Posted on 10/26/2014 7:02:25 PM PDT by blam

By Michael Snyder

October 26th, 2014

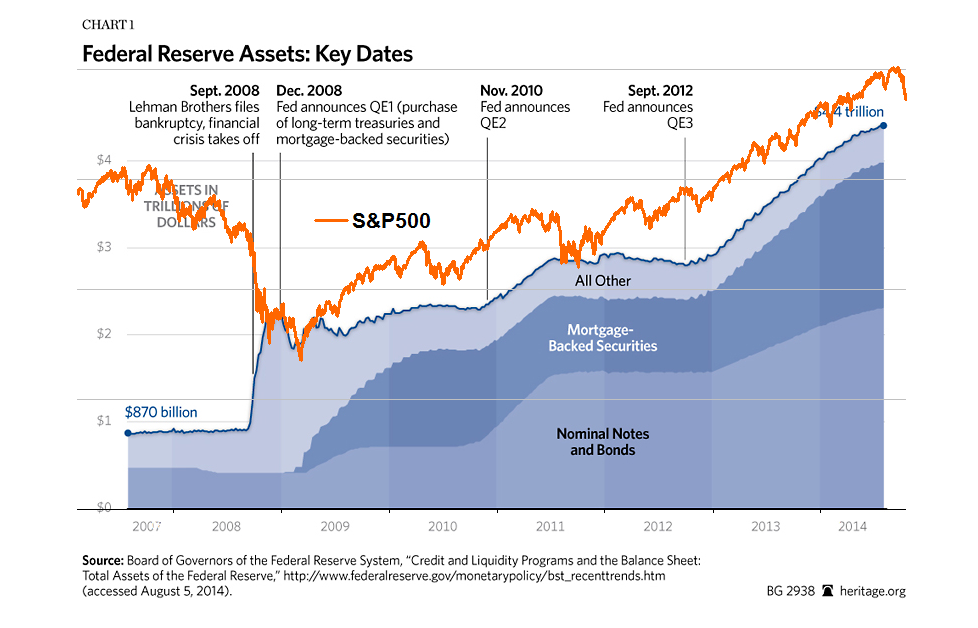

It is widely expected that the Federal Reserve is going to announce the end of quantitative easing this week. Will this represent a major turning point for the stock market? As you will see below, since 2008 stocks have risen dramatically throughout every stage of quantitative easing. But when the various phases of quantitative easing have ended, stocks have always responded by declining substantially. The only thing that caused stocks to eventually start rising again was a new round of quantitative easing. So what will happen this time? That is a very good question. What we do know is that the the performance of the stock market has become completely divorced from economic reality, and in recent weeks there have been signs of market turmoil that we have not seen in years. Could the end of quantitative easing be the thing that finally pushes the financial markets over the edge?

After all this time, many Americans still don't understand what quantitative easing actually is. Since the end of 2008, the Federal Reserve has injected approximately 3.5 trillion dollars into the financial system. Of course the Federal Reserve didn't actually have 3.5 trillion dollars. The Fed created all of this money out of thin air and used it to buy government bonds and mortgage-backed securities.

If that sounds like "cheating" to you, that is because it is cheating. If you or I tried to print money, we would be put in prison. When the Federal Reserve does it, it is called "economic stimulus".

But the overall economy has not been helped much at all. If you doubt this, just look at these charts.

(snip)

(snip)

(Excerpt) Read more at theeconomiccollapseblog.com ...

cheaper fuel prices will counteract it

Interest rates can’t be allowed to go up to any meaningful extent for long-suffering savers due to inability on the part of government to service their own debt at that level of interest. Combine that with a history of fairly strong corrections whenever QE has ceased, and it’s fairly clear to me that they’re stuck with it.

The banking system can't shed these funds.

They never bought that much.

Only if less than 2.5 trillion is considered close to 4 trillion.

Yup our first black presidents term is almost up... He has damaged the democrat name and once again republicans are poised to take over, time to stop propping up the economy, so republicans get blamed for the economy crashing again.

Bullspit.

After the market tanks, they will tell the ignorant masses that the market tanked as a reaction to the prospective Republican Senate.

I just read the Fed report you linked...just out of curiosity.....do you believe the figures they post?...there is only one way to do books...it is called a one-write system...three columns ...credit / debit / balance when Federal reserve prints $ at any time and then put out any figures it sees fit ...who is able to verify? Don’t get me wrong I I understand the complexity of our monetary system (sometimes)...but the old saying is “if you can’t dazzle em’ with your brilliance...baffle em’ with bullshit” I feel the FED relies on the tail end of that saying.

I thought the market already had its decline.

The Fed's checked us all into "Hotel California"..

"Last thing I remember, I was Running for the door I had to find the passage back To the place I was before 'relax,' said the night man, We are programmed to receive. You can checkout any time you like, But you can never leave!"

“I won’t end voluntarily... it’ll end when our money’s worth the same as a scrap of Scott’s paper towel.”

Are you preparing now, doing now what you will wish you would have done, when this happens?

I understand the incentive to under report inflation. I understand the incentive to under report unemployment.

What would the Fed under/over report and why?

lol!!! The market place is where adults earn a living so they can feed their families. The Economic Collapse is where kids play and pretend to be adults; and while the little darlings fantasize about how QE is rigging the market, none of them actually does any real life trading. In fact, I don't think they're even allowed sharp objects but I digress. Here's what's really going on--

--which means when the Fed buys, sometimes stocks go up, sometimes down, and sometimes stocks do nothing. Mean while, doom'n'gloom fed-bashers will complain about the rigged markets and adults will continue to work for a living.

Hey....there’s my ol buddy todsternotsopatriot. The guy with all the answers and loves the charts like ol Ross Perot. How the heck are ya?

iirc that's either from Thomas Paine or Boyd Crowder.

Fed’s $4 Trillion Holdings to Boost Growth Beyond End of QE.

> As the Federal Reserve prepares to end its third round of bond buying next week, the central bank plans to hang on to the record $4.48 trillion balance sheet it has accumulated since announcing the first round of purchases in November 2008.

Math makes you cry?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.