--and a happy Monday morning to all! While futures traders may be seeing most commodiites falling (grains are down a percent) they got metals up a tenth and stock indexes are up two tenths of a percent. Can't wait for the day to begin --no major econ reports today, I mean, what could possibly go wrong now?

- Reuters World stocks advance on strong data, earnings Global stocks climbed on Monday, with strong U.S. MSCI's broadest index of Asia-Pacific shares outside Japan surged 1.2 percent overnight as an upbeat survey of U.S. "Calm returns after last week's roller-coaster ride," Saxo Bank trader Andrea Tueni said. Japan's $1.2 trillion Government Pension Investment

- Could Another Sell-Off Be Lurking This Week? Last week's tumultuous week in the stock market sets the stage for yet more nervousness and hand-wringing as a fresh set of earnings and economic data are due to be released. Money

- Why health insurance companies are doomed Massive political contributions notwithstanding, competition among health systems and pressure to reduce costs will put an end to health insurers as we know them. Fortune

- China's Banks Are Getting Ready For A Debt Implosion Chinese banks are seeing the writing on the... Business Insider

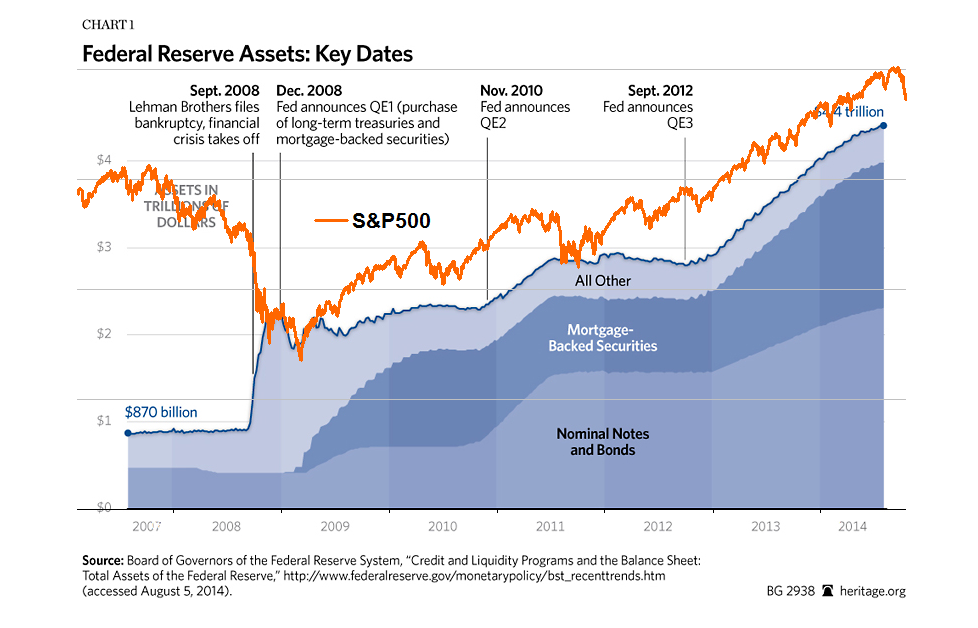

- Markets Point To a Fed Unequal To Its Task - Reuven Brenner, Asia Times