Skip to comments.

Investment & Finance Thread (Labor Day week edition)

Weekly investment & finance thread ^

| Aug. 29, 2014

| Freeper Investors

Posted on 08/30/2014 3:08:28 PM PDT by expat_panama

This morning looking in today's Real Clear MarketsGet I got a real kick out of this link that appeared : Kick Off Labor Day Weekend With Some Depressing Charts - Quartz.

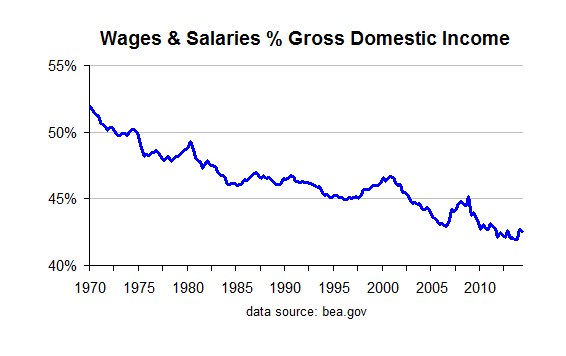

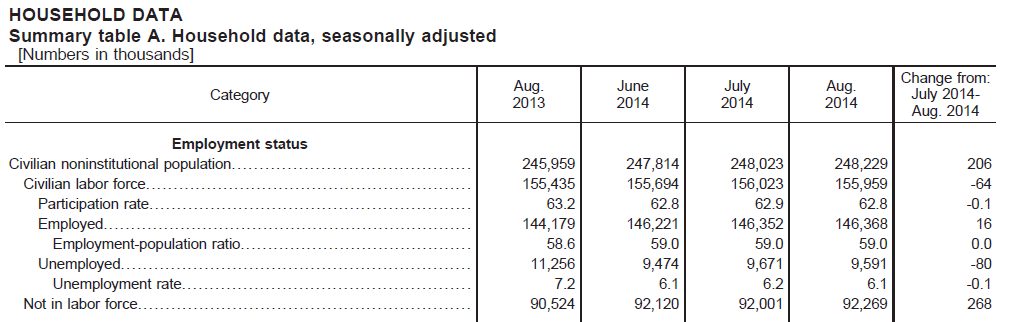

What the Quartz guys were wetting their pants over was how employee pay % total Gross Domestic Income was falling. Here's a plot of the numbers they stole from the American Tax Payer supported BEA.gov: (Note: Freepers can't post Quartz articles because of an alleged copyright complaint) |

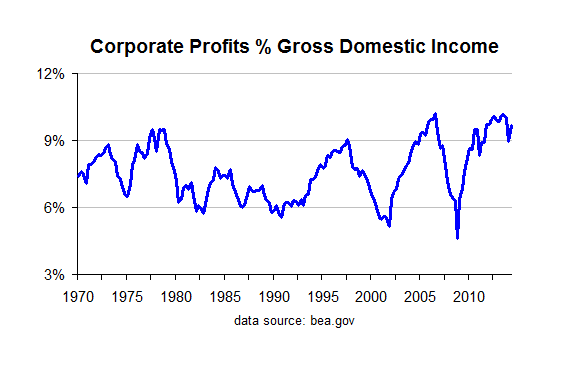

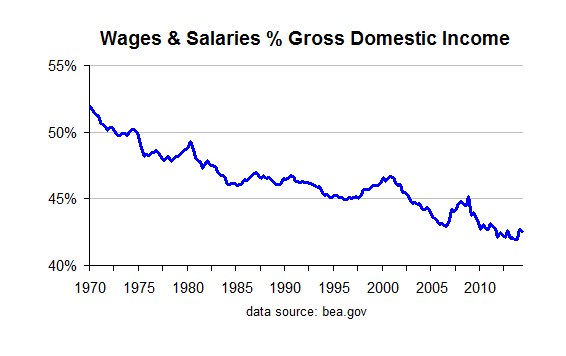

Apparently what's really got them upset is that the evil capitalist is exploiting the American Worker and the the share for evil corporate profits was climbing --here're the numbers the plagiarized from the BEA to 'prove' their point'. OK, like everyone's probably guessed, they left out a lot. One thing is the fact that-- |

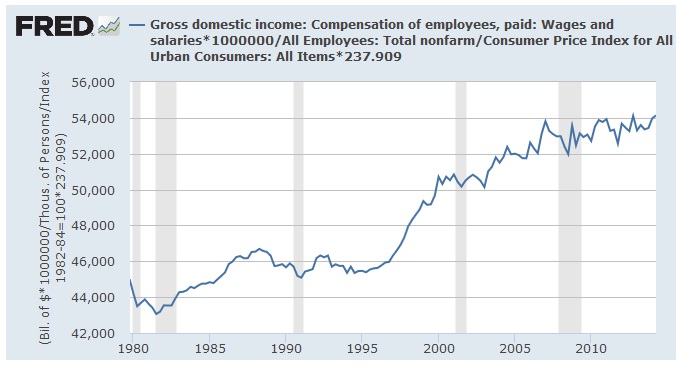

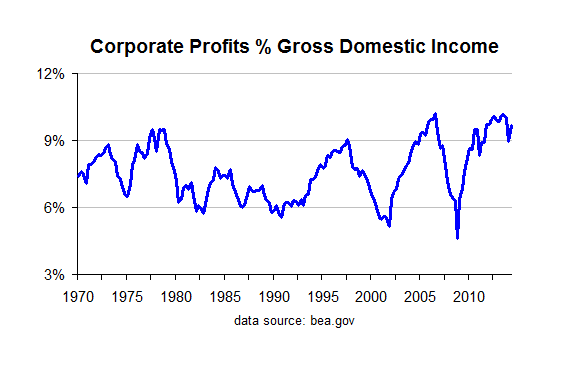

---total employee compensation per worker is at an all time high, even after adjusting for inflation. FWIW, the % plot at the top only showed wages and salaries, not total comp like this one does. Over the years employees have been getting and ever increasing % of their pay as benefits --obamacare etc.. |

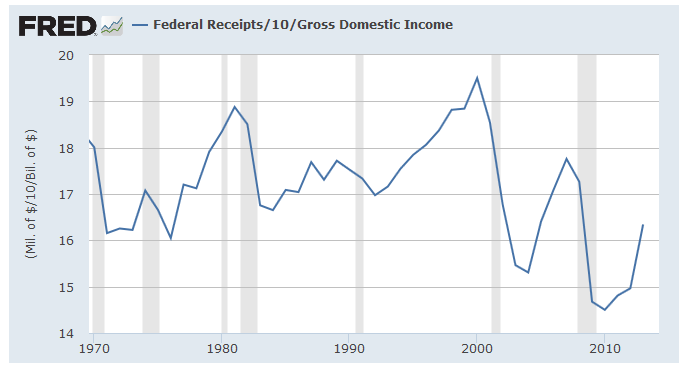

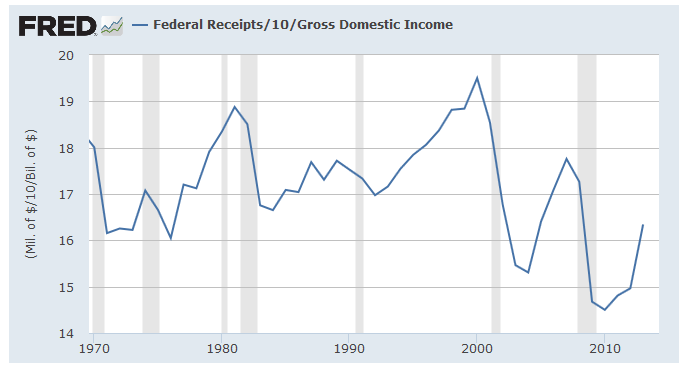

One other thing we ought to keep in mind while we ponder relative percents of the pie, namely the slice that the federal government's gobbling up. Looking at those numbers it seems that the good news is that it's been going down since the turn of Y2K, though lately we're seeing a rebound. Let's hope the Nov. elections help there. Almost forgot; the evil corporate profit %'s shown above that were used in the Quartz op-ed was based on profits before taxes. The real world after tax profit numbers are much smaller... |

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: expat_panama

To: expat_panama

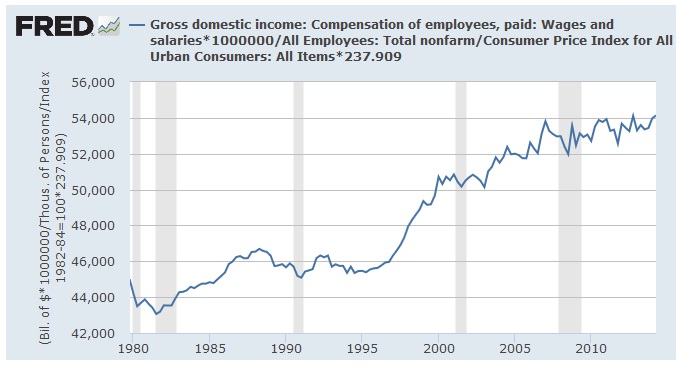

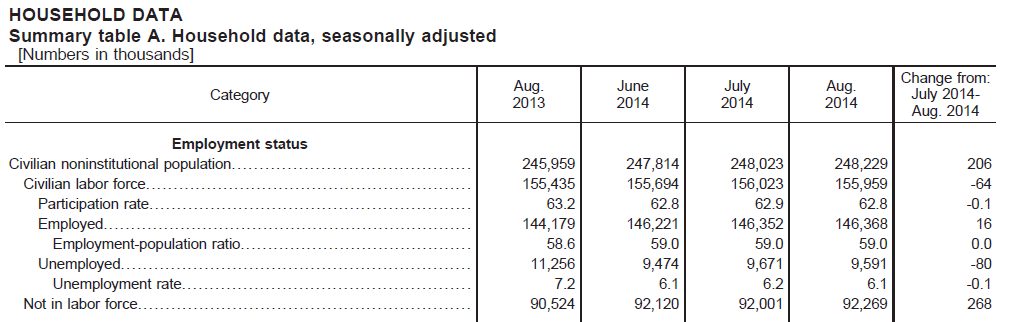

Worst print of 2014 - participation rate fell so U3 declined. This is a bad report so put it on that side of the ledger :-)

To: expat_panama

The sheer tonnage that the RRs move is phenomenal. The future will have to put their thinking cap on to replace that icon of the past.

63

posted on

09/05/2014 5:36:21 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

To: expat_panama

To: expat_panama

August jobless rate for people 25+ with

Bachelor’s degree or more: 3.2%

Some college: 5.4%

High school grads: 6.2%

No h.s. diploma: 9.1%

To: Wyatt's Torch

Futures traders liked the 6.1 unemployment rate and ignored the 268 increase in "Not in labor force".

To: expat_panama

No we are in a “bad news is good news” phase...

To: Wyatt's Torch

To: expat_panama

To: Wyatt's Torch

BLS Chartapalooza: whoa, a number geek's garden of delights!

re- 15.Unemployment rates for adult men, adult women, and teenagers + 17.Unemployment rates for persons 25 years and older by educational attainment: What you & I would see is that women and degreed workers fared much better during the crisis than did everyone else. I'm expecting some pundit to take the same data and post headlines like: "BLS admits recovery hardest on women and degreed workers as unemployment for everyone else falls much faster..."

re- 18.Persons not in the labor force who want a job: With the definitions they're using it's looking like the recession only saw an increase of a million. So when we look at the total not working it means that w/ the '08 election 15 million employees suddenly decided that they did not want a job any more. Believe it or not I've actually had liberals try to tell me that --I kid you not!

To: expat_panama

1) I did see several charts during the financial crisis of it being a

"mancession" 2) Small data set but I have a few friends who have relatives that have said, "why would I want to work when I'm getting all this stuff for free?"

To: Wyatt's Torch

Small data set but... ..."why would I want to work when I'm getting all this stuff for free?" There're ample data showing a broad based general shift in American culture; check out post #15 the way Ameircans have changed their source of financial support. From 2006 to 2009 we saw 4% go from wages to gov't assistance --it had been static for three decades following a similar shift in the late 1960's.

Even so, this 4% cultural change would not explain the 16 million increase in the "not-employed" working age population that we're seeing in the raw data. My take is we got left-wing misrepresentation of bls research.

To: All

...direct from the fwiw dept.:

To: expat_panama

Interesting. I wondered why WV was at 5.1. I thought coal was on the decline. I found this.

“

While coal production is certainly on a downswing, the past six months have seen a bump over last year because of the bitterly cold winter that required a lot more coal for utilities to keep homes warm. But when it comes to the natural gas side of the energy sector, Deskins explained there is a huge boon happening in the state as companies are extracting gas from the Marcellus and Utica shale formations.

That certainly lends to the overall health of the economy, he explained.

“Natural gas is the huge driver in this index,” Deskins said. “There’s a growth of more than 20 percent in the last year — nothing else is even close to that

“It’s a big boost to our state,” he said. “Last year our state had the third-fastest growth in GDP among all of the states, mostly driven by the natural gas boon.”

http://www.timeswv.com/news/article_e2ec5c5c-33fe-11e4-accf-001a4bcf887a.html

75

posted on

09/05/2014 1:37:19 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch; expat_panama

I’m in Chicago. It’s a mess.

Home Prices Rising Slightly

by John Burns

John explains on Fox Business News what our team is seeing:

Strength in the markets where foreign buyers are active

Weakness in the entry level, where potential buyers have almost $1 trillion more in student debt than they did one decade ago

Some overpriced situations such as San Francisco, where prices have risen much faster than incomes and the housing cost / income ratio is much higher than norm. Nonetheless, John is expecting prices to keep appreciating there this year because demand continues to exceed supply, even at these prices.

Some huge submarket differences such as Chicago, where our local office leader says downtown is doing fine and the distant suburbs are extremely soft

John was surprised to hear from the reporter that government officials believe we are having a robust housing recovery. We were having one, but it is a flattish recovery now. If there is a message to be communicated to those in DC, it is that the focus needs to be on continued job and wage growth, and better clarity for the banks on mortgage underwriting. That is what we need to get back to—— a normal level of 800K new home sales per year, which is almost double where we are at right now.

76

posted on

09/05/2014 1:52:40 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD; Chgogal

in Chicago. It’s a mess.My daughter & family live in the 'burbs; I was born there & I always dream of moving back. Maybe I'll be happy w/ visiting often...

To: Lurkina.n.Learnin

wondered why WV was at 5.1.Maybe because it's got such a tiny economy and it only needed an increase of $3B to make that 5.1%. Contrast that to Texas whose economy expanded by $49B -- and that 'only' comes up to +3.7%...

To: expat_panama

Or nearly double California’s number. If California were Texas’ competitor in the marketplace (it is), you’d be firing your CEO and top management in CA and hiring Texans right now.

79

posted on

09/06/2014 6:51:48 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama; 1010RD

Some huge submarket differences such as Chicago, where our local office leader says downtown is doing find and the distant suburbs are extremely soft I live in the city proper just 1.5 blocks from Da Mayor Rahmbo. Property values increased about 10% in the second quarter. Got four new neighbors. Now, nothing is moving. The market is dead. In April one of my doggie neighbors got a cash offer for their 100 yr. old Victorian - $1.5 million. They took the offer and ran to the Lincoln Square neighborhood.

My daughter & family live in the ‘burbs; I was born there & I always dream of moving back. Maybe I'll be happy w/ visiting often...

Promises, promises! ; ) When you do come our way, I expect a Ping at the very least!

80

posted on

09/06/2014 9:12:13 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson