Skip to comments.

This Week --December 11 Budget Decision; Investment & Finance Thread

Weekly investment & finance thread ^

| Dec. 7, 2014

| Freeper Investors

Posted on 12/07/2014 8:02:25 AM PST by expat_panama

Soap box time.

Even as we speak the hired help in Washington are working out how to deal with the fact that the current budget continuing resolution expires this Thursday. We got rumors galore on what they're coming up with but let's face it-- this is just not their strong point. We're in a situation where the hired help is going to need our intensive supervision. I know it's a lot of work to keep 'em in line but it's what we do.

We can google here to find your congress contact info and I found this site good for senators and this one for my house member. Congress has been hearing how the loony press wants everyone to agree w/ the loopy left on more tax'n'spending. It's our job to tell 'em we need:

- spending cuts on 'human recourses' (which gets most spending),

- personal and corporate tax cuts on both incomes and capital gains,

- borrowing limited by congress --no more 'blank checks'.

Let's remind congress:

The constitution says congress decides how much to tax and how much to spend and president is required to either comply or get nothing. If the president chooses a government shutdown then so be it. We can wait for January 6, 2015 and let the 114th congress override his veto. You must neither vote for business as usual nor even vote to restrict debate and allow others to conduct business as usual.

There simply is no more money to be spent. The BLS, the BEA, the Census Br, and the Federal Reserve have the facts and the facts speak for themselves:

- that 12 million people lost their jobs w/ the 110th congress--

- 4 million more went w/ the 111th bringing the total to 16 million job losses that have not yet been replaced,

- of those that did keep their jobs, over 3 million were demoted from full to part time work,

- the median family income has been slashed 9%,

- real per capita wealth has fallen.

The money is simply no longer there.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * *

btw, the current state of investments is fine; stocks at all time highs and precious metals continues to stabilize its 3-week base. For now.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: expat_panama; abb

21

posted on

12/10/2014 5:13:24 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Until it stops. What we know of economics is that high prices cure themselves and so do low prices. Leave the market alone and things will stabilize.

22

posted on

12/10/2014 5:47:14 AM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

I hope so. I have lost my a** on energy stocks. Already cutting back on some drilling here. With oil there are other global factors in the price than supply/demand.

To: Rusty0604

So no more “drill baby drill”???

To: Rusty0604

I attended a conference in Houston last week that had a panel discussion headed by top people from the Chamber of Commerce, American Chemical Council, and several other petrochemical industry groups...

They don’t believe global demand for oil has really dropped. They believe speculators are playing a BIG role in the current decline in stocks...

I’m not so sure. I hear from petrochemical customer around the world that “rates are reduced due to lack of demand”... some plants have even shut done for “inventory control”. Low oil prices should help spur things.... but, that takes a little time.

25

posted on

12/10/2014 7:46:29 AM PST

by

SomeCallMeTim

( The best minds are not in government. If any were, business would hire them!)

To: Wyatt's Torch

Just my opinion, but I think Saudi Arabia doesn’t like the fact that we are producing so much, and they are also trying to get Russia out of business so it can scoop up some European customers, so they are not cutting production as the market would normally demand.

To: expat_panama

Just wondering, what does this mean?

“Someone tell me they see something different but imho we’re getting lots of signs of a typical index top.”

Is it time to buy energy stocks, or are things going to go lower still?

To: Abigail Adams

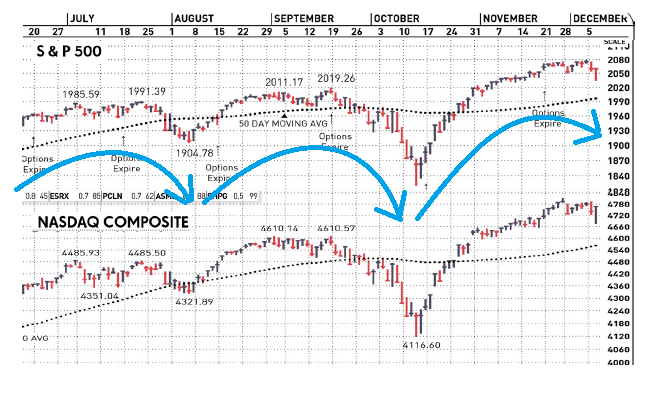

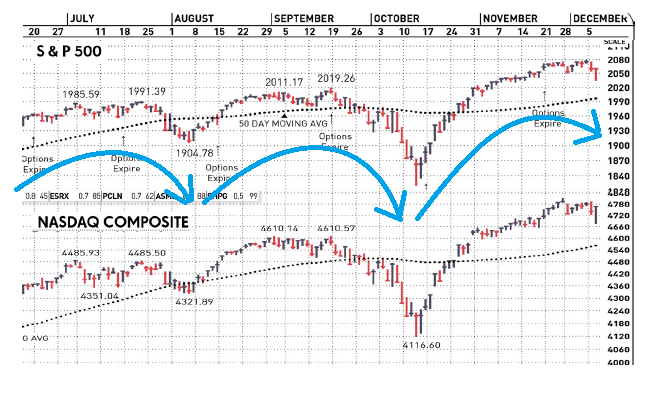

what does this mean? “Someone tell me they see something different but imho we’re getting lots of signs of a typical index top.”Yeah, that really can be taken a lot of ways. I was thinking about stock indexes, like the Standard&Poors500 or the NASDAQ and how for a while now we've been seeing a repeating pattern:

So since every 3 months or so we get that umbrella shaped bounce like, my thinking is that we were looking at just one more in a long series of market tops before the next plunge. The danger is that the human eye can often see patterns even when they're not there, so that's why I was wondering if anyone else was seeing this or was it just me.

To: Rusty0604

If exports are approved, and that depends on Obama, things should improve. What will happen eventually is demand will return. I believe that will happen post-Obama and not before.

29

posted on

12/10/2014 9:21:34 AM PST

by

1010RD

(First, Do No Harm)

To: expat_panama

Yea I been thinking this rally is getting a little long in the tooth too.

30

posted on

12/10/2014 9:39:29 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

Oh, I see. Thank you for the explanation! Looks like a pattern to me.

To: Abigail Adams

Is it time to buy energy stocks, or are things going to go lower still? This week I have been buying BP. The lower price makes the dividend yield very attractive. That said, I am fully capable of, and have the history to prove, buying too high, and selling too low. IOW, I cannot pick the exact top or bottom.

32

posted on

12/10/2014 10:09:00 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD

When we import, we pay in dollars. The exporting country spends those dollars buying our treasuries. Doesn’t Obama need that to happen to continue his spending?

To: Rusty0604

so China sends us gold & our $ go to the US treasury. Not sure why that’s a bad thing...

To: expat_panama

Still sitting on the sidelines. Late in the night I heard on the news the price of crude, high 60's I believe. The thought came to me maybe I ought to buy some Exxon. Around noon when everything seemed to be hitting the lows for the day, I couldn't remember that stock.

After closing, it came to me so I googled it; some think it might be good. I will have to do more research on it. It's at high 80's and I don't like buying stocks over $50 because it seems riskier and uses up too much of my capital for "playing" in the market. Just haven't felt like "playing" in it.

Also I have 10,000 bu of corn I don't know what to do with. I contacted someone in an ag hedge fund but then I thought I'm tired but would have to learn how to do it myself plus they would probably charge an arm and a leg to invest my money for me.

I realized when corn was $2.99 that I should have gotten someone to get some options for me only I got puts mixed up with calls. I should have bought a bunch of calls. My grain rep told me puts go down and calls go up. Is that right?

I don't like paying for storage for too long but it occurred to me that I have a commodity that has intrinsic value which would possibly be a hedge against inflation but I can't wrap my mind around that and food prices. It's terrible the prices of groceries and they are way out of sync with other sectors of the economy except possibly for meat because so many sold off their cattle during the drought 2 years back.

Corn and soybeans are forecast to stay fluctuating but around where they are now into 2020. Then I read to watch oats but forgot what the connection would be with that.

35

posted on

12/10/2014 8:17:11 PM PST

by

Aliska

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning and IBD's outlook is now officially "Market Under Pressure"! Stock indexes fell nearly 2% w/ the NY exchange in higher volume. The good news is that today's futures see a rebound and 2-1/2 hr before opening indexes are up +0.19%. Metals show a reverse image --futures down this AM after yesterday's leap. Huge day today for reports:

8:30 AM Initial Claims

8:30 AM Continuing Claims

8:30 AM Retail Sales

8:30 AM Retail Sales ex-auto

8:30 AM Export Prices ex-ag.

8:30 AM Import Prices ex-oil

10:00 AM Business Inventories

10:30 AM Natural Gas Inventories

Lurkina.n.Learnin nailed it when he said "this rally is getting a little long in the tooth" but there's lots of news/threads anyway:

To: Aliska

As a long-term investment, XOM is one of the best there is. Remember, they not only explore for oil, they refine it and market it. That is to say, they have several segments from which to add value - exploration, production, transportation, manufacturing (refining), and marketing.

It’s not like a pure play in one segment of the business only.

37

posted on

12/11/2014 4:24:18 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Plunging oil prices took a heavy toll on Wall Street Wednesday as fears of a slowdown in the energy sector sent stocks to their biggest drop in two months and pushed crude oil to a new five-year low. There are only two explanations for that link. First is that the lack of demand for oil presages a drop in production or profits that would impact equities in the near future. The second explanation is that a lot of equities are supported in some way by commodity speculation. In my mind the second explanation seems more likely although there can be a mixture. The Fed has basically promoted speculation since 2006 or 2007 with a short interlude which caused the 2008 crash.

I believe we have no chance of regaining a normal market footing until the Fed is brought back to sanity. In a sane financial world, a drop in energy prices would cause a rise in equities.

38

posted on

12/11/2014 4:39:40 AM PST

by

palmer

(Free is when you don't have to pay for nothing. Or do nothing. We want Obamanet.)

To: Aliska

--and this morning futures traders see grains soaring and meats tanking.

IBD has very little in the way of good news about Exxon Mobil Corp. (XOM), horrible earnings, poor stock performance. True, institutions are favoring Exxon relatively speaking, but that's becuase they're dumping other oil stocks more. Out of 197 industry sectors IBD ranks oil/gas down at 190.

Yuck.

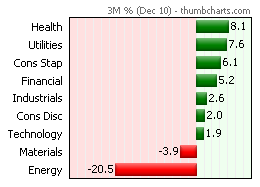

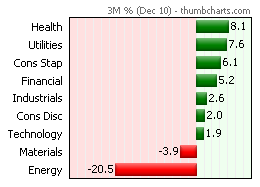

Not to worry, my thinking this AM is that in a week or two we'll see plenty of great buying opportunities in the stronger sectors, here're the returns over the past 3 months:

To: expat_panama

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson