Skip to comments.

It's Coming: $65 Oil {Good News / Bad News}

The Atlantic ^

| OCT 28 2014

| DEREK THOMPSON

Posted on 10/30/2014 4:47:37 AM PDT by thackney

Gas prices are falling below $3 a gallon across the United States for two big reasons: (1) the world economy is growing slower than we hoped, and (2) global oil production is improving faster than we expected.

"India and China are slowing down,” said Charles K. Ebinger, director of the Energy Security Initiative at Brookings. "The IMF just downgraded Europe’s growth to less than 1 percent, and they're already quite energy efficient. Brazil’s a problem, too. All around the world there is no great growth story, and expectations are that things will stay that way or get worse."

There is also unanticipated supply. A few years ago, political turmoil was taking up to 2 million barrels a day off the market. Now production is roaring back in Libya, southern Sudan, Yemen, Nigeria, and even Iraq, and the global price of crude has fallen about 25 percent in the last five months. It's the same old story: low demand, high supply, etc.

Andrew John Hall, the alleged "God" of oil trading, is predicting $150 barrels within the next five years. But the deeper you dig, the more reasons you find to be down on the price of oil in the near future. "Japan’s announcement that they’re starting two reactors means that there will be less oil import for Japan,” Ebinger said. Second, there are industrial shifts that are reducing oil’s share in the energy market. For example, many U.S. companies are using natural gas rather than petroleum products to power their refineries. Third, hedge funds...

(Excerpt) Read more at theatlantic.com ...

TOPICS: News/Current Events

KEYWORDS: energy; oil

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-91 next last

To: thackney

Yep, we’re pulling most of our contract now. At that price, pulling out of shale isn’t as lucrative. As long as we can buy that finite resource from our overseas enemies, I say do it, because why use our own resources when we can take theirs for just trading small amounts of money.

41

posted on

10/30/2014 5:58:39 AM PDT

by

TexasGunLover

("Either you're with us or you're with the terrorists."-- President George W. Bush)

To: Cruz_West_Paul2016

42

posted on

10/30/2014 6:02:05 AM PDT

by

urbanpovertylawcenter

(the law and poverty collide in an urban setting and sparks fly)

To: Cletus.D.Yokel

43

posted on

10/30/2014 6:04:00 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: MeneMeneTekelUpharsin

Nope, it is just another bubble. The real economic value of oil, adjusted for inflation, is closer to $40. I don’t think they will rise after the elections. I think they still have a lot further to fall actually. China, India, production, etc doesn’t matter. If you look at global supply and global demand as a hole, it has been virtually unchanged since 2002, yet the price tripled. So China and India’s gains were someone else’s loss. Demand is a zero sum game. There have certainly been short term supply shocks, but the price of oil has never recovered since Hurricane Katrina aside from a few months during the 2008 financial crisis.

To: Cletus.D.Yokel

45

posted on

10/30/2014 6:06:12 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: thackney

Yeah, that's the ticket. Magic control of the world's commodity markets. All they had to do was ask. < /sarc> More likely the regime was advised to stop interfering with energy production until after the election, and did so (kicking and screaming, of course).

46

posted on

10/30/2014 6:09:25 AM PDT

by

JimRed

(Excise the cancer before it kills us; feed & water the Tree of Liberty! TERM LIMITS NOW & FOREVER!)

To: Smokin' Joe

Things change, I recall that my family’s first TV cost about two months wages for my father. A month’s electricity back then cost about half a day’s wages for him or a little more and the programming was free once you paid for an antenna. Now anyone with a minimum wage job can buy a nice TV for a week’s pay or less but the month’s electric may cost two days pay and almost everyone is paying a cable bill that no one in the old days would have even considered paying and the programming is lousy except for the reruns of fifty year old shows.

47

posted on

10/30/2014 6:10:09 AM PDT

by

RipSawyer

(OPM is the religion of the sheeple.)

To: thackney

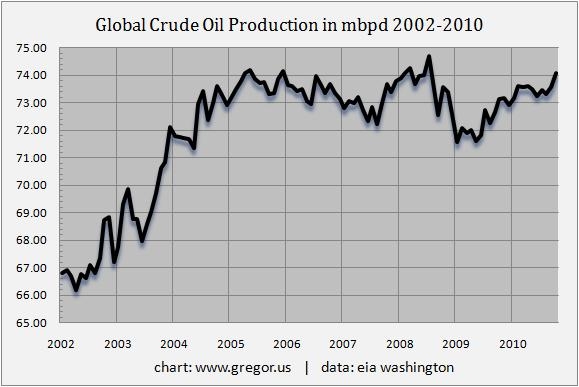

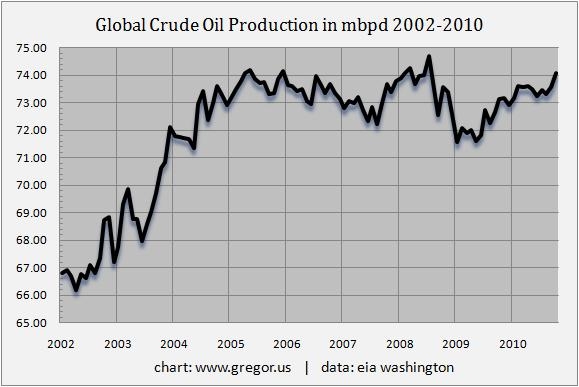

World oil demand. Between the '04 and '10 looks like it went up what 2%, yet the price tripled?

Lets look at production.

Nope, wasn't a big hit in supply that caused it either. The market has been in an artificial, derivative driven bubble since Hurricane Katrina. I was managing 7-Elevens at the time. Prices spiked from around $1.50 to over $3 and NEVER recovered.

To: wolfman23601

49

posted on

10/30/2014 6:14:11 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: randita

I have a relative who works for Chevron. They’re in full crisis mode.What did they do when oil was around $35 to $40 a barrel? I think people might start to drive much more, and the oil companies might make up some of that money, by sheer volume.

50

posted on

10/30/2014 6:14:31 AM PDT

by

Mark17

(MAs & PAs: Mugwumps, high jumps, low slumps, big bumps-don't you work as hard as you play)

To: Cruz_West_Paul2016

Great news. Everyone can afford to pump Ethyl again!

To: thackney

I meant to say 2004, not 2002. Yes, there was a spike in supply between 2002 and 2004, but prices tripled between 2004 and 2010, despite the supply and demand being almost unchanged. Fact is they never recovered from the supply shock of the 2005 hurricane season, but instead have been kept artificially high by the banking conglomerate.

To: thackney

Who was the industry ‘expert’ that said just a year or so ago that we would never see <$3 a gallon gas again?...........................

53

posted on

10/30/2014 6:22:28 AM PDT

by

Red Badger

(If you compromise with evil, you just get more evil..........................)

To: Mark17

They will have to learn how to ‘compete’ all over again....................

54

posted on

10/30/2014 6:23:16 AM PDT

by

Red Badger

(If you compromise with evil, you just get more evil..........................)

To: MeneMeneTekelUpharsin

I’m not sure about that...

is there anyone that equates “democrats” with “lower gas prices”?

55

posted on

10/30/2014 6:24:01 AM PDT

by

MrB

(The difference between a Humanist and a Satanist - the latter admits whom he's working for)

To: wolfman23601

Wells are not magic machines that produce the same amount forever. And the days of finding cheap easy oil have been over for a while.

Cost to produce has gone up greatly. They are not drilling 2 mile long horizontals in tight formations with +30 fracking stages, nor $8~10 billion deepwater platforms just for fun.

56

posted on

10/30/2014 6:25:40 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: Red Badger

Predictions are real tough in a market that is greatly influenced not only by supply/demand, but politics, wars, environmentalists, weather...

Anyone who claims to be sure of future prices, and doesn’t use Bill Gates to polish his shoes, should be considered suspect in his writing.

57

posted on

10/30/2014 6:28:02 AM PDT

by

thackney

(life is fragile, handle with prayer.)

To: randita

To: randita

“I have a relative who works for Chevron. They’re in full crisis mode.”

The Saudis are hoping that’s true.

59

posted on

10/30/2014 6:42:41 AM PDT

by

ryan71

(The Partisans)

To: wolfman23601

they never recovered from the supply shock of the 2005 hurricane season, Do you understand just how much prices moved up and down since then?

60

posted on

10/30/2014 6:45:28 AM PDT

by

thackney

(life is fragile, handle with prayer.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-91 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Lets look at production.

Lets look at production.  Nope, wasn't a big hit in supply that caused it either. The market has been in an artificial, derivative driven bubble since Hurricane Katrina. I was managing 7-Elevens at the time. Prices spiked from around $1.50 to over $3 and NEVER recovered.

Nope, wasn't a big hit in supply that caused it either. The market has been in an artificial, derivative driven bubble since Hurricane Katrina. I was managing 7-Elevens at the time. Prices spiked from around $1.50 to over $3 and NEVER recovered.