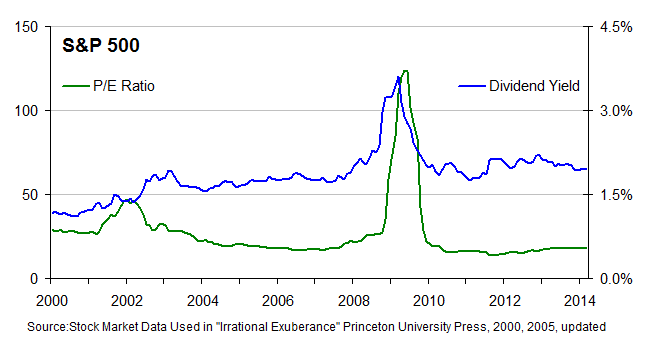

- The price-to-earnings, or P/E, ratio for stocks was among the highest decile of reported values since 1881;

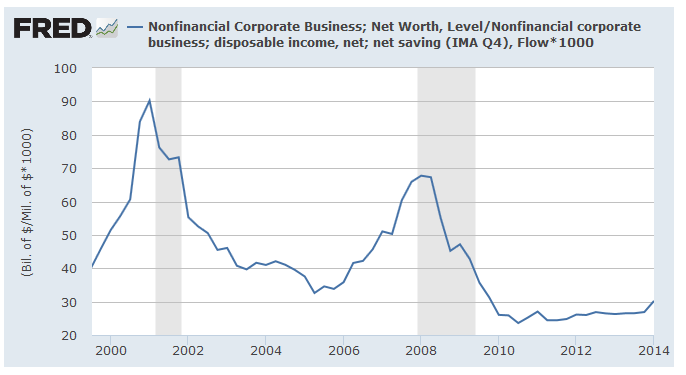

- The market capitalization of U.S. stocks as a fraction of our economic output was at its highest since the record set in 2000;

Here are the PE ratios (along w/ dividend yields) for the S&P 500 from Princeton---

---and here's the total U.S. market cap divided by total US corp profits:

IMHO the numbers just don't support Fisher's claims. FWIW, the phrase "irrational exuberance" is how Sir Alan described stocks in the mid-'90's. When the dot-com bubble finally did come up a half decade later, his big worry by then was (I swear I'm not making this up) Y2K!!