Skip to comments.

The dangers of deflation The pendulum swings to the pit

The Economist ^

| Oct 25th 2014

| [editors]

Posted on 10/23/2014 10:43:12 AM PDT by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 last

To: 1010RD

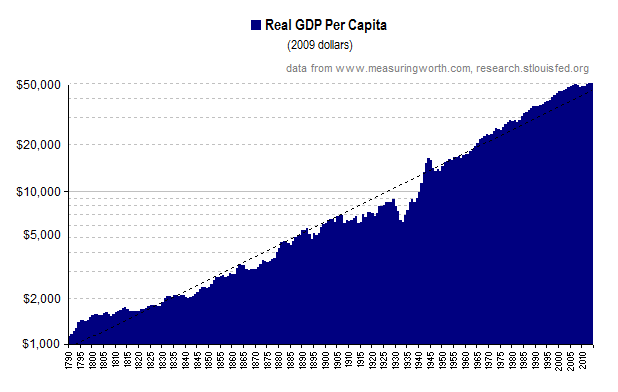

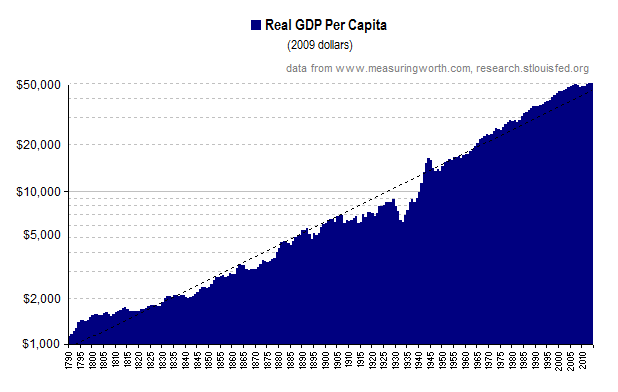

The Long Depression is proof positive that we don’t need the Fed.There are some who like that era so much they'd argue we don't need airplanes, penicillin, or internet either. To each his own, but most people prefer the modern age. Sure, there was a lot of romance to the era of the wild west, but actual records show that while the western states were really not all that lawless, the nation as a whole was not all that economically stable and prosperous either:

Even a 140 years later the era is controversial and the NBER folks still maintain that the Oct. '73 to Mar '79 stretch was a contraction. That may be because of the big hit wage growth took (and it wasn't helped by deflation), or it might be because of sub-par production. Regardless, the U.S. may have had a couple more spurts of below average growth left in it--

--but by '06 Chase & Morgan told the president that they were neither interested nor able to keep up the old 'bail-out-America' routine that the feds were depending on. Moving over from Morgan-Chase money to Fed money took a couple decades but since the FMOC in the '30's and monetary policy defined in the '40's we've been enjoying faster and more dependable growth than the bad old '1800's.

To: expat_panama

You know I love the modern world. Don’t be facetious. It’s tedious and distracting. I believe you are mis-measuring. What’s the cause of the deflation?

For instance, is it the fact that Rockefeller was able to lower the prices of oil distillates like kerosene over and over again? In 1865 a gallon of kerosene cost 58 cents. By 1880 a gallon cost only 9 cents.

Deflation doesn’t necessarily hurt savers, producers or even workers. If labor pricing falls 25%, but so do prices, net/net workers are just as well off as before the deflation. Arguing for a managed economy isn’t an improvement. It is enabling government abuse via confiscatory taxation/regulation and debt.

What’s the driver of deflation? How did they get growth and deflation? A lot of the evidence points toward improving productivity. Volatility and creative destruction are the hallmarks of a free market. We want innovation. Government controlled economies end up with markets skewed by regulatory capture in favor of big business. Your chart of “inflation” isn’t measuring real contraction given the fact that GDP/capita growth continued. Keep in mind that we experienced massive immigration during the same time pushing labor pricing down.

This time period is also one of broad industrialization in the US. I think productivity gains explain much of the so-called deflation. Productivity gains are the good form of deflation.

The Fed has missed again and again starting with the Great Depression. Its actions benefit the creditor class and big government, the two main clients of the Fed. I’m not a goldbug, but the Fed isn’t independent.

Here we have a period of very low to negative inflation driven by productivity gains and rising per capita GDP. What’s not ideal about that?

An a logical analyst of what is and isn’t you shouldn’t be so casually dismissive. We know that central planning doesn’t work for fiscal or regulatory policy. Why should monetary policy be different?

82

posted on

10/27/2014 5:10:32 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

You know I love the modern world...Please understand that there are some very dear folks I chat w/ that scorn the modern world and insist that everyone was better off living as primative hunter/gatherers. They tell me this on the interent --I kid you not. I'm very glad you're not into that stuff tho your aversion to modern monetary policy does puzzle me.

Don’t be facetious. It’s tedious and distracting...

Please also take me at face value. This text mode is difficult in that we're deprived of the wink'n'nod of real life chats. otoh, we do have some advantages here --in the mean time I'm wishing there was some way to convey my sincere respect, tho I'll confess that my people skills are not as sharp as other folks on these threads.

Deflation doesn’t necessarily hurt savers, producers or even workers...

We agree that it's possible to imagine a situation where prices fall and it's good, maybe we can agree that we can imagine situations where it's bad too. That's where we go to the historical record and see if deflation's been associated w/ what we like or not. Of course, we need to also agree on what we like. I like increasing gdp, increasing employment/population ratios, increasing incomes, and low changes in prices from one year to the next. We got records of most of those things. If it would make any difference we could run a regression analysis to see if or how strong the correlation is --although it's only worth the effort if you're interested in the results too.

To: expat_panama

The belief that money made tomorrow will be worth less than money today stymies investment The author writes this confused statement, erroneously believing himself to be describing deflation. Deflation stymies investment because the reward for sitting on cash is greater than investing in assets that will lose monetary value. Idle cash increases in value in deflation in direct proportion to assets losing monetary value. Idle cash is increasingly valuable because it is in comparatively short supply. It's worth more so it takes less cash to buy a given asset, service or goods.

Returning yet again to the author's garbled attempt at defining deflation, he actually is describing inflation. Prices going up in aggregate means the money itself is worth less. More money is required to purchase the same asset, service or goods. Therefore, there is every incentive to spend and convert cash that is losing value into assets that are maintaining their value. This offers the illusion of "appreciation," when in fact a diluted currency just does not buy as much as before. There are too many dollars chasing too few assets, services or goods.

Inflation or deflation is first and foremost a direct effect of increasing or decreasing the money supply. Yes, there is so-called "cost-push" inflation, but that is seldom sufficient standalone to move the needle. It would need to be approaching crisis level shortage with a severe price shock in order to qualify as a truly inflationary event. For instance, the oil embargo of 1973. That was an inflationary event, it was an induced shortage that was widespread leading to massive price increases with severe economic consequence.

To: expat_panama

OK, thanks for the clarification. I believe in the truth. If it leads to the Fed is the best thing we have going for us, so be it. If not, then we need to examine that and work for change. So we’re discussing “modern monetary policy”. What is that exactly?

The reason I ask is that definitions are important. We saw that problem earlier in defining inflation - a monetary phenomenon causing a general increase in prices aka too many dollars (or other nominal currency) chasing too few goods.

My point is that I’m a free marketer and that goes along with my other beliefs, driven by personal experience and knowledge of history. I love liberty, but hate anarchy. My experience is that human beings do spontaneously order their lives. I experienced that as a kid when we organized our own games without a single adult influence or observer. We were our own referees and designed games with objective rules, strict standards and they worked very well.

I’ve observed this directly in business where trust is critical and miscommunication kills deals and trust. This spontaneity is driven by self-interest. The kids who wanted to play figured out the rules that made the game fun. Those that didn’t undermined the process and were expelled or they conformed of their own free will and choice.

We both recognize the benefits of free trade between individuals regardless of their national origins, location, skin color, et al. We both recognize that government has a role to play - a nation of laws, good objective laws that lay out the playing field. We don’t want fraud, we need a fair and objective judicial system founded on the right to contract and private property. Commerce is deceptively simple and can get quite entangled as we’ve seen recently and throughout America’s history.

What causes that entanglement? Usually, individuals can resolve these entanglements via contract (some are poorly written and end up in front of a judge who can make it worse) and clear property rights. What entanglements usually cannot be resolved? Those in which government uses force to play the game. Take a look at the market problems in America and you’ll find some government policy skewing the market in an unnatural direction.

Is the Fed doing that? I think it very well is, given my previous experience with life and direct observation of government intervention in the markets in which I work. The argument that the Fed benefits us flies in the face of that. It is a very socialistic position. It is an extraordinary claim and deserves extraordinary proof.

For the Fed to be good for what we would call the General Welfare - that is no bias for or against a segment of our nation - it would have to be peopled by prescient angels as third parties, disinterested in the results and wholly objective. I don’t have any example of that outside of liberal/progressive/Marxist theory. I reject liberalism due to my direct experience with it (Chicago Ill-Annoy is where I live). This, not some Jekyll Island conspiracy theory, is what causes me to question the Fed.

They missed both the Great Depression and now the Great Recession. Why are they so good? Why can’t markets set interest rates?

85

posted on

10/28/2014 4:26:28 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

86

posted on

10/28/2014 4:27:58 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

Lots of definitions around, but we can say "monetary" means money-stuff, and it's governments job to create and

"regulate the value thereof", and since the 1940's we've come to say that the tax'n'spending part is fiscal policy and not monetary policy. That leaves--

- the size of the money supply

- dollar's value

- having a healthy banking system.

The big difference between with that stuff in the 1800's and now happened in the 1930's when banks got insured and the dollar's value got moved over to consumer purchases and off precious metals. Another big change that came in was swearing off deflation. That happened in '33. Back in '13 when the fed was created nothing much happened w/ monetary policy which changed little in the decade before to the decade after. Modern monetary policy has nothing to do w/ charging interest and creating money out of nothing. That's been going on for thousands of years --it's as old as money itself.

Question is where do we want MP to take us? Fewer bank failures. Stable prices from year to year. We still together?

To: 1010RD

"...95% of people in Vietnam agree that most people are better off under capitalism, even if there is inequality. By contrast, only 70% of Americans believe the same thing."Whooaaa....

To: expat_panama

Question is where do we want MP to take us? Fewer bank failures. Stable prices from year to year. We still together?No we're not together. Apply everything you said above but replace bank with business and stable prices to the stock market. I believe in the free market.

How can anyone know how many or few banks should fail? How can anyone know what the "stable" price is? You're calling for central planning via the Fed's monetary policy. The Fed is Big Government. Why would you trust them?

89

posted on

10/29/2014 4:04:52 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

...replace bank with business and stable prices to the stock market... ...You're calling for central planning...I'd love to take the credit but we went thru this back in post 87 in how it's government's job to create money and "regulate the value thereof". For me it's not a question of whether the government should regulate the dollar's value but how the gov't should regulate the dollar.

Most money is created using banks, we need money to live, so I'm voting for a congress that has banks making the amount of money necessary for $100 to buy roughly the same amount of food, clothing, and shelter than it did the week before. I'm still guessing we're really still together on this but if not then it's good we've been able to identify the root of our differences.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson