Skip to comments.

Investment & Finance Thread November Rally Progress Report

Weekly investment & finance thread ^

| Nov. 23, 2014

| Freeper Investors

Posted on 11/23/2014 12:48:39 PM PST by expat_panama

Investment & Finance Thread November Rally Progress Report

Great time for investing! Gold & silver have been recovering for a couple weeks now and a stock index rally is already in it's sixth week. What's next --can it last? Pundits (as usual) are covering all sides, so anyone wanting to indulge their confirmation bias need only pick their favorite flavor op-ed:

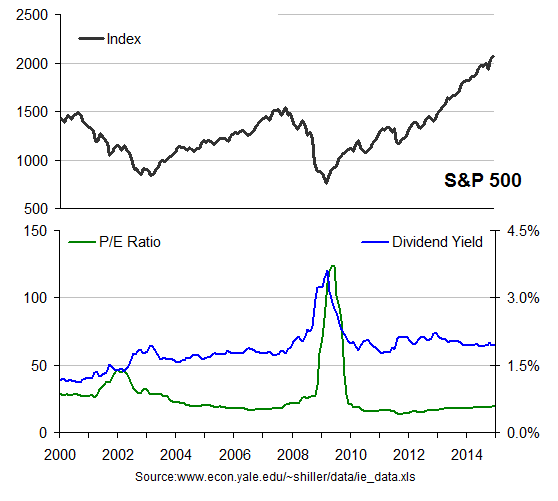

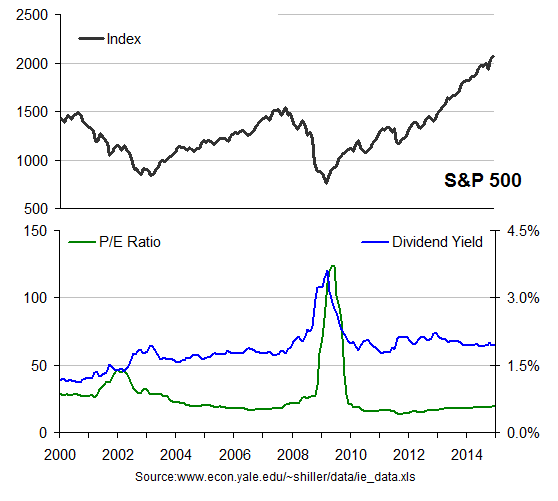

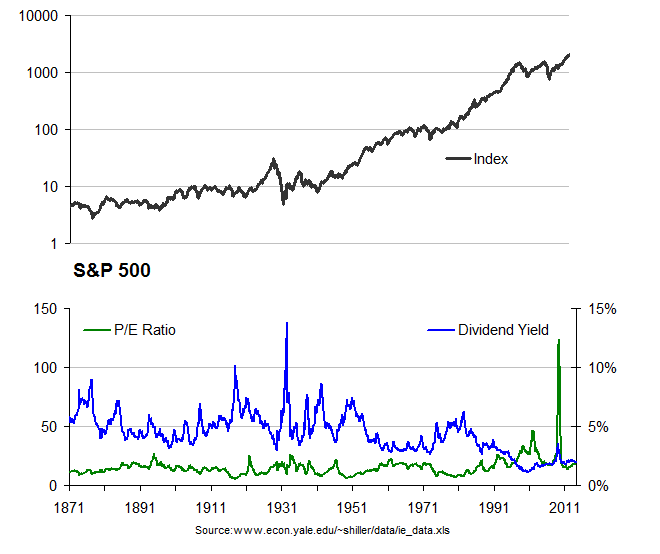

Looking at the new stock highs we want to know two things: first is the surge normal, and second is the increase out of proportion to company earnings and dividends.  So lots of folks check out the ratio gotten by dividing stock prices by their earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices to get a dividend yield percentages. Forget the pundits, they get it wrong. In fact, here's Obama saying PE's were bullish (he miss pronounced it as 'profit earnings ratio') at the very time they were spiking to an all time bearish.

So lots of folks check out the ratio gotten by dividing stock prices by their earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices to get a dividend yield percentages. Forget the pundits, they get it wrong. In fact, here's Obama saying PE's were bullish (he miss pronounced it as 'profit earnings ratio') at the very time they were spiking to an all time bearish.

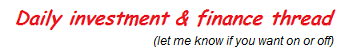

These days anyone can get stats going back over a century --here's a link to Bob Shiller's site at Yale w/ S&P valuations from 1871. A plot of the index plus PE and div yield looks like the graph on the right (click to enlarge), and going back over all the data kind of shows the idea that when stocks are cheap the PE goes down and the dividends look big. OK, some of the time they show that.

However, nobody here is managing his life savings over a 143-year time frame so lets zoom in on the past 14 years:

Doesn't matter what the pundits say, the numbers are not telling us stocks are over priced. Valuation prices are right where they were at the beginning of 2008. Bad example. They're right where they were in the beginning of 2004.

* * *

Bottom line here is that our upcoming Thanksgiving Day we can add this rally to our long list of things we're grateful for. Since the whole idea of flavoring wine w/ toast (hence "toasting") began around the time of the first Thanksgiving Day, my extended family celebration will most probably begin the meal with a shared toast "...to all that has come to pass!"

Happy Thanksgiving all!

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-47 next last

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

Happy TurkeyDay week ping!

To: expat_panama

When everything is not real and money is printed...debt balloon, I just look for bargains and such.

Compass Minerals intrigues me as cold winters needing ice melt...also SWHC is on sale guilt by association...

3

posted on

11/23/2014 12:56:12 PM PST

by

CincyRichieRich

(In Times of Universal Deceit, Telling the Truth Becomes a Revolutionary Act.)

To: expat_panama

RGR (Sturm Ruger) has dropped from $80+ to $38. It appears to have hit bottom.

4

posted on

11/23/2014 1:10:00 PM PST

by

aimhigh

(1 John 3:23)

To: aimhigh

RGR —ah, a blast from the past. Sold that one in the beginning of Dec ‘13 and it hasn’t come up on my radar since. IBD’s now rating it at a decrepit ‘14’ these days.

To: CincyRichieRich

SWHC used to look really good to me but its current quarter earnings is -60% for the year and sales last qtr is -23%. Lot of negatives there lately, tho as you say ‘by association’ the sector is currently dismal.

To: expat_panama

Gold is becoming very interesting.

Russia has been trading its falling rubles for gold, which has been rising in the past few weeks. So Russia’s been coming out ahead.

And so can everyone else, if they, too, convert their ever-decreasing currencies — as the world’s printing presses remain in overdrive — into precious metals.

If China decides to join in, happy days will be here again for gold bugs.

There’s a low-priced gold stock called Gold Resource Corporation (GORO) which pays a 3.20% dividend, which is suitable even for gold skeptics who want to earn a greater return on their money than they can get from a bank.

To: Bluestocking

China and Russia don't have to buy gold to up the price, all they need to do is stop selling it.

Top Gold Producing Countries

1. China – 355,000 kilograms

2. Australia – 270,000 kilograms

3. United States – 237,000 kilograms

4. Russia – 200,000 kilograms

To: expat_panama; All

Happy TurkeyDay week ping!Same to you. Thanks for your work/posts on FR. Best wishes to all informed FReeper investors.

9

posted on

11/23/2014 5:05:00 PM PST

by

PGalt

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

To: Wyatt's Torch; All

Two things about

US Stocks 2nd Most Overbought In History.

One is that it's awfully easy to get the impression that the blogger was lurking on this site the day before he wrote the blog. The other is that the 1871-2014 time frame is the only thing that makes today's stocks seem overpriced. I agree with him though. Anyone who thinks we are now in an investing environment that involves the Austrian empire invading Bosnia while the the Tsar rules Warsaw --that's an investor that needs to sell everything as soon as possible and take up knitting.

This is his 140 year time frame, and I like these choices better.

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

To: expat_panama

I have a hypothetical for you. Say you had a Uncle that died and left you $50,000 in stock. Your choice between AAPL,AMZN, FB, GOOG, MSFT, or TSLA. The one stipulation is that you have to leave it alone for ten years. Which would you pick? Feel free to add to that list if you think there is a better long term prospect.

13

posted on

11/25/2014 9:43:50 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Dang -one heck of a question. There’ve been sooo many names that everyone thought were eternal and invulnerable -—General Motors, Pan Am, Woolworth, Atari, Lehman Brothers, they all went bankrupt leaving shareholders w/ nothing even while a decade earlier they were all favored darlings.

To: Lurkina.n.Learnin

Last night the wife and I were watching the episode of “Downton Abby” where the Earl of Downton finds out what a mistake he’d made ten years before when he put the entire family fortune into one stock —it was a sure thing that failed while he was ignoring all the warning signs.

imho investments need to be checked regularly because the future’s never certain.

To: expat_panama

Good afternoon.

imho investments need to be checked regularly because the future’s never certain.

A wise investor will look at the performance of his assets quarterly, and "re-balance" when necessary.

Then again, if you are Hillary Clinton, and make an extremely risky bet on cattle futures, have 100x the ROI, I'd listen to her "advisors."

Spit.

5.56mm

16

posted on

11/25/2014 12:49:47 PM PST

by

M Kehoe

To: expat_panama

I agree about keeping an eye on them. I was wondering about which ones you thought most likely to grow by leaps and bounds. I debated about putting Microsoft on there but they seem to have a little fire in their belly after Balmer. Apple is hard to argue against. Amazon is an enigma. If they ever focus on making a profit it should soar. Google and Facebook seem to be branching into some pretty future orientated areas. Tesla is too if they can make it work.

17

posted on

11/25/2014 5:49:43 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

Good morning all on this busy week of anticipation/preparation --for the markets that is. Stock indexes and precious metals all inched up in tight trade and NASDAQ even punched in another 14-year high before settling back. After yesterdays solid production news we'll be flooded w/ a huge morning report stack:

MBA Mortgage Index

Initial Claims

Continuing Claims

Durable Orders

Durable Goods -ex transportation

Personal Income

Personal Spending

PCE Prices - Core

Chicago PMI

Michigan Sentiment - Final

New Home Sales

Pending Home Sales

Crude Inventories

Natural Gas Inventories |

To: M Kehoe

A wise investor will look at the performance of his assets quarterly, and "re-balance" when necessary.That can work, the idea that what's being rebalanced is between broad based diversified portfolios that are being rebalanced into different investment types --like stocks into bonds or antiques into real estate. A buddy of mine sunk the entire family inheritance into one real estate fund that only communicated w/ him thru an 'annual report'. He lost out big time when the bubble burst.

imho my friend's big mistake was like w/ the character in Downton Abby, thinking that creating wealth w/ one's capital takes any less effort than creating wealth w/ one's labor. Very foolish thinking, though it's a popular misunderstanding.

To: Lurkina.n.Learnin

Apple is hard to argue against. Amazon is an enigma. If they ever focus on making a profit it should soar. Google and Facebook Those companies are sure in the news a lot these days, Apple's now worth $700B --(imagine it becoming a TRILLION DOLLAR corp in a few years); GOOG's been buying out a NASA space station and now talking about breaking up spinning off subsidiaries. The thought of predicting a decade into the future leaves me a bit fogged over though, kind of like asking me if the Republicans will take the Whitehouse in 2024.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-47 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

So lots of folks check out the ratio gotten by dividing stock prices by their earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices to get a dividend yield percentages. Forget the pundits, they get it wrong. In fact, here's Obama saying PE's were bullish (he miss pronounced it as 'profit earnings ratio') at the very time they were spiking to an all time bearish.

So lots of folks check out the ratio gotten by dividing stock prices by their earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices to get a dividend yield percentages. Forget the pundits, they get it wrong. In fact, here's Obama saying PE's were bullish (he miss pronounced it as 'profit earnings ratio') at the very time they were spiking to an all time bearish.