are not stocks. Then again, there's also life insurance reserves, pension entitlements, and business equity --those are stocks. So now we've not gotten to the point now that the value of our businesses is most (54%) of our private assets. Personally, my thinking is that a thousand people sitting by their phones ready to chat about the risky scary stock market, does not impress me. They can't be representative of the same United States that came into its own in the 1800's, prevailed on the world stage in the 1900's, and the current millennium it's ah.. OK so we're not done with that one just yet..

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good Morning! Our new week begins with underachieving futures (stock indexes -0.10% and metals -.36%). Easy start tho, w/ no econ announcements; morning reading:

To: Abigail Adams

...a financial advisor for things like how much do we need to save for retirement, or do we need long-term care insurance, or for tax strategies...While paying someone for the info can be easier and faster than just getting it direct/online the two big risks are conflict (asking a barber if you need a haircut) and the problem of doing something just because it cost so much --common mistake. Everyone has their own needs but imho this info age is super; eg: retirement calculator links, msn seemed nice.

To: expat_panama

To: Abigail Adams

Back when I was first asking those very questions some 25 years ago, I began reading a magazine called Changing Times, published by Kiplinger. It is now called Kiplinger’s Personal Finance.

It is written for the novice and doesn’t talk down to its readers. It covers all the basics and has some advanced stuff.

I highly recommend it.

24

posted on

04/13/2015 7:43:20 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama; abb

Thanks for the info! I’m thinking we need to make more money. Yikes!

To: Abigail Adams

Yes, that helps. However, there are some steps that can be effective, at least from my experience.

Pay yourself first, EVERY payday. That doesn't mean depositing your entire paycheck, and then deciding how much to set aside for that pay period.

Have a set amount for savings withheld from your paycheck EVERY payday. It is a technique the Federal Government started using in 1943 to take money from taxpayers before they could get their hands on it. History shows just how effective it has been.

That "savings withholding" should be about 10% or so. If you can live on $100/day, you can live on $90/day.

26

posted on

04/13/2015 5:53:30 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

A very good morning to you! Even while stocks eased off in lite trade yesterday, (lowering the current distribution count as the rally endures) metals continue to hang on to a tight trading price range. Today's futures are mixed seeing stocks flat/off (-0.07%) and metals falling -1.06%. More econ reports today to make traders nervous--

Retail Sales

Retail Sales ex-auto

PPI

Core PPI

Business Inventories

--and in other news:

To: expat_panama; All

28

posted on

04/14/2015 10:56:09 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Huh. NASDAQ went up in higher volume (distribution: bad sign) and the S&P went up in higher volume (good sign). Meanwhile metals continue to plod. Anyway, this morning stock indexes are seen up +0.29% by futures traders who also are calling metals -0.07%. Don't know about y'all but I can live w/ this.

To: abb

Social Security benefits (means-testing)It irks me the way the leftists (even those w/ the "R") like to say that SS is not a welfare/charity, and then they turn right around and say "we need to make SS even more fair so it's not just for the 1%...."

To: expat_panama

Well, the NASDAQ is above 5000 again. Do we have escape velocity this time?

31

posted on

04/15/2015 11:18:21 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

When we're talking about individual stocks and a shorter time frame then the act of lifting up over an old high in strong volume means we're seeing the beginning of a new major advance. Thing is the NASDAQ's an index not a stock & we're talking 15 years later not say, 3 months.

My take is that we've got a lot of great HASDAQ type corps on the table.

mho...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: expat_panama; All

34

posted on

04/16/2015 12:10:09 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

A lot of the more strict Muslim countries have laws against any kind of interest charge, so the way they have bank loans is the banks ‘invest’ in you and after a fixed time you ‘buy back’ their shares at an agreed upon higher price. In function of course it’s the same as anywhere else but by the strict terminology it’s completely different. If they haven’t changed these limits then for the Saudis to have a stock exchange (with margins, short sales, a bond market) then they’ll have to be doing the same contortions throughout.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

A happy Friday to everyone; IBD (as usual) said it best: "Stocks Do Nothing Quietly; Volume Also Fades" in describing yesterdays action. Interestingly metals followed suit also with subdued price swings. This morning futures traders see the two diverging w/ metals up 0.38% and stock indexes plunging -0.83%. YIKES! Maybe I'll hide out on these threads:

Other headlines:

To: expat_panama

I made a nice chunk-o-change this first quarter via investments, so I’m not complaining. I’ve always gained, no matter what the economy, or no matter how hard Government is trying to lower even further my lower-middle class status, LOL! Diversification is the key.

Going into my busy season at work, so I’ll be racking up the Overtime, as well. (Taxes are set up that I don’t owe one more DIME than I am legally obligated, so I don’t take a ding there, either.)

One quarter closer to Retirement, Baby! Wa-Hoo! :)

37

posted on

04/17/2015 5:17:32 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Diana in Wisconsin

Great going! My plan had been to retire earlier but at the last minute my employer just ruined my sched and made it impossible. What they did was they paid me enormous piles of money to hang on for another year to the point I’d be a fool to pass up on it. What I’m saying is that in spite of all the obstacles that are thrown in our way it’s still possible to do well in this wonderful world. Complainers are often much louder than doers so thanks for your post, so nice to hear from a fellow doer.

To: expat_panama; Diana in Wisconsin

It’s always amazed me how people that work hard, invest & save, spend money wisely, and keep current in their field of endeavor, are also “lucky” when it comes to finances.

And how those who don’t do the above are “unlucky” and are always broke.

39

posted on

04/17/2015 6:39:02 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

people that work hard, invest & save, spend money wisely... ..."lucky"Yeah, I've heard that too; goes along with the idea that they should 'give back" what they've made for themselves.

Hey where am I going here? We can't give up just because the world is big enough to include some who're lazy, dishonest, and covetous. Sure, just getting around 'em is extra work, but that'll never prevent us from succeeding.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson