Skip to comments.

Investment & Finance Thread (week July 27 - August 2 edition)

Weekly investment & finance thread ^

| July 27, 2014

| Freeper Investors

Posted on 07/27/2014 10:28:41 AM PDT by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-102 next last

To: Wyatt's Torch; expat_panama

The question is can it (or will it) given the Obamacare impact which has to be real. We might very well have seen a permanent level change in part-time jobs because if it. That's one of my many worries. The long term policies of this administration are uncompetitive vis a vis the rest of the world.

His energy policy which is exchanging our cheapest and most plentiful fuel for fuel choices that are five times more expensive will hurt residential customers with massive increases to their electric bill hurting the poorer amongst us. It will be a double whammy for residential customers by increasing production costs for the products they buy. I won't get into the operational problems that eliminating 40% of a very sound fuel source and replacing it with wind farms and solar energy. Replacing coal with natural gas isn't bad, but you better be damn sure you have the pipeline capacity in place.

His health care bill really is ridiculous on so many levels.

His tax policies are bad.

His belief in government handouts and government dependency does not promote a healthy work ethic.

I depressed myself. Back to Ebola news.

81

posted on

07/31/2014 3:17:07 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama; Wyatt's Torch

That’s only going to happen post-Obama. The next POTUS is going to be our greatest simply by returning the tax and regulatory regime back to the unacceptable levels they were at under GW Bush.

It will be the most important election since Reagan and we need a Gov/Gov ticket. I like Perry/Walker. They’re not perfect, but no candidate is and, Perot back then and Herman Cain recently, political naïfs are just pure trouble. You have to understand how government works and how the executive and legislative interact along with the political risks of judicial decisions. Too many TEA Partiers are not ready for prime time.

Perry’s not responsible for Texas’ success, but he’s a product of a political machine that supports that kind of pro-commerce attitude. He’s from the most dynamic, fastest growing state in the union.

Walker’s a brilliant blue state politician. Wisconsin is a blue state and the fact that he won there and keeps on winning despite that says a lot. He’s extremely savvy and astute. He understands how government works and picks his battles with the keen eye of a master strategist. He’s a Sun Tzu of political acumen.

They’d make a great team and Walker would be able to do what Bush I didn’t, win two terms. We need 16 straight years of GOP control to clear out Obama’s mess - judges, executive appointments, etc.

Opinions?

82

posted on

07/31/2014 3:33:09 PM PDT

by

1010RD

(First, Do No Harm)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Happy Friday Everyone!!

We got super buying opportunities in stocks yesterday and our futures pals are telling us to expect even lower prices today. Interesting note in stocks is that market leaders did well and IBD still has the situation rated "market under pressure" where the yellow light means 'proceed w/ caution'. Another point is that distribution days are only at 6 for the NASDAQ and 5 for the S&P500. Fine. Still, yesterday's volume went ballistic and all indexes are on or though their 50day moving averages. Metals were up a tad yesterday but futures are pegging them lower today also --along w/ most everything.

But wait, there's more; today's reports:

Nonfarm Payrolls

Nonfarm Private Payrolls

Unemployment Rate

Hourly Earnings

Average Workweek

Personal Income

Personal Spending

PCE Prices - Core

Michigan Sentiment - Final

ISM Index

Construction Spending

Auto Sales

Truck Sales

Too much news today --everyone's invited to click Google Market Summary, Townhall Finance, Yahoo Finance, and Real Clear Markets while go hide under my bed.

To: 1010RD

The hope is that in another half dozen years it'll climb to expansion levels. only going to happen post-Obama.

Or more precisely, post-Obama-voter; then again, much would have been different if everyone that voted for McCain had voted for Romney. Personally I'm a bit at a loss to figure out what could turn folks around because the results of these decisions take so long to feedback into active consequences, and the immature personality is always ready to blame others for failure. What confuses things more is that so many of us are struggling to build things back up while the left tears it down.

The good news is that if we made it through the New Deal then we can survive this.

To: expat_panama

When you have the time and the spirit moves can you (and anyone) post your theory how the Federal Reverse created so much money the last few years (since Obama took office actually and in the months prior) without major crazy inflation. Though we are beginning to see it in food and real estate in selected areas like San Fransisco and NYC. And of course it has been inflating the stock market since the low point of winter 2009 when Sands inc (las Vegas) was at $5 and today is at $73.25 http://www.marketwatch.com/investing/stock/lvs

Some stocks deserve the higher prices since winter 2009 but many are higher/much higher dues to Federal Reverse machinations. Illusory prosperity in my book.

Apple which sells world wide would be less of a case. Its higher price is more deserved because sales in Japan, Europe, worldwide are not as much due (directly at least) to Federal Reverse money printing via bond buying. Others are in the same category as Apple.

85

posted on

08/01/2014 4:55:39 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: dennisw

“And of course it has been inflating the stock market since the low point of winter 2009 when Sands inc (las Vegas) was at $5 and today is at $73.25 “

That peaked at around $140 before the crash. So now it is about half way back.

86

posted on

08/01/2014 5:24:31 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: All

Anybody looking at buying at this time? I actually sold some yesterday. I locked in profits on MOBL and will play with it when it comes back down. Stocks I will monitor are GE, CELG, GILD and SO. I hate to catch a falling knife but if they get into my price range I will be tempted. I don’t want to get too heavy in one sector and I already have ARWR in bio but GILD and CELG are solid and mine is a spec.

87

posted on

08/01/2014 5:41:27 AM PDT

by

BipolarBob

(It wasn't me, it was my clone.)

To: 1010RD

“They’d make a great team and Walker would be able to do what Bush I didn’t, win two terms. We need 16 straight years of GOP control to clear out Obama’s mess - judges, executive appointments, etc.

Opinions?”

While there is still a lot of work to be done in Wisconsin, if Walker grooms another no-lose Republican to fill his void, y’all can have him.

I don’t know a whole lot about Governor Perry - some here aren’t crazy about him, but I like your line of thought...

Love My Gov! :)

88

posted on

08/01/2014 6:15:49 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Lurkina.n.Learnin

89

posted on

08/01/2014 6:18:18 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: Diana in Wisconsin

Send a clone south, asap.

90

posted on

08/01/2014 7:41:16 AM PDT

by

1010RD

(First, Do No Harm)

To: BipolarBob

Anybody looking at buying at this time? We're sitting on about 21% cash right now - not really on purpose, more because we got out of a few things a while ago and just haven't re-invested. We're heavy in stocks, so investment wisdom says to buy bonds, but that' hard to do when interest rates are so low. I guess we'll review things this weekend and maybe take action Monday. Gee, I wish I had a crystal ball!

91

posted on

08/01/2014 9:31:03 AM PDT

by

ConstantSkeptic

(Be careful about preconceptions)

To: expat_panama

92

posted on

08/01/2014 9:58:30 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: dennisw; Wyatt's Torch; 1010RD; All

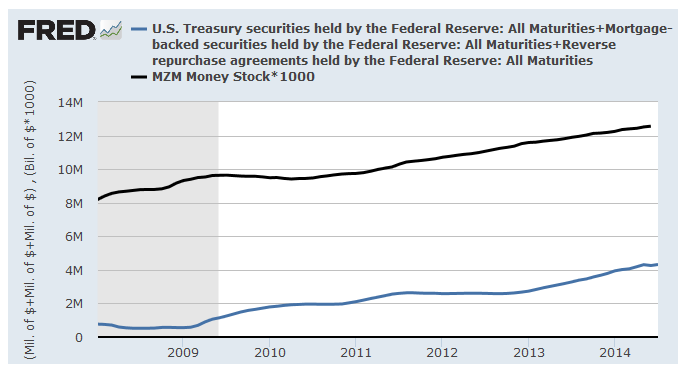

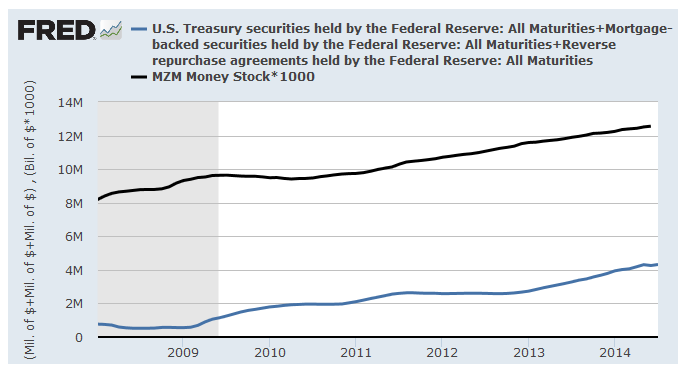

"...post your theory how the Federal Reverse created so much money the last few years (since Obama took office actually and in the months prior) without major crazy inflation." Whoa, I'm sure glad I took the time to try and explain it, 'cause I found out that what I was going to say was totally wrong. Thing is that usually almost all money is created by banks, not the Fed. Back in the end of '08 the total money supply was $9.3T and of that less than $0.6T of it had been created by the Fed printing money to buy U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements. Since then the money supply's increased by $3.2T even while the Fed has poured $3.8T into the economy buying up debt.

That's big news. Every single bit of the expansion of the U.S. money supply has been thanks to the Fed. That also means that without the Fed's intervention the money supply would have collaped and the black hole of deflation would have swallowed America.

Someone tell me what I'm missing...

To: expat_panama; dennisw; Wyatt's Torch; 1010RD

I think you and WT know that I’m not against deflation. Productivity improvements across an economy can cause deflation. That’s a good thing. We’re told that deflation is a bad thing, but the history of deflation in the US allowed resets of price levels to their proper market level as bubbles released their malevolence across the economy. Growth slows, goes heavily negative, cash holders and the prudent start snatching up bargains and the economy restarts.

Today we have permanent contract debt. The FED’s tools are very clumsy and limited. It’s like driving in the back seat using string tied to the steering wheel and a cane to push the accelerator and break. But, the FED isn’t alone in the car. There’s a driver called Fiscal Policy and it has two brains - the President and the Congress. They always grab the wheel and push the accelerator because that’s what politicians do.

Worse still, different parts of the economy are in different stages of the business cycle and those can be affected by local, county, and state level fiscal policies. It’s a mess. Much more resetting of debt needed to take place, particularly in RE. Many more banks needed to be taken over and/or closed, but they needed to be replaced by new banks. Capital is the life blood of an economy and it comes in the form of cash (or equivalents) and loans.

Focusing on people “underwater” is like just using your rear sight to hit a target. A majority of homes still cannot generate enough wealth to invite a sale and a purchase of a replacement home. Those people are trapped, despite no longer being “underwater”. The cost of selling and then buying new keeps them in place. Exacerbating a labor market skills mismatch. People struggle to move to where jobs are.

Toss in Democratcare and, as I believe WT has commented recently, you have permanently altered the labor market in the United States. It is a major driver of PT work. Worse, Obama and Co. are trying to play smart by reducing the number of hours considered for insurance eligible work. It used to be that FT was 40 hours plus. Now IIRC it is 29.5, but since Obama is writing the rules on the fly it could be as low as 25 hours. This will simply create less work by driving part timers under the threshold.

It’s a mess when government interferes in the market. I don’t see how they’ll ever withdraw, although I have an idea it could happen via applying Wickard v. Filburn to local, county and state laws that interfere with interstate commerce. I mean if wheat grown for personal consumption affects IC, then what government reg doesn’t? It could form a mean weapon... if only I could get standing.

That’s my two cents.

Wickard for reference: http://en.wikipedia.org/wiki/Wickard_v._Filburn

94

posted on

08/01/2014 1:56:50 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

I totally agree with you. Betting against America is a losers bet. If we take Congress, even with all its RINOs, we hold Obama back, force him to reduce his insane policies and get a GOP Governor/Governor ticket elected in 2016.

A growing economy and money in people’s pockets and you can run things for a long time. There is a permanent disruption in the MSM and I’ve noticed it in how the Clintons cannot get ahead of the media. Every lie is laid bare, every misstep recorded and amplified. The media find it hard to lie. Everybody is watching and fact checking.

If Obama had grown the economy on average post-recession, Democrats and Hillary would be utterly safe. But then they wouldn’t be Democrats and Obama wouldn’t be a Cook County Democrat, the worst of them all. It’s like watching someone murder themselves, slowly.

95

posted on

08/01/2014 2:04:11 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama; Wyatt's Torch

If it would just settle at 100 we’d all be fine.

I suspect that if the three of us were buying and selling stocks in Paris circa 1720 or tulip bulbs in Holland circa 1630s it wouldn’t phase us. Manias are as natural as greed. Nothing new under the sun.

http://biblehub.com/isaiah/29-14.htm

96

posted on

08/01/2014 2:08:43 PM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

We’re told that deflation is a bad thing, but the history of deflation in the US allowed resets of price levels to their proper market level...Some how this is sounding like a converstion we've already gone through though I may be confused here, but most people's history shows pricing resets from deflation coming with an enormous destruction of wealth and unspeakable human suffering. There are many folks on these threads that don't see it, and everyone has all the facts available on line to see for themselves. My experience in sharing what we all got is that when someone falls in love w/ deflation they fall madly and deeply.

Wickard for reference: http://en.wikipedia.org/wiki/Wickard_v._Filburn

The Court decided that Filburn's wheat growing activities reduced the amount of wheat he would buy for chicken feed on the open market, and because wheat was traded nationally, Filburn's production of more wheat than he was allotted was affecting interstate commerce. Thus, Filburn's production could be regulated by the federal government.

Truly amazing! That logic could be applied without any logical limit; a couple wanting to have one child could be told that the amount of children they have affects the amount of food and clothing they'd need to buy on the open market...

To: expat_panama

Whoa, I'm sure glad I took the time to try and explain it, 'cause I found out that what I was going to say was totally wrong. Thing is that usually almost all money is created by banks, not the Fed. Back in the end of '08 the total money supply was $9.3T and of that less than $0.6T of it had been created by the Fed printing money to buy U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements. Since then the money supply's increased by $3.2T even while the Fed has poured $3.8T into the economy buying up debt. Roughly speaking, since 2009 the US money supply has increased only as much as the Federal Reserve has been printing money via buying U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements

Before 2009 the FR had much less (.6 trillion) Federal securities on its balance sheet. This was the normal way of doing things which we are way beyond by now.

98

posted on

08/01/2014 5:45:53 PM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: Wyatt's Torch

Considering AAPL is 12X FCF while GOOG is 19X, AMZN in 144X, NFLX is 268X then it’s really pretty cheap...Maybe among it's peers. However, AAPL is two product failures away from a corporate entity that may be we worth really 10% of it's present value. Back in late '90's and early 00's, I smartly avoided the technology sector. The sector is awash in risk.

99

posted on

08/02/2014 2:12:24 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: dennisw

Before 2009 the FR had much less (.6 trillion) Federal securities on its balance sheet. This was the normal way of doing things which we are way beyond by now. My thinking is that the problem isn't the Fed expanding the money supply. The problem is that the American people aren't. We need to get the patient breathing again, not simply remove life support. Our question is why money's not being created; maybe we could check the numbers on loans because it's credit that creates money. Somehow I'd thought there was no problem there.

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-102 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson