Posted on 11/30/2014 1:24:35 PM PST by expat_panama

Once again we can say we're looking at a great time for investing! OK, so it means we wince over last Friday's metals prices, but like who does metals anyway dude, like it's soooo 2013 even. That and the general feeling we get reading stuff like Gold mining industry mostly ‘under water’ – Gold Fields CEO (h/t Chgogal).

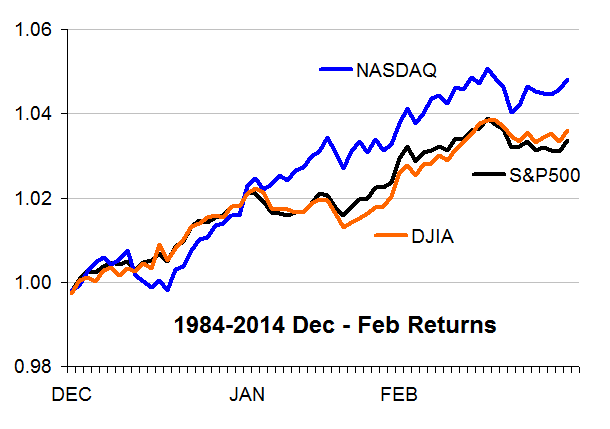

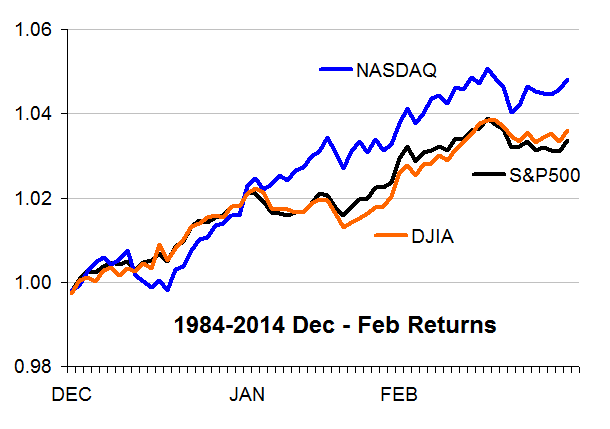

Hey, I'm talking stock market year end "window dressing"† January effect --check out the averages over the past 30 years for the Dow, S&P500, and the NASDAQ, they typically go up 3.4%, 3.6% and 4.8% respectively. On top of that these are for just 3 months and it translates to annualized returns of 15%, 14% and 21%!

Only thing we could hope for is that we're looking at an average year --problem is that the reason this time it's different is becuase it's always different. The plots on the right (click to enlarge) show how the stellar year-end trends look compared to what the 30-year extremes have been. Sure, the past 3 decades includes the 2009 Inaugaration Grand Market Crash that was in all the papers, but still we all know that we can't just buy and expect any guarantees here.

That said yours truly is cautiously moving back in w/ one hand while the other hand's holding on to the ejection seat lever. Stay calm. Remember that the new congress takes office in the latter part of Jan. and they won't be able to have any actual impact until weeks later. At the same time we know the President has already gotten middleeast-defeat, amnesty, Ferguson, and obabacare-defiance completely out of his system so that there's nothing down the pike that he might toss out that can possibly be any worse....

† "window dressing" is when institutional traders clean up their portfolios at year's end w/ pop darlings bought w/ cash from dumping the bow-wows --the idea being they want the annual report to look better.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

@JimPethokoukis Both the participation & employment rate were unchanged, while broader U-6 underemployment rate ticked down to 11.4%

An investment look at 2015 without the scare stuff, but still things we need to be aware of.

The author suggests 3 ETF’s for timid souls like me.

This is an awesome, fabulous, fantastic energy commercial by ExxonMobil. I like it because a laymen can understand the importance of energy. I think it makes it crystal clear how important and basic energy is to everyday living. Also, if know of any smart young person who is trying to figure out what to do with their life, point them to a career in the energy field.....everything from a cook on a rig, controller, pipeline engineer, to a helo pilot!

What a pitiful existence we would lead if it weren’t for the “evil” oil companies providing us with relatively cheap energy that we use at every turn of life.

Un río revuelto, ganancias para los pescadores. (That’s for you, Pete)

It’s volatility that makes fortunes!

Until it does.

Welcome back. Glad you’re better. Enjoy your weekend.

Lockheed’s fusion reactor is still a few years out!

http://www.cnbc.com/id/102243878

Hold on: Jobs report wasn’t so great after all

Here’s the contrarian view (which you never hear on FR) ;-]

I’ve seen a lot on the 4,000 from the household survey. But here’s the key phrase from the article:

“However, this follows an outsized gain of 683,000 in October and 232,000 in September, leaving the three-month moving average still up a healthy 306,000”

http://online.wsj.com/articles/16-rules-for-investors-to-live-by-1417789469

16 Rules for Investors to Live By

Our Columnist Shares a List of Fundamental—and Often Overlooked—Truths

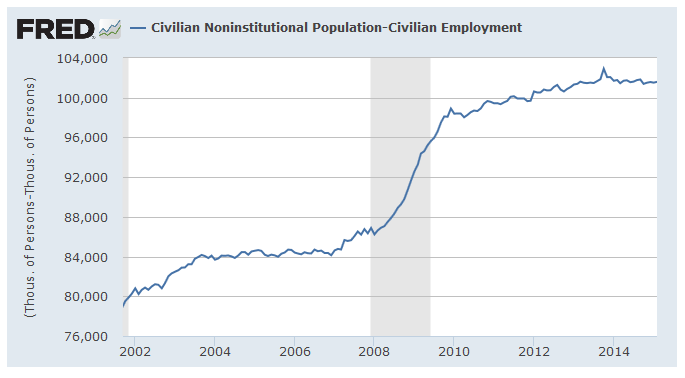

True, 306K jobs/month average will go a long way to meeting the needs of the 187K/month growth in the population and the 268K/month that were discouraged and are slowly moving back into the workforce. That said, the bottom line is that the situation is horrible --and that's good news because the fear was that things were worse than horrible.

The numbers are sobering enough with employment almost keeping up w/ population and the good news is that we're keeping what we got. The bad news is we don't want to keep what we got, we need to get back what we had six years ago when 16 million people lost their jobs and have yet to get them back--

--and 3 million of those who managed to stay on the payrolls but were cut down to part time status.

That’s a good analysis and a real opportunity for conservatives. The difference is Obama & Co.’s devastating war on commerce and productivity. Over the next two years the GOP Congress needs to send Obama a pro-growth bill a week. Ideally, targeting the states that the GOP needs to defend in 2016 so they can keep Congress.

Keep burying Obama and the Congressional Democrats. Destroy their brand and we can hold Congress for a generation of great change.

There are 92 million Americans not working. That’s an incredible waste of human potential (note I didn’t say capital - that’s a media trap).

That’s an opportunity for populist conservatism. I was just speaking to a black single mom who is barely holding it together. She has a son in college and she’s learning to be a nurse. Her words were utterly heartening:

“They want to raise the minimum wage. That’s just going to make it harder for people to get work. It will be a mess for me and my family.”

She voted for Obama, but he could be the last Democrat she votes for if conservatives play it right. Are there conservative urban blacks where you live? Meet them and work with them. We can get America back.

Hi Stu.

I understand exactly what you're doing here, but I have a question:

Why NFLX? There are several hundred stocks/etfs with weekly options. Why and how did you choose NFLX? Did you find it by pure luck or was there a method to your madness?

Just wonderin' ...

Thanks.

Also, it is highly advantageous to use moderate or lower-volatility stocks in calendar spreads generally, because of the condition that a rise in the IV of the oppies helps the trade profit. If the IVs are moderate-to-lowish to begin with, this is an advantage for the trader. Note that NFLX IVs (except near earnings) are typically low-30s, high-20s; certainly not "high" by any means.

Hope this helps, and good trading! (...and, no, I haven't found candidates other than NFLX, but I **am** looking around energetically for them.)

Looks like this week, we'll be using 347.5 as the center point of our putative range, and thus the 335 and 360 strikes for our calendar spread. Of course (note the time of this post), this datum may change by 3:00 EST...in which case the strikes will change. Always put the trade on with an hour or less remaining in the session.

Thanks for the reading recommendation!

Are you still doing the NFLX double calendar spreads? How's it been working out?

The only one available in January, by my rule, was this past week, and it was my first loser. I've let the near week expire and will hold for either 1 more hour or 1 more day, Monday (Monday being NFLX's historically most volatile day).

Overall, up approx. $7300 in 10 weeks (incl. open loss this past week).

We're into earnings season next week, and my other principal strategy kicks into high gear. Made 1K approx. on BBBY double VERTICAL (not calendar) spreads this past week. Not sure what's on tap this week; that's what Sunday afternoons are for, right?

;^)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.