To: abb

Maybe. The bigger issue is whether these companies are profitable on their own, or if they are only profitable because they operate in an environment marked by “crony capitalism” and business activity under government mandate.

9 posted on

10/13/2014 4:18:01 AM PDT by

Alberta's Child

("The ship be sinking.")

To: Alberta's Child

This is in no way an effort to make excuses for Big Government, or Crony Capitalism, or any other such thing. I’m as much a Free Enterprise type as much as any other FReeper. And I will continue to do all within my power on a local, state, and federal level to reduce the size and scope of government. For example, tomorrow night I will spend four hours at a county commission meeting covering what happens and reporting on it.

But we still have to deal with money, markets and life in general as it comes. Investors have to learn to deal with what’s out there, instead of sitting on cash and whining about .5% interest rates. And conservatives cannot sulk in a cave and refuse to participate.

When you sit on your hands, they’ve won.

14 posted on

10/13/2014 4:29:18 AM PDT by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Alberta's Child; abb; ryan71

Are any of these companies we see every day worth more than twice what they were 6 years ago? No.are they making more or less money than they were six years ago

are profitable on their own, or if they are only profitable because they operate in an environment marked by “crony capitalism”

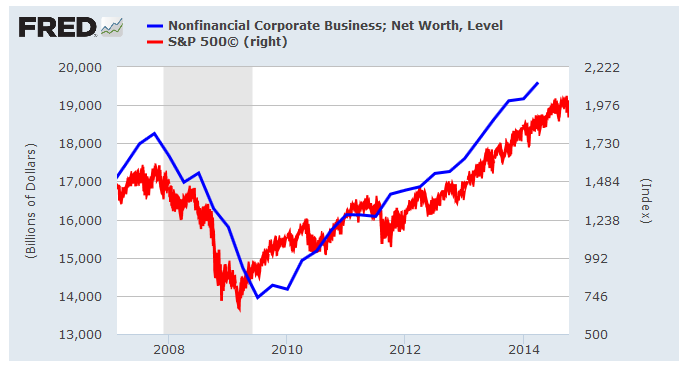

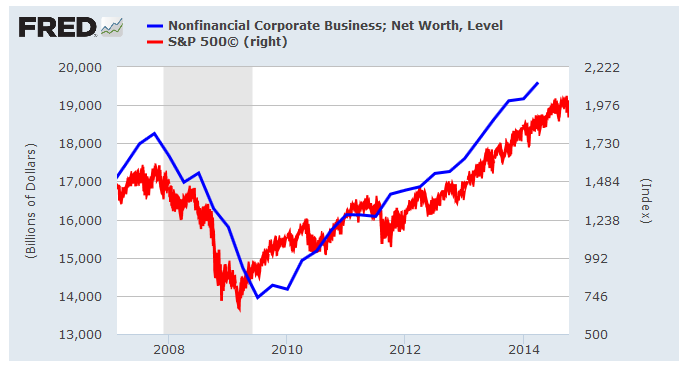

Don't know which "these companies" y'all are talking about but here's the total net worth of all non-bank U.S. corps along w/ the S&P 500:

U.S. companies are worth just over seven percent what they were seven years ago --that's a one percent annual growth rate. The S&P500 index is part company value and investor profit, and it's had an average yearly growth at 3%. That's fair, especially considering we got corp values plus the 2% dividend yield. Then again, if everyone wants to talk about the 40% gains since the '09 inauguration then we need to decide whether that drop made sense.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson