Posted on 12/14/2014 7:43:31 AM PST by expat_panama

So while nobody knows the future we still need to know what to expect from the week's two big headlines, even though our view can easily (and will probably) be muddied w/ other factors. So we deal with an unknown future by checking the historical record for clues on at what the news means to our future investment returns.

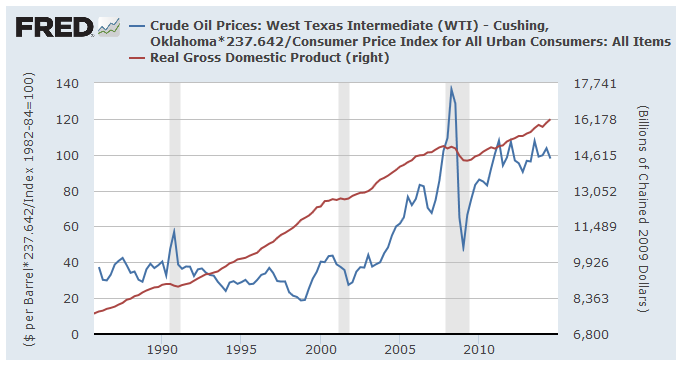

What oil bargains do: namely, what's it doing to the economy and to investments; here's what tanking oil's done in the past (ya gotta LOVE the fed's data site) and how real oil prices (2014$ per barrel) track real GDP--

[click to enlarge]

--and what we got is that it's the oil price surge that precedes a recession while crashing oil is what comes to the rescue afterword. True, there's more to econ growth than oil (wars and stuff) and sometimes econ growth can launch oil prices right back into orbit. Just the same, cyclical economic patterns come and go. We deal with it.

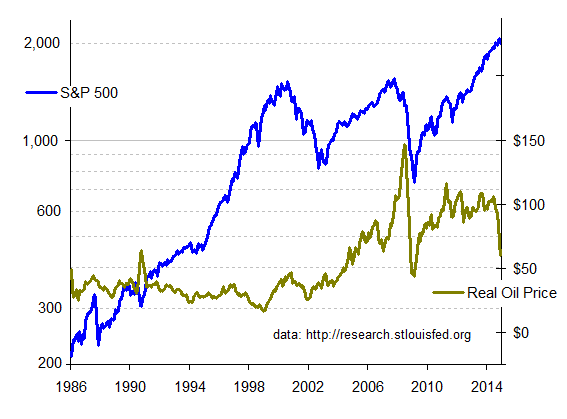

I n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

Someone please tell me if they're seeing something that I'm missing, but I believe I'm getting the same thing for stocks as w/ GDP. Namely, that a price surge is what tanks stocks and an oil price plunge (or prolonged era of low prices) does quite well thank you.

My first glance made me sing the old "...but this time is different..." tune because of how "this time" we've just been having several years of rising stock prices. My problem is that I'd been looking at this graph --with the S&P on a linear plot. In stocks we care about our gains --what percent we're doing now. A log plot shows percent increases better, so using the log plot at the right we can ask what a few years of $40 oil will do, and look at the long term oil price decline from Reagan thru Clinton. It made great gains even better.

Until the '99 oil rally that is, and then we had a dot.com bust. Still, I personally wouldn't mind another five years of super gains, even w/ another dot.com at the end.

More tax'n'spending: --and the other big headline being the fact that the House caved and gave the budget busters everything they wanted and the big question is what has this done in the past.

Answer: nothing.

OK, so why nothing? The answer is that (w/ few rare exceptions) the extreme left has controlled taxes & spending pretty much continuously for decades and that there's no way of seeing how a few years of budget restraint could have affected GDP and stocks. Sure, we know that big tax cuts (for those that remember that far back) did wonders for our personal lives and our ability to save and invest. We also know how increased investment w/ lower costs affect business activity. It might happen in the future and we can simply agree it would be great. It's not happening now, it hasn't happened before, and we're still here. We need to remember the enormous economic power of the American people and how we can build and prosper even during loooong stretches of abysmal government leadership.

In the meantime right now stocks are crashing ("market under pressure") and metals are continuing a month of solid gains. That can change.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

h/t to Lurkina.n.Learnin for asking us this question (here).

Krugman Fighting Consensus Says 2015 Fed Rate Increase Unlikely

Here in Louisiana, the talk of more gasoline taxes has popped up a few times lately, but we have statewide legislative elections next year. I doubt many will want to run for reelection on a platform of higher taxes, especially after “tax and spend” Mary Landrieu got the stuffing beat out of her.

About $70 million/year is taken out of our transportation fund (gas taxes) and given to the State Police to waste. If they talk taxes, we conservatives will point out that misappropriation of money.

1/4 of the funds from our new cap and trade are earmarked to the highspeed rail from Bakersfield to Modesto. Now you might ask Bakersfield, Modesto? Exactly.

Obviously a payoff to someone. Reckon who the recipient of the largesse is?

My understanding is Mister Dianne Feinstein stands to make a bundle.

I'm not sure this would apply to "items" across the board. The U.S. dollar was very strong back in the late 1990s when everyone and anyone was moving manufacturing to Asia. This was also right after NAFTA was pretty much fully implemented, too.

Most of the foreign money coming into this country isn't buying "items" at all. Instead, it's flowing into our capital markets in the form of stock, bond and real estate purchases.

Libya Imposes Force Majeure on 2 Oil Ports After Clashes

These sayings miss the whole point.

The idea is to buy some thing at some price and sell it soon enough --the same thing-- at a higher price soon enough. Knowing the time frame is as important as the % return because earning 19% in one month is the same as doubling your money in four months (re compounding). Knowing oil prices are down --by itself-- means little; we've got to also know how high the price is rising and how long it will take to get there. There are ways of finding this stuff out but it's a lot of work and I haven't seen anyone do it here yet.

If I could accurately predict the markets, I wouldn’t be posting from my home office now. I would be doing so from my 300’ yacht off the coast of France, or the Virgin Islands, or some such.

I doubt very many people predicted how fast and how much oil would fall these past weeks.

http://www.freerepublic.com/focus/f-news/3237183/posts

State will finally break ground in Fresno on high-speed rail construction

Fresno Bee ^ | December 12, 2014 | BY TIM SHEEHAN

Posted on 12/14/2014, 3:57:22 PM by Jim Robinson

Fine, and the effect should most likely be roughly what it's been in the past. Here are the dates of the congressional give-away dates since 2009:

January 18, 2014

September 30, 2013

March 27, 2013

April 15, 2011

December 21, 2010

September 30, 2010

September 30, 2009

We got no dates of any sane balanced budget being signed into law --therefore we can't calculate what the benefit would have been. So you tell me: based on what we got, how can we predict that the results from this slimy sell-out will be any different than all we've had over past five years?

Aw heck, we're doing just fine.

Every time we go to the supermarket we usually got a pretty good idea how much money we'll need to spend. When our kids enter the labor market we know enough to give 'em the score on why they got to show up on time and why they need to do what the boss says.

Labor market, super market, stock market, it's all the same --very few people buy the winning lotto ticket at the super market and very few make 70 million in one afternoon with the stockmarket. Nobody knows everything but most people know enough to earn a living and imho that's pretty good.

Historically, U. S. equities trend upward. I expect it to continue. The speed bumps along the way make it interesting.

by Josh Zumbrun

Dec. 14, 2014 3:04 p.m. ET

Much has changed in the U.S. economy since Federal Reserve officials last issued their economic projections, in September. Oil prices have fallen by more than one-third, the dollar has climbed 5.3% against a broad basket of currencies, and about 800,000 more Americans have found jobs.

These developments present overlapping challenges as Fed Chairwoman Janet Yellen and her central-bank colleagues wrestle with shifting fundamentals at home and mounting jitters overseas. She will hold a news conference Wednesday, after the Fed’s two-day policy meeting, to discuss the central bank’s outlook and plans going into 2015.

Falling oil prices are a boost to the U.S. consumer. But lower prices also are putting downward pressure on already low inflation, potentially moving the nation further away from the Fed’s objective of 2% annual increases in consumer prices.

If Ms. Yellen and her colleagues put more weight on the looming inflation drop, they will hold off on interest-rate increases, which are expected by mid-2015. If they put more weight on underlying economic strength, they will proceed as planned, or even accelerate their move.

The signs so far are that the Fed will proceed as planned.

snip

Thanks for the headsup on Wednesday —hope we don’t get any surprises. That piece is very well written; I may have to google “Josh Zumbrun” on a regular basis...

Dollar Ends 7-Week Gain on Oil Slump Before Fed Meeting

Hurdles Appear Higher for Next Stock Market Bounce

There Are Numerous Obstacles and Possibly More Sharp Swings

By E.S. Browning

Dec. 14, 2014 4:21 p.m. ET

This is the year of sudden tailspins.

In January, April, July and September, U.S. stocks took sharp dives, only to recover and hit new highs. Now they are diving again, with the Dow Jones Industrial Average down 3.8% last week, its worst week in three years.

Many money managers expect another rebound, but the market faces numerous obstacles and, possibly, more sharp swings.

The root cause has been similar for each selloff: soft global growth, creating trouble for investments in commodities, junk bonds and risky stocks. The selling has spilled over to the broad indexes because of investor unease that stock prices are high across the board.

The flash point this time was plunging oil prices, which hurt both stocks and junk bonds issued by energy companies. Europe’s continued growth problems made things worse.

Money managers said they saw signs of panic among short-term traders, who sent the Dow down 315 points on Friday to 17280.83, and that made many uneasy.

snip

“We got no dates of any sane balanced budget being signed into law “

Heck just having any kind of a budget will be a dramatic shift.

A bit of schadenfreude

Spanish Newspapers Want Google News Back

http://techcrunch.com/2014/12/14/spanish-newspapers-want-google-news-back/

I've lived in a midwest collage town for many years. I have seen and experienced the upturns and downturns of the economy. Until a few years ago the main drag was full of run down bars and food joints. Businesses came and went on a frequent basis. Somewhere around QE2 all that started to change. A good chunk of the strip has been bulldozed and multi-million dollar apartment complexes have been built. Are these projects viable? I don't think they are, but only time will tell..

Many things become viable at a certain price, even if that price is zero.

But if the debt is not liquidated, that is the worst of all worlds - because everyone “pretends”.....owners, borrowers and tax collectors.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.