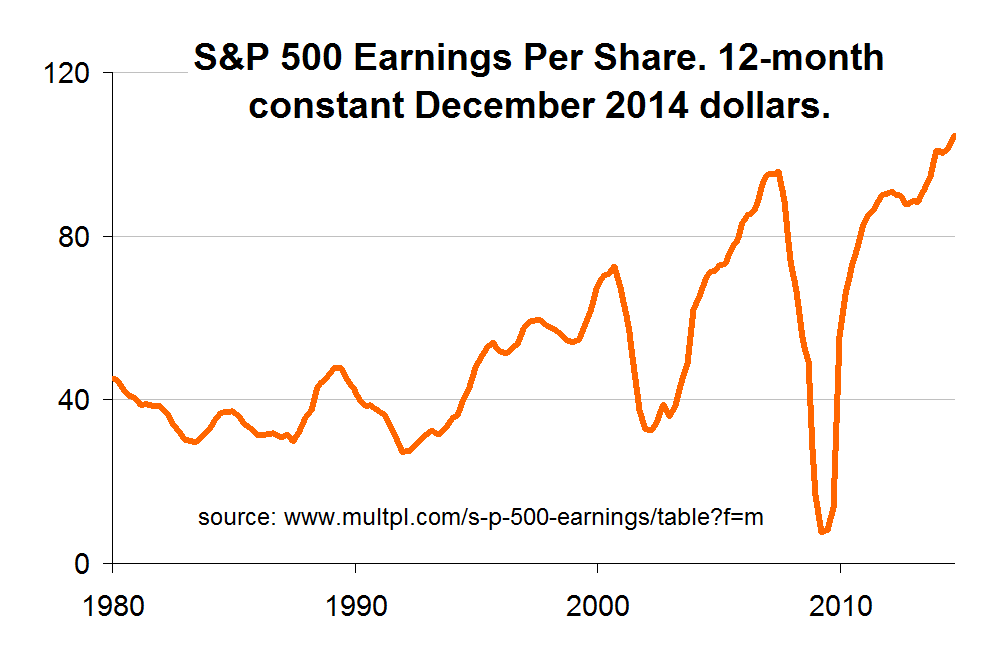

Not sure where that idea came from but let's put it to rest and have both of us agreeing that fundamentals matter and they mean things. We talked a lot about EPS's, so lets actually look at them:

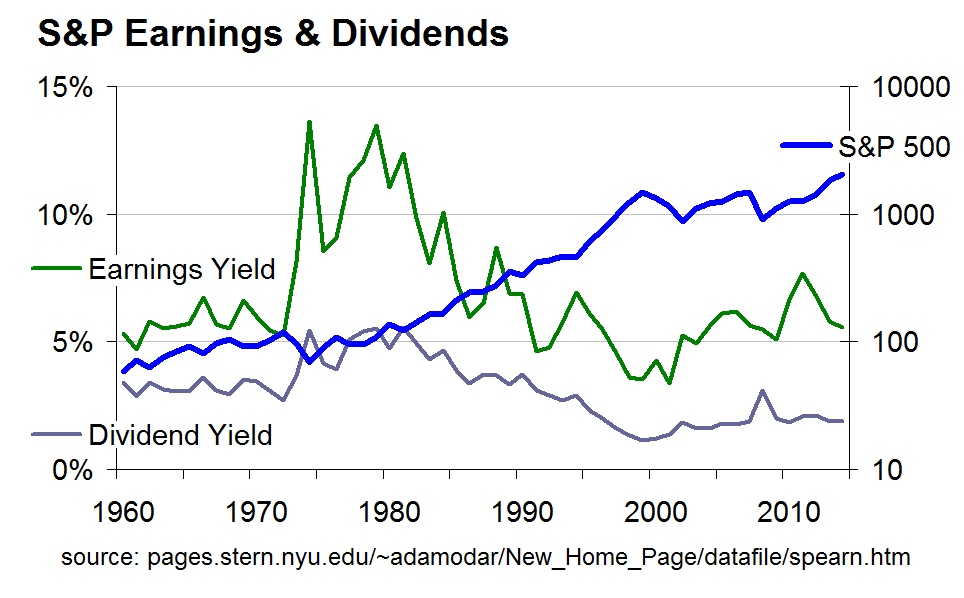

Sure they're at an all time high, just like they were in '88, '89, '93, '94, '95, '97 --the point being that as a metric it's not by itself clearly bearish. This site has 'em going back to 1870 and 'all time high' levels is the norm. Let's go the whole enchelada w/ earnings and dividends on top of share prices:

You tell me: why should we see current levels as bearish?

...This is a fed-driven market...

That line works great for pundits and politicians, but working for a living demands hard facts and numbers. The fed does not buy common stock so they can't move share prices. Loony leftists like to say the government's all powerful but in real life the Fed's small potatoes. Right now Fed banks got about $4T --mostly T-bills plus a few mortgages. Total corporate assets (from page 124 of the Flow of Funds) for non-financial businesses is $37T. The Fed --or any governmental agency for that matter-- couldn't control the free market even if it wanted to. Central planning is a lie.