Posted on 04/06/2014 11:34:34 AM PDT by expat_panama

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well.

Keywords: financial, WallStreet, stockmarket.

|

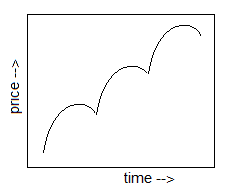

====================== A heck of a week, gold'n'silver lept back up and stocks plunged back down --10 year performance: (click pic to enlarge

Of course, while that's all well and good for what's been happening til now (telling us what we shudda done) but the plan we need now is for what we're supposed to do tomorrow. IBD TV mentions that last Friday's drop means the market's officially in a correction now, and they say it means we got to reduce holdings and show patience with new buys. |

|

Makes sense considering that stock price patterns are typically self-similar (English translation: "the trend is your friend"), but for the heck of it I checked out past IBD trend calls and saw that recent history showed--

---that correction beginnings have been great buying opportunities. Don't get me wrong, the IBD people aren't idiots and stock timing is not best done by throwing darts at a colander. The IBD editors stress that everyone's got his own set of goals for return risk/v/reward, and we all make our own choices.

|

Let's compare choices; I'll start. My choice is see what Monday brings and my stocks will either work for me or get replaced by EFT's (YAHOO's got a neat eft finder/screener here).

That said...you can learn a lot from IBD.

I suppose it depends on where you are...and what you need.

I personally buy info from a P & F guy....and L Bros. That's it..

I trade fairly often....and that works for me.

Learned a lot from McNeil though.....

Good luck....

Excellent and well said, but I am not a believer in the cloud, yet.

I feel sure you aren’t accusing the fed of withholding blood...... ;-)

Thanks. I took them up on their free trial. I got the digital + weekly print. On the west coast out in the sticks so the paper version would be lucky to be here two days late.

Interesting, and maybe this could actually help things in the short run. We need to keep in mind that this entire "too big to fail" situation is nothing new and is something governments always have to deal with.

Many decades ago American ship builders consolidated until what was left was critical to national defense for naval ship building --that meant America's security depended on preventing the last ship builders fail. Same situation happens in downtown cities when a big building gets built and becomes weakened for whatever reason (fire next door, underground cave-ins, etc.). Government is forced to strengthen the building to prevent a structural failure from messing up the whole block.

It's how it works; if we want a free country where people are allowed to make their business really big, then we've got to be prepared for intervention when the community as a whole is threatened by a sudden collapse. Bernanke made it clear back in 2008 that serious needs of the state have to come first, and after that the state has to prevent it from happening again.

I'm only surprised the increased cap. reserves req'mt didn't come up sooner.

BIIB just poked its head through the 300 level. 11 minutes to closing time.

The trouble, as you both well know, is moral hazard. The analogy to a surprise fire, war, earthquake or other Act of God doesn't apply because the consequence is obvious. Were either of you two surprised that the economy had a melt-down? I wasn't. I actually thought the bubble was occurring back in 02/03, but the party remained in full swing into 2006/7 when people started looking for the exits.

These events are not unpredictable and the political rules should be spelled out now and clearly. Top management, BODs and share holders should take the first hit, bond holders/creditors the next and taxpayers last - each bank/corp (like in GMs case) should be placed on an expedited prepack BK with the US Treasury/FED/FDIC (depending on the circumstance) as the backstop.

Without clear and fierce rules you get private gains and public losses. Let these guys take a look at losing and perhaps they'll act with a bit more prudence. It should be public and automatic and work outside the political process. The system is gamed to benefit the wealthy and insiders. That's abusive and the worst form of corporate welfare (well, maybe making loan guarantees to "green" tech companies is a close second).

GM was totally political and a violation of law, yet it happened. That's got to stop. The GOP needs to become the free market party and attack crony capitalism, instead it's a major investor and enabler of crony capitalism. I mean look at the losers and it's the taxpayers and a bunch of schmucks. The real insiders who were positioned to either know about the problems or protect the system did pretty well.

huh, was above 300 last Friday.

Right now my thinking is that all this volatility gives me a good time to step back for a few days to let everything settle out. Tomorrow morning we’ll see how today’s final numbers look and how the new day is shaping up.

I like the way the components of IBB are getting tested re: the bubble talk and the over-pricing chatter against GILD/Sovaldi.

In the end, IBB and its components will demonstrate its/their inherent value.

I bought some more at the dip. Paid off today.

Good luck....

It's just that it is coming whether we believe or not.

A freeper in IT responded to me last week that his Fortune 500 organization has migrated to the cloud and their IT costs have been cut in half.

It appears that private firms (have heard that Kaspersky is one) are developing protocols to protect data in the cloud as securely as they do on your PC.

That said, the cloud revolution is infinitely more powerful than that, for example, of the auto insurance industry's Usage Based Insurance in which drivers are charged based on mileage, demonstrated driving experience, acceleration, stopping, etc.

Yet they are similar conceptually.

Using UBI, your auto insurance will reflect your actual performance and you will not bear the cost of fellow drivers who are accident prone or who abuse their equipment. Soon the same will be true of health insurance. Abuse your body...pay the price in terms of higher insurance.

The internet of everything is upon us and the cloud is a component of such.

Using the cloud, our cost of computing will plummet and our power of access will explode.

But the speed of genome developments and the new technologies useful by the industry and the furious work by scientists working in the field...and the fact that we can buy the NASDAQ biotech ETF which spreads our risk over 122-4 companies.

Well, as a retired investment banker (just a businessman mind you) who spent years hunting good deals (many of which were Venture Cap)...I am delighted to be an investor in this sector (and in IBB).

I have made some stunning returns so far...and will swing trade this sector for the foreseeable future.

I also recommend that folks who are comfortable in biotechs scan the Baker Bros SEC filings (hedge funds, like Baker Bros., still have to file with the SEC and list their holdings by name, amount, shares, value).

I don't know you yet, and must apologize that I don't quite get your comments.

I feel certain they are not as insecure as they sound.

My apologies.

I thought those on this thread might be like all Freepers in their invitation to all who are interested and might be able to contribute some tiny comment of value.

If I have stepped into someone's private domain...please forgive me.

Anything with that kind of cost savings will naturally drive consumers to it and I get what you’re saying. I have heard those numbers too and am considering it for our organization. Given that the Tech sector just rolled over for blanket NSA snooping isn’t a selling point. Until “secure” really means something, and not just from a technology point, there will have to be legislation with teeth that seriously limits domestic spying without a warrant. That’s my only point. Trust is critical to business success.

--and a merry Thursday morning to all!

--and a merry Thursday morning to all!We got metals futures orbital and stock futures downward this morning, the thing was that the past two days of stock gains were in decreasing volume (Market Rebounds In Thinner Volume) -a sign that fewer and fewer traders felt the higher prices were justified. What muddied the waters though was all the false signals coming out --so we'll just have to see today... Morning's news:

That's always the ideal; my take is that I think of a dip as a low point between a drop before and a surge after.  If we're at the dip we can only see the drop before because the surge after hasn't happened yet. OK, maybe if a traders is super intuitive, or lucky, or maybe if there's a steady pattern--

If we're at the dip we can only see the drop before because the surge after hasn't happened yet. OK, maybe if a traders is super intuitive, or lucky, or maybe if there's a steady pattern--

<-- but for me at least there's never an guarantee that we'll see yesterday's pattern tomorrow. Fortunately our good news is that there are soo many ways that someone can make money by just doing hard work of seeing where effort pays off and where it doesn't.

The way strategy results seem to change from time to time and person to person means that hard/fast rules don't work that well, but heck if was too easy it wouldn't be fun!

lol-- how about not as 'confident' as they sound!

Seriously, I had much better returns a decade ago when indicators seemed to correlate so much better with results. These days my experiences with all the slow advances & sudden drops are telling me that until trends change I want to buy less aggressively and sell earlier. A buddy of mine calls it "an unstable market" and IBD called it "choppy market". Please keep letting me know if what I say doesn't make sense --the better I can clarify my thoughts to others the better my tactics, and too often when something isn't explained well it's because it's wrong.

Something else is being a morning guy I fade out in the evenings and do better over morning coffee. I haven't retired yet, I'm just old. OK, so I moved from decades of civil engineering to finance so maybe I'm like you as being active/busy retired.

Jobless claims tumble to near seven-year low

http://www.freerepublic.com/focus/f-news/3142868/posts

tx fer the headsup. Stock index futures improving now; funny, I’d have thot they’d tank w/ goodnews=badnews thinking...

“I’d have thot they’d tank w/ goodnews=badnews thinking...”

LOL, indeed.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.